Virtual events software company (NYSE: ONTF) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 5.4% year on year to $35.33 million. Guidance for next quarter’s revenue was better than expected at $33.9 million at the midpoint, 0.8% above analysts’ estimates. Its non-GAAP profit of $0.02 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy ON24? Find out by accessing our full research report, it’s free.

ON24 (ONTF) Q2 CY2025 Highlights:

- Revenue: $35.33 million vs analyst estimates of $34.66 million (5.4% year-on-year decline, 1.9% beat)

- Adjusted EPS: $0.02 vs analyst estimates of $0.01 ($0.01 beat)

- Adjusted Operating Income: -$919,000 vs analyst estimates of -$1.12 million (-2.6% margin, relatively in line)

- The company slightly lifted its revenue guidance for the full year to $138.2 million at the midpoint from $137.5 million

- Management reiterated its full-year Adjusted EPS guidance of $0.04 at the midpoint

- Operating Margin: -26%, up from -35% in the same quarter last year

- Free Cash Flow Margin: 5.9%, similar to the previous quarter

- Billings: $25.93 million at quarter end, down 14.3% year on year

- Market Capitalization: $200.9 million

Company Overview

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE: ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

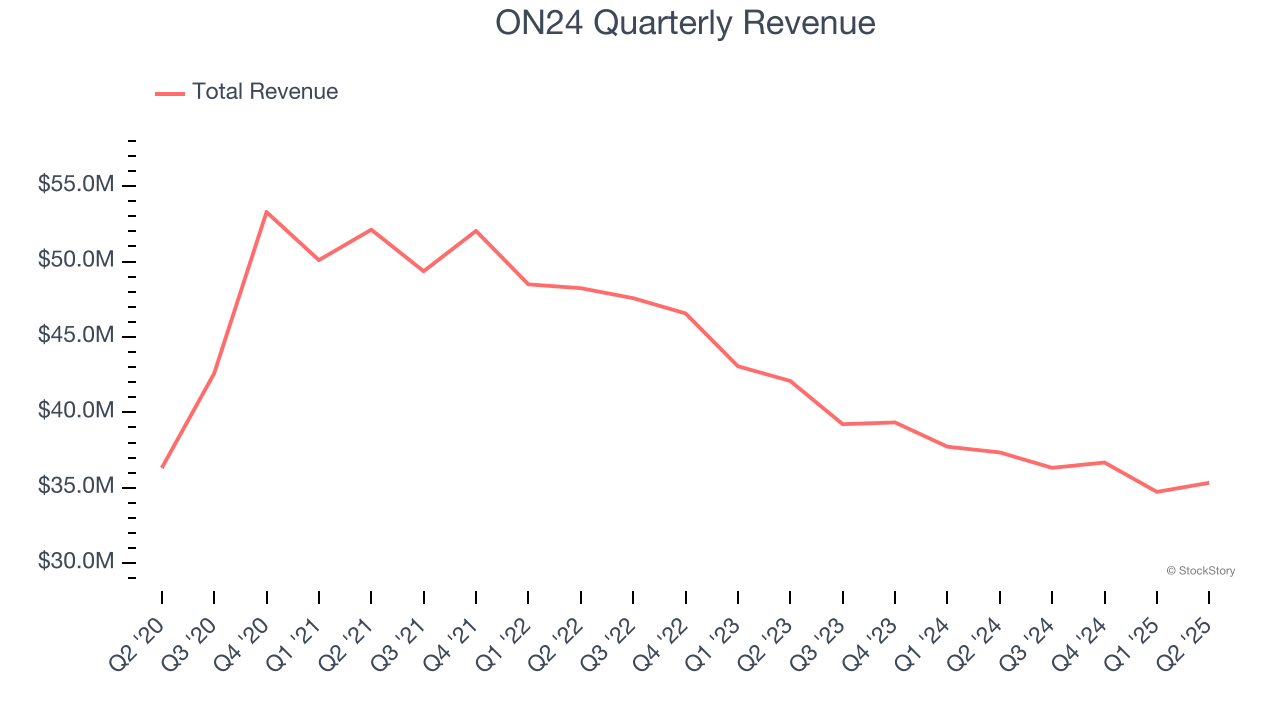

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, ON24’s demand was weak and its revenue declined by 10.3% per year. This wasn’t a great result and is a sign of poor business quality.

This quarter, ON24’s revenue fell by 5.4% year on year to $35.33 million but beat Wall Street’s estimates by 1.9%. Company management is currently guiding for a 6.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 5.2% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

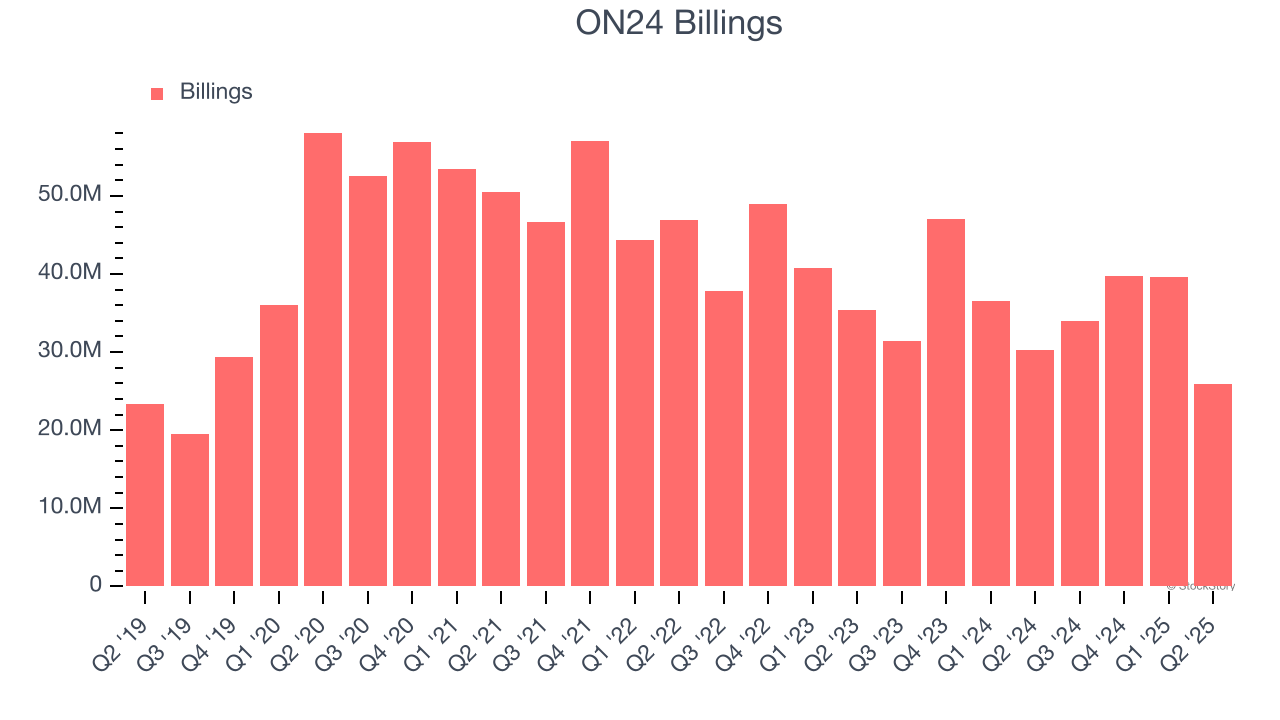

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

ON24’s billings came in at $25.93 million in Q2, and it averaged 3.3% year-on-year declines over the last four quarters. However, this alternate topline metric outperformed its total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for ON24 to acquire new customers as its CAC payback period checked in at 55.5 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from ON24’s Q2 Results

We were impressed by ON24’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its billings missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock remained flat at $4.73 immediately following the results.

Big picture, is ON24 a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.