Let’s dig into the relative performance of Rapid7 (NASDAQ: RPD) and its peers as we unravel the now-completed Q1 cybersecurity earnings season.

Cybersecurity continues to be one of the fastest-growing segments within software for good reason. Almost every company is slowly finding itself becoming a technology company and facing rising cybersecurity risks. Businesses are accelerating adoption of cloud-based software, moving data and applications into the cloud to save costs while improving performance. This migration has opened them to a multitude of new threats, like employees accessing data via their smartphone while on an open network, or logging into a web-based interface from a laptop in a new location.

The 9 cybersecurity stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

While some cybersecurity stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.5% since the latest earnings results.

Rapid7 (NASDAQ: RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ: RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

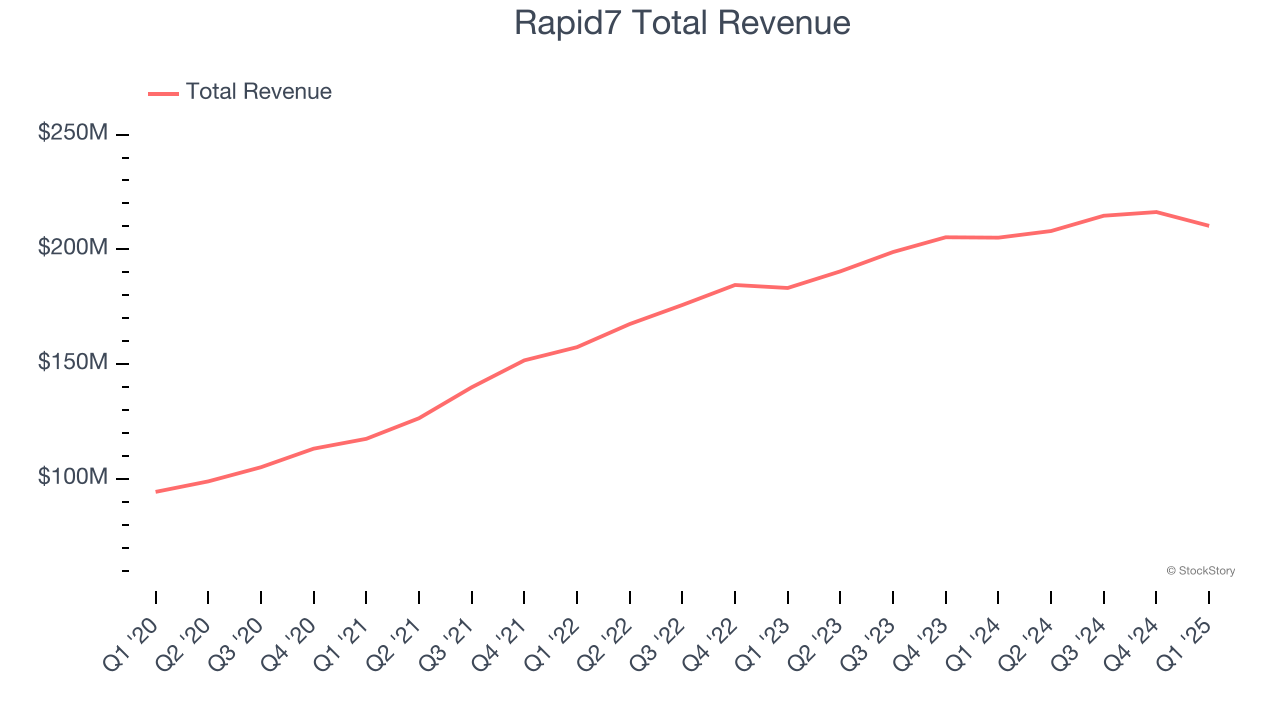

Rapid7 reported revenues of $210.3 million, up 2.5% year on year. This print exceeded analysts’ expectations by 1.1%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“We had a slower start to 2025 than anticipated however we have a clear strategy and strong conviction in our long-term opportunity,” said Corey Thomas, Chairman and CEO of Rapid7.

Rapid7 delivered the slowest revenue growth and weakest full-year guidance update of the whole group. The company lost 42 customers and ended up with a total of 11,685. The stock is down 16.5% since reporting and currently trades at $22.32.

Is now the time to buy Rapid7? Access our full analysis of the earnings results here, it’s free.

Best Q1: Zscaler (NASDAQ: ZS)

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

Zscaler reported revenues of $678 million, up 22.6% year on year, outperforming analysts’ expectations by 1.6%. The business had a very strong quarter with full-year EPS guidance exceeding analysts’ expectations and a solid beat of analysts’ annual recurring revenue estimates.

Zscaler scored the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 20.7% since reporting. It currently trades at $302.99.

Is now the time to buy Zscaler? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SentinelOne (NYSE: S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE: S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $229 million, up 22.9% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted a solid beat of analysts’ EBITDA estimates but a miss of analysts’ billings estimates.

As expected, the stock is down 11% since the results and currently trades at $17.50.

Read our full analysis of SentinelOne’s results here.

CrowdStrike (NASDAQ: CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ: CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $1.10 billion, up 19.8% year on year. This number was in line with analysts’ expectations. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

CrowdStrike had the weakest performance against analyst estimates among its peers. The stock is down 2.5% since reporting and currently trades at $476.50.

Read our full, actionable report on CrowdStrike here, it’s free.

Okta (NASDAQ: OKTA)

Founded during the aftermath of the financial crisis in 2009, Okta (NASDAQ: OKTA) is a cloud-based software-as-a-service platform that helps companies manage identity for their employees and customers.

Okta reported revenues of $688 million, up 11.5% year on year. This result surpassed analysts’ expectations by 1.2%. Zooming out, it was a satisfactory quarter as it also recorded EPS guidance for next quarter exceeding analysts’ expectations but a miss of analysts’ billings estimates.

The stock is down 20.8% since reporting and currently trades at $99.51.

Read our full, actionable report on Okta here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.