Since July 2020, the S&P 500 has delivered a total return of 98.8%. But one standout stock has more than doubled the market - over the past five years, BancFirst has surged 251% to $130.91 per share. Its momentum hasn’t stopped as it’s also gained 16.1% in the last six months thanks to its solid quarterly results, beating the S&P by 8.5%.

Is now still a good time to buy BANF? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does BancFirst Spark Debate?

Operating as a "super community bank" with a decentralized management approach that emphasizes local responsiveness, BancFirst Corporation (NASDAQ: BANF) operates as a financial holding company providing commercial banking services to retail customers and small to medium-sized businesses primarily in Oklahoma and Texas.

Two Positive Attributes:

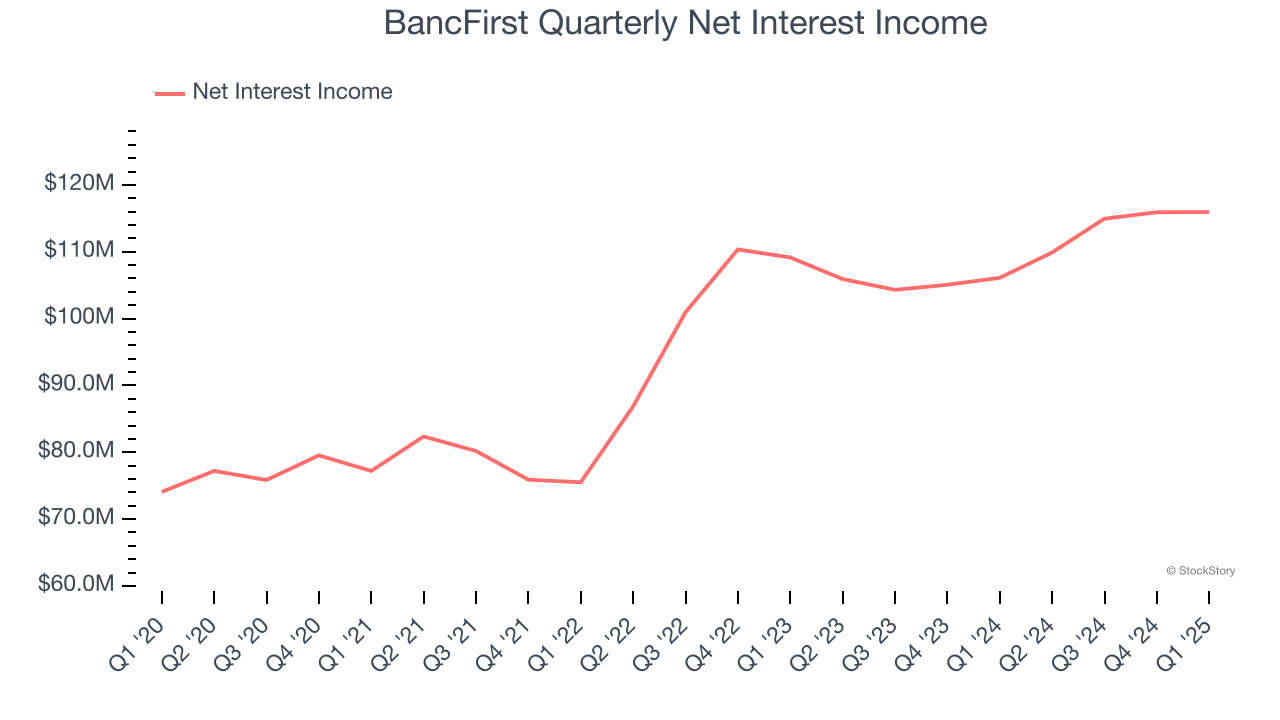

1. Net Interest Income Drives Additional Growth Opportunities

While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

BancFirst’s net interest income has grown at a 10.2% annualized rate over the last four years, a step above the broader bank industry.

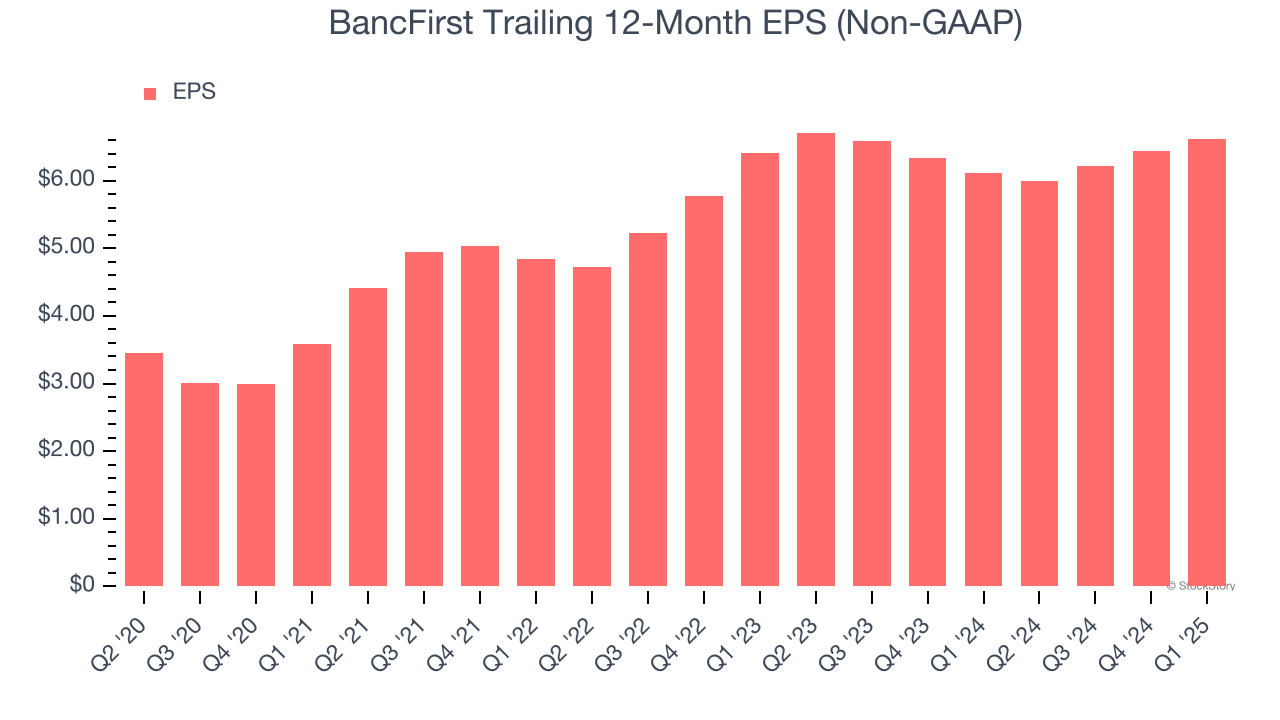

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

BancFirst’s EPS grew at an astounding 12.6% compounded annual growth rate over the last five years, higher than its 8.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect BancFirst’s net interest income to rise by 1.7%, a deceleration versus its 5.9% annualized growth for the past two years. This projection is below its 5.9% annualized growth rate for the past two years.

Final Judgment

BancFirst’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 2.5× forward P/B (or $130.91 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than BancFirst

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.