Over the past six months, Enterprise Financial Services’s shares (currently trading at $53.47) have posted a disappointing 9.7% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Given the weaker price action, is now a good time to buy EFSC? Find out in our full research report, it’s free.

Why Does EFSC Stock Spark Debate?

Starting as a single bank in Missouri in 1988 and expanding through strategic growth, Enterprise Financial Services (NASDAQ: EFSC) is a financial holding company that offers banking, lending, and wealth management services to businesses and individuals across seven states.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

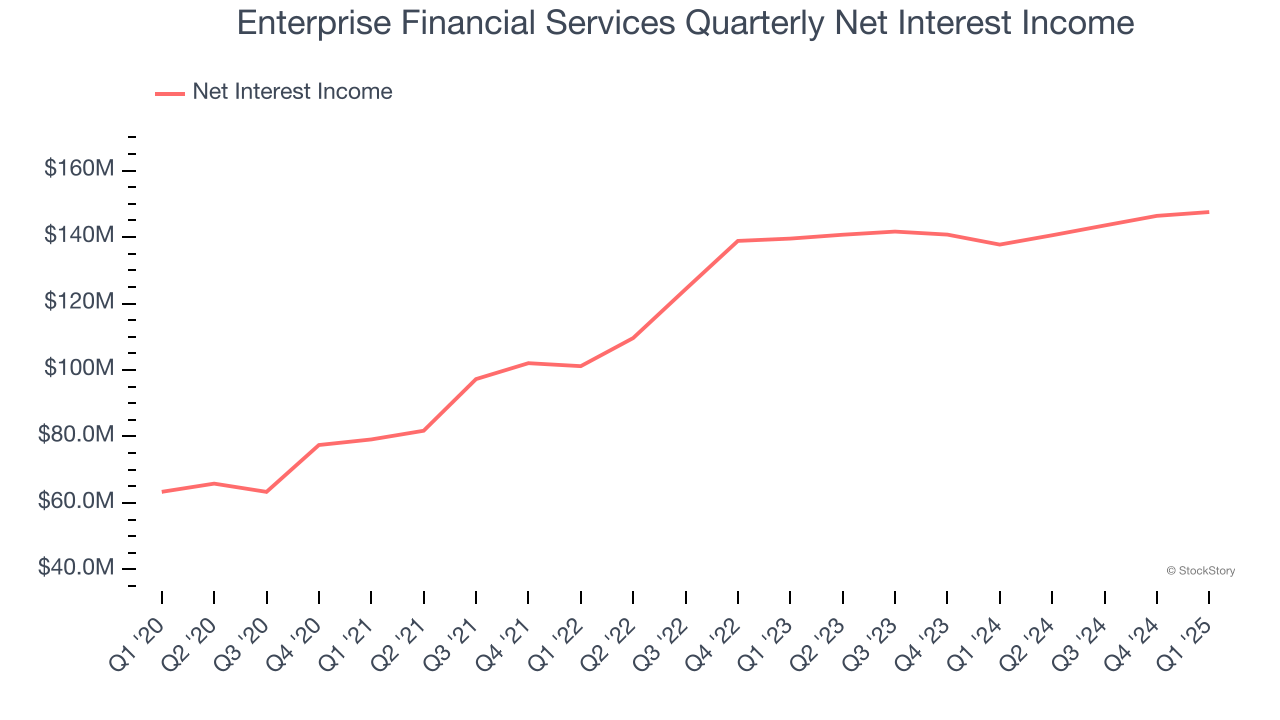

Net interest income commands greater market attention due to its reliability and consistency, whereas non-interest income is often seen as lower-quality revenue that lacks the same dependable characteristics.

Enterprise Financial Services’s net interest income has grown at a 19.3% annualized rate over the last four years, much better than the broader banking industry.

2. Steady Increase in TBVPS Highlights Solid Asset Growth

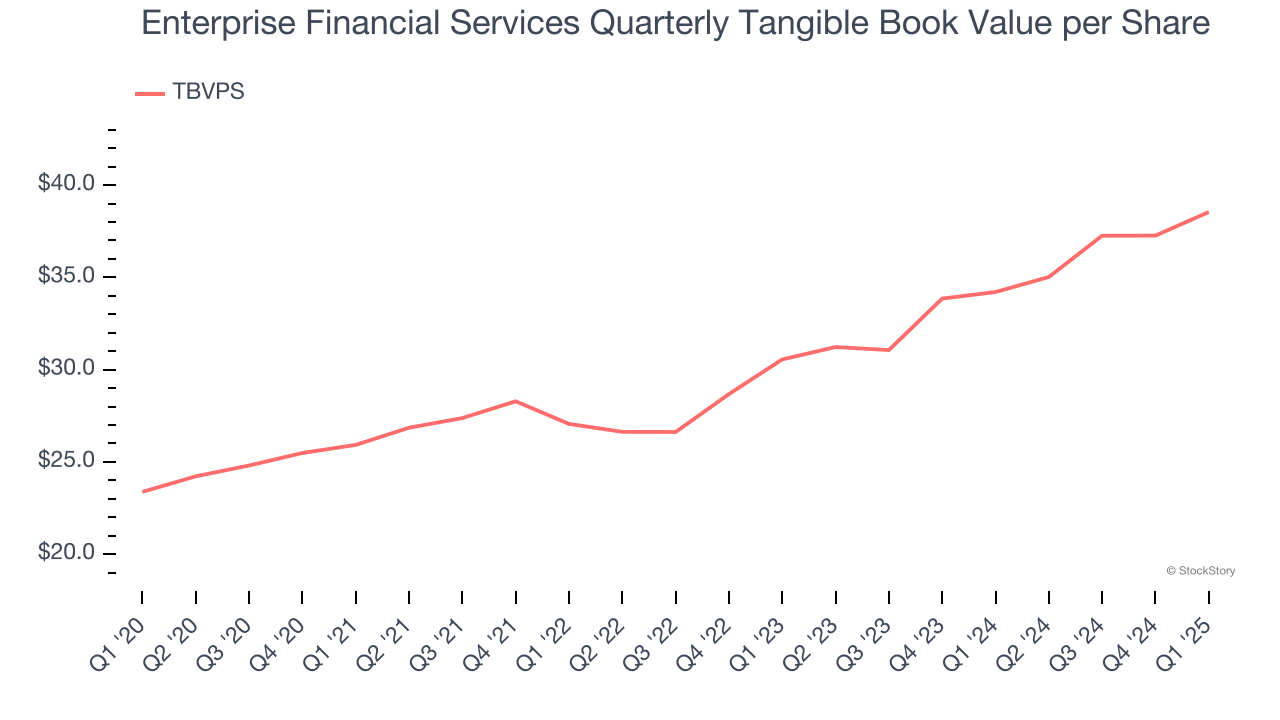

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Enterprise Financial Services’s TBVPS increased by 10.5% annually over the last five years, and growth has recently accelerated as TBVPS grew at a solid 12.3% annual clip over the past two years (from $30.55 to $38.54 per share).

One Reason to be Careful:

Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Enterprise Financial Services’s net interest income to rise by 5.5%, close to its 6.2% annualized growth for the past two years. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet. At least the company is tracking well in other measures of financial health.

Final Judgment

Enterprise Financial Services’s merits more than compensate for its flaws. After the recent drawdown, the stock trades at 1× forward P/B (or $53.47 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Enterprise Financial Services

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.