Medical tech company Masimo (NASDAQ: MASI) reported Q1 CY2025 results exceeding the market’s revenue expectations, but sales fell by 24.5% year on year to $372 million. The company expects the full year’s revenue to be around $1.52 billion, close to analysts’ estimates. Its non-GAAP profit of $1.36 per share was 12.5% above analysts’ consensus estimates.

Is now the time to buy Masimo? Find out by accessing our full research report, it’s free.

Masimo (MASI) Q1 CY2025 Highlights:

- Revenue: $372 million vs analyst estimates of $367.9 million (24.5% year-on-year decline, 1.1% beat)

- Adjusted EPS: $1.36 vs analyst estimates of $1.21 (12.5% beat)

- Adjusted EBITDA: $95.7 million vs analyst estimates of $108.5 million (25.7% margin, 11.8% miss)

- Management lowered its full-year Adjusted EPS guidance to $4.98 at the midpoint, a 5.2% decrease

- Operating Margin: 21%, up from 6.9% in the same quarter last year

- Free Cash Flow Margin: 9.5%, up from 7.6% in the same quarter last year

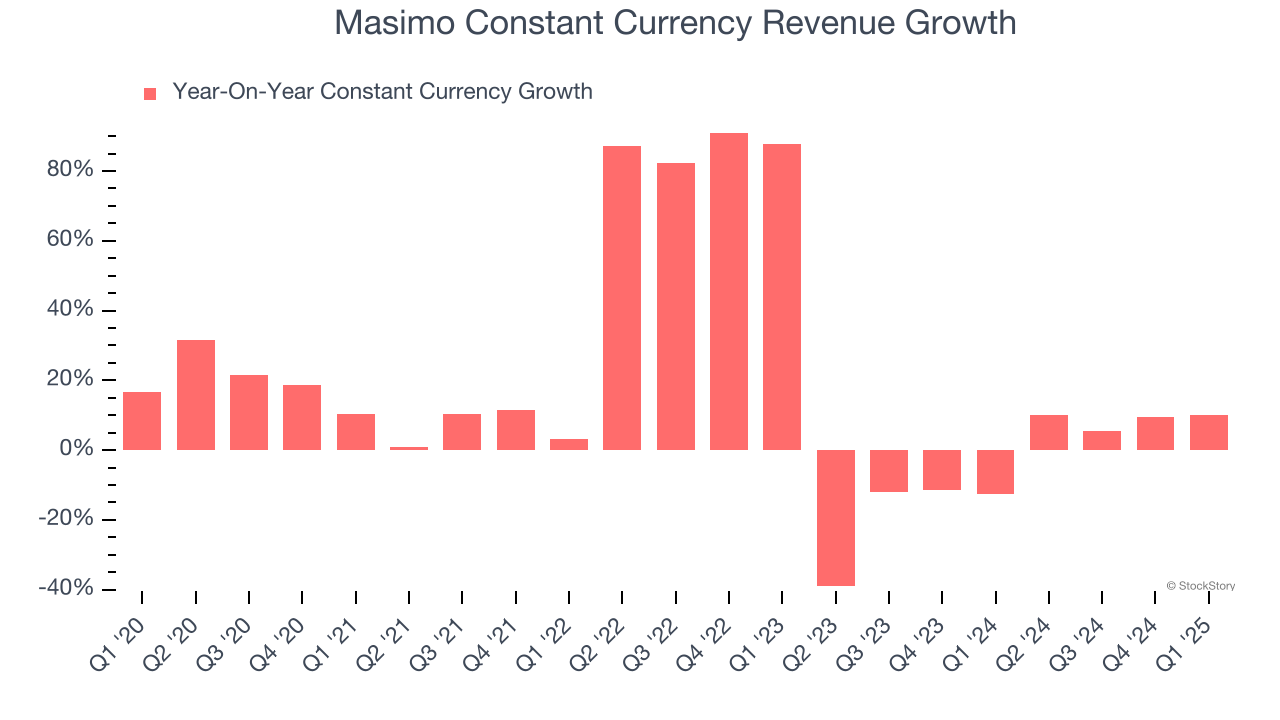

- Constant Currency Revenue rose 10% year on year (-12.5% in the same quarter last year)

- Market Capitalization: $8.8 billion

Katie Szyman, Chief Executive Officer of Masimo, said, “Since joining Masimo as CEO three months ago, I have been focused on immersing myself in our business. I have visited customers, employees, manufacturing and R&D sites, evaluated our innovation pipeline, and attended national meetings with our sales team. My key takeaways are that our technology advantage is real, we have a stellar team that is enthusiastic about the path forward at Masimo, and we have an opportunity to build and improve from a position of meaningful strength. Our first quarter results clearly demonstrate the earnings power of our core business as we delivered double-digit revenue growth and exceptional earnings growth.”

Company Overview

Founded in 1989 to solve the "unsolvable problem" of accurate pulse oximetry during patient movement, Masimo (NASDAQ: MASI) develops and manufactures noninvasive patient monitoring technologies, including its breakthrough pulse oximetry systems that accurately measure blood oxygen levels even during patient movement.

Sales Growth

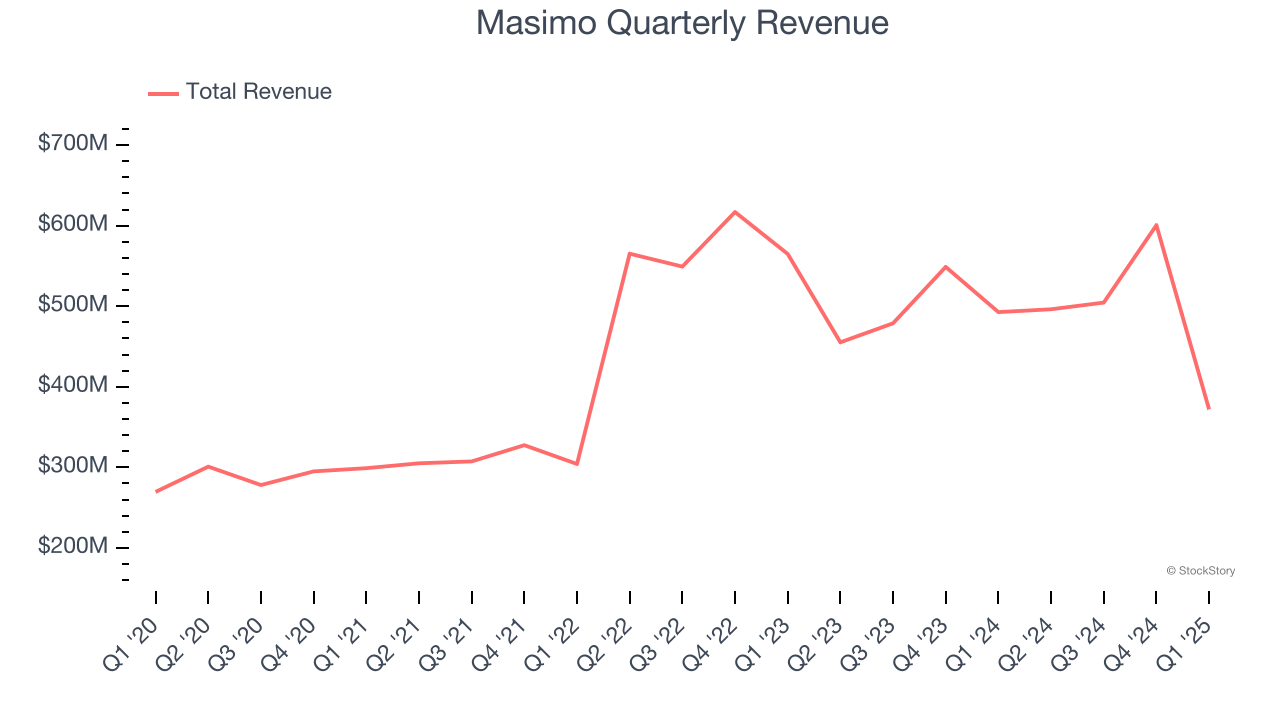

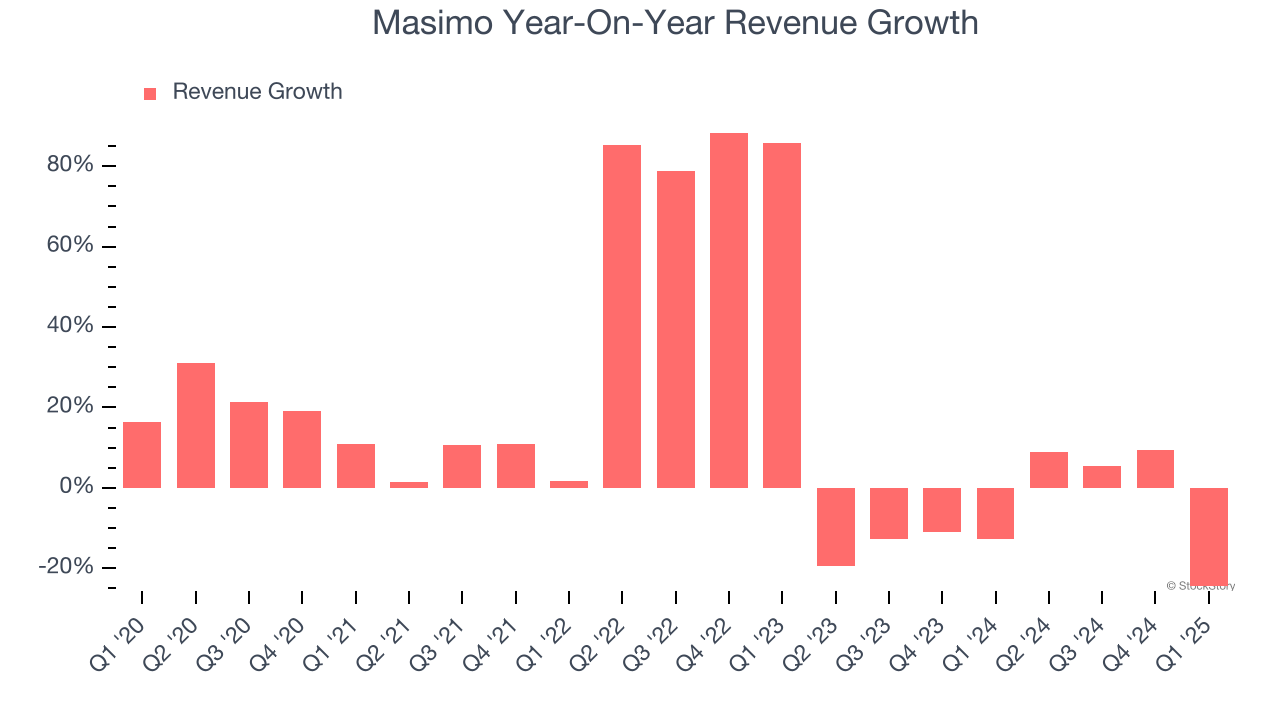

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Masimo’s sales grew at a solid 15.1% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Masimo’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 7.3% over the last two years.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 5% year-on-year declines. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Masimo.

This quarter, Masimo’s revenue fell by 24.5% year on year to $372 million but beat Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to decline by 21.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

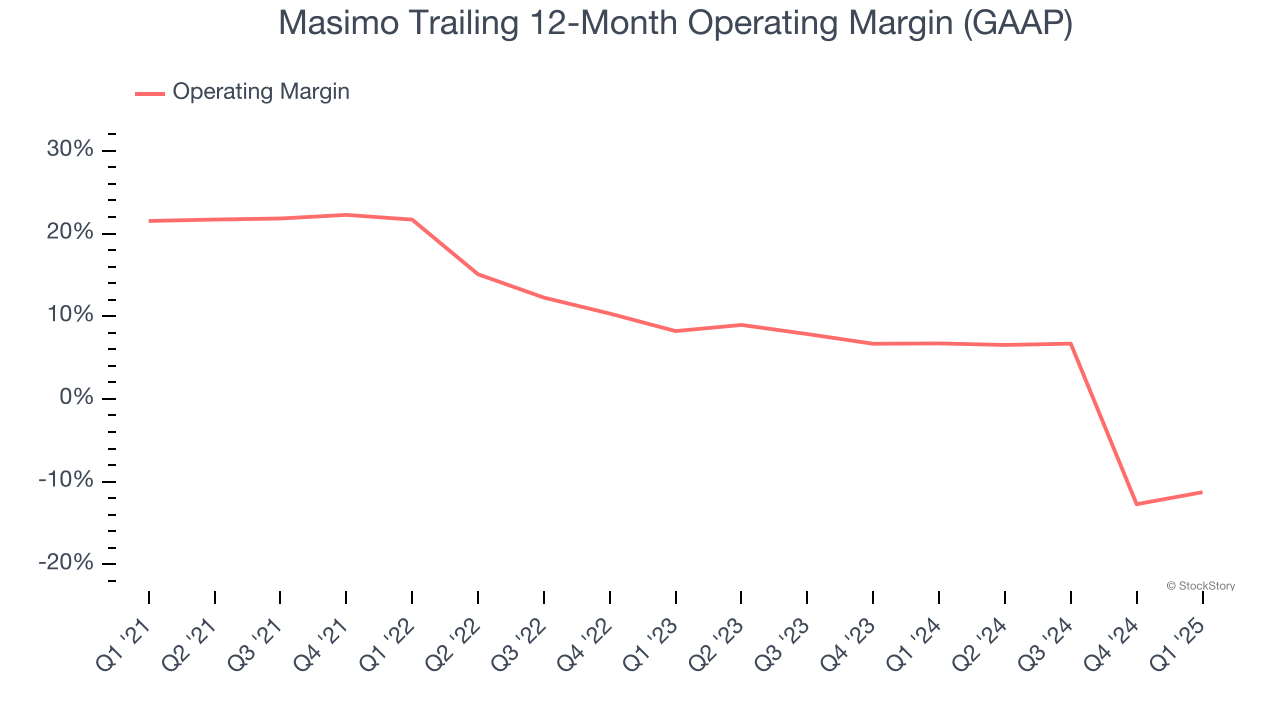

Masimo was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.2% was weak for a healthcare business.

Analyzing the trend in its profitability, Masimo’s operating margin decreased by 32.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 19.5 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Masimo generated an operating profit margin of 21%, up 14.1 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

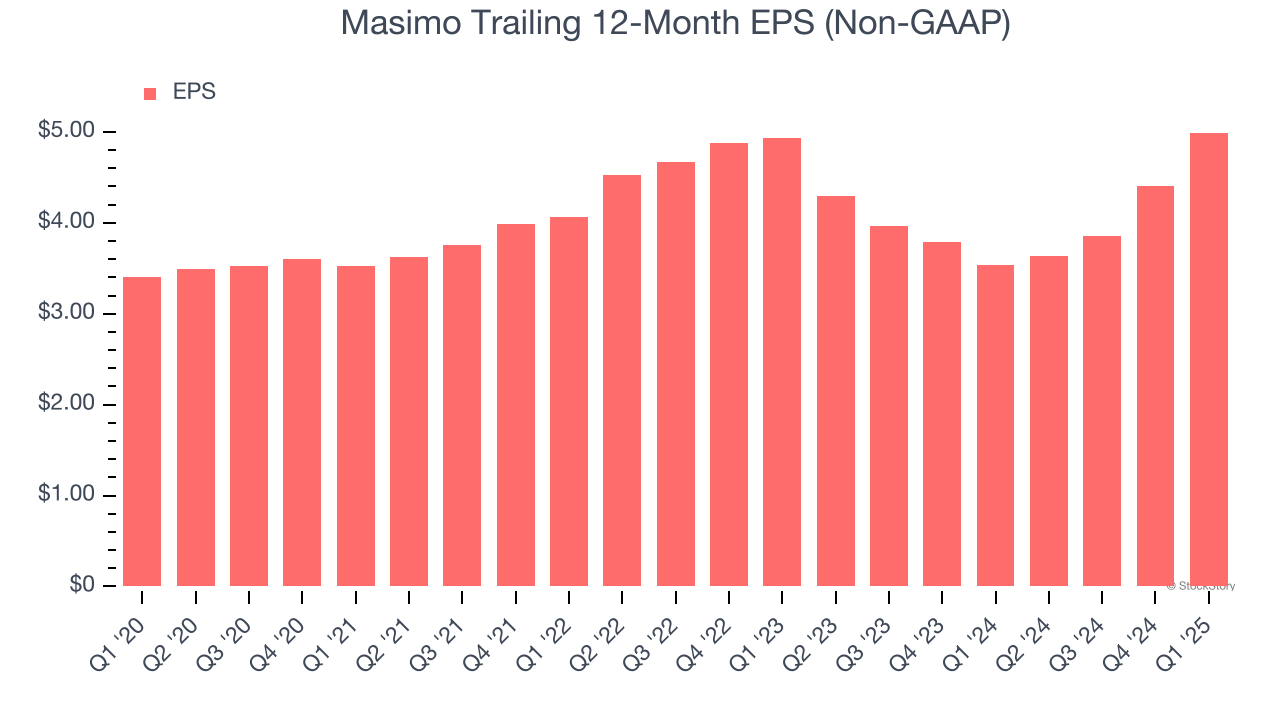

Masimo’s EPS grew at a solid 8% compounded annual growth rate over the last five years. However, this performance was lower than its 15.1% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

Diving into Masimo’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Masimo’s operating margin improved this quarter but declined by 32.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Masimo reported EPS at $1.36, up from $0.77 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Masimo’s full-year EPS of $4.99 to grow 8.5%.

Key Takeaways from Masimo’s Q1 Results

We were impressed by how significantly Masimo blew past analysts’ constant currency revenue and EPS expectations this quarter. On the other hand, its EBITDA missed and it lowered its full-year EPS guidance. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 5.9% to $151.25 immediately after reporting.

Big picture, is Masimo a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.