Concentrix trades at $59 per share and has stayed right on track with the overall market, gaining 9.3% over the last six months. At the same time, the S&P 500 has returned 5.8%.

Is now a good time to buy CNXC? Find out in our full research report, it’s free.

Why Does CNXC Stock Spark Debate?

With a team of approximately 450,000 employees across 75 countries, Concentrix (NASDAQ: CNXC) designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

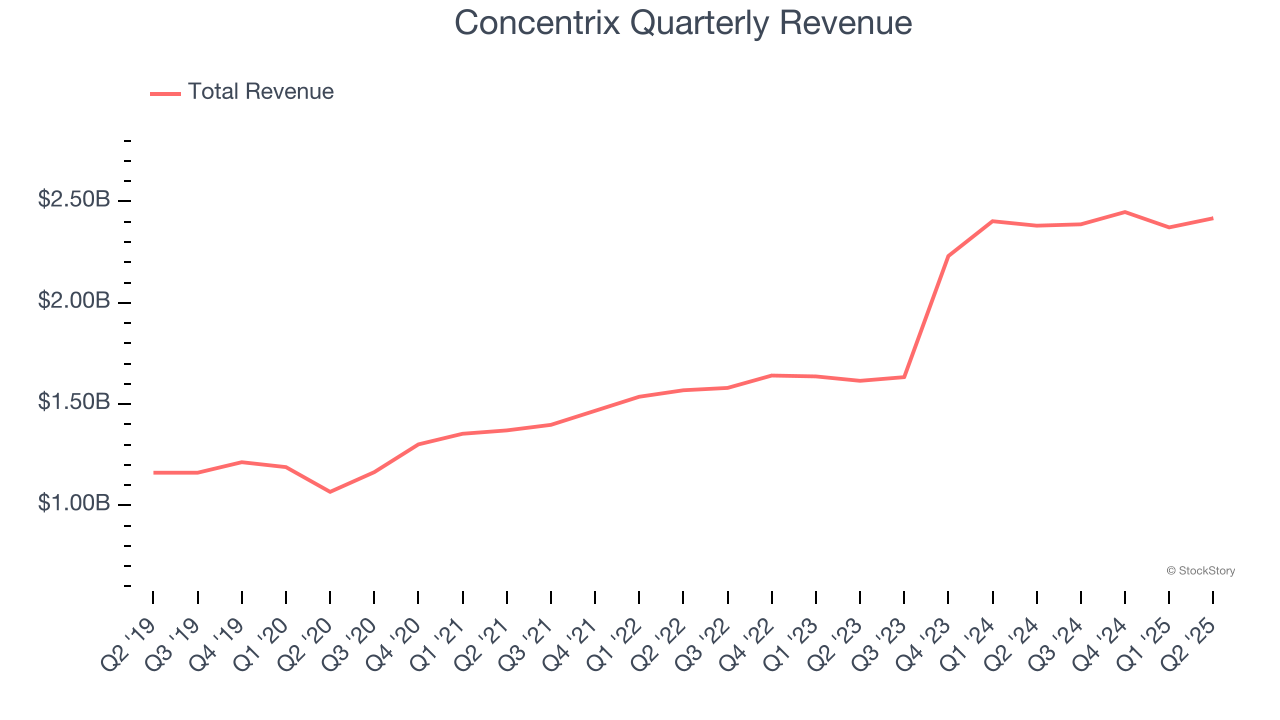

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Concentrix grew its sales at an incredible 15.8% compounded annual growth rate. Its growth surpassed the average business services company and shows its offerings resonate with customers.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $9.63 billion in revenue over the past 12 months, Concentrix is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

One Reason to be Careful:

EPS Barely Growing

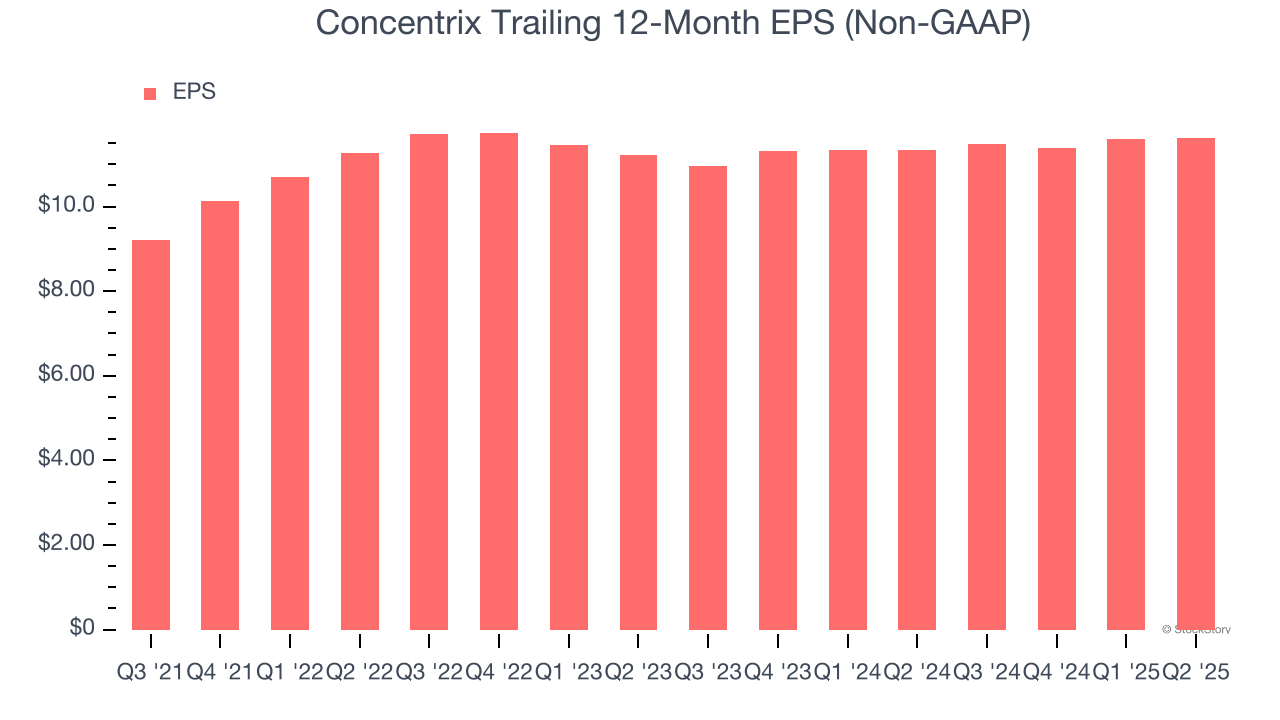

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Concentrix’s full-year EPS grew at an unimpressive 6.8% compounded annual growth rate over the last four years, in line with the broader business services sector.

Final Judgment

Concentrix’s merits more than compensate for its flaws, but at $59 per share (or 5× forward P/E), is now the right time to buy the stock? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Concentrix

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.