Fresh produce company Dole (NYSE: DOLE) announced better-than-expected revenue in Q2 CY2025, with sales up 14.3% year on year to $2.43 billion. Its non-GAAP profit of $0.55 per share was 18.2% above analysts’ consensus estimates.

Is now the time to buy Dole? Find out by accessing our full research report, it’s free.

Dole (DOLE) Q2 CY2025 Highlights:

- Revenue: $2.43 billion vs analyst estimates of $2.18 billion (14.3% year-on-year growth, 11.2% beat)

- Adjusted EPS: $0.55 vs analyst estimates of $0.47 (18.2% beat)

- Adjusted EBITDA: $137.1 million vs analyst estimates of $122.1 million (5.6% margin, 12.3% beat)

- EBITDA guidance for the full year is $385 million at the midpoint, below analyst estimates of $392.8 million

- Operating Margin: 4.3%, in line with the same quarter last year

- Free Cash Flow was -$1.02 million, down from $22.76 million in the same quarter last year

- Market Capitalization: $1.39 billion

Company Overview

Known for its delicious pineapples and Hawaiian roots, Dole (NYSE: DOLE) is a global agricultural company specializing in fresh fruits and vegetables.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $8.76 billion in revenue over the past 12 months, Dole is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. For Dole to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

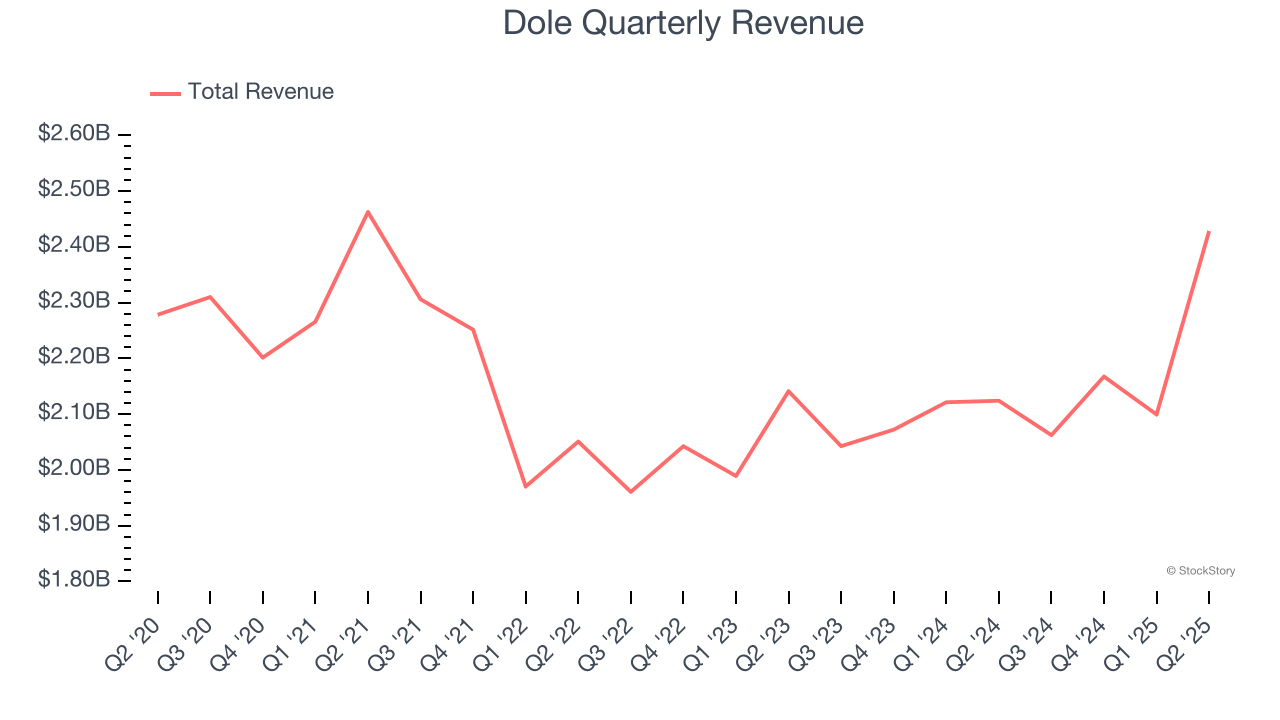

As you can see below, Dole struggled to increase demand as its $8.76 billion of sales for the trailing 12 months was close to its revenue three years ago. This shows demand was soft, a rough starting point for our analysis.

This quarter, Dole reported year-on-year revenue growth of 14.3%, and its $2.43 billion of revenue exceeded Wall Street’s estimates by 11.2%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and suggests its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

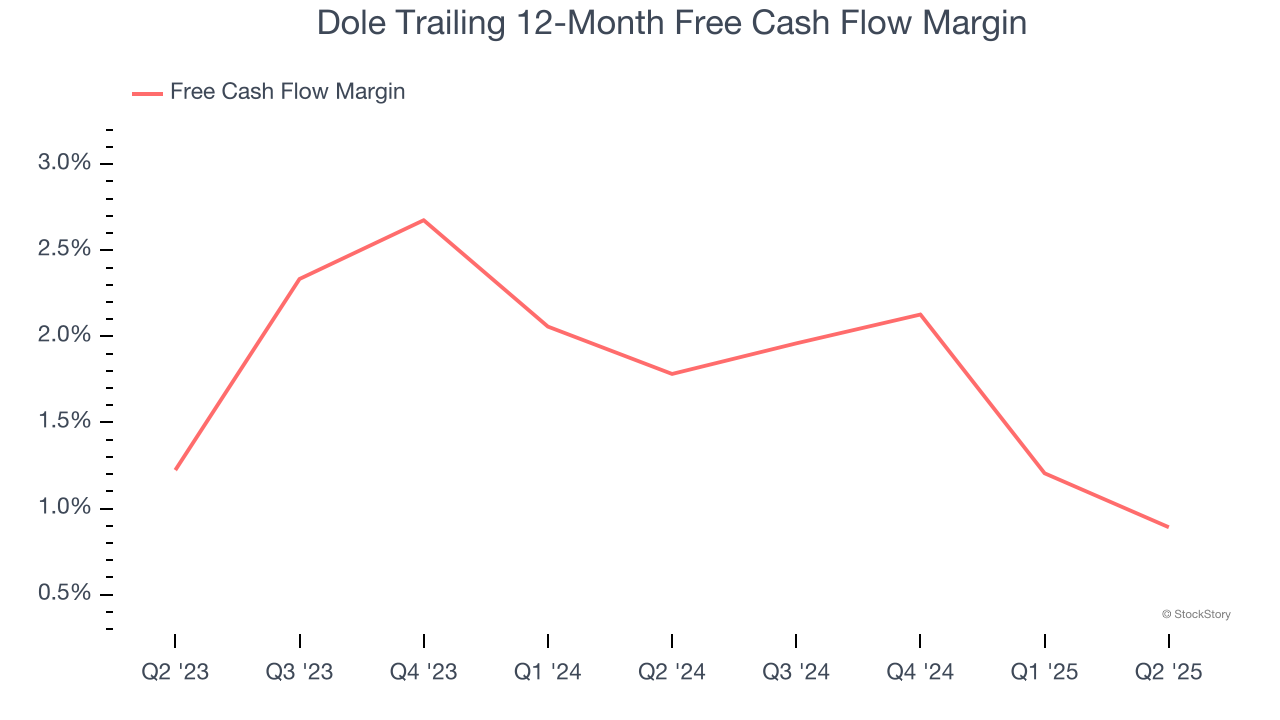

Dole has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.3%, subpar for a consumer staples business.

Dole broke even from a free cash flow perspective in Q2. The company’s cash profitability regressed as it was 1.1 percentage points lower than in the same quarter last year. This warrants extra attention because consumer staples companies typically produce more consistent and defensive performance.

Key Takeaways from Dole’s Q2 Results

We were impressed by how significantly Dole blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. On the other hand, its full-year EBITDA guidance missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2% to $14.93 immediately following the results.

Indeed, Dole had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.