Specialty insurance company Bowhead Specialty Holdings (NYSE: BOW) reported Q2 CY2025 results topping the market’s revenue expectations, with sales up 34.7% year on year to $133.3 million. Its GAAP profit of $0.37 per share was 2.9% above analysts’ consensus estimates.

Is now the time to buy Bowhead Specialty? Find out by accessing our full research report, it’s free.

Bowhead Specialty (BOW) Q2 CY2025 Highlights:

- Net Premiums Earned: $119.1 million vs analyst estimates of $120.3 million (32.2% year-on-year growth, 1% miss)

- Revenue: $133.3 million vs analyst estimates of $131 million (34.7% year-on-year growth, 1.7% beat)

- Combined Ratio: 96.8% vs analyst estimates of 97.3% (0.5 percentage point beat)

- EPS (GAAP): $0.37 vs analyst estimates of $0.36 (2.9% beat)

- Market Capitalization: $1.06 billion

Company Overview

Named after the Arctic bowhead whale known for navigating challenging waters, Bowhead Specialty Holdings (NYSE: BOW) is a specialty insurance company that provides customized coverage for complex and high-risk commercial sectors.

Revenue Growth

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

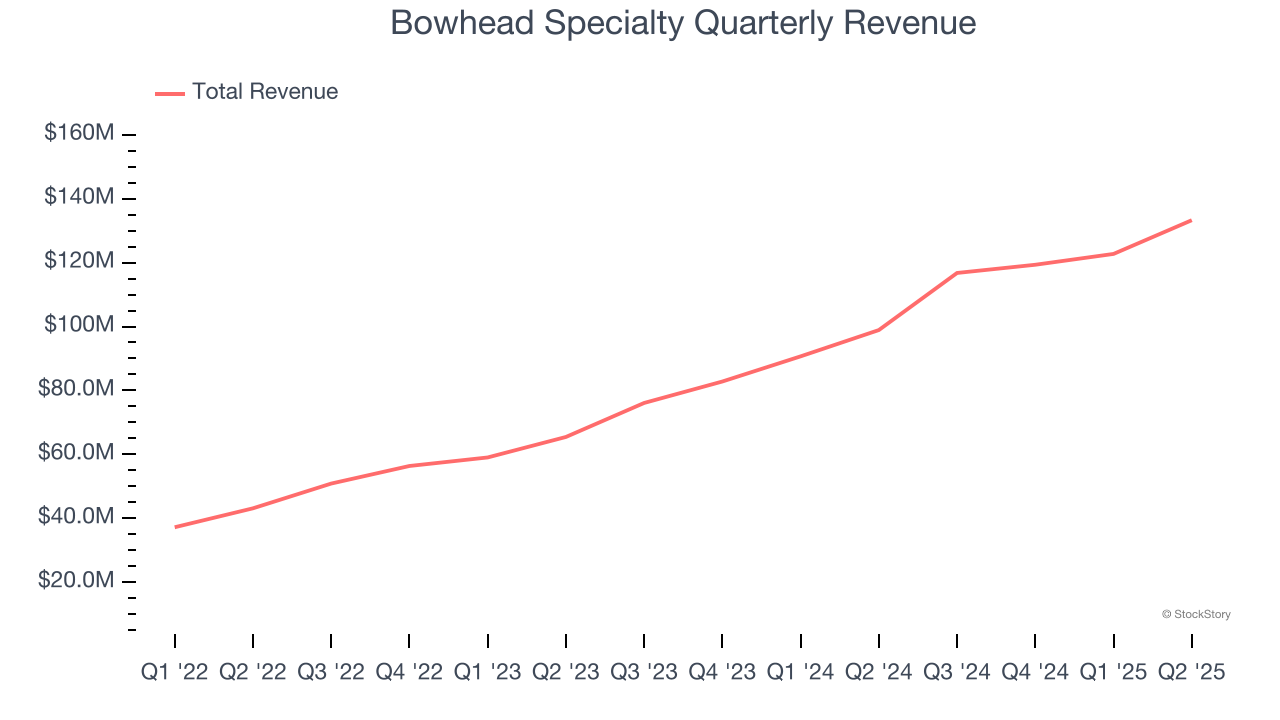

Bowhead Specialty’s annualized revenue growth rate of 45.7% over the last two years was incredible for an insurance business.

This quarter, Bowhead Specialty reported wonderful year-on-year revenue growth of 34.7%, and its $133.3 million of revenue exceeded Wall Street’s estimates by 1.7%.

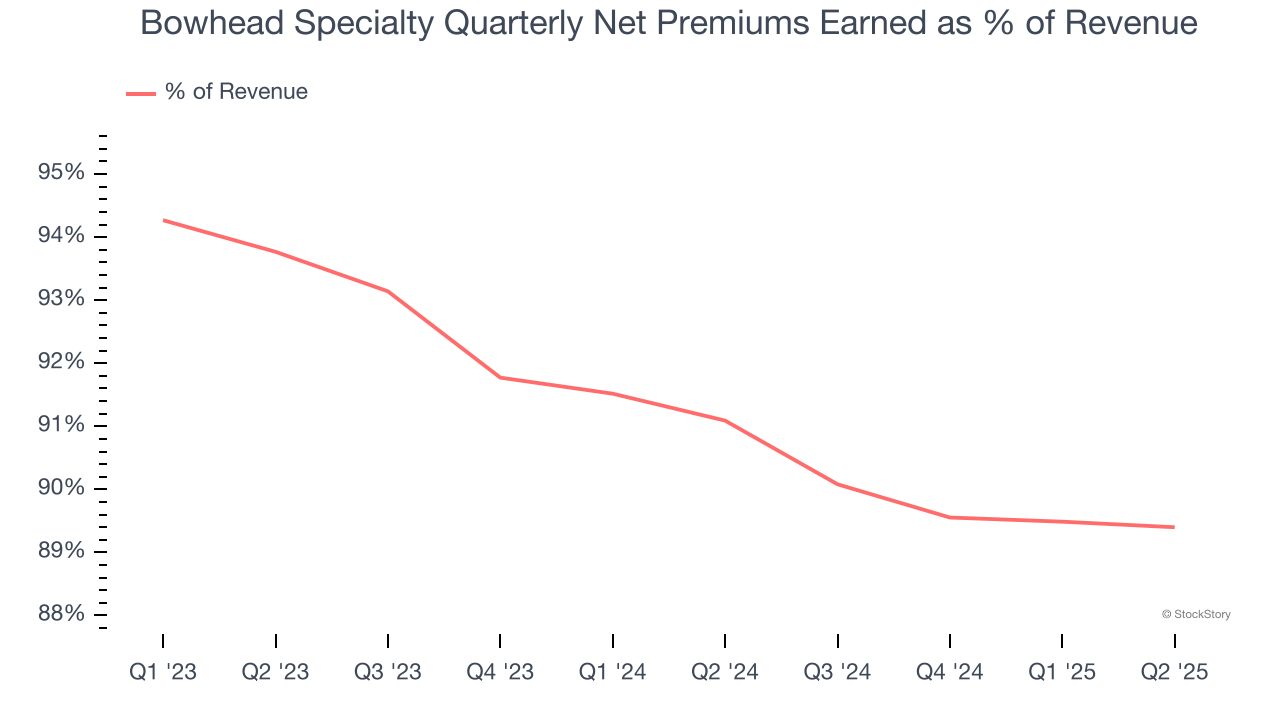

Net premiums earned made up 91% of the company’s total revenue during the last three years, meaning Bowhead Specialty lives and dies by its underwriting activities because non-insurance operations barely move the needle.

Markets consistently prioritize net premiums earned growth over investment and fee income, recognizing its superior quality as a core indicator of the company’s underwriting success and market penetration.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Net Premiums Earned

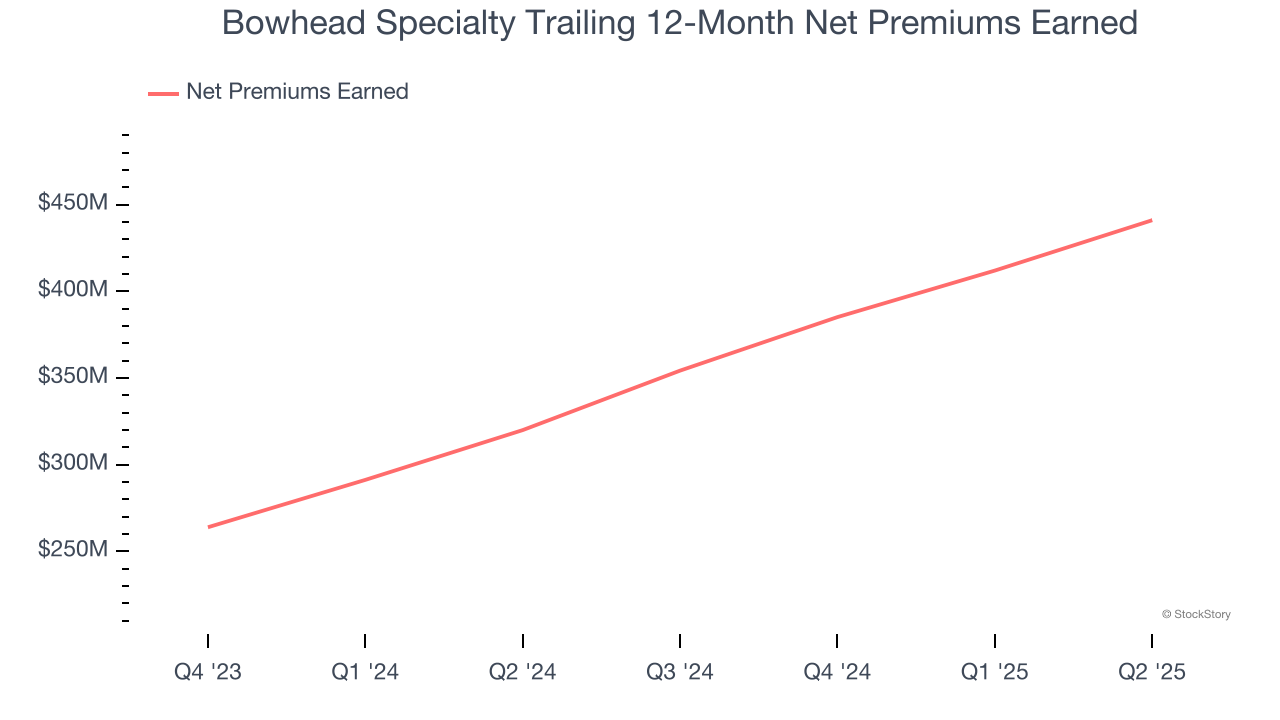

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Bowhead Specialty’s net premiums earned has grown at a 39.9% annualized rate over the last two years, much better than the broader insurance industry but slower than its total revenue.

Bowhead Specialty’s net premiums earned came in at $119.1 million this quarter, up a hearty 32.2% year on year and in line with Wall Street Consensus estimates.

Key Takeaways from Bowhead Specialty’s Q2 Results

It was encouraging to see Bowhead Specialty beat analysts’ revenue expectations this quarter. On the other hand, its net premiums earned slightly missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $32.50 immediately following the results.

Is Bowhead Specialty an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.