Since July 2020, the S&P 500 has delivered a total return of 97.3%. But one standout stock has doubled the market - over the past five years, NMI Holdings has surged 198% to $40.97 per share. Its momentum hasn’t stopped as it’s also gained 17.5% in the last six months thanks to its solid quarterly results, beating the S&P by 10.7%.

Is now still a good time to buy NMIH? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Is NMIH a Good Business?

Founded in the aftermath of the 2008 housing crisis to bring new capacity to the mortgage insurance market, NMI Holdings (NASDAQ: NMIH) provides mortgage insurance that protects lenders against losses when homebuyers default on their mortgage loans.

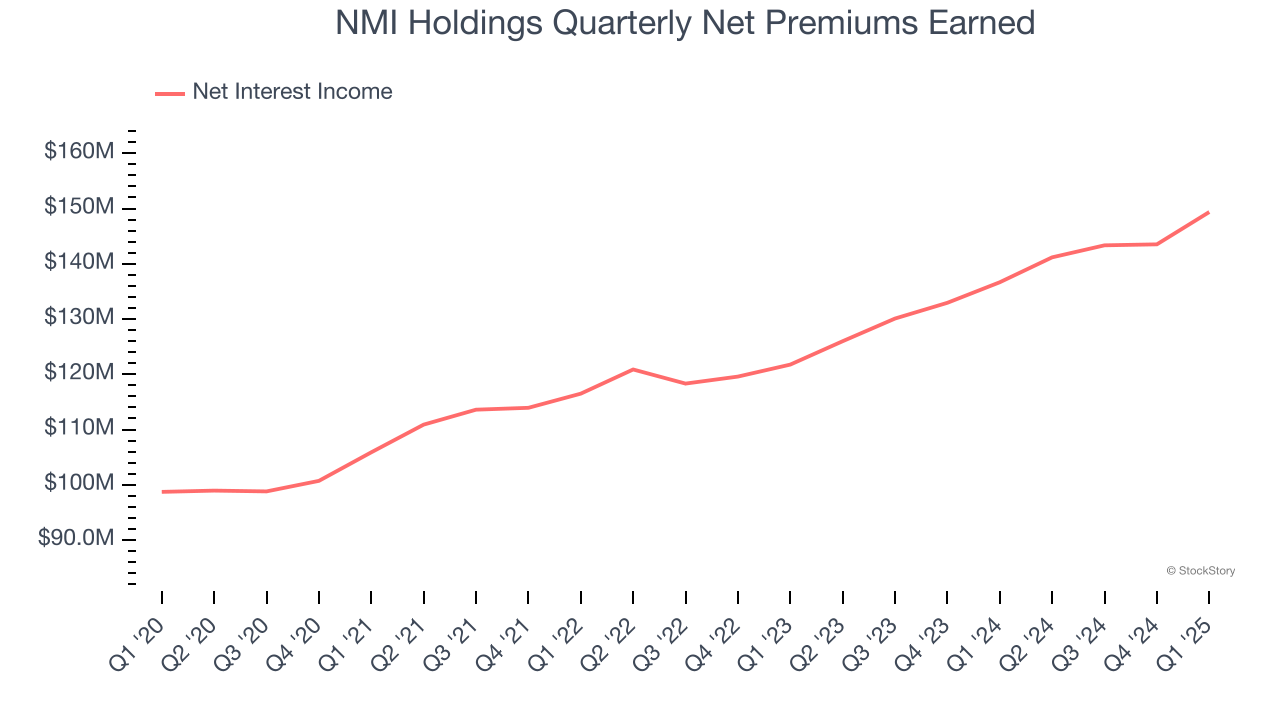

1. Net Premiums Earned Drives Additional Growth Opportunities

While insurers generate revenue from multiple sources, investors view net premiums earned as the cornerstone - its direct link to core operations stands in sharp contrast to the unpredictability of investment returns and fees.

NMI Holdings’s net premiums earned has grown at a 9.6% annualized rate over the last two years, a step above the broader insurance industry.

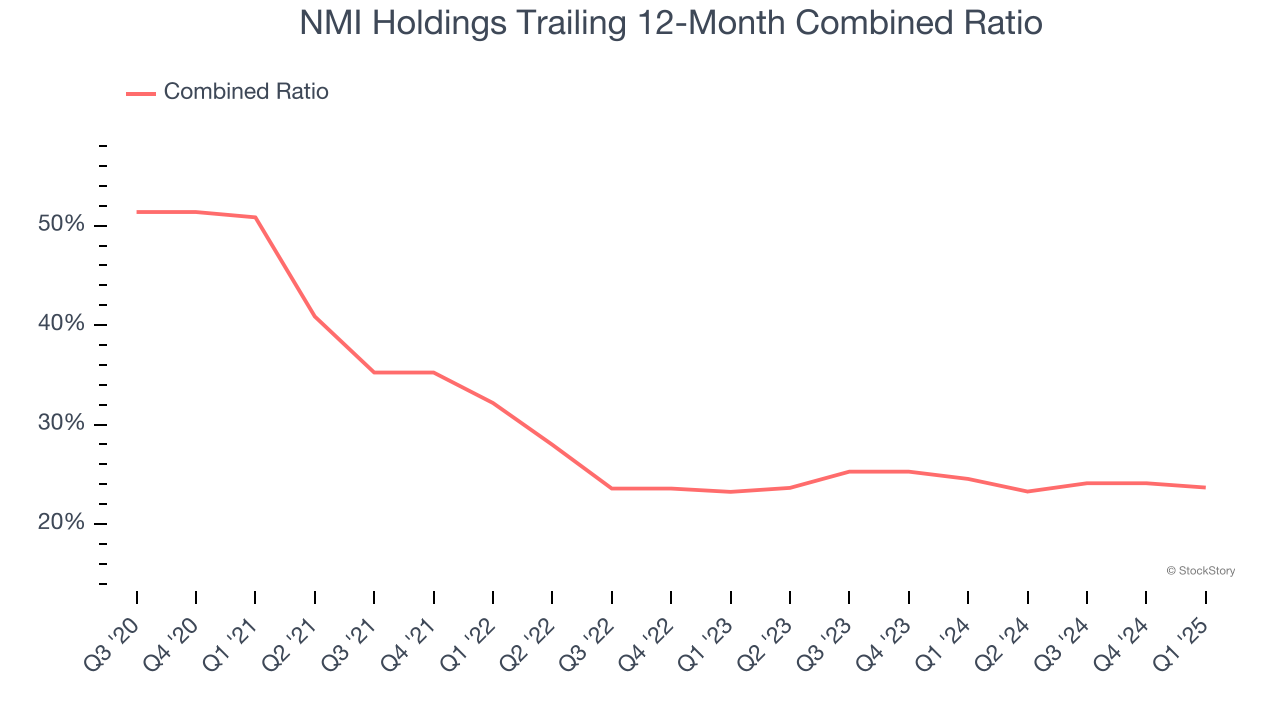

2. Combined Ratio Improving, Profits Up

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For insurance companies, we look at the combined ratio rather than the operating expenses and margins that define sectors such as consumer, tech, and industrials.

The combined ratio is:

- The costs of underwriting (salaries, commissions, overhead) + what an insurer pays out in claims, all divided by net premiums earned

If a company boasts a combined ratio under 100%, it is underwriting profitably. If above 100%, it is losing money on its core operations of selling insurance policies.

Over the last four years, NMI Holdings’s combined ratio has decreased by 27.2 percentage points, clocking in at 23.7% for the past 12 months. Said differently, the company’s expenses have grown at a slower rate than revenue, which is always a positive sign.

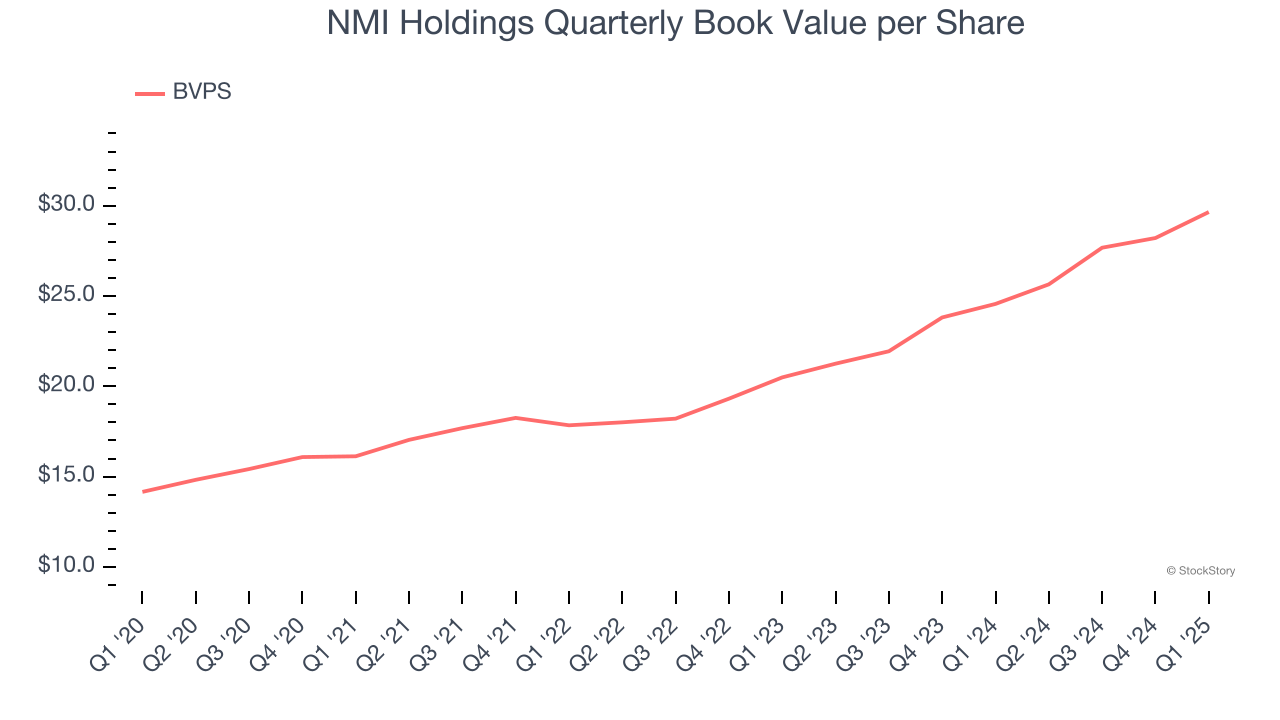

3. Growing BVPS Reflects Strong Asset Base

In the insurance industry, book value per share (BVPS) provides a clear picture of shareholder value, as it represents the total equity backing a company’s insurance operations and growth initiatives.

NMI Holdings’s BVPS increased by 15.9% annually over the last five years, and growth has recently accelerated as BVPS grew at an excellent 20.3% annual clip over the past two years (from $20.49 to $29.65 per share).

Final Judgment

These are just a few reasons why we think NMI Holdings is a high-quality business, and with its shares topping the market in recent months, the stock trades at 1.2× forward P/B (or $40.97 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than NMI Holdings

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.