Car rental services provider Avis (NASDAQ: CAR) reported Q2 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $3.04 billion. Its GAAP profit of $0.10 per share was 94.5% below analysts’ consensus estimates.

Is now the time to buy Avis Budget Group? Find out by accessing our full research report, it’s free.

Avis Budget Group (CAR) Q2 CY2025 Highlights:

- Revenue: $3.04 billion vs analyst estimates of $3 billion (flat year on year, 1.4% beat)

- EPS (GAAP): $0.10 vs analyst expectations of $1.83 (94.5% miss)

- Adjusted EBITDA: $277 million vs analyst estimates of $237.2 million (9.1% margin, 16.8% beat)

- Operating Margin: 36.8%, up from 4.4% in the same quarter last year

- Free Cash Flow Margin: 63.1%, up from 4.2% in the same quarter last year

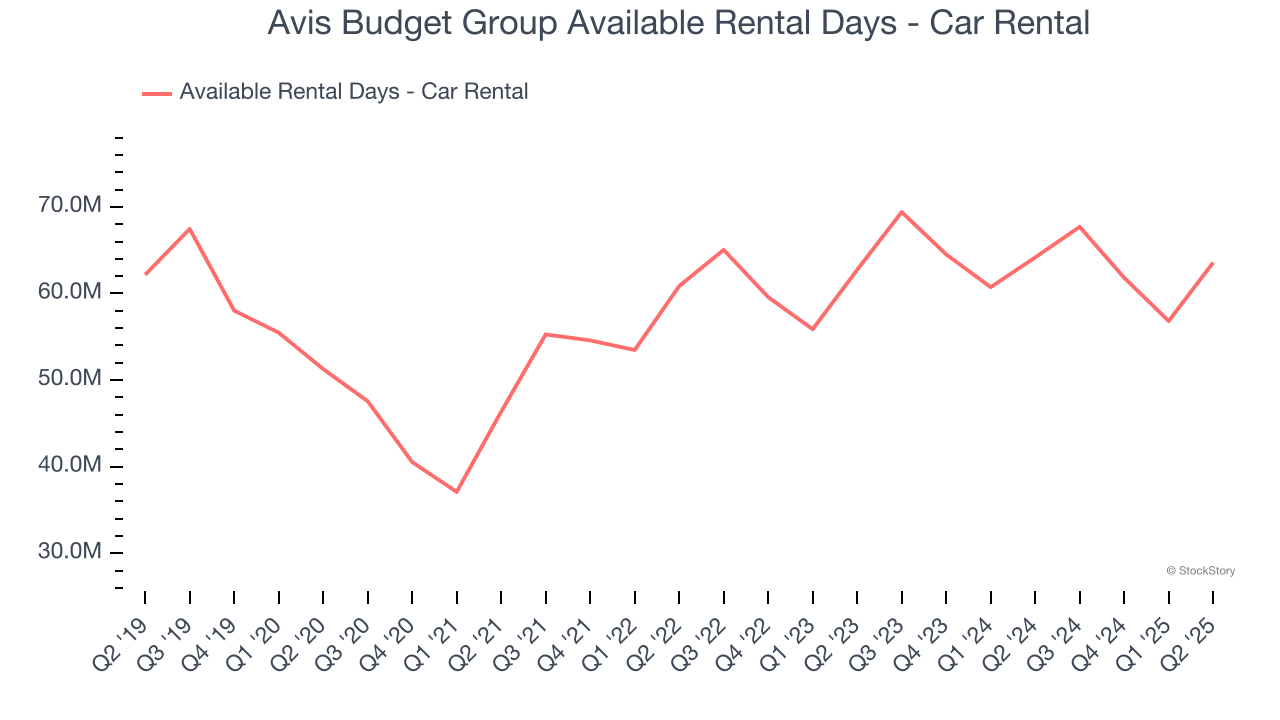

- Available rental days - Car rental: 63.58 million, in line with the same quarter last year

- Market Capitalization: $7.25 billion

Company Overview

The parent company of brands such as Zipcar and Budget Truck Rental, Avis (NASDAQ: CAR) is a provider of car rental and mobility solutions.

Revenue Growth

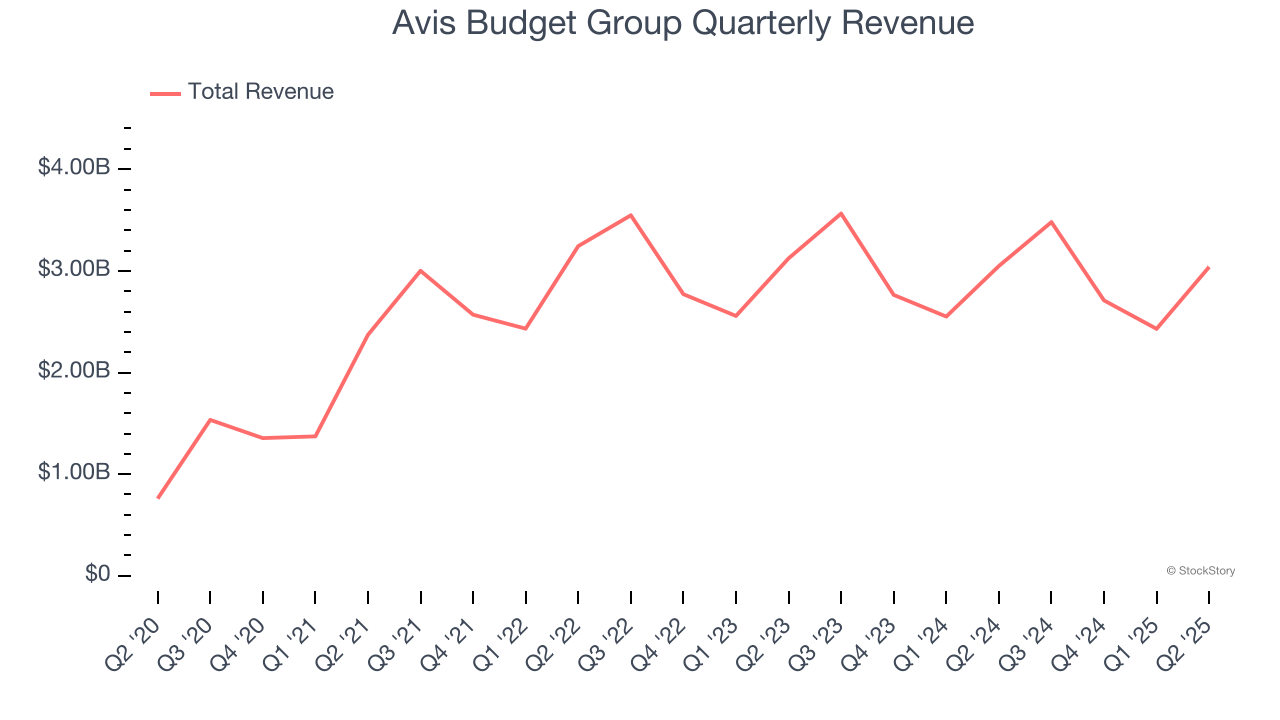

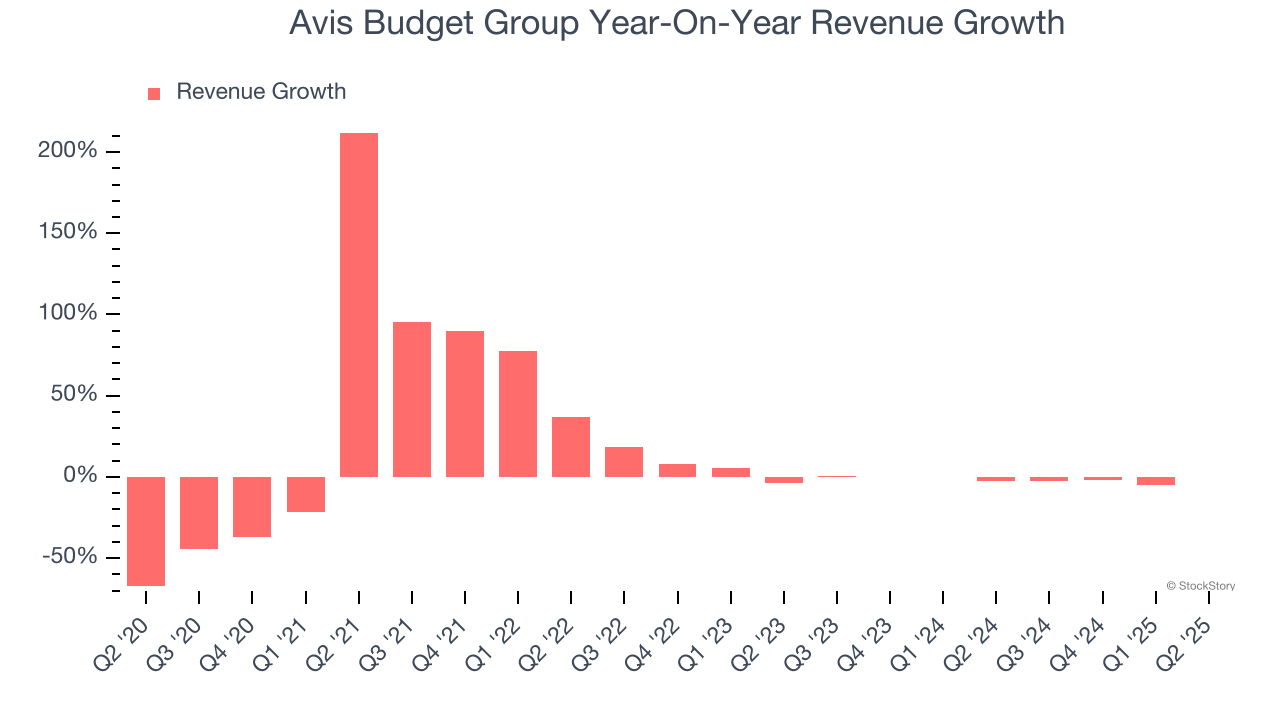

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Avis Budget Group’s sales grew at a solid 9.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Avis Budget Group’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.4% over the last two years. Avis Budget Group isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can better understand the company’s revenue dynamics by analyzing its number of available rental days - car rental, which reached 63.58 million in the latest quarter. Over the last two years, Avis Budget Group’s available rental days - car rental averaged 1.5% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Avis Budget Group’s $3.04 billion of revenue was flat year on year but beat Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

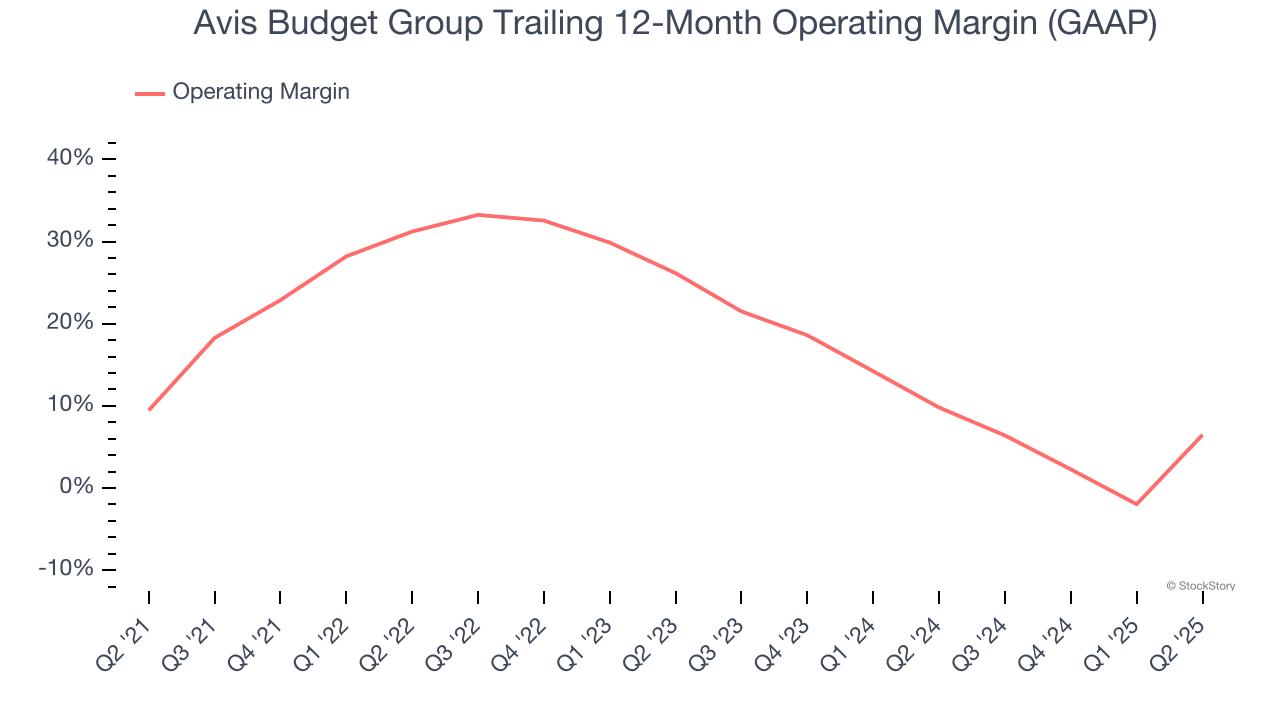

Avis Budget Group has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 17.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Avis Budget Group’s operating margin decreased by 3 percentage points over the last five years. Many Ground Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope Avis Budget Group can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

In Q2, Avis Budget Group generated an operating margin profit margin of 36.8%, up 32.4 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

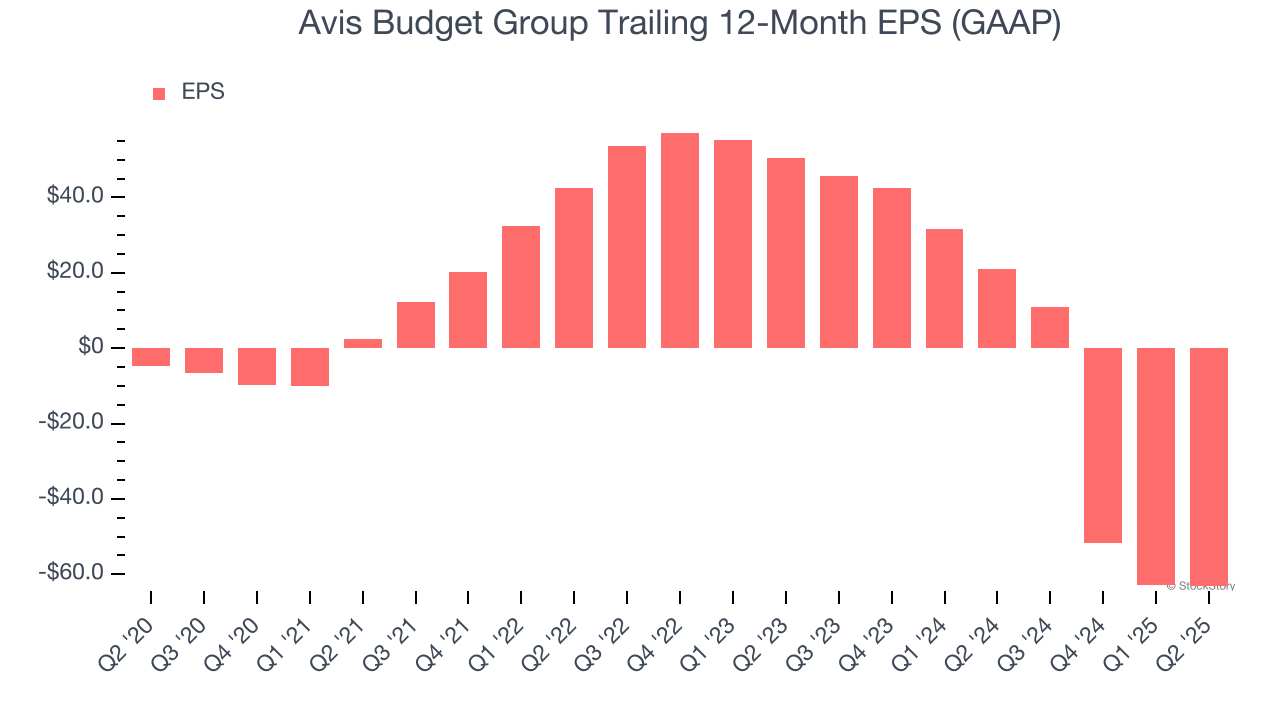

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Avis Budget Group’s earnings losses deepened over the last five years as its EPS dropped 68.3% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Avis Budget Group’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Avis Budget Group, its EPS declined by more than its revenue over the last two years, dropping 80.3%. This tells us the company struggled to adjust to shrinking demand.

In Q2, Avis Budget Group reported EPS at $0.10, down from $0.39 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Avis Budget Group’s Q2 Results

We were impressed by how significantly Avis Budget Group blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 3.7% to $195.98 immediately after reporting.

Big picture, is Avis Budget Group a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.