Over the past six months, Pinnacle Financial Partners’s shares (currently trading at $107.54) have posted a disappointing 6.1% loss while the S&P 500 was flat. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Following the drawdown, is now an opportune time to buy PNFP? Find out in our full research report, it’s free.

Why Does PNFP Stock Spark Debate?

Founded in 2000 with a focus on delivering big-bank capabilities with community bank personalization, Pinnacle Financial Partners (NASDAQ: PNFP) is a Tennessee-based financial holding company that provides banking, investment, trust, mortgage, and insurance services to businesses and individuals.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

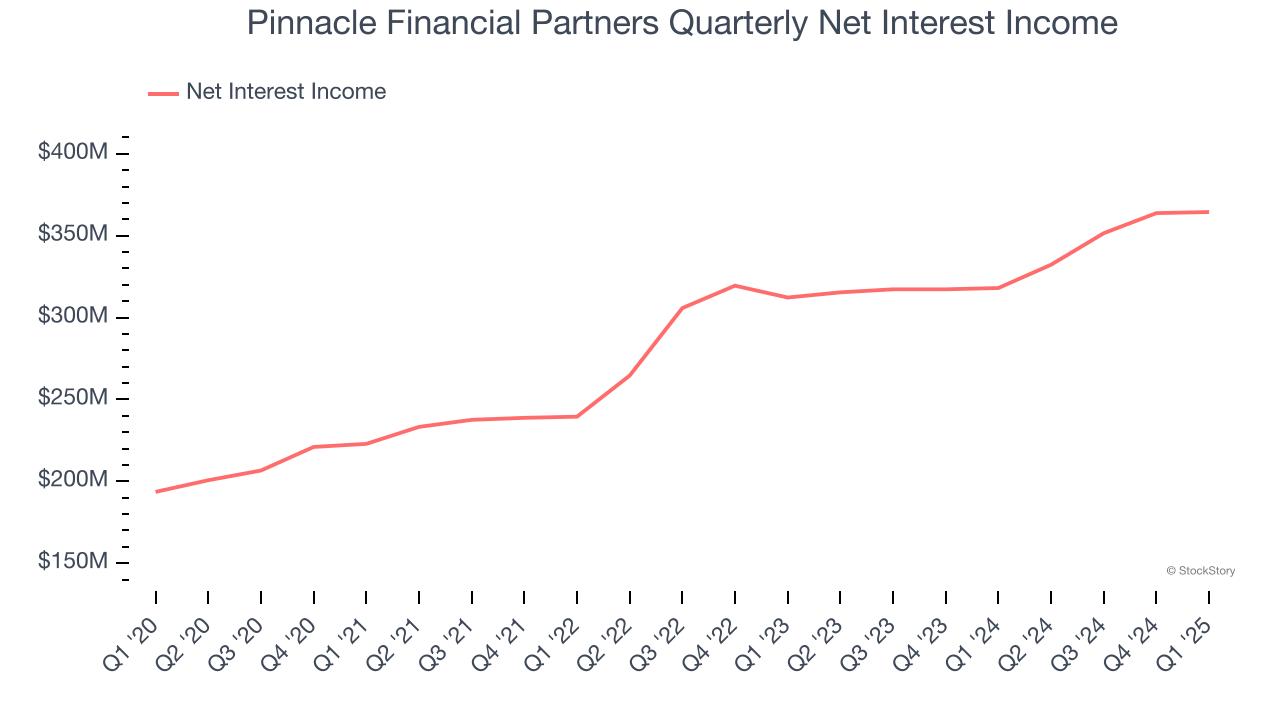

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

Pinnacle Financial Partners’s net interest income has grown at a 13.5% annualized rate over the last four years, better than the broader bank industry.

2. Forecasted Efficiency Ratio Shows Stronger Profits Ahead

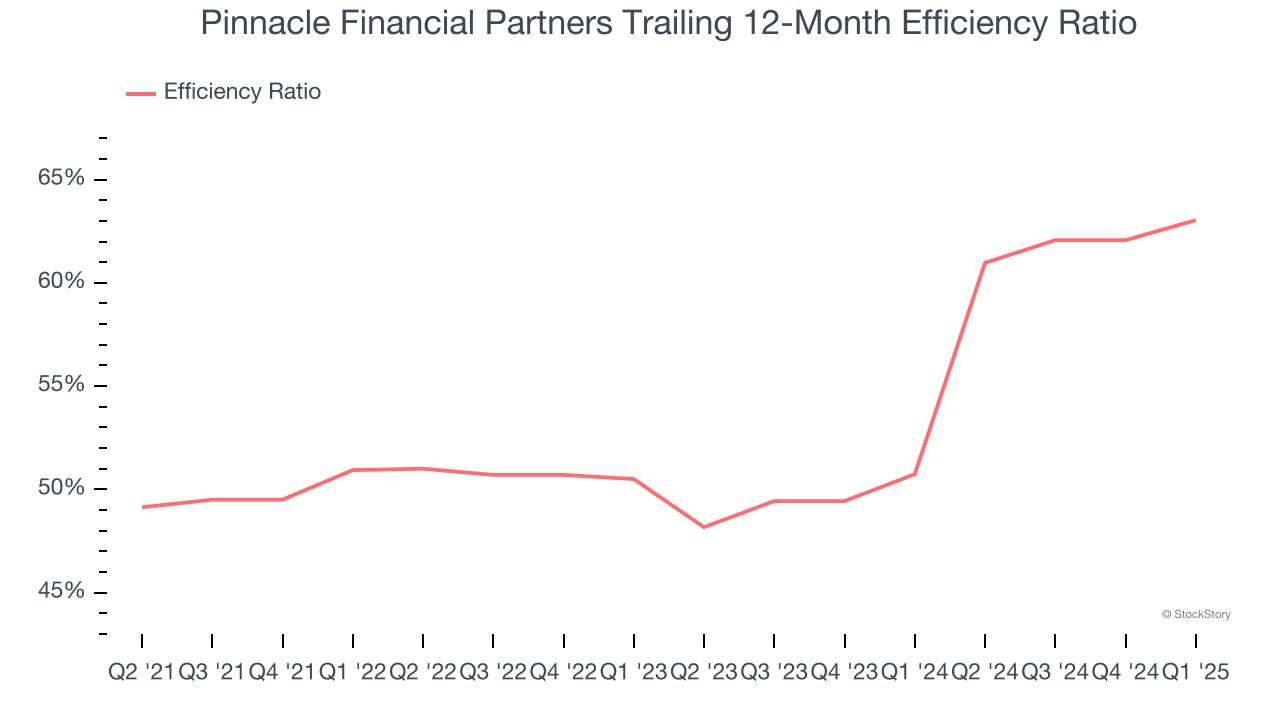

Topline growth is certainly important, but the overall profitability of this growth matters for the bottom line. For banks, we look at efficiency ratio, which is non-interest expense (salaries, rent, IT, marketing, excluding interest paid out to depositors) as a percentage of total revenue.

Investors place greater emphasis on efficiency ratio movements than absolute values, understanding that expense structures reflect revenue mix variations. Lower ratios represent better operational performance since they show banks generating more revenue per dollar of expense.

For the next 12 months, Wall Street expects Pinnacle Financial Partners to rein in some of its expenses as it anticipates an efficiency ratio of 56% compared to 63% over the past year.

One Reason to be Careful:

Lackluster Revenue Growth

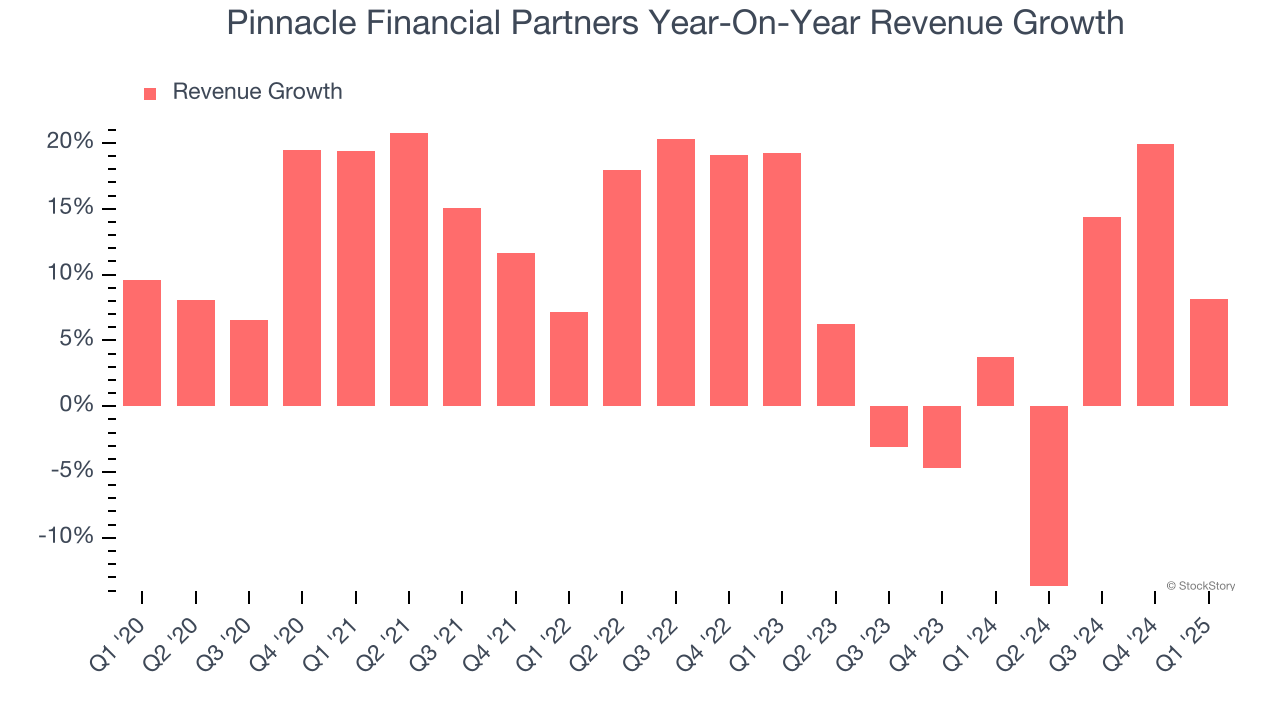

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Pinnacle Financial Partners’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.6% over the last two years was well below its five-year trend.

Final Judgment

Pinnacle Financial Partners’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 1.2× forward P/B (or $107.54 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.