Over the past six months, Fifth Third Bancorp’s stock price fell to $39.13. Shareholders have lost 7.4% of their capital, which is disappointing considering the S&P 500 has climbed by 1.9%. This might have investors contemplating their next move.

Is there a buying opportunity in Fifth Third Bancorp, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Fifth Third Bancorp Not Exciting?

Despite the more favorable entry price, we're cautious about Fifth Third Bancorp. Here are three reasons why you should be careful with FITB and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

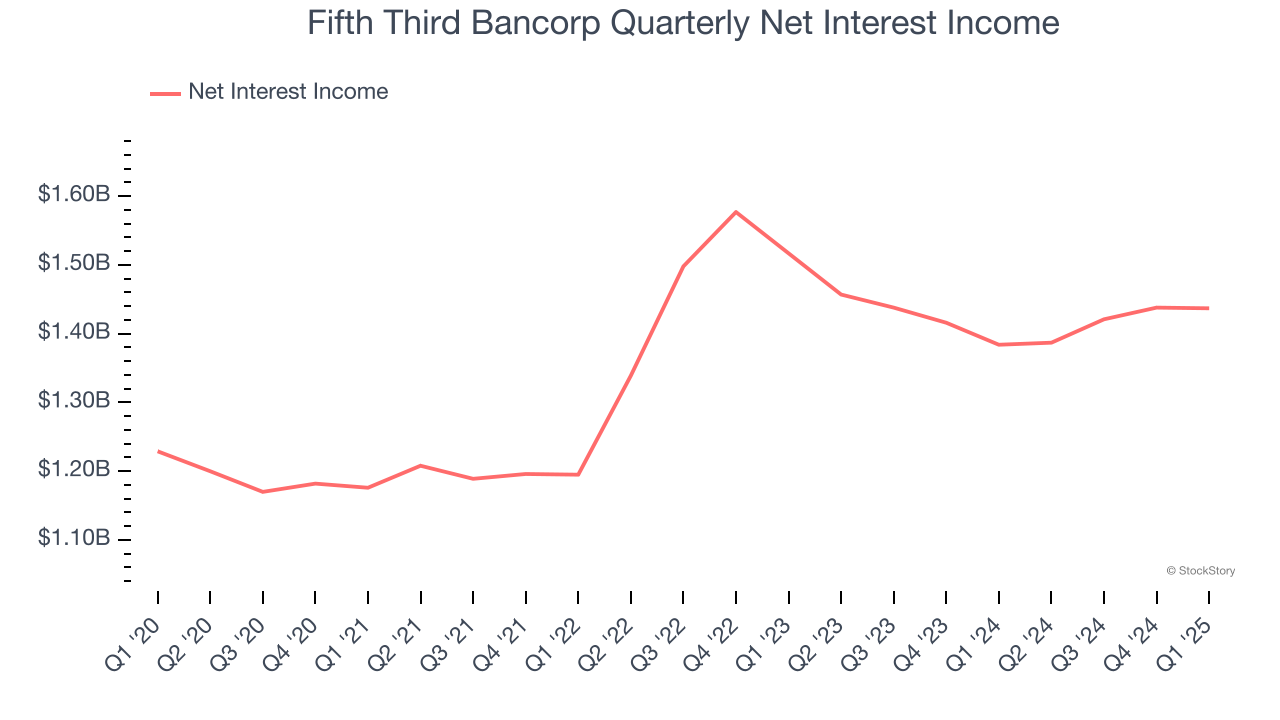

Our experience and research show the market cares primarily about a bank’s net interest income growth as non-interest income is considered a lower-quality and non-recurring revenue source.

Fifth Third Bancorp’s net interest income has grown at a 4.7% annualized rate over the last four years, worse than the broader bank industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

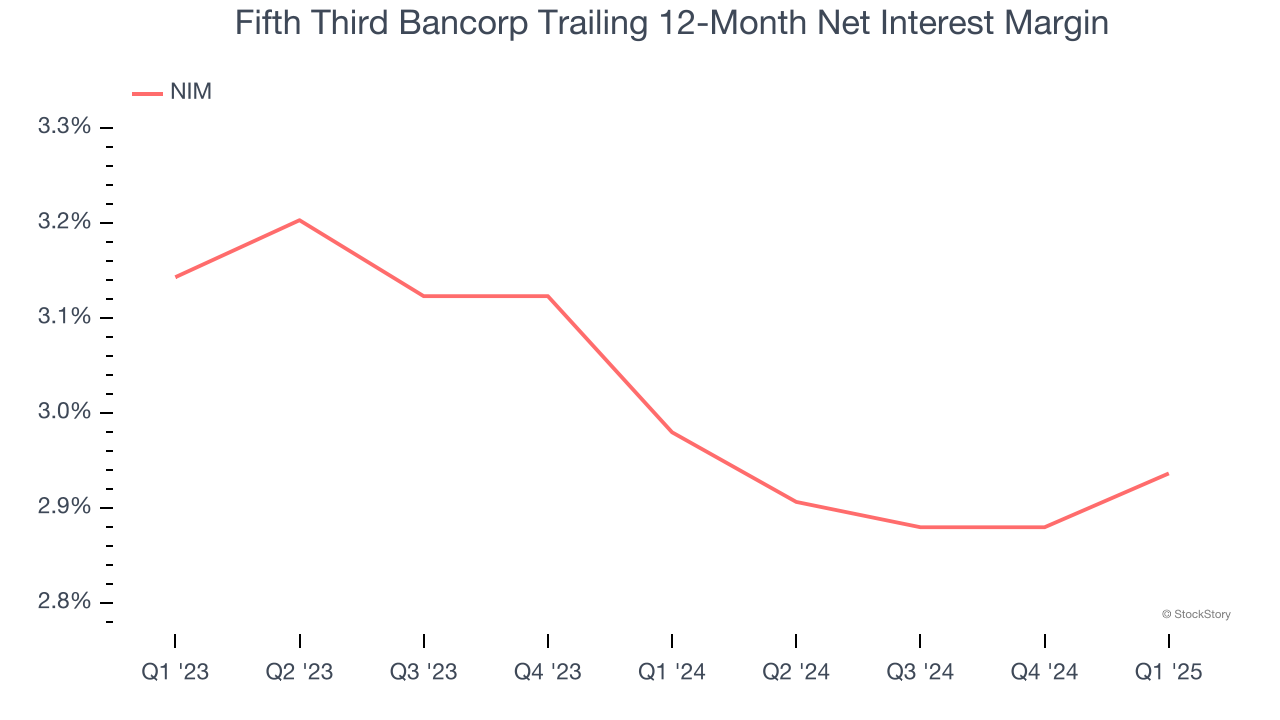

Revenue is a fine reference point for banks, but net interest income and margin are better indicators of business quality for banks because they’re balance sheet-driven businesses that leverage their assets to generate profits.

Over the past two years, we can see that Fifth Third Bancorp’s net interest margin averaged a weak 3%, reflecting its high servicing and capital costs.

3. TBVPS Growth Demonstrates Strong Asset Foundation

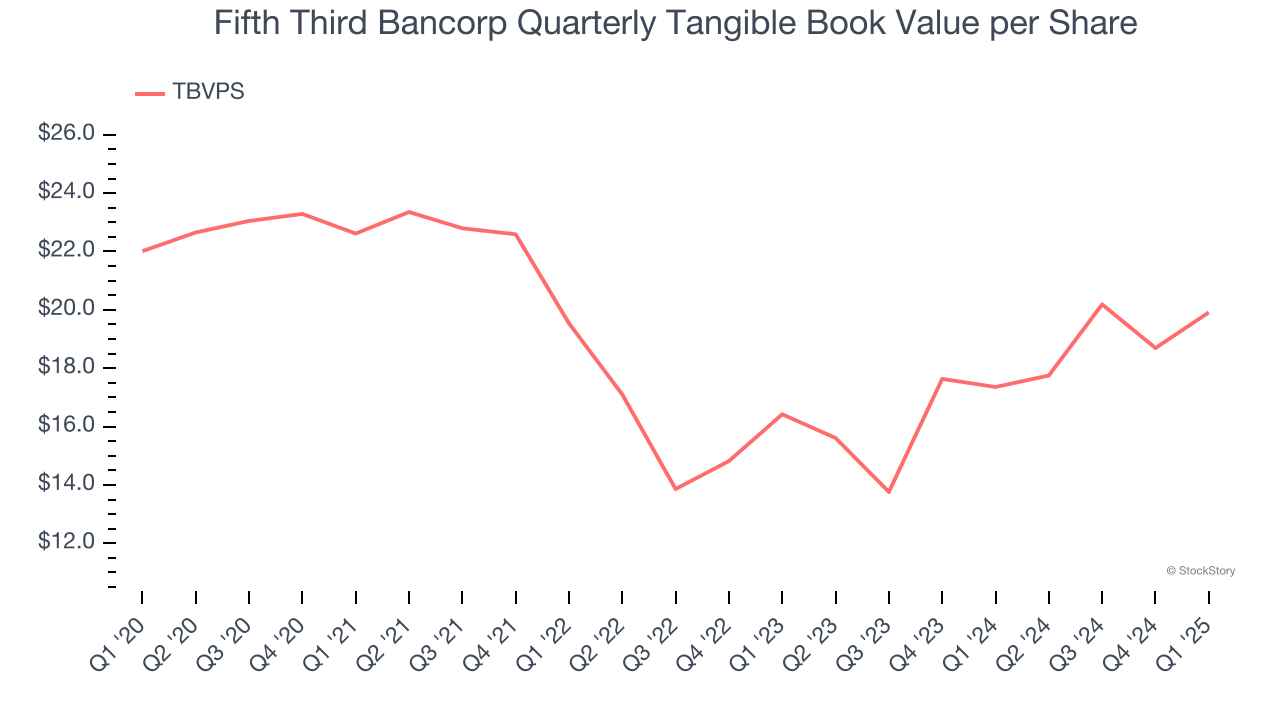

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Although Fifth Third Bancorp’s TBVPS declined at a 2% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as TBVPS grew at a decent 10.1% annual clip (from $16.42 to $19.91 per share).

Final Judgment

Fifth Third Bancorp isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 1.3× forward P/B (or $39.13 per share). This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward one of our all-time favorite software stocks.

Stocks We Like More Than Fifth Third Bancorp

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.