Video software platform Vimeo (NASDAQ: VMEO) fell short of the market’s revenue expectations in Q2 CY2025, with sales flat year on year at $104.7 million. Its GAAP profit of $0.04 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Vimeo? Find out by accessing our full research report, it’s free.

Vimeo (VMEO) Q2 CY2025 Highlights:

- Revenue: $104.7 million vs analyst estimates of $105.8 million (flat year on year, 1% miss)

- EPS (GAAP): $0.04 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $9 million vs analyst estimates of $5.60 million (8.6% margin, 60.7% beat)

- EBITDA guidance for the full year is $35 million at the midpoint, above analyst estimates of $27.97 million

- Operating Margin: 3.6%, down from 7.1% in the same quarter last year

- Free Cash Flow Margin: 19.4%, similar to the same quarter last year

- Market Capitalization: $601.3 million

Company Overview

Originally launched in 2004 as a platform for filmmakers seeking a high-quality alternative to YouTube, Vimeo (NASDAQ: VMEO) provides cloud-based video creation, editing, hosting, and distribution software that helps businesses and creators make, manage, and share professional-quality videos.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $415.4 million in revenue over the past 12 months, Vimeo is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

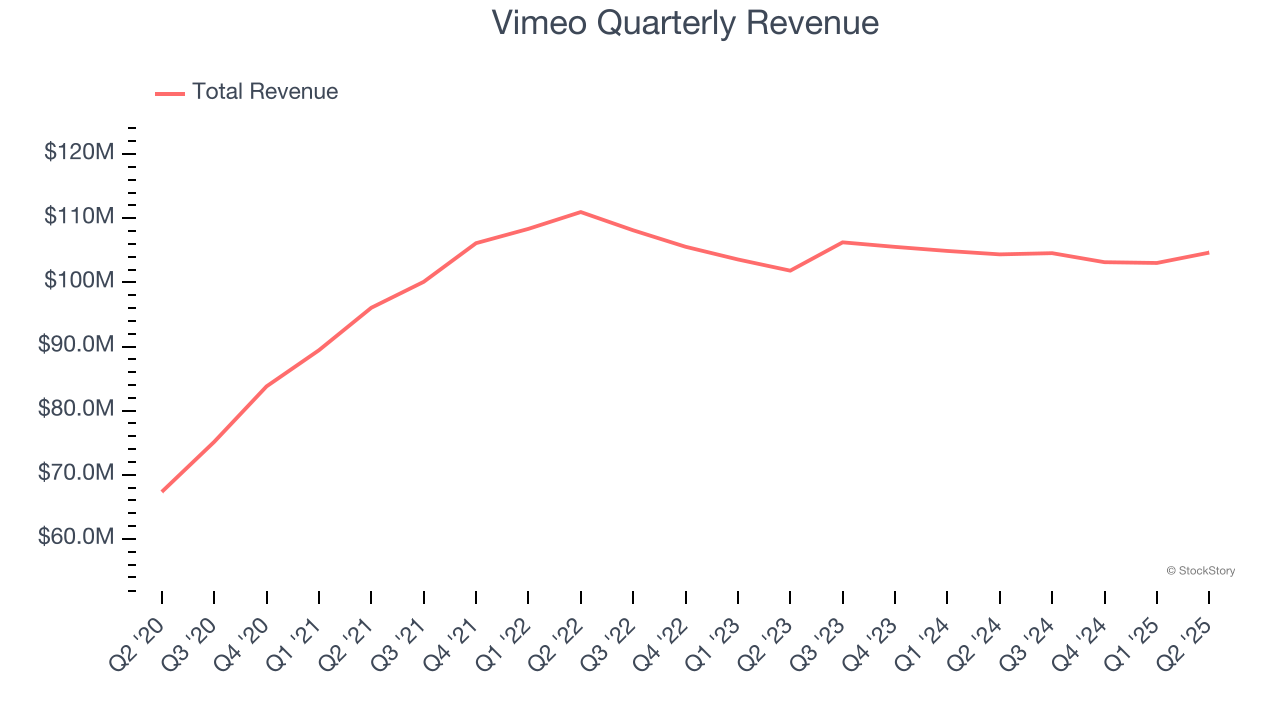

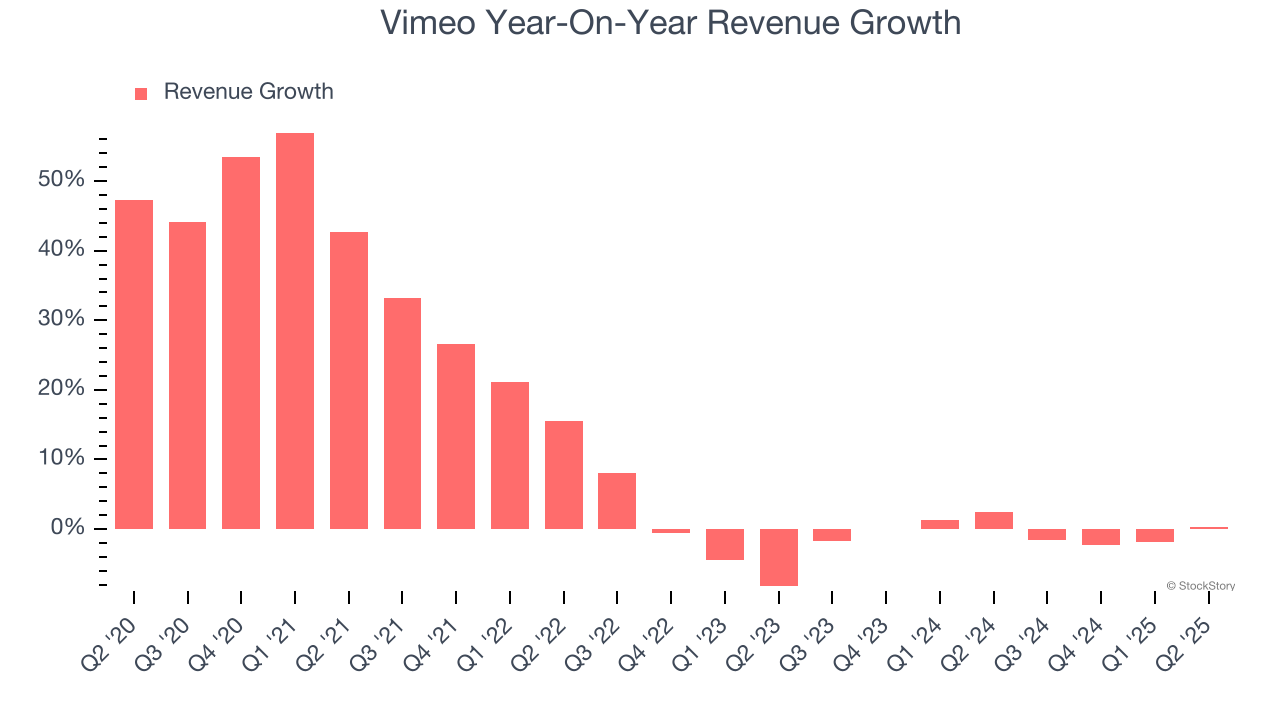

As you can see below, Vimeo’s 12.5% annualized revenue growth over the last five years was excellent. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Vimeo’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

This quarter, Vimeo’s $104.7 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

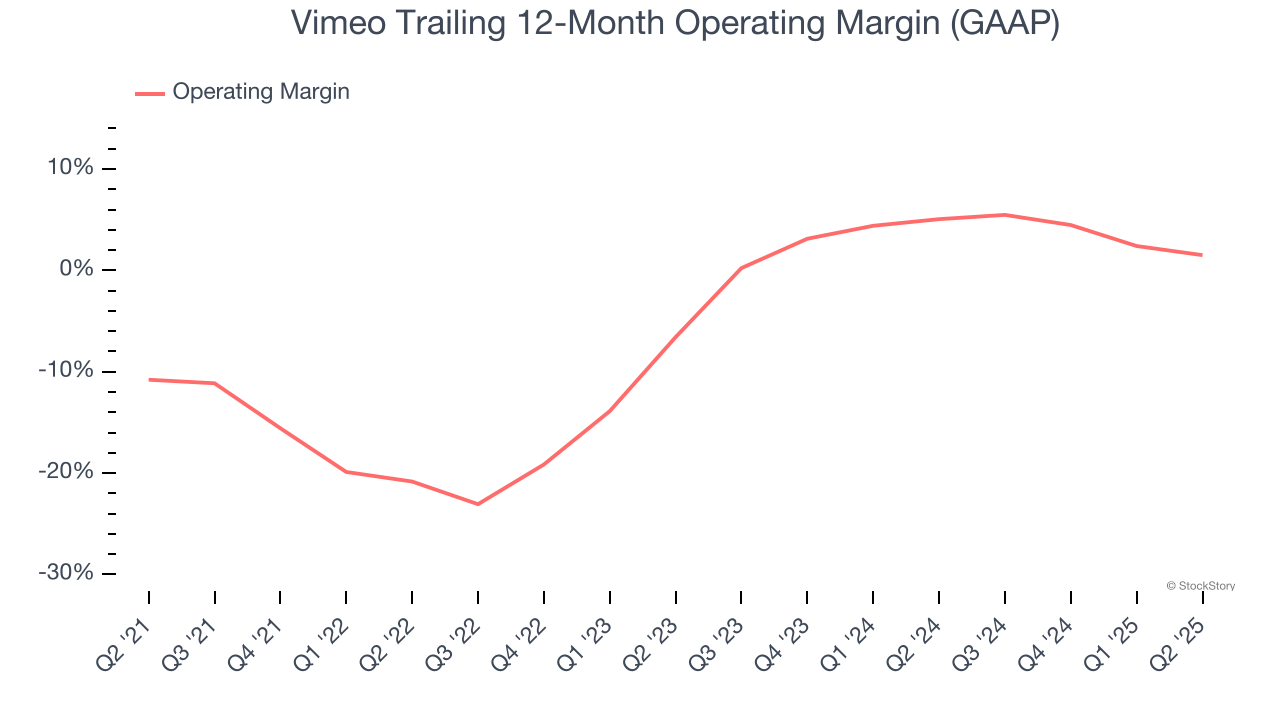

Although Vimeo was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 6.2% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Vimeo’s operating margin rose by 12.3 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to show consistent profitability.

In Q2, Vimeo generated an operating margin profit margin of 3.6%, down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

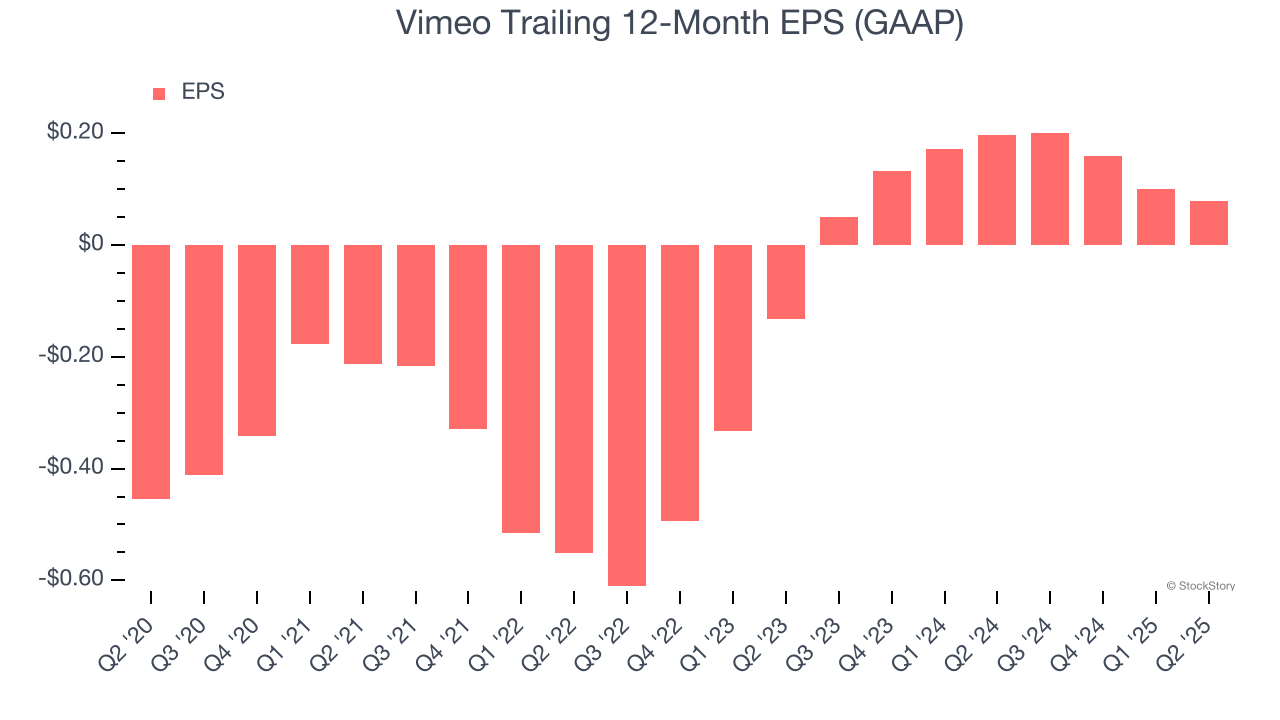

Vimeo’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Vimeo, its two-year annual EPS growth of 61.3% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, Vimeo reported EPS at $0.04, down from $0.06 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Vimeo to perform poorly. Analysts forecast its full-year EPS of $0.08 will hit $0.03.

Key Takeaways from Vimeo’s Q2 Results

Even though revenue missed slightly, EBITDA beat handily and EBITDA guidance also came in well above expectations. This is showing a more profitable business than Wall Street envisioned. The stock traded up 23.3% to $4.73 immediately after reporting.

Sure, Vimeo had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.