The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Unity (NYSE: U) and the rest of the design software stocks fared in Q2.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 5 design software stocks we track reported a very strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

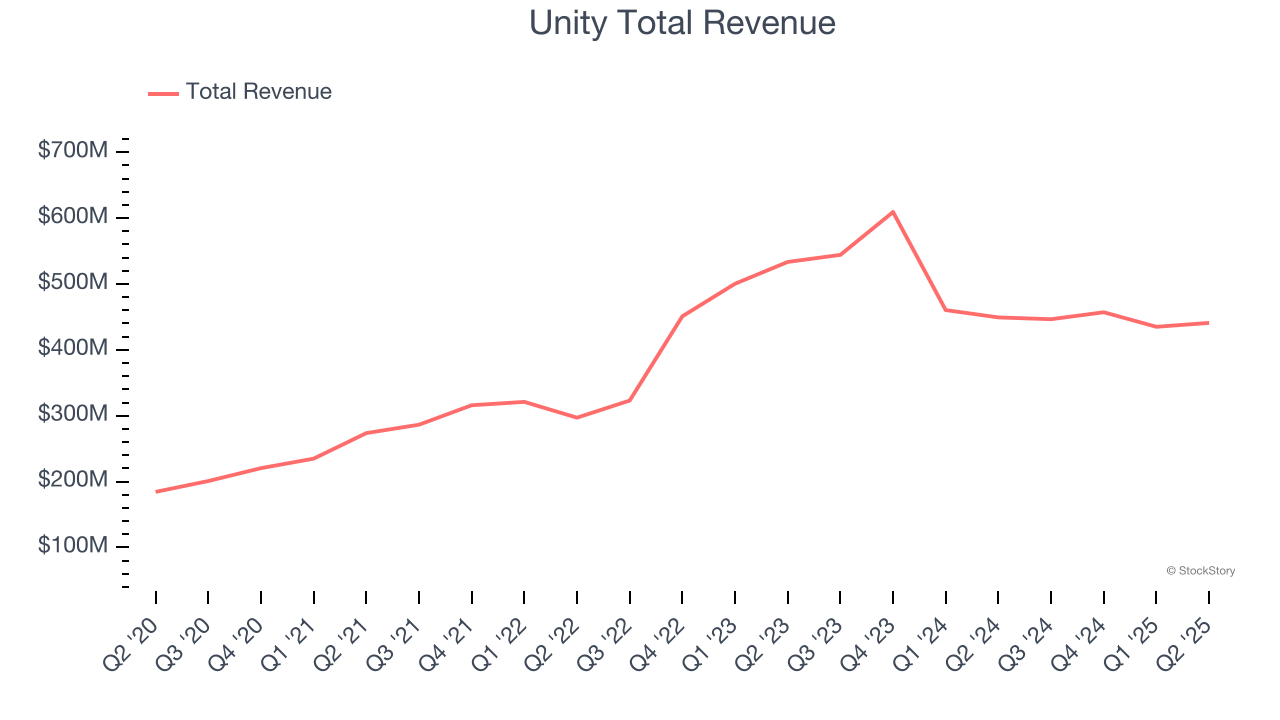

Weakest Q2: Unity (NYSE: U)

Powering over half of the world's mobile games and expanding into industries from automotive to architecture, Unity (NYSE: U) provides software tools and services that allow developers to create, run, and monetize interactive 2D and 3D content across multiple platforms.

Unity reported revenues of $440.9 million, down 1.9% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ billings estimates and a solid beat of analysts’ EBITDA estimates.

"We believe the second quarter of 2025 will be remembered as an inflection point in the Unity story, where our commitment to accelerating product innovation and delivering for our customers translated to markedly better performance," said Matt Bromberg, President and CEO of Unity.

Unity delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 12% since reporting and currently trades at $38.05.

Is now the time to buy Unity? Access our full analysis of the earnings results here, it’s free.

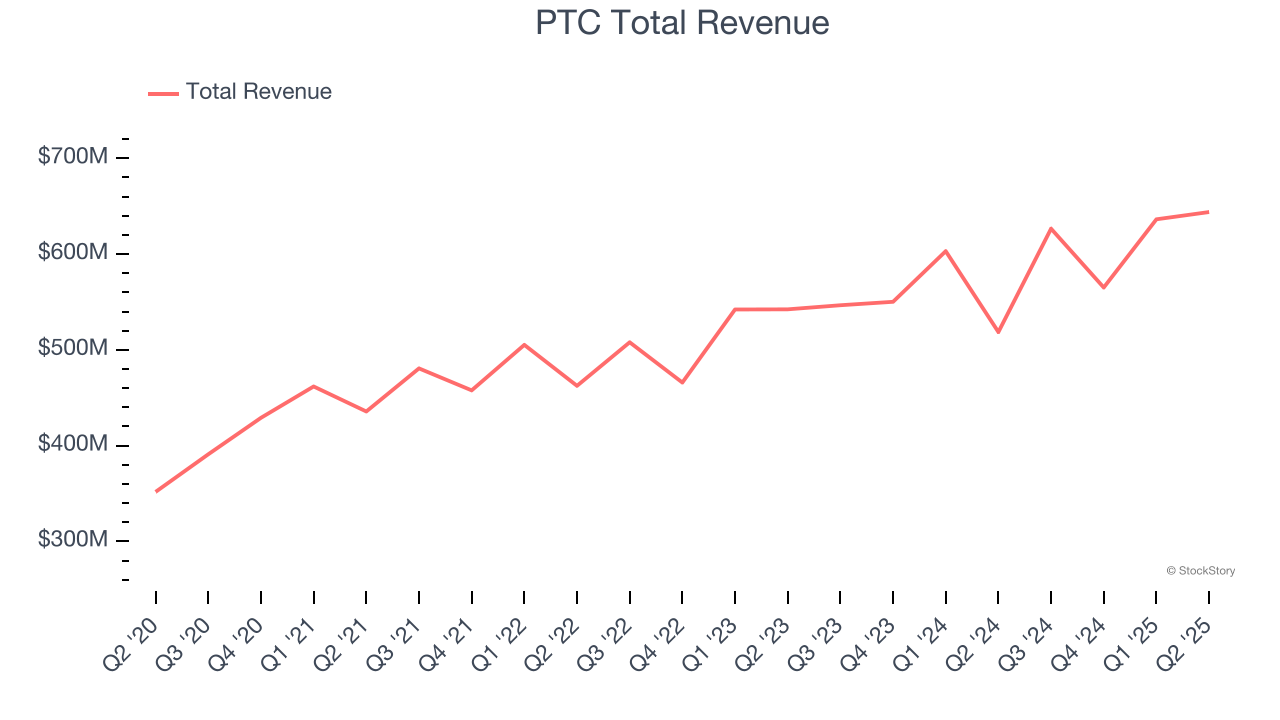

Best Q2: PTC (NASDAQ: PTC)

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ: PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

PTC reported revenues of $643.9 million, up 24.2% year on year, outperforming analysts’ expectations by 10.4%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

PTC delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 1% since reporting. It currently trades at $205.40.

Is now the time to buy PTC? Access our full analysis of the earnings results here, it’s free.

Adobe (NASDAQ: ADBE)

Originally named after Adobe Creek that ran behind co-founder John Warnock's house, Adobe (NASDAQ: ADBE) develops software products used for digital content creation, document management, and marketing solutions across desktop, mobile, and cloud platforms.

Adobe reported revenues of $5.87 billion, up 10.6% year on year, exceeding analysts’ expectations by 1.5%. It may have had the worst quarter among its peers, but its results were still good as it also locked in an impressive beat of analysts’ billings estimates and full-year EPS guidance slightly topping analysts’ expectations.

Adobe delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 14% since the results and currently trades at $356.04.

Read our full analysis of Adobe’s results here.

Cadence Design Systems (NASDAQ: CDNS)

Powering the chips behind everything from smartphones to AI accelerators for over 35 years, Cadence Design Systems (NASDAQ: CDNS) provides essential computational software, hardware, and intellectual property used by engineers to design and verify advanced electronic systems and semiconductors.

Cadence Design Systems reported revenues of $1.28 billion, up 20.2% year on year. This number beat analysts’ expectations by 1.8%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ billings estimates.

The stock is up 4.9% since reporting and currently trades at $350.20.

Read our full, actionable report on Cadence Design Systems here, it’s free.

Procore Technologies (NYSE: PCOR)

With a mission to build software for the people that build the world, Procore Technologies (NYSE: PCOR) provides cloud-based software that enables owners, contractors, and other stakeholders to collaborate and manage construction projects from any device.

Procore Technologies reported revenues of $323.9 million, up 13.9% year on year. This result topped analysts’ expectations by 3.9%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ annual recurring revenue estimates.

The company added 195 customers to reach a total of 17,501. The stock is down 8.5% since reporting and currently trades at $65.26.

Read our full, actionable report on Procore Technologies here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.