Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Waters Corporation (NYSE: WAT) and its peers.

The life sciences subsector specializing in research tools and consumables enables scientific discoveries across academia, biotechnology, and pharmaceuticals. These firms supply a wide range of essential laboratory products, ensuring a recurring revenue stream through repeat purchases and replenishment. Their business models benefit from strong customer loyalty, a diversified product portfolio, and exposure to both the research and clinical markets. However, challenges include high R&D investment to maintain technological leadership, pricing pressures from budget-conscious institutions, and vulnerability to fluctuations in research funding cycles. Looking ahead, this subsector stands to benefit from tailwinds such as growing demand for tools supporting emerging fields like synthetic biology and personalized medicine. There is also a rise in automation and AI-driven solutions in laboratories that could create new opportunities to sell tools and consumables. Nevertheless, headwinds exist. These companies tend to be at the mercy of supply chain disruptions and sensitivity to macroeconomic conditions that impact funding for research initiatives.

The 9 research tools & consumables stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 0.7% below.

Thankfully, share prices of the companies have been resilient as they are up 6.4% on average since the latest earnings results.

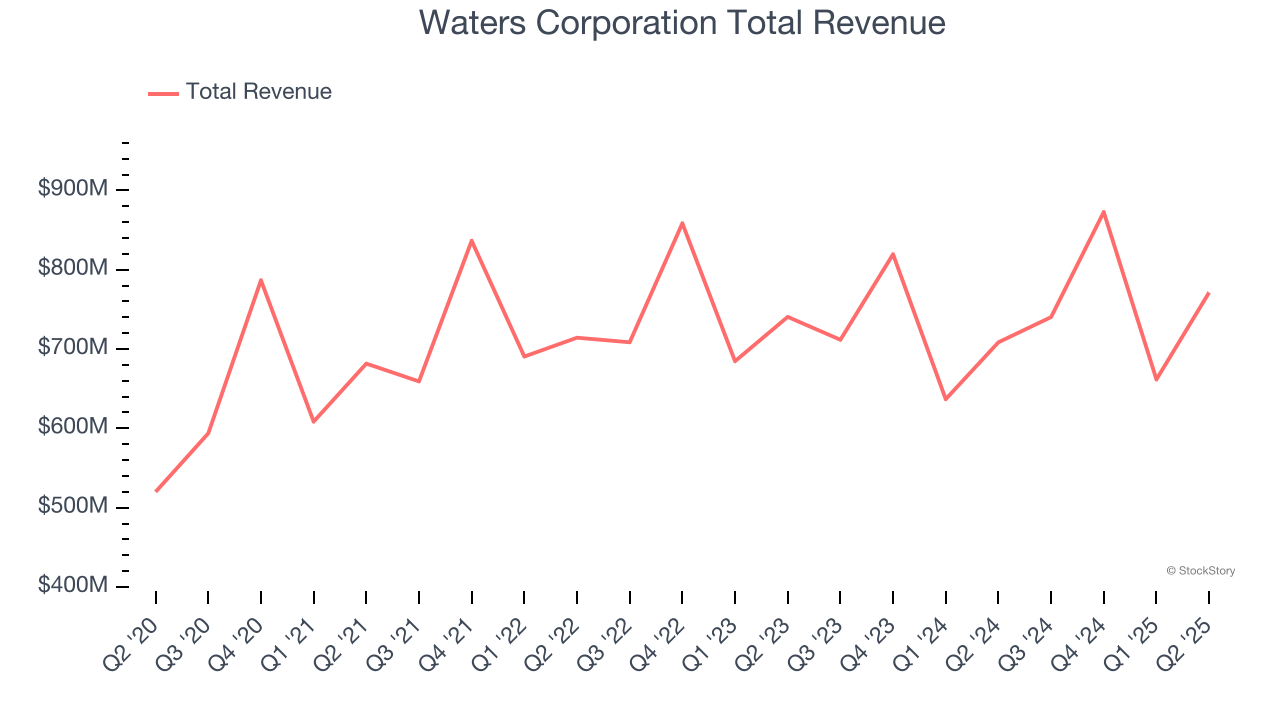

Waters Corporation (NYSE: WAT)

Founded in 1958 and pioneering innovations in laboratory analysis for over six decades, Waters (NYSE: WAT) develops and manufactures analytical instruments, software, and consumables for liquid chromatography, mass spectrometry, and thermal analysis used in scientific research and quality testing.

Waters Corporation reported revenues of $771.3 million, up 8.9% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ organic revenue estimates but revenue guidance for next quarter meeting analysts’ expectations.

"Our team continues to execute extremely well and we delivered excellent results again this quarter, driven by robust instrument replacement trends–particularly among large pharma and CDMO customers," said Dr. Udit Batra, President & CEO, Waters Corporation.

Waters Corporation scored the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 1.9% since reporting and currently trades at $296.14.

Is now the time to buy Waters Corporation? Access our full analysis of the earnings results here, it’s free.

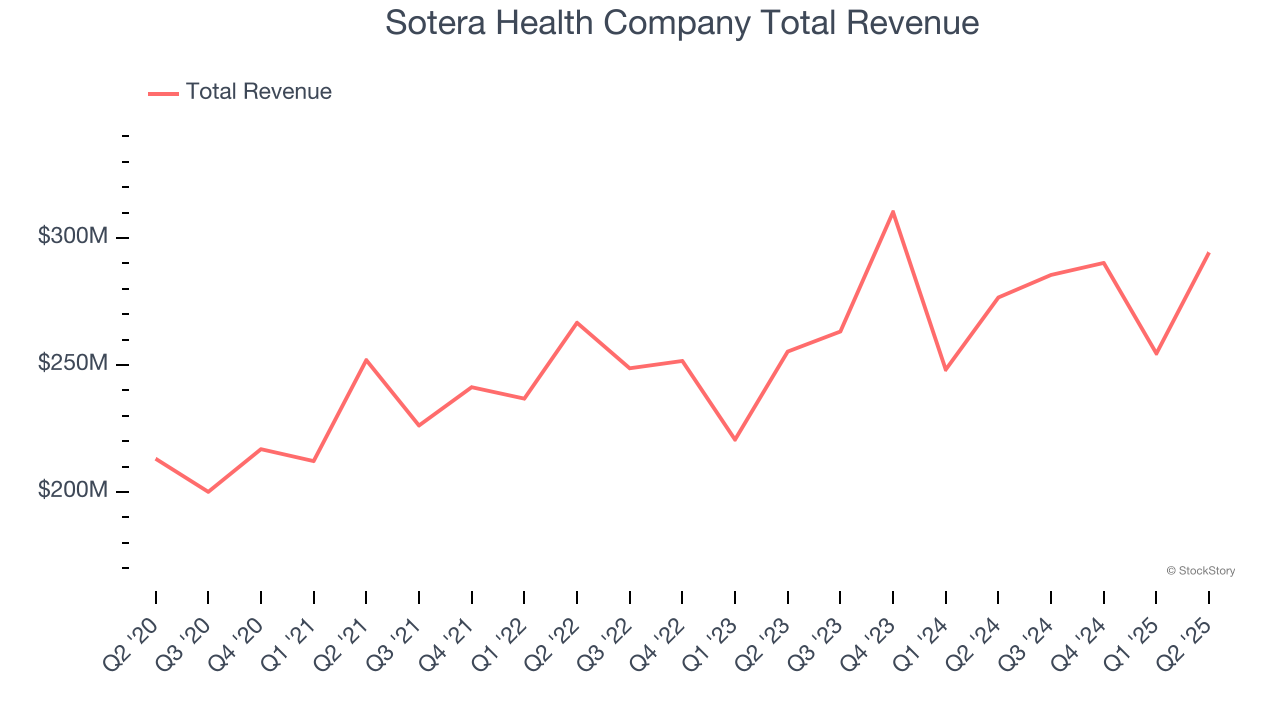

Best Q2: Sotera Health Company (NASDAQ: SHC)

With a critical role in ensuring the safety of millions of patients worldwide, Sotera Health (NASDAQGS:SHC) provides sterilization services, lab testing, and advisory services to ensure medical devices, pharmaceuticals, and food products are safe for use.

Sotera Health Company reported revenues of $294.3 million, up 6.4% year on year, outperforming analysts’ expectations by 6.8%. The business had a stunning quarter with an impressive beat of analysts’ organic revenue estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

Sotera Health Company achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 45.9% since reporting. It currently trades at $16.40.

Is now the time to buy Sotera Health Company? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Bruker (NASDAQ: BRKR)

With roots dating back to the pioneering days of nuclear magnetic resonance technology, Bruker (NASDAQ: BRKR) develops and manufactures high-performance scientific instruments that enable researchers and industrial analysts to explore materials at microscopic, molecular, and cellular levels.

Bruker reported revenues of $797.4 million, flat year on year, falling short of analysts’ expectations by 1.5%. It was a disappointing quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates and a significant miss of analysts’ EPS estimates.

Bruker delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 9.7% since the results and currently trades at $34.27.

Read our full analysis of Bruker’s results here.

Mettler-Toledo (NYSE: MTD)

With roots dating back to the precision balance innovations of Swiss engineer Erhard Mettler, Mettler-Toledo (NYSE: MTD) manufactures precision weighing instruments, analytical equipment, and product inspection systems used in laboratories, industrial settings, and food retail.

Mettler-Toledo reported revenues of $983.2 million, up 3.9% year on year. This number topped analysts’ expectations by 2.9%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ organic revenue estimates and a decent beat of analysts’ full-year EPS guidance estimates.

The stock is up 4.2% since reporting and currently trades at $1,286.

Read our full, actionable report on Mettler-Toledo here, it’s free.

Thermo Fisher (NYSE: TMO)

With over 14,000 sales personnel and a portfolio spanning more than 2,500 technology manufacturers, Thermo Fisher Scientific (NYSE: TMO) provides scientific equipment, reagents, consumables, software, and laboratory services to pharmaceutical, biotech, academic, and healthcare customers worldwide.

Thermo Fisher reported revenues of $10.86 billion, up 3% year on year. This result surpassed analysts’ expectations by 1.6%. It was a strong quarter as it also produced a narrow beat of analysts’ organic revenue estimates and a decent beat of analysts’ operating income estimates.

The stock is up 14.3% since reporting and currently trades at $488.

Read our full, actionable report on Thermo Fisher here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.