BeautyHealth has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 5.9% and now trades at $1.62. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy BeautyHealth, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think BeautyHealth Will Underperform?

Despite the momentum, we're cautious about BeautyHealth. Here are three reasons why you should be careful with SKIN and a stock we'd rather own.

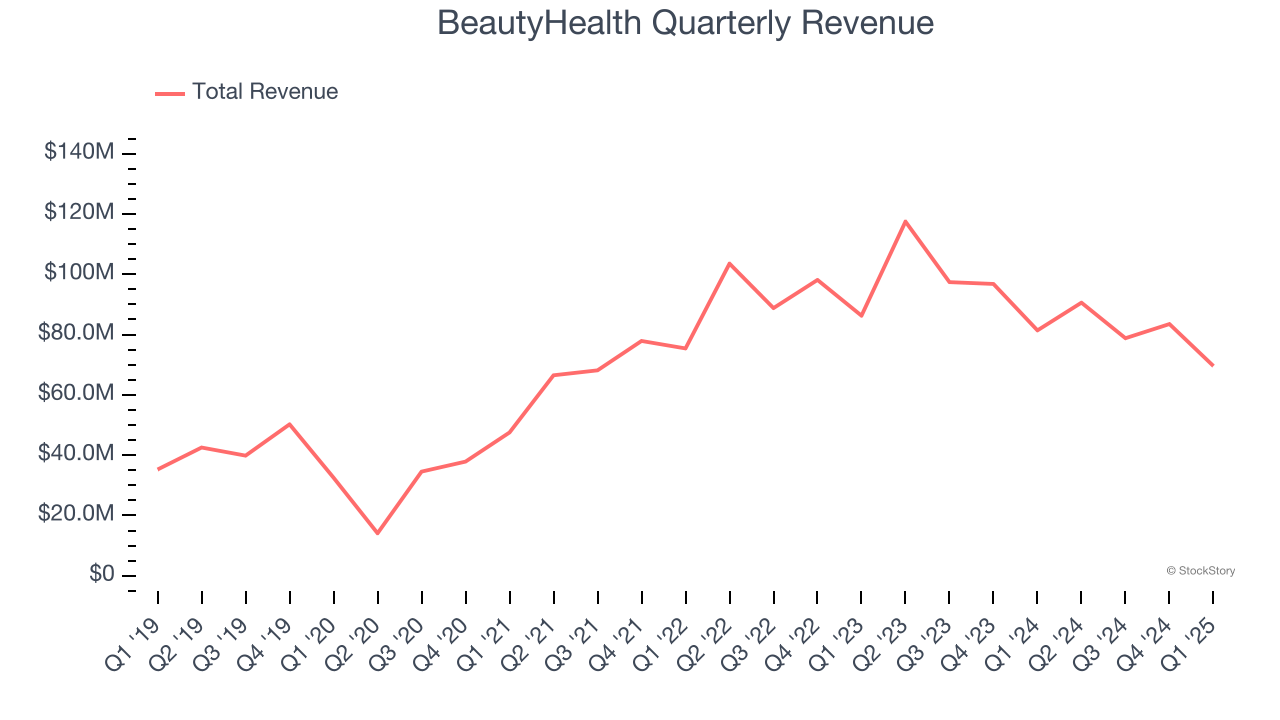

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, BeautyHealth’s 3.8% annualized revenue growth over the last three years was sluggish. This fell short of our benchmark for the consumer staples sector.

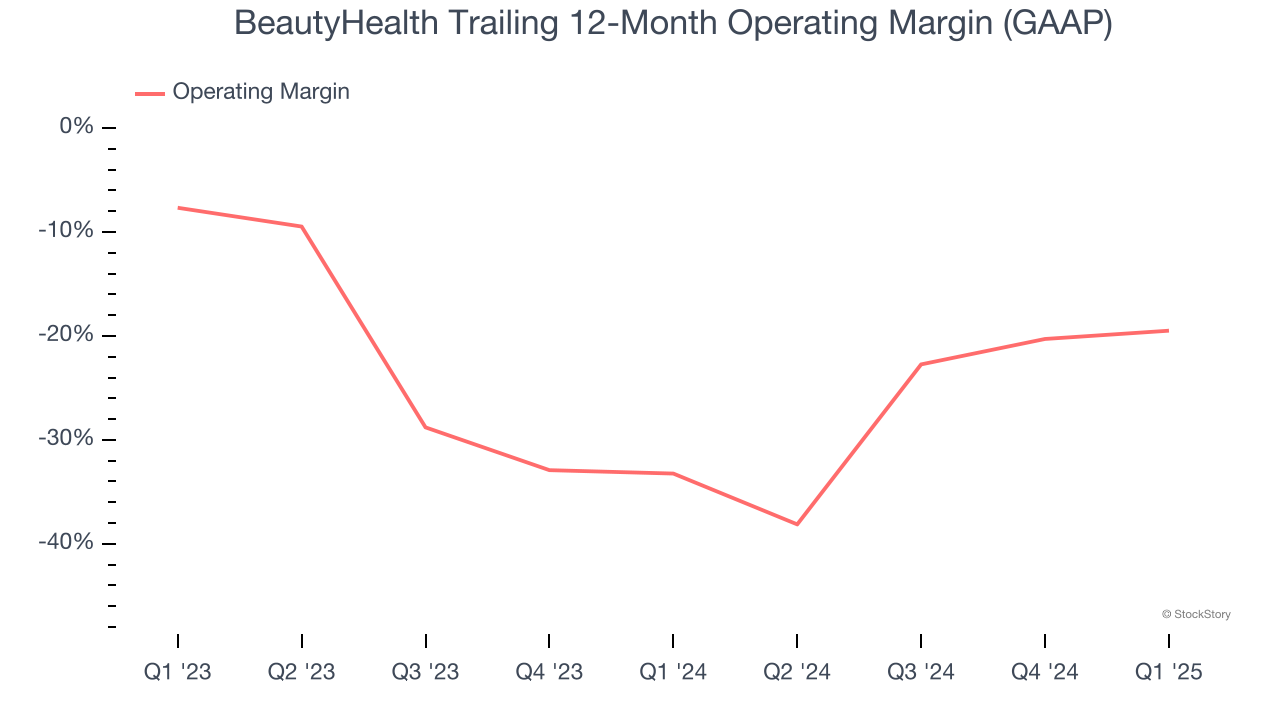

2. Operating Losses Sound the Alarms

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, BeautyHealth was one of them over the last two years as its high expenses contributed to an average operating margin of negative 27%.

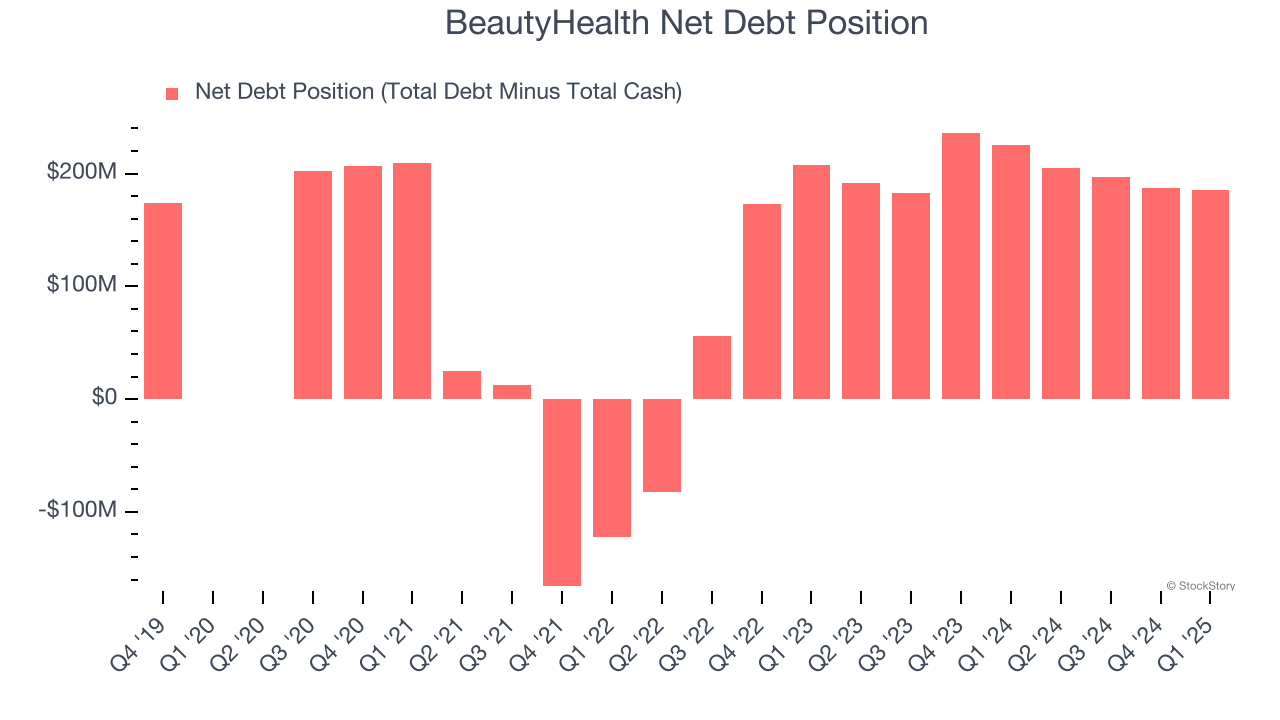

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

BeautyHealth’s $558.1 million of debt exceeds the $373 million of cash on its balance sheet. Furthermore, its 10× net-debt-to-EBITDA ratio (based on its EBITDA of $19.2 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. BeautyHealth could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope BeautyHealth can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of BeautyHealth, we’ll be cheering from the sidelines. With its shares beating the market recently, the stock trades at 12.5× forward EV-to-EBITDA (or $1.62 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Like More Than BeautyHealth

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.