As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer electronics industry, including Peloton (NASDAQ: PTON) and its peers.

Consumer electronics companies aim to address the evolving leisure and entertainment needs of consumers, who are increasingly familiar with technology in everyday life. Whether it’s speakers for the home or specialized cameras to document everything from a surfing session to a wedding reception, these businesses are trying to provide innovative, high-quality products that are both useful and cool to own. Adding to the degree of difficulty for these companies is technological change, where the latest smartphone could disintermediate a whole category of consumer electronics. Companies that successfully serve customers and innovate can enjoy high customer loyalty and pricing power, while those that struggle with these may go the way of the VHS tape.

The 4 consumer electronics stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 2.7%.

Luckily, consumer electronics stocks have performed well with share prices up 69.2% on average since the latest earnings results.

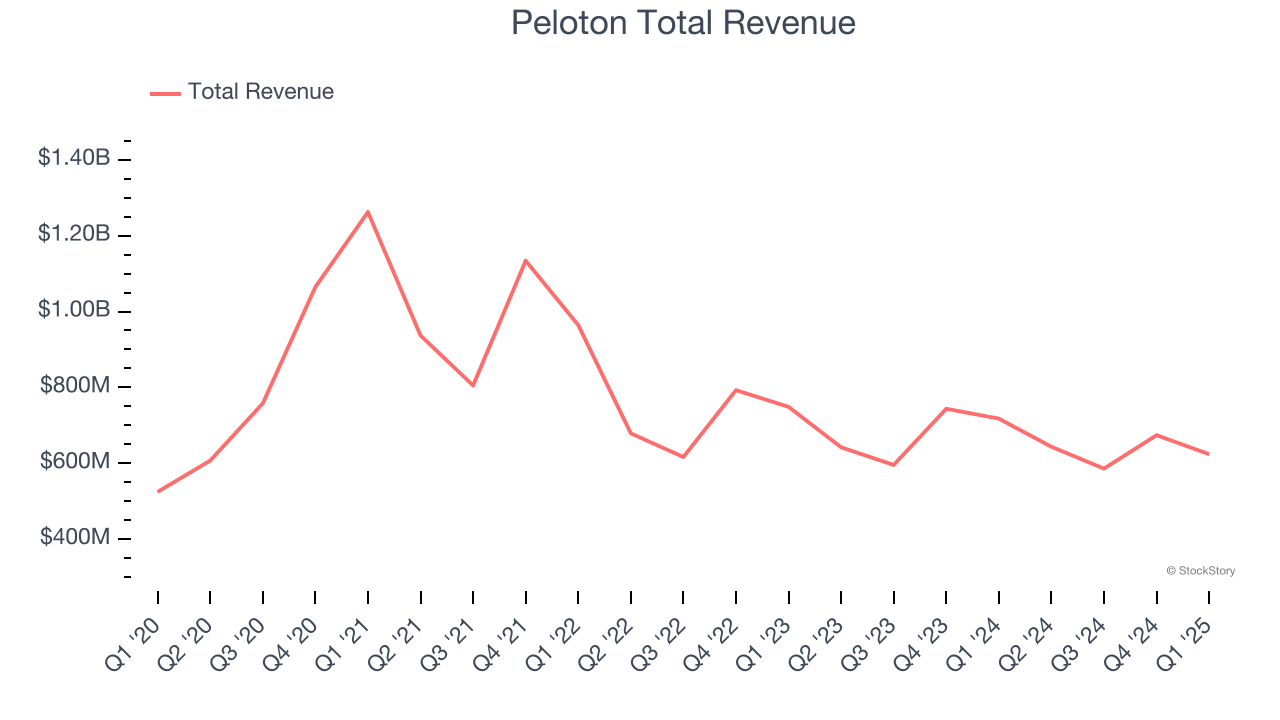

Weakest Q1: Peloton (NASDAQ: PTON)

Started as a Kickstarter campaign, Peloton (NASDAQ: PTON) is a fitness technology company known for its at-home exercise equipment and interactive online workout classes.

Peloton reported revenues of $624 million, down 13.1% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ adjusted operating income estimates but a miss of analysts’ EPS estimates.

Peloton delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 6.9% since reporting and currently trades at $6.50.

Is now the time to buy Peloton? Access our full analysis of the earnings results here, it’s free.

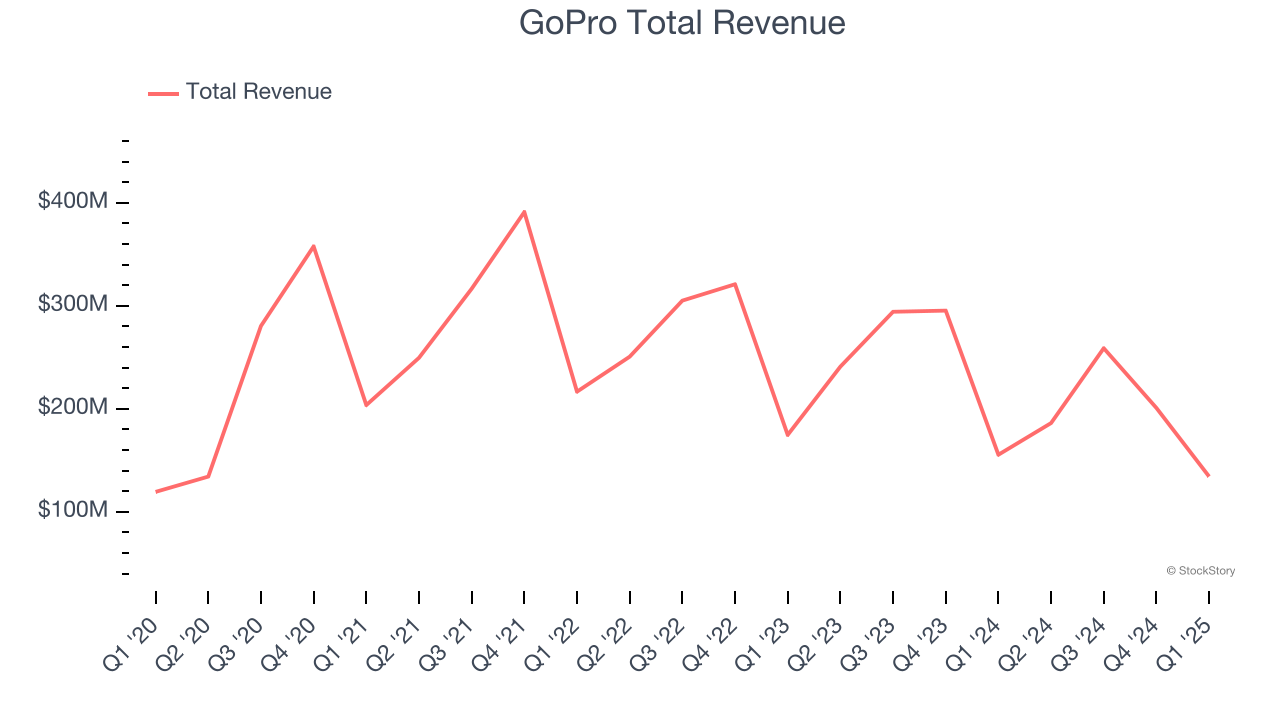

Best Q1: GoPro (NASDAQ: GPRO)

Known for sponsoring extreme athletes, GoPro (NASDAQ: GPRO) is a camera company known for its POV videos and editing software.

GoPro reported revenues of $134.3 million, down 13.6% year on year, outperforming analysts’ expectations by 7.8%. The business had a strong quarter with a decent beat of analysts’ EBITDA estimates.

GoPro delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 259% since reporting. It currently trades at $2.19.

Is now the time to buy GoPro? Access our full analysis of the earnings results here, it’s free.

Apple (NASDAQ: AAPL)

Creator of the iPhone and App Store, Apple (NASDAQ: AAPL) is a legendary developer of consumer electronics and software.

Apple reported revenues of $95.36 billion, up 5.1% year on year, exceeding analysts’ expectations by 0.7%. It was a satisfactory quarter as it also posted We were also happy its revenue narrowly outperformed Wall Street’s estimates, and the beat in Products was a bright spot.

The stock is flat since the results and currently trades at $214.82.

Read our full analysis of Apple’s results here.

Sonos (NASDAQ: SONO)

A pioneer in connected home audio systems, Sonos (NASDAQ: SONO) offers a range of premium wireless speakers and sound systems.

Sonos reported revenues of $259.8 million, up 2.8% year on year. This number topped analysts’ expectations by 1.8%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 23.4% since reporting and currently trades at $11.05.

Read our full, actionable report on Sonos here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.