Over the past six months, Simply Good Foods’s stock price fell to $33.71. Shareholders have lost 14.9% of their capital, disappointing when considering the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Simply Good Foods, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Simply Good Foods Not Exciting?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than SMPL and a stock we'd rather own.

1. Fewer Distribution Channels Limit its Ceiling

With $1.41 billion in revenue over the past 12 months, Simply Good Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

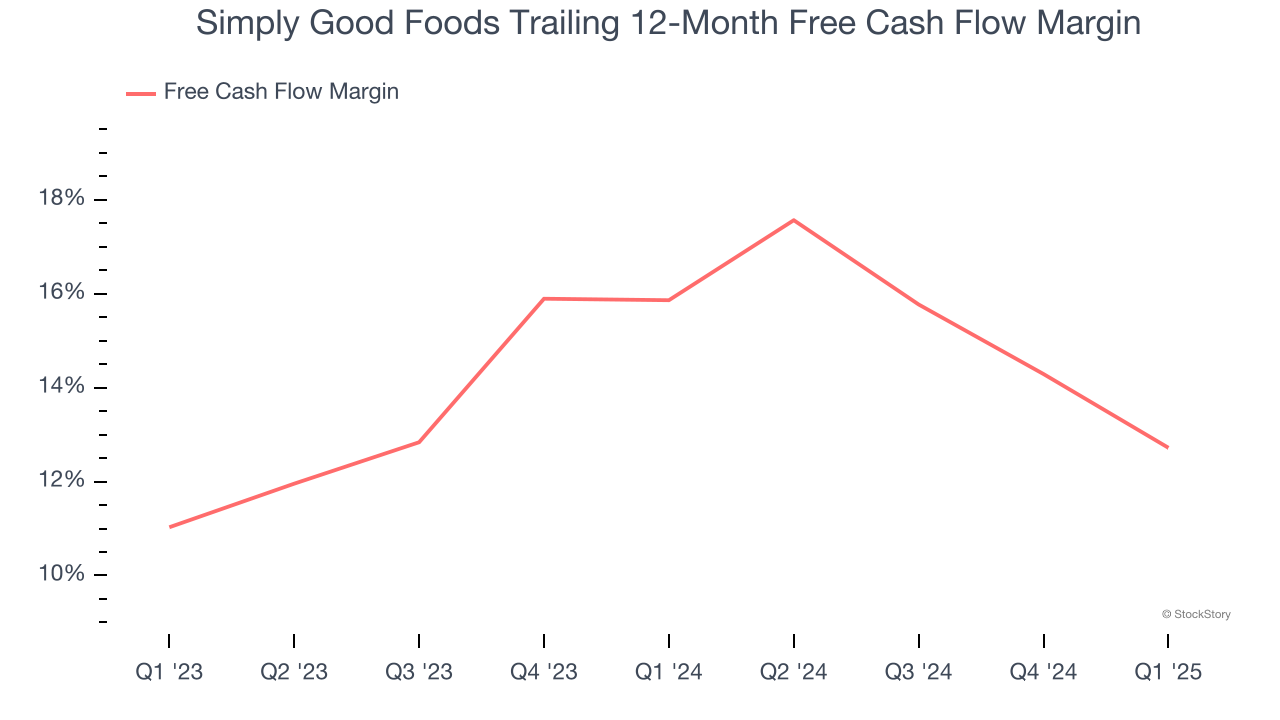

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Simply Good Foods’s margin dropped by 3.1 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. Simply Good Foods’s free cash flow margin for the trailing 12 months was 12.7%.

3. Previous Growth Initiatives Haven’t Impressed

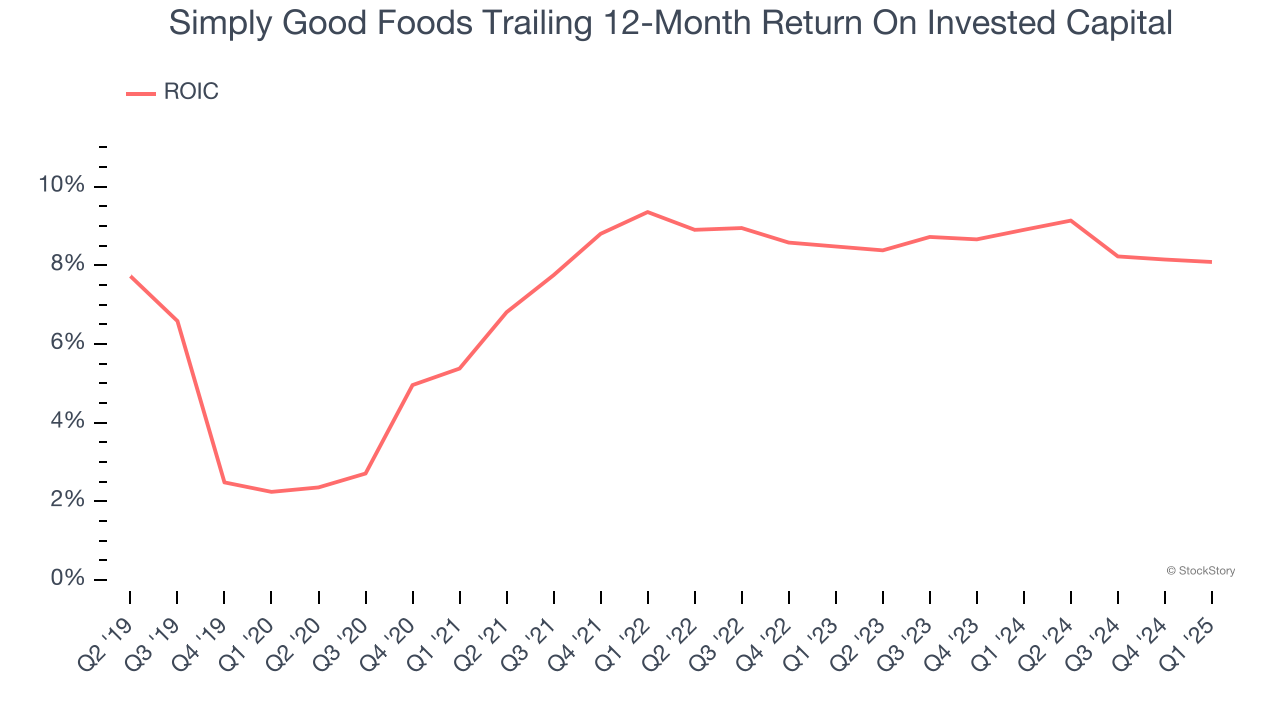

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Simply Good Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

Final Judgment

Simply Good Foods isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 16.5× forward P/E (or $33.71 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Simply Good Foods

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.