Breakfast restaurant chain First Watch Restaurant Group (NASDAQ: FWRG) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 16.4% year on year to $282.2 million. Its GAAP loss of $0.01 per share was significantly below analysts’ consensus estimates.

Is now the time to buy First Watch? Find out by accessing our full research report, it’s free.

First Watch (FWRG) Q1 CY2025 Highlights:

- Revenue: $282.2 million vs analyst estimates of $283.5 million (16.4% year-on-year growth, in line)

- EPS (GAAP): -$0.01 vs analyst estimates of $0.03 (significant miss)

- Adjusted EBITDA: $22.75 million vs analyst estimates of $25.81 million (8.1% margin, 11.9% miss)

- EBITDA guidance for the full year is $116.5 million at the midpoint, below analyst estimates of $125 million

- Operating Margin: 0.4%, down from 5.1% in the same quarter last year

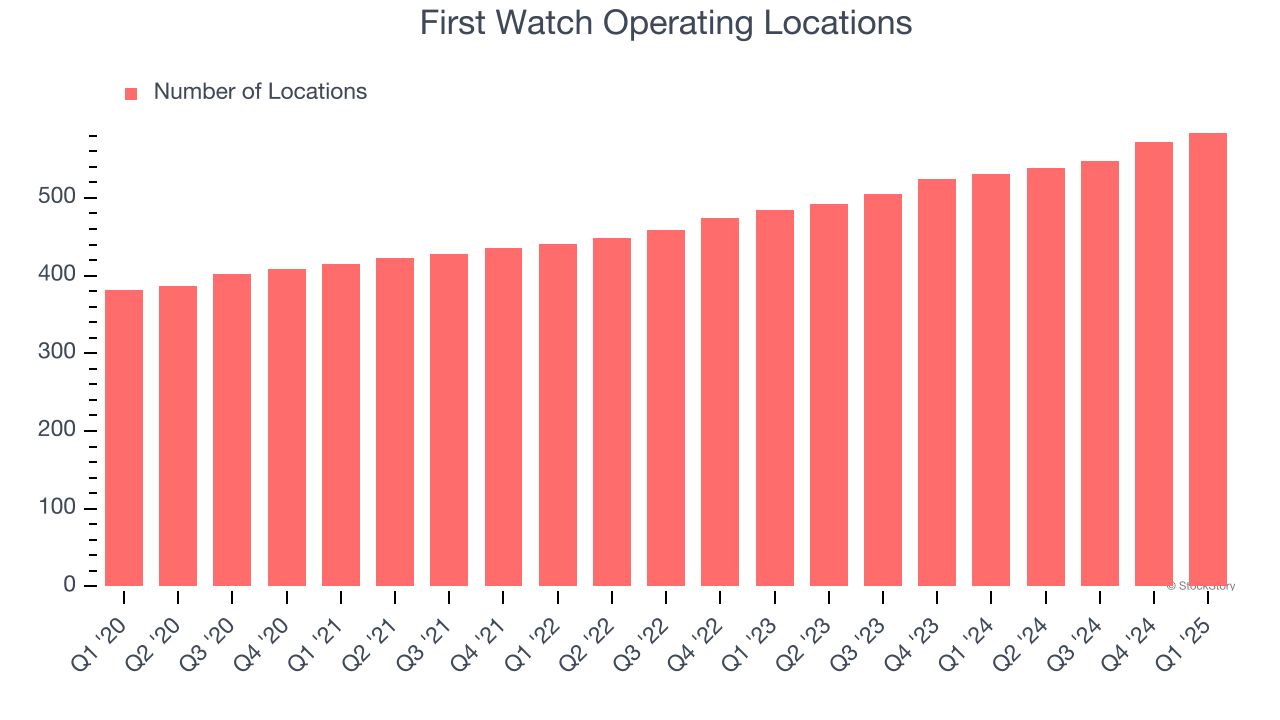

- Locations: 584 at quarter end, up from 531 in the same quarter last year

- Same-Store Sales were flat year on year, in line with the same quarter last year

- Market Capitalization: $1.13 billion

"First quarter same restaurant traffic results are encouraging and continued the trends we experienced exiting 2024, demonstrating both the strength and the resilience of the First Watch brand,” said Chris Tomasso, CEO and President of First Watch.

Company Overview

Based on a nautical reference to the first work shift aboard a ship, First Watch (NASDAQ: FWRG) is a chain of breakfast and brunch restaurants whose menu is heavily-focused on eggs and griddle items such as pancakes.

Sales Growth

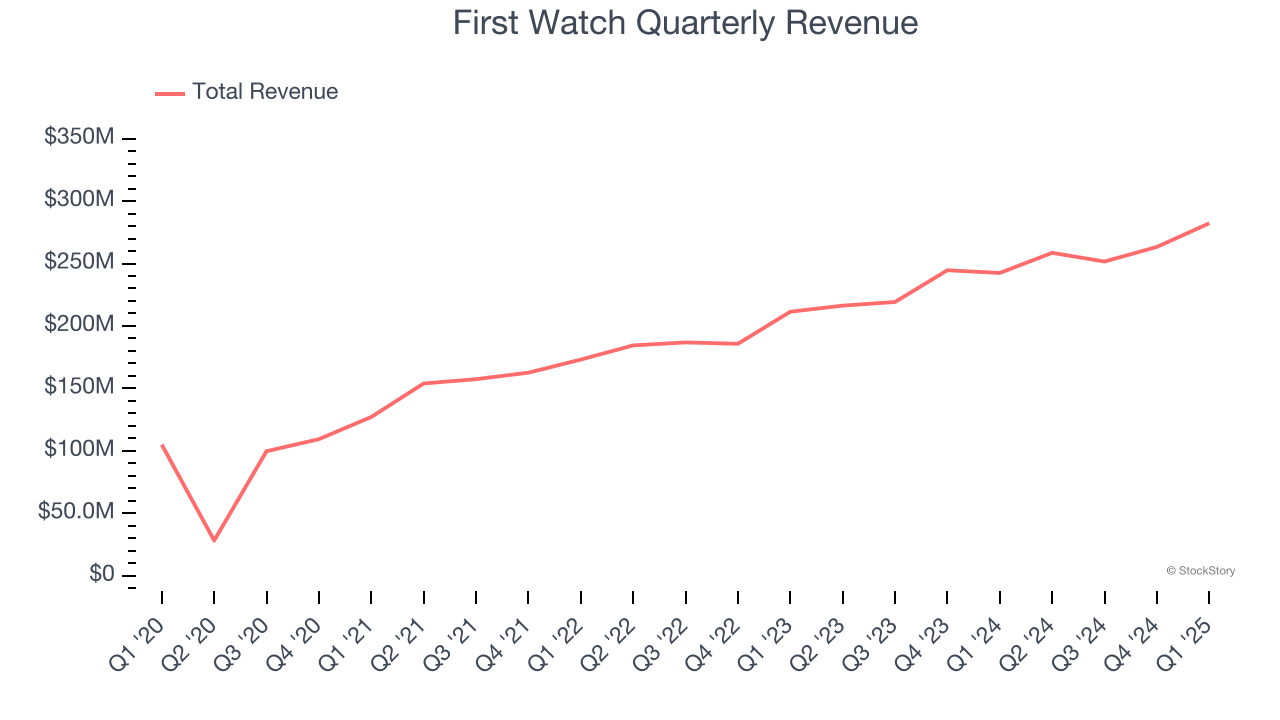

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.06 billion in revenue over the past 12 months, First Watch is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, First Watch grew its sales at an exceptional 19.2% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, First Watch’s year-on-year revenue growth was 16.4%, and its $282.2 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 20% over the next 12 months, similar to its five-year rate. This projection is admirable and suggests the market is baking in success for its menu offerings.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

First Watch operated 584 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 9.6% annual growth, much faster than the broader restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

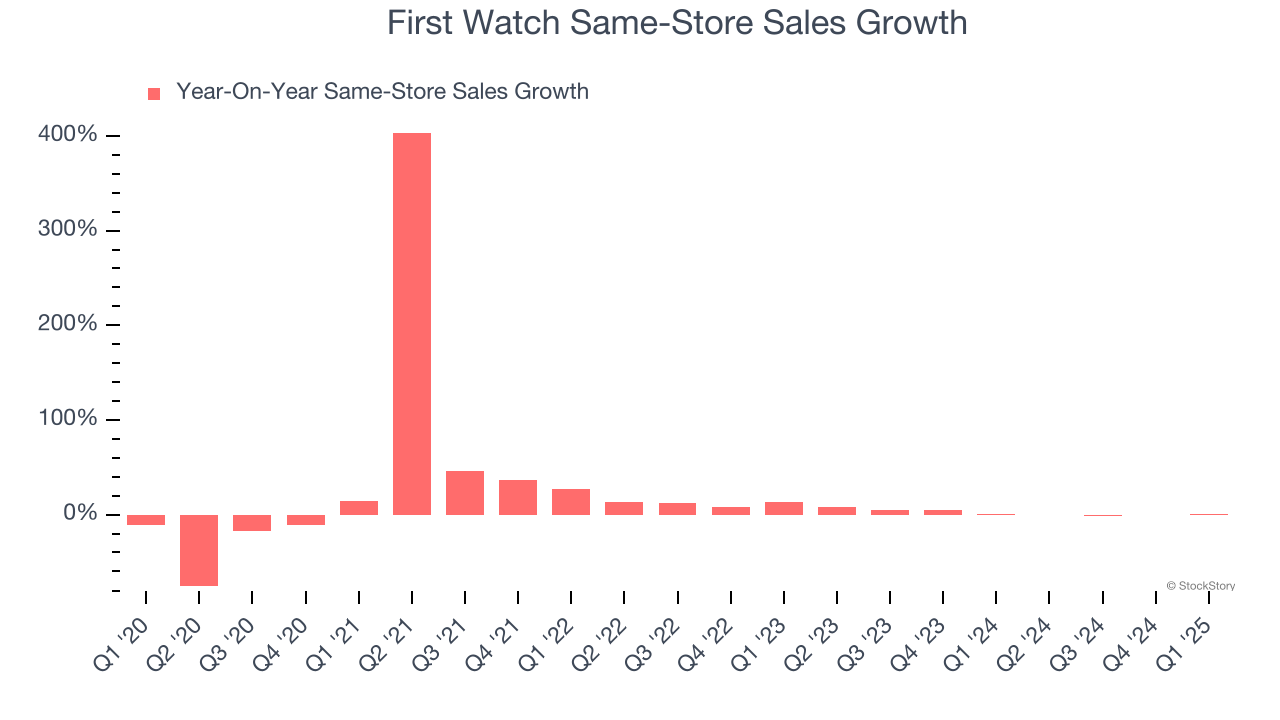

Same-Store Sales

A company's restaurant base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

First Watch’s demand rose over the last two years and slightly outpaced the industry. On average, the company’s same-store sales have grown by 2% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, First Watch’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if First Watch can reaccelerate growth.

Key Takeaways from First Watch’s Q1 Results

We struggled to find many positives in these results. Its full-year EBITDA guidance missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.3% to $17.60 immediately after reporting.

First Watch’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.