Let’s dig into the relative performance of Lucid (NASDAQ: LCID) and its peers as we unravel the now-completed Q1 automobile manufacturing earnings season.

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

The 7 automobile manufacturing stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 4.5%.

Luckily, automobile manufacturing stocks have performed well with share prices up 10.7% on average since the latest earnings results.

Lucid (NASDAQ: LCID)

Founded by a former Tesla Vice President, Lucid Group (NASDAQ: LCID) designs, manufactures, and sells luxury electric vehicles with long-range capabilities.

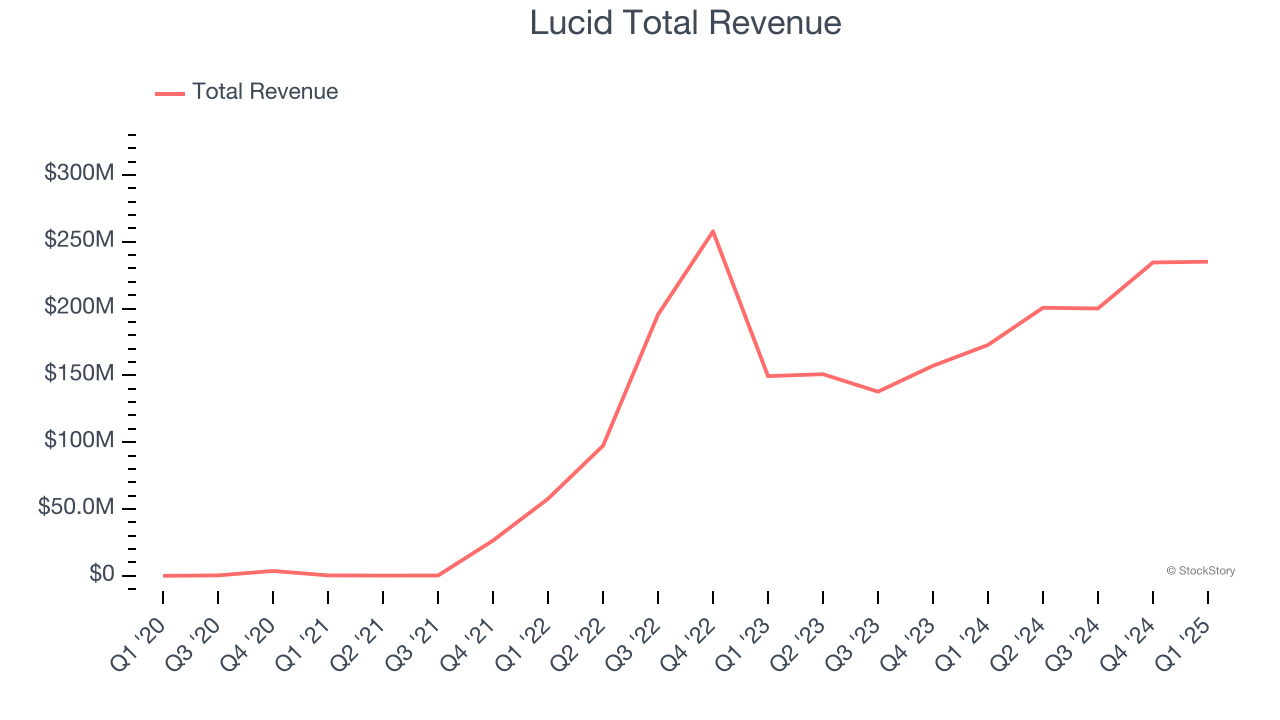

Lucid reported revenues of $235 million, up 36.1% year on year. This print fell short of analysts’ expectations by 0.9%, but it was still a strong quarter for the company with an impressive beat of analysts’ sales volume estimates and a solid beat of analysts’ adjusted operating income estimates.

"We continued to build momentum in the first quarter as we achieved yet another delivery record, further strengthened our market position, and executed against operational priorities," said Marc Winterhoff, Interim CEO at Lucid.

Lucid achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 1.3% since reporting and currently trades at $2.29.

Best Q1: THOR Industries (NYSE: THO)

Created through the acquisition and merger of various RV manufacturers, THOR Industries manufactures and sells a range of recreational vehicles, including motorhomes and travel trailers, catering to consumers seeking the freedom and comfort of the RV lifestyle.

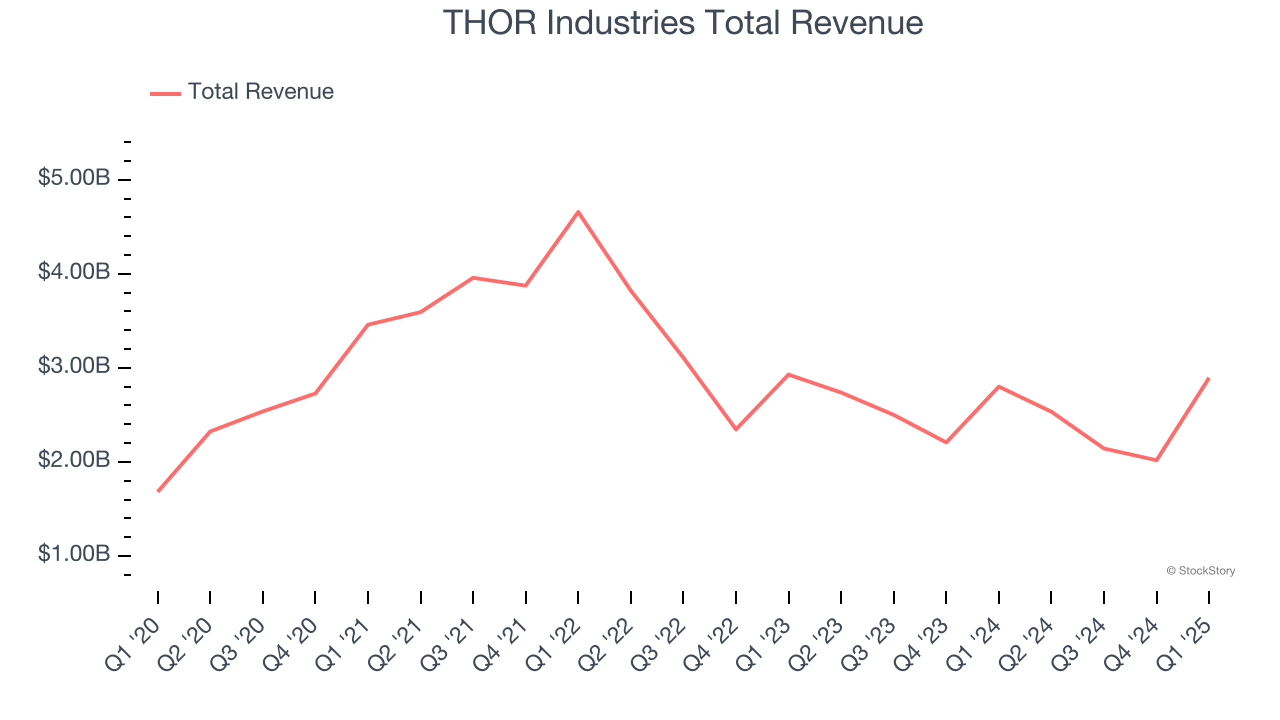

THOR Industries reported revenues of $2.89 billion, up 3.3% year on year, outperforming analysts’ expectations by 10.1%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 13.3% since reporting. It currently trades at $93.23.

Is now the time to buy THOR Industries? Access our full analysis of the earnings results here, it’s free.

Slowest Q1: Tesla (NASDAQ: TSLA)

Originally founded by Martin Eberhard and Marc Tarpenning in 2003, Tesla (NASDAQ: TSLA) is an electric vehicle company accelerating the world’s transition to sustainable energy.

Tesla reported revenues of $19.34 billion, down 9.2% year on year, falling short of analysts’ expectations by 8.1%. It was a disappointing quarter as it posted a miss of analysts’ revenue estimates, as Services, Automotive, and Energy all missed and a significant miss of analysts’ operating income estimates.

Tesla delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 31.3% since the results and currently trades at $312.80.

Read our full analysis of Tesla’s results here.

General Motors (NYSE: GM)

Founded in 1908 by William C. Durant, General Motors (NYSE: GM) offers a range of vehicles and automobiles through brands such as Chevrolet, Buick, GMC, and Cadillac.

General Motors reported revenues of $44.02 billion, up 2.3% year on year. This number topped analysts’ expectations by 2.7%. Taking a step back, it was a mixed quarter as it also recorded a narrow beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EBITDA estimates.

The stock is up 12.9% since reporting and currently trades at $53.29.

Read our full, actionable report on General Motors here, it’s free.

Ford (NYSE: F)

Established to make automobiles accessible to a broader segment of the population, Ford (NYSE: F) designs, manufactures, and sells a variety of automobiles, trucks, and electric vehicles.

Ford reported revenues of $40.66 billion, down 5% year on year. This result beat analysts’ expectations by 4.3%. It was a stunning quarter as it also produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

The stock is up 15.6% since reporting and currently trades at $11.78.

Read our full, actionable report on Ford here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.