Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Applied Materials (NASDAQ: AMAT) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was 2.9% below.

Thankfully, share prices of the companies have been resilient as they are up 7.1% on average since the latest earnings results.

Applied Materials (NASDAQ: AMAT)

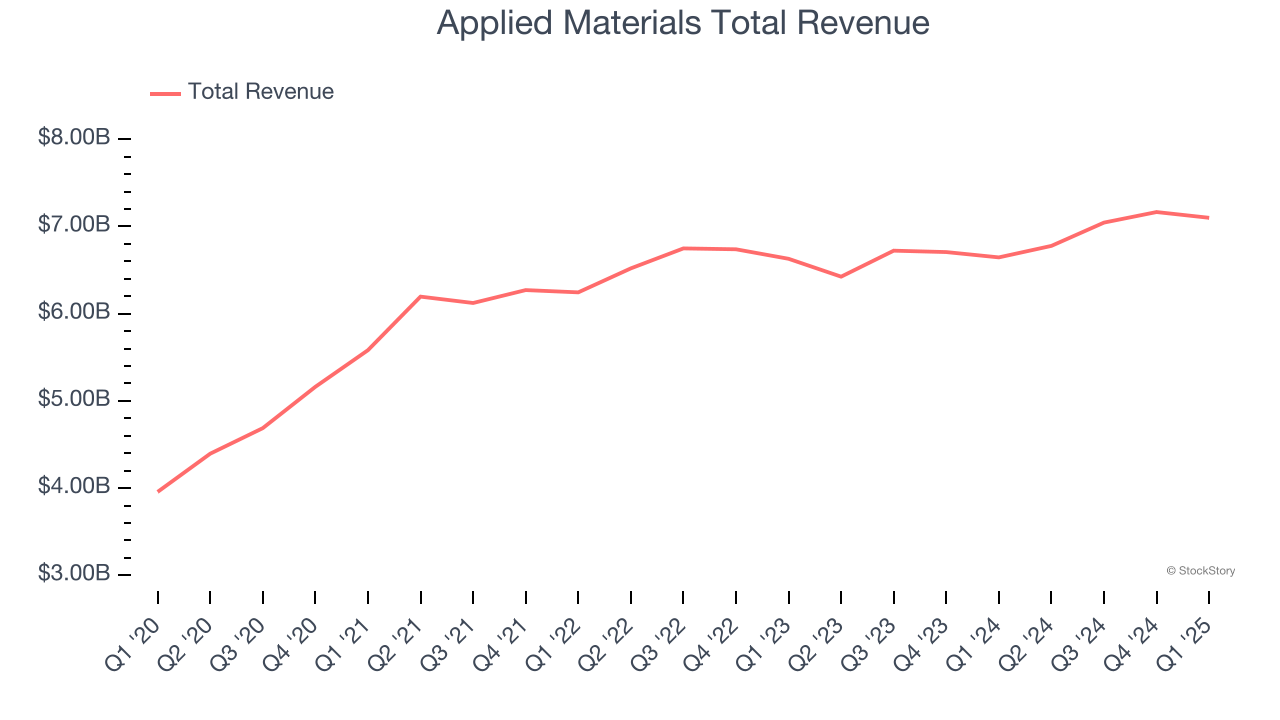

Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ: AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $7.1 billion, up 6.8% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a solid beat of analysts’ EPS estimates but an increase in its inventory levels.

“Applied Materials’ broad capabilities and connected product portfolio are driving strong results in 2025 amidst a highly dynamic macro environment,” said Gary Dickerson, President and CEO.

The stock is down 4.3% since reporting and currently trades at $167.

Is now the time to buy Applied Materials? Access our full analysis of the earnings results here, it’s free.

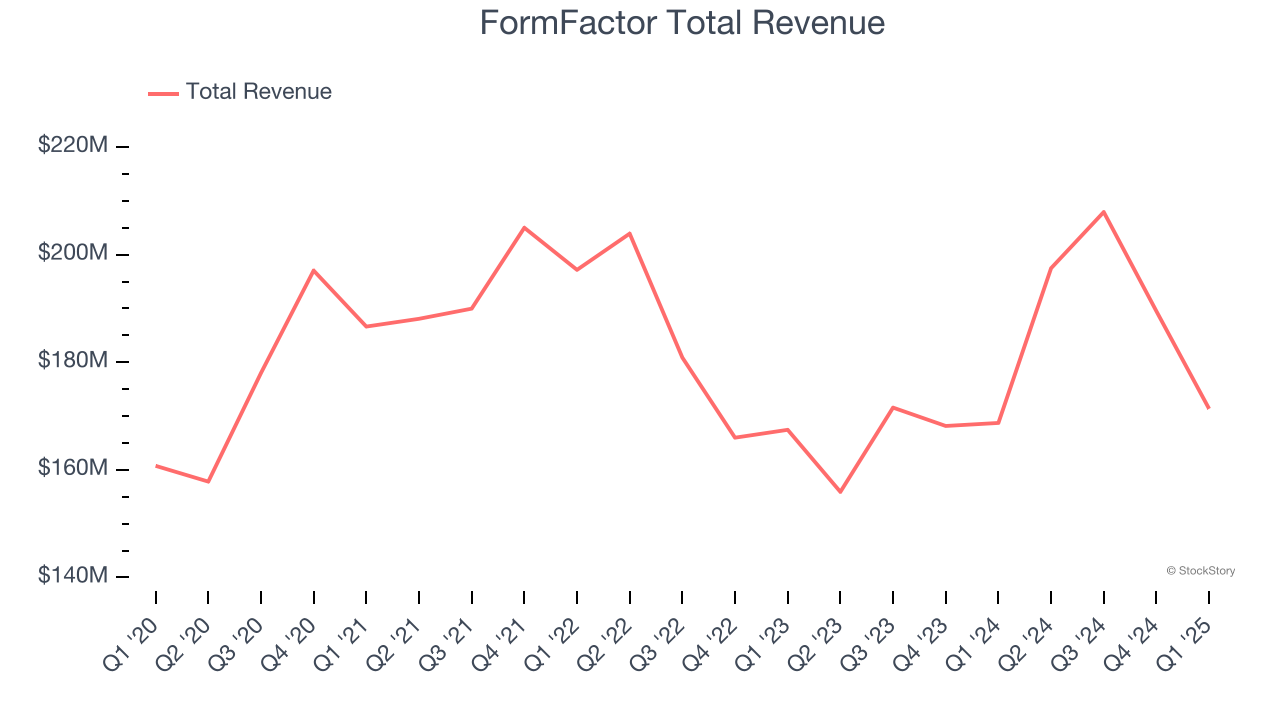

Best Q1: FormFactor (NASDAQ: FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $171.4 million, up 1.6% year on year, outperforming analysts’ expectations by 0.9%. The business had a strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 16.7% since reporting. It currently trades at $32.76.

Is now the time to buy FormFactor? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Photronics (NASDAQ: PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ: PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $211 million, down 2.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 10.5% since the results and currently trades at $17.97.

Read our full analysis of Photronics’s results here.

Entegris (NASDAQ: ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ: ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $773.2 million, flat year on year. This result missed analysts’ expectations by 2.1%. It was a softer quarter as it also recorded a significant miss of analysts’ EPS estimates and an increase in its inventory levels.

The stock is down 10.8% since reporting and currently trades at $74.

Read our full, actionable report on Entegris here, it’s free.

Amtech (NASDAQ: ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ: ASYS) produces the machinery and related chemicals necessary for semiconductor manufacturing.

Amtech reported revenues of $15.58 million, down 38.7% year on year. This number came in 15.8% below analysts' expectations. Overall, it was a disappointing quarter as it also logged revenue guidance for next quarter missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

Amtech had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 21.4% since reporting and currently trades at $4.08.

Read our full, actionable report on Amtech here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.