As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at design software stocks, starting with Unity (NYSE: U).

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 5 design software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 2.2% on average since the latest earnings results.

Unity (NYSE: U)

Started as a game studio by three friends in a Copenhagen apartment, Unity (NYSE: U) is a software as a service platform that makes it easier to develop and monetize new games and other visual digital experiences.

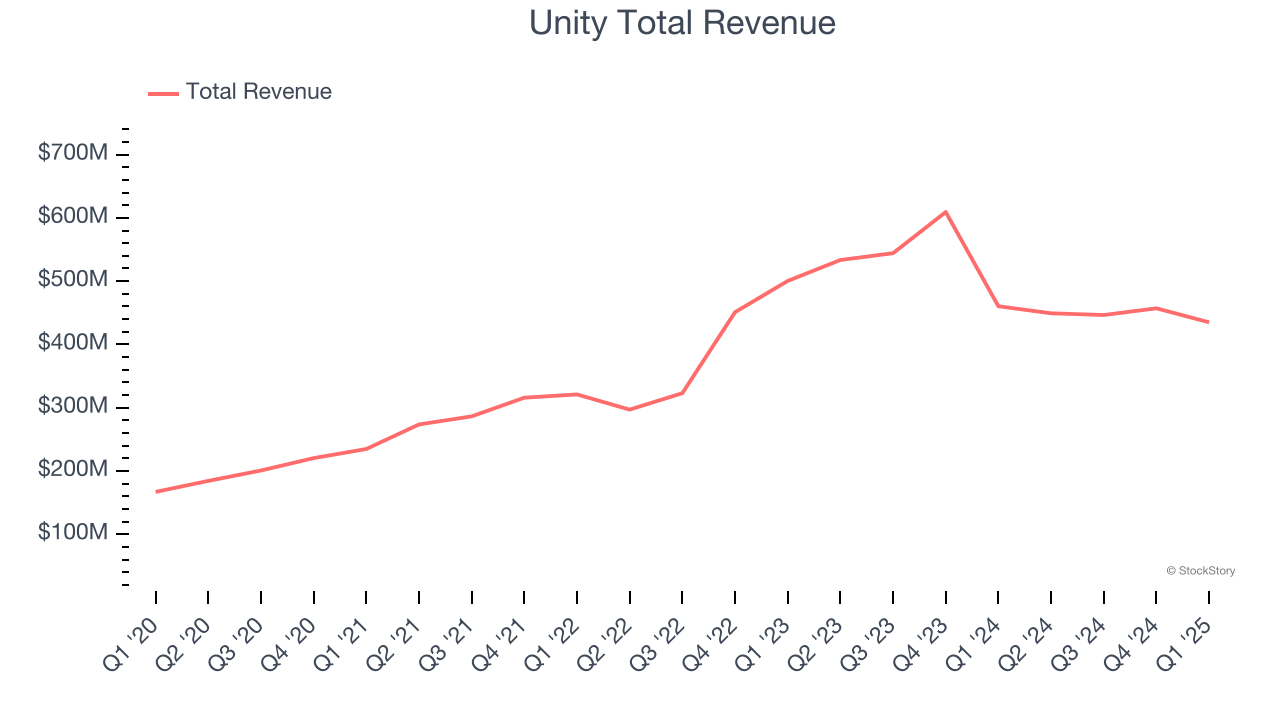

Unity reported revenues of $435 million, down 5.5% year on year. This print exceeded analysts’ expectations by 4.4%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ billings estimates but revenue guidance for next quarter slightly missing analysts’ expectations.

"The Company’s first quarter results once again meaningfully exceeded expectations on both revenue and Adjusted EBITDA, highlighting our progress as we continue to build a culture of execution and discipline,” said Matt Bromberg, President and CEO of Unity.

Unity delivered the slowest revenue growth of the whole group. The stock is down 2.8% since reporting and currently trades at $20.73.

Is now the time to buy Unity? Access our full analysis of the earnings results here, it’s free.

Best Q1: Procore (NYSE: PCOR)

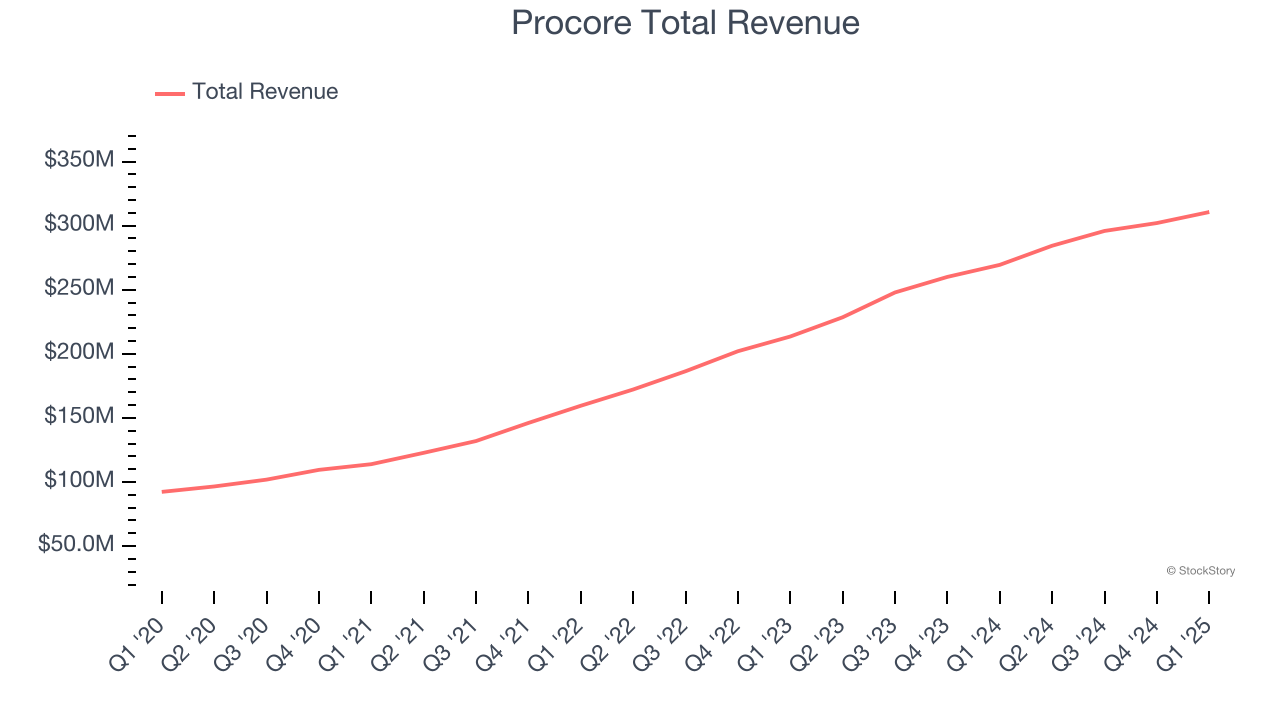

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore (NYSE: PCOR) offers a software-as-service project, finance, and quality management platform for the construction industry.

Procore reported revenues of $310.6 million, up 15.3% year on year, outperforming analysts’ expectations by 2.6%. The business had a strong quarter with accelerating customer growth and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 7% since reporting. It currently trades at $67.61.

Is now the time to buy Procore? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Adobe (NASDAQ: ADBE)

One of the most well-known Silicon Valley software companies around, Adobe (NASDAQ: ADBE) is a leading provider of software as service in the digital design and document management space.

Adobe reported revenues of $5.71 billion, up 10.3% year on year, exceeding analysts’ expectations by 1%. Still, it was a mixed quarter as it posted EPS guidance for next quarter meeting analysts’ expectations.

Adobe delivered the weakest full-year guidance update in the group. As expected, the stock is down 12.5% since the results and currently trades at $383.75.

Read our full analysis of Adobe’s results here.

PTC (NASDAQ: PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ: PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $636.4 million, up 5.5% year on year. This result surpassed analysts’ expectations by 5%. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

PTC pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 11.7% since reporting and currently trades at $172.97.

Read our full, actionable report on PTC here, it’s free.

Cadence (NASDAQ: CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ: CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.24 billion, up 23.1% year on year. This print was in line with analysts’ expectations. Zooming out, it was a satisfactory quarter as it also logged a solid beat of analysts’ EBITDA estimates but a slight miss of analysts’ billings estimates.

Cadence scored the fastest revenue growth but had the weakest performance against analyst estimates among its peers. The stock is up 7.6% since reporting and currently trades at $307.40.

Read our full, actionable report on Cadence here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.