Since June 2020, the S&P 500 has delivered a total return of 100%. But one standout stock has nearly doubled the market - over the past five years, Cardinal Health has surged 193% to $154 per share. Its momentum hasn’t stopped as it’s also gained 31.2% in the last six months, beating the S&P by 31.9%.

Is now still a good time to buy CAH? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does CAH Stock Spark Debate?

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE: CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Two Things to Like:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $222.3 billion in revenue over the past 12 months, Cardinal Health is one of the most scaled enterprises in healthcare. This is particularly important because healthcare distribution & related services companies are volume-driven businesses due to their low margins.

2. EPS Increasing Steadily

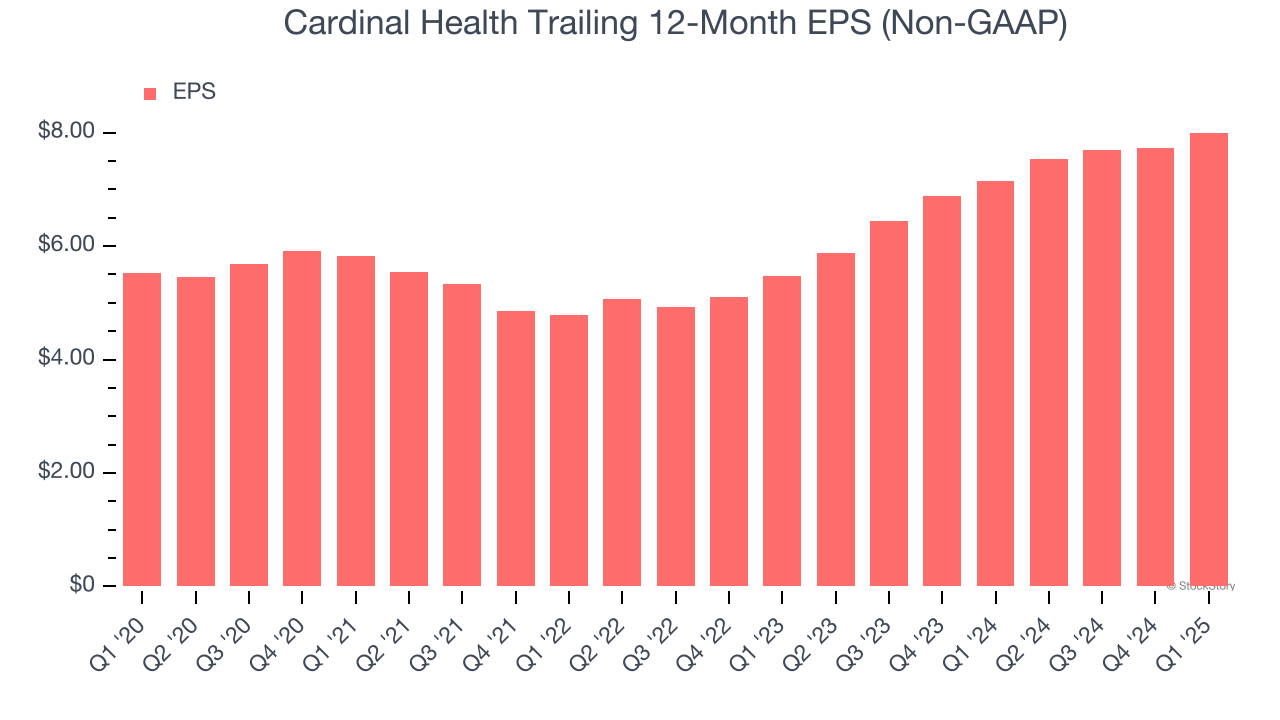

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Cardinal Health’s solid 7.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

One Reason to be Careful:

Lackluster Revenue Growth

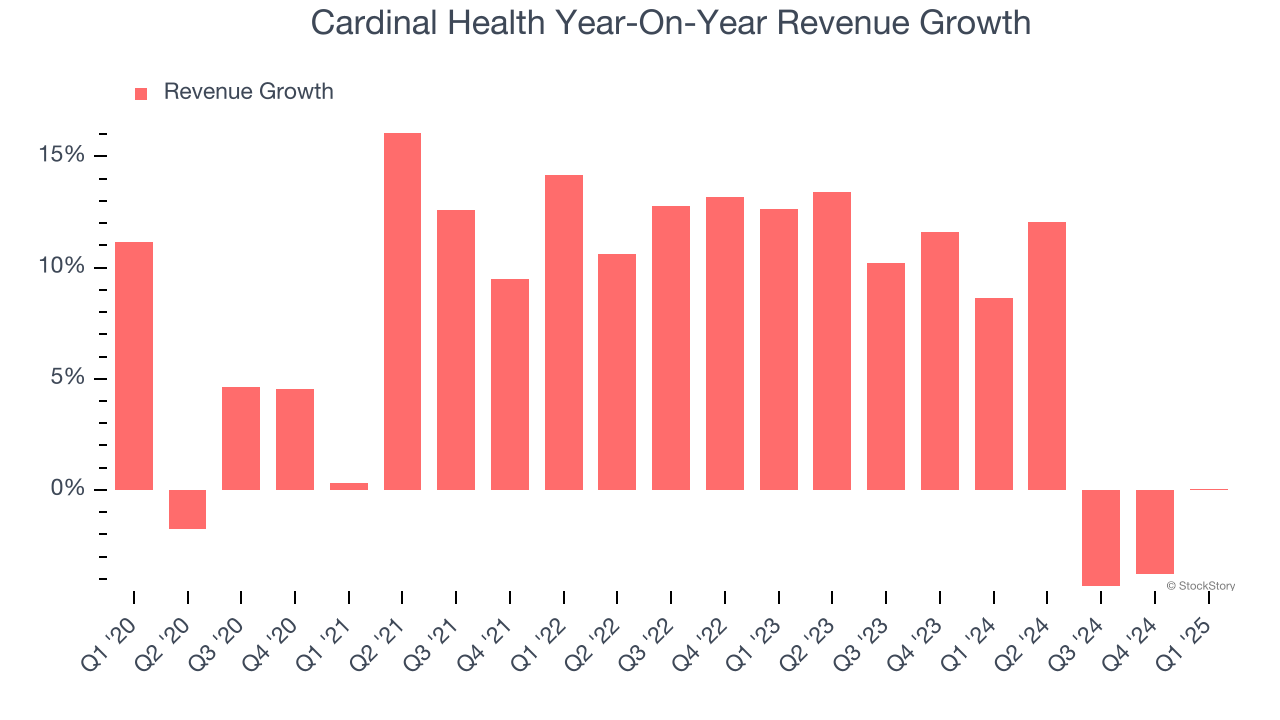

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. Cardinal Health’s recent performance shows its demand has slowed as its annualized revenue growth of 5.8% over the last two years was below its five-year trend.

Final Judgment

Cardinal Health’s merits more than compensate for its flaws, and with its shares outperforming the market lately, the stock trades at 17.5× forward P/E (or $154 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Cardinal Health

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.