As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at hr software stocks, starting with Paylocity (NASDAQ: PCTY).

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The 5 hr software stocks we track reported a slower Q2. As a group, revenues beat analysts’ consensus estimates by 0.5% while next quarter’s revenue guidance was 2.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.4% since the latest earnings results.

Paylocity (NASDAQ: PCTY)

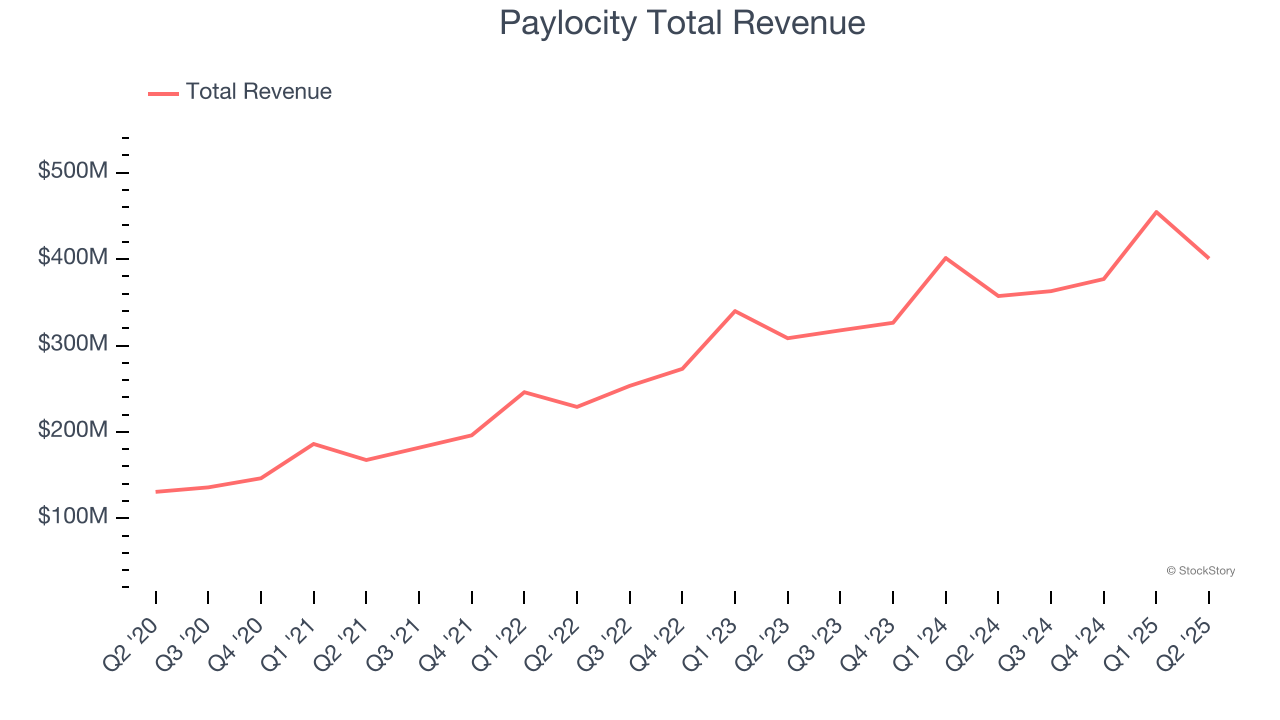

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ: PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $400.7 million, up 12.2% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but full-year guidance of slowing revenue growth.

“Fiscal 25 was a very strong year as our differentiated position in the market was reflected in solid sales and operational execution, helping to drive 15% recurring and other revenue growth and 14% total revenue growth. Our strong growth was driven by the continued expansion of average revenue per client and a 7% increase in our client base – while also focusing on efficiency and productivity across our organization. Most recently, we announced the launch of Paylocity for Finance, expanding our modern workforce platform into the Office of the CFO, and bringing both finance and HR teams together through a unified system grounded in the employee record. By unifying data to connect critical workflows, we’re delivering enhanced visibility, improved efficiency, and an exceptional user experience that drives value through increased adoption across teams. In addition to strong revenue and profitability growth in fiscal 25, we also returned capital to shareholders by repurchasing $150 million or approximately 800,000 shares of our stock. I would also like to thank all of our employees for their efforts supporting our clients, and congratulate our teams for another successful year,” said Toby Williams, President and Chief Executive Officer of Paylocity.

Paylocity scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Even though it had a relatively good quarter, the market seems discontent with the results. The stock is down 3.1% since reporting and currently trades at $171.64.

Is now the time to buy Paylocity? Access our full analysis of the earnings results here, it’s free.

Best Q2: Paycom (NYSE: PAYC)

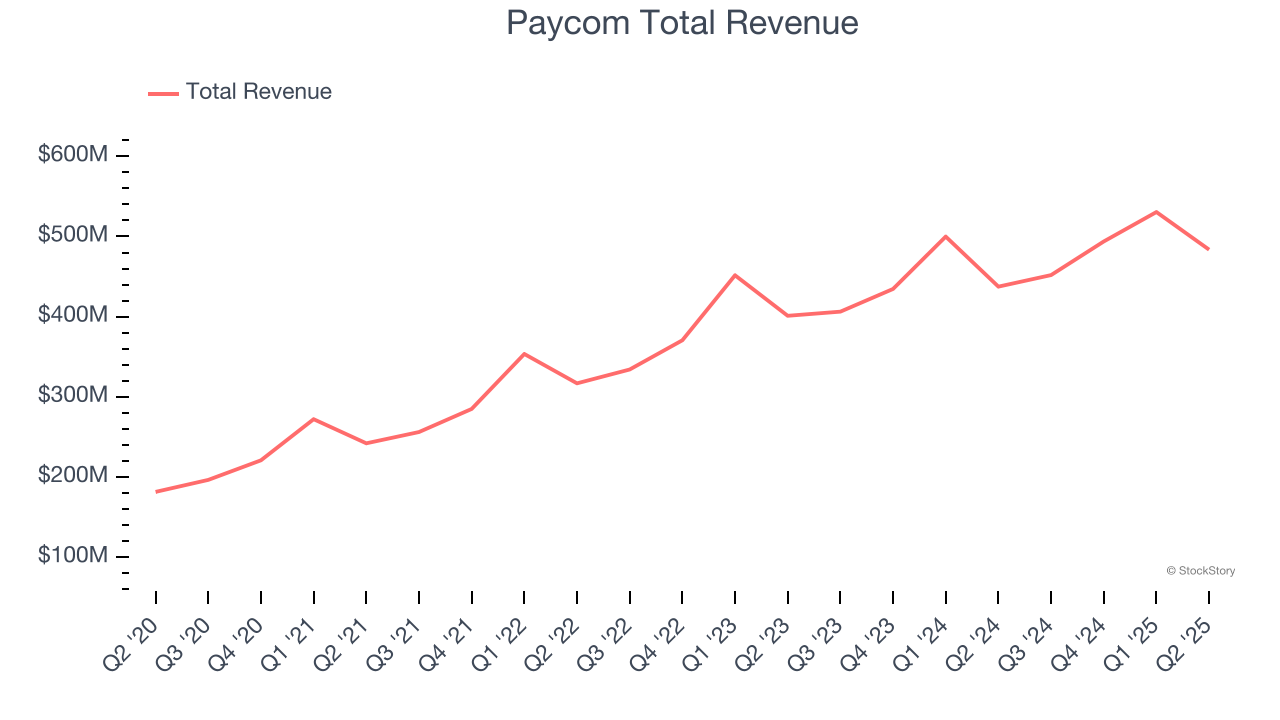

Founded in 1998 as one of the first online payroll companies, Paycom (NYSE: PAYC) provides software for small and medium-sized businesses (SMBs) to manage their payroll and HR needs in one place.

Paycom reported revenues of $483.6 million, up 10.5% year on year, outperforming analysts’ expectations by 2.5%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.1% since reporting. It currently trades at $216.

Is now the time to buy Paycom? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Paychex (NASDAQ: PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ: PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.43 billion, up 10.2% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA estimates.

As expected, the stock is down 9.5% since the results and currently trades at $137.72.

Read our full analysis of Paychex’s results here.

Dayforce (NYSE: DAY)

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE: DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Dayforce reported revenues of $464.7 million, up 9.8% year on year. This number topped analysts’ expectations by 1.5%. More broadly, it was a slower quarter as it produced revenue guidance for next quarter missing analysts’ expectations significantly.

Dayforce had the weakest full-year guidance update among its peers. The stock is flat since reporting and currently trades at $53.41.

Read our full, actionable report on Dayforce here, it’s free.

Asure (NASDAQ: ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $30.12 million, up 7.4% year on year. This result missed analysts’ expectations by 3.2%. Overall, it was a softer quarter as it also logged EBITDA guidance for next quarter missing analysts’ expectations significantly and a significant miss of analysts’ billings estimates.

Asure achieved the highest full-year guidance raise but had the weakest performance against analyst estimates and weakest performance against analyst estimates among its peers. The stock is down 14.5% since reporting and currently trades at $8.30.

Read our full, actionable report on Asure here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.