Electric vehicle charging company EVgo (NASDAQ: EVGO) announced better-than-expected revenue in Q1 CY2025, with sales up 36.5% year on year to $75.29 million. The company’s full-year revenue guidance of $360 million at the midpoint came in 2.3% above analysts’ estimates. Its GAAP loss of $0.09 per share was in line with analysts’ consensus estimates.

Is now the time to buy EVgo? Find out by accessing our full research report, it’s free.

EVgo (EVGO) Q1 CY2025 Highlights:

- Revenue: $75.29 million vs analyst estimates of $74.21 million (36.5% year-on-year growth, 1.4% beat)

- EPS (GAAP): -$0.09 vs analyst estimates of -$0.09 (in line)

- Adjusted EBITDA: -$5.93 million vs analyst estimates of -$6.61 million (-7.9% margin, 10.3% beat)

- The company reconfirmed its revenue guidance for the full year of $360 million at the midpoint

- EBITDA guidance for the full year is $2.5 million at the midpoint, above analyst estimates of $1.76 million

- Operating Margin: -44.4%, up from -58.7% in the same quarter last year

- Free Cash Flow was -$25.24 million compared to -$35.15 million in the same quarter last year

- Gigawatt-hours Sold: 83 at quarter end

- Market Capitalization: $369.9 million

“EVgo once again achieved a record level of revenues, starting 2025 off on a strong foundation,” said Badar Khan, EVgo’s CEO.

Company Overview

Created through a settlement between NRG Energy and the California Public Utilities Commission, EVgo (NASDAQ: EVGO) is a provider of electric vehicle charging solutions, operating fast charging stations across the United States.

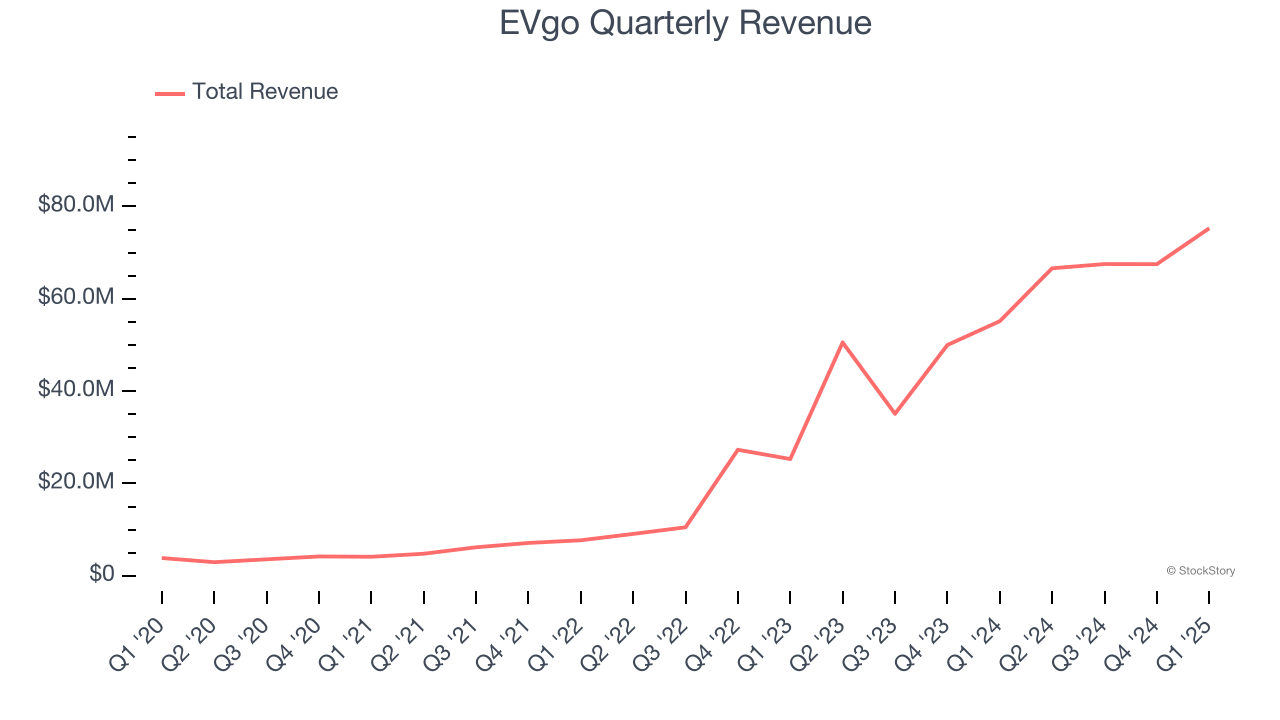

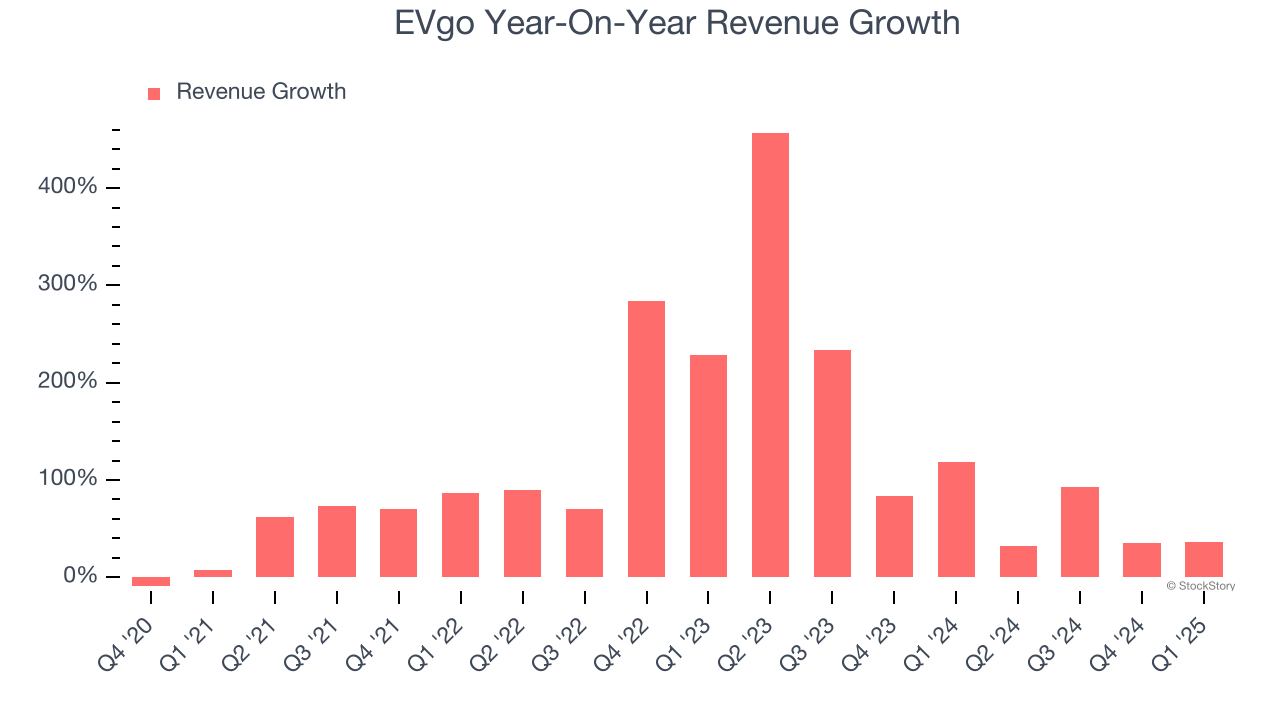

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, EVgo’s sales grew at an incredible 75.9% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. EVgo’s annualized revenue growth of 95.9% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated. EVgo recent performance stands out, especially when considering many similar Renewable Energy businesses faced declining sales because of cyclical headwinds.

This quarter, EVgo reported wonderful year-on-year revenue growth of 36.5%, and its $75.29 million of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 39.5% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

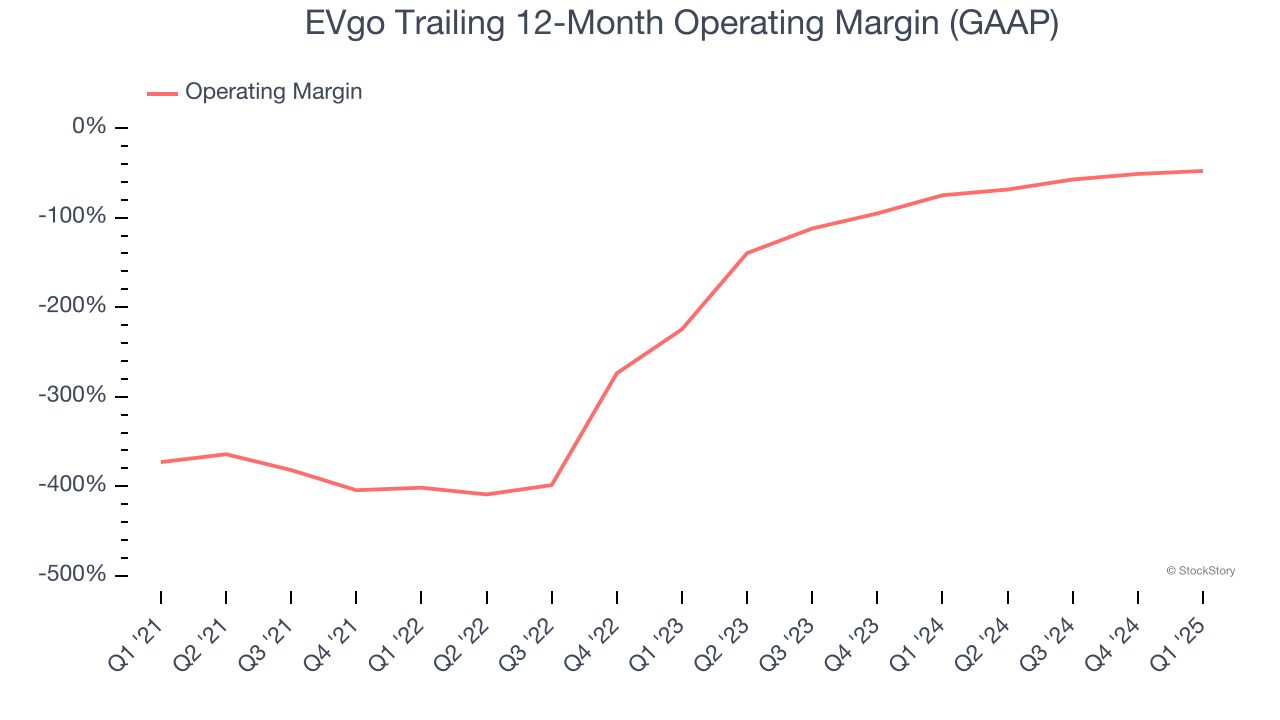

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

EVgo’s high expenses have contributed to an average operating margin of negative 103% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, EVgo’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, EVgo generated a negative 44.4% operating margin. The company's consistent lack of profits raise a flag.

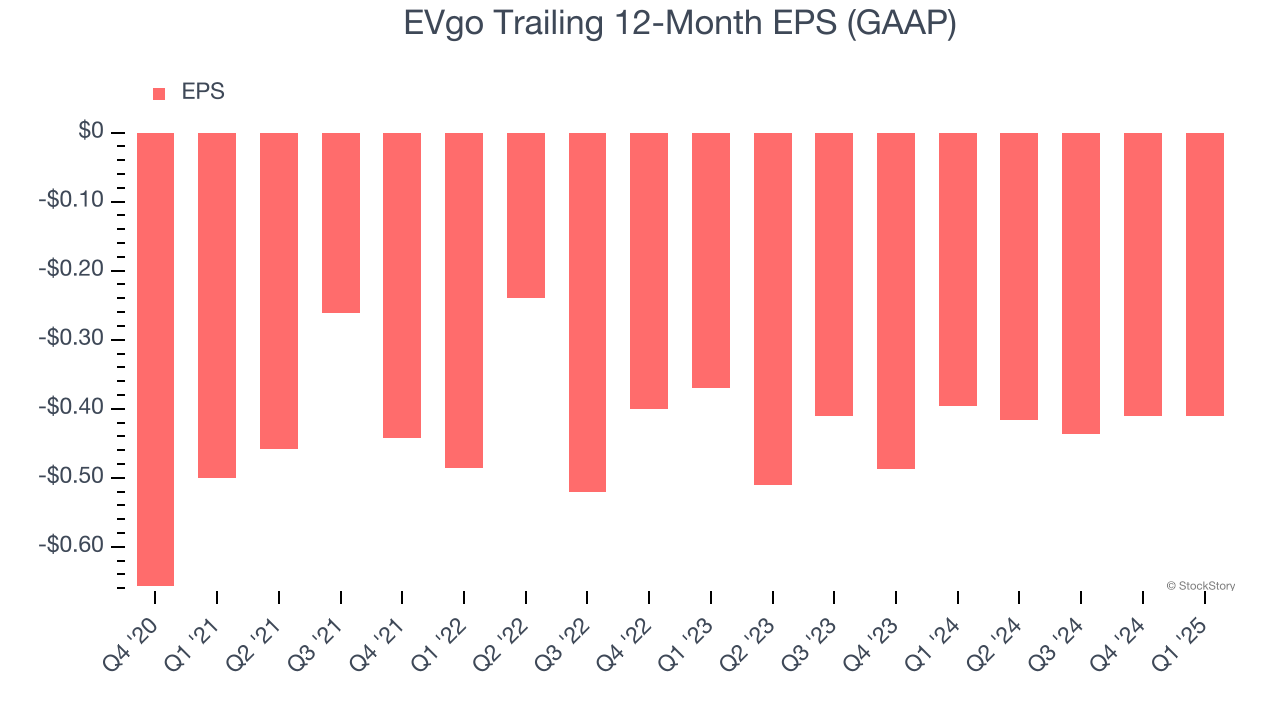

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although EVgo’s full-year earnings are still negative, it reduced its losses and improved its EPS by 4.8% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For EVgo, its two-year annual EPS declines of 5.3% show it’s continued to underperform. These results were bad no matter how you slice the data, but given it was successful in other measures of financial health, we’re hopeful EVgo can generate earnings growth in the future.

In Q1, EVgo reported EPS at negative $0.09, in line with the same quarter last year. This print beat analysts’ estimates by 2.2%. Over the next 12 months, Wall Street is optimistic. Analysts forecast EVgo’s full-year EPS of negative $0.41 will reach break even.

Key Takeaways from EVgo’s Q1 Results

We were impressed by how significantly EVgo blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 6.9% to $2.95 immediately after reporting.

Sure, EVgo had a solid quarter, but if we look at the bigger picture, is this stock a buy? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.