Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Rumble (NASDAQ: RUM) and the best and worst performers in the digital media & content platforms industry.

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

The 7 digital media & content platforms stocks we track reported a mixed Q2. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Luckily, digital media & content platforms stocks have performed well with share prices up 16.4% on average since the latest earnings results.

Rumble (NASDAQ: RUM)

Founded in 2013 as a champion for content creator rights and free expression, Rumble (NASDAQ: RUM) is a video sharing platform that positions itself as a free speech alternative to mainstream platforms, offering creators more favorable revenue-sharing opportunities.

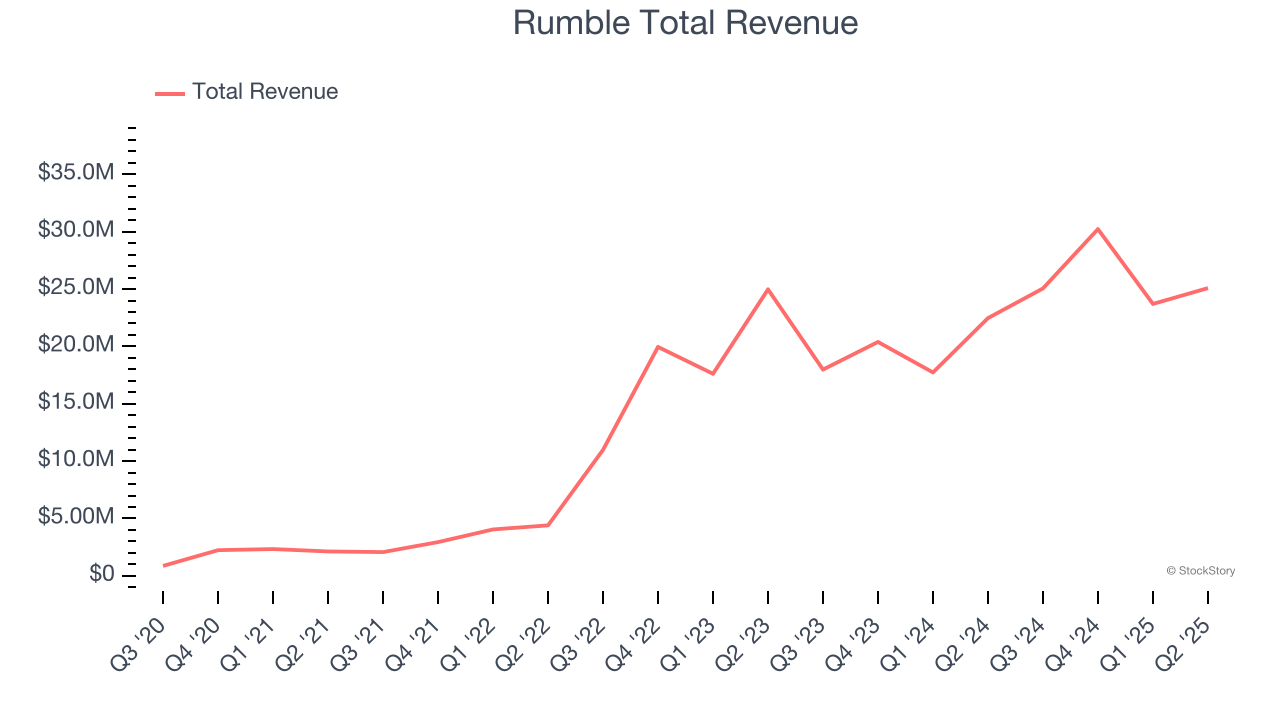

Rumble reported revenues of $25.08 million, up 11.6% year on year. This print fell short of analysts’ expectations by 6.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

Rumble's Chairman and CEO, Chris Pavlovski, commented, “With the incredible backing of Tether and the resources now at our disposal, Rumble is entering a new phase of aggressive growth. We’ve always been ambitious, but today we’re in a different position: pursuing bold initiatives to not only compete with, but surpass, big tech peers. In the second quarter, we proved the stickiness of our platform with 51 million MAUs, delivered double-digit revenue growth, and built momentum through strategic partnerships with leaders like Cumulus Media, and MoonPay, as well as a top AI innovator in Q3. With the upcoming launch of Rumble Wallet and our expanding cloud and AI initiatives, we are laying the foundation for sustained growth while protecting a free and open internet.”

Rumble delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 2.7% since reporting and currently trades at $8.11.

Is now the time to buy Rumble? Access our full analysis of the earnings results here, it’s free.

Best Q2: Stride (NYSE: LRN)

Formerly known as K12, Stride (NYSE: LRN) is an education technology company providing education solutions through digital platforms.

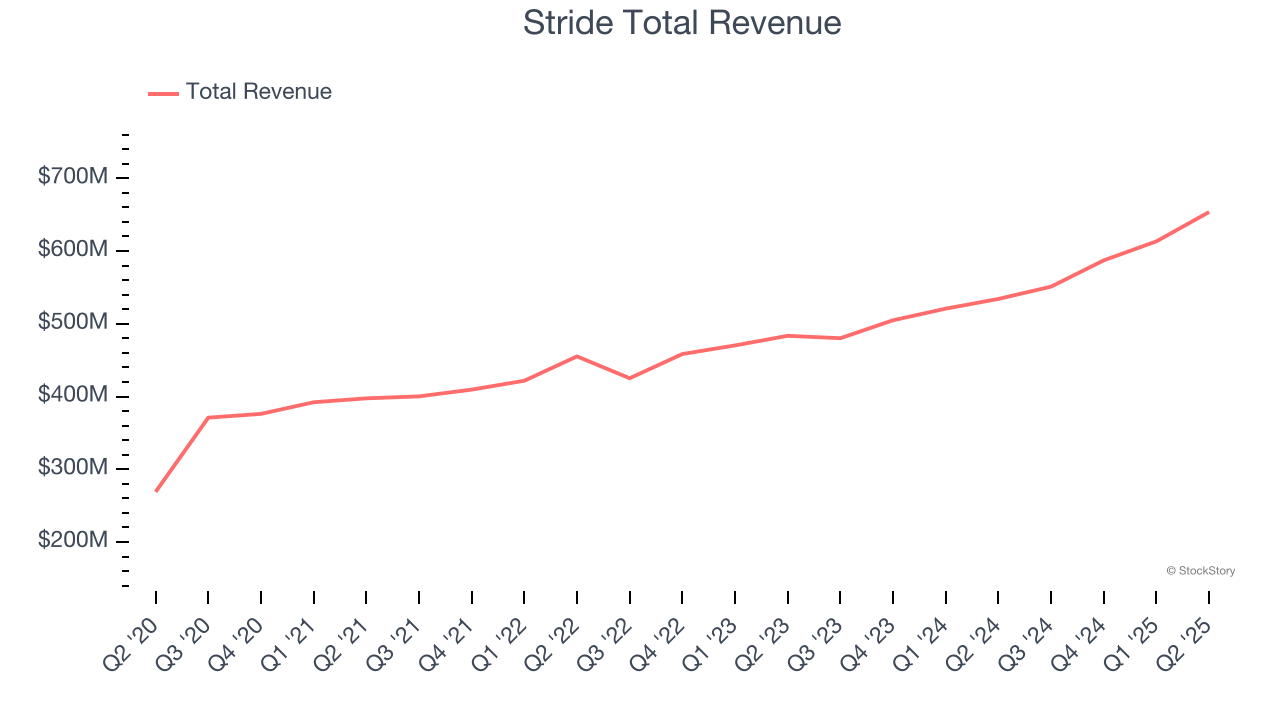

Stride reported revenues of $653.6 million, up 22.4% year on year, outperforming analysts’ expectations by 4.2%. The business had a stunning quarter with a beat of analysts’ EPS estimates.

Stride pulled off the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 22.4% since reporting. It currently trades at $157.08.

Is now the time to buy Stride? Access our full analysis of the earnings results here, it’s free.

IAC (NASDAQ: IAC)

Originally known as InterActiveCorp and built through Barry Diller's strategic acquisitions since the 1990s, IAC (NASDAQ: IAC) operates a portfolio of category-leading digital businesses including Dotdash Meredith, Angi, and Care.com, focusing on digital publishing, home services, and caregiving platforms.

IAC reported revenues of $586.9 million, down 7.5% year on year, falling short of analysts’ expectations by 2.4%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

IAC delivered the slowest revenue growth in the group. As expected, the stock is down 9.2% since the results and currently trades at $35.88.

Read our full analysis of IAC’s results here.

Vimeo (NASDAQ: VMEO)

Originally launched in 2004 as a platform for filmmakers seeking a high-quality alternative to YouTube, Vimeo (NASDAQ: VMEO) provides cloud-based video creation, editing, hosting, and distribution software that helps businesses and creators make, manage, and share professional-quality videos.

Vimeo reported revenues of $104.7 million, flat year on year. This result came in 1% below analysts' expectations. More broadly, it was actually a strong quarter as it logged a beat of analysts’ EPS estimates.

The stock is up 3.3% since reporting and currently trades at $3.96.

Read our full, actionable report on Vimeo here, it’s free.

Ziff Davis (NASDAQ: ZD)

Originally a pioneering technology publisher founded in 1927 that became famous for PC Magazine, Ziff Davis (NASDAQ: ZD) operates a portfolio of digital media brands and subscription services across technology, shopping, gaming, healthcare, and cybersecurity markets.

Ziff Davis reported revenues of $352.2 million, up 9.8% year on year. This print beat analysts’ expectations by 4.5%. It was a very strong quarter as it also logged an impressive beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

Ziff Davis scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is up 16.5% since reporting and currently trades at $36.22.

Read our full, actionable report on Ziff Davis here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.