Cadence Bank’s 16% return over the past six months has outpaced the S&P 500 by 5.5%, and its stock price has climbed to $37.64 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy CADE? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does Cadence Bank Spark Debate?

With roots dating back to 1885 and a strategic focus on middle-market commercial lending, Cadence Bancorporation (NYSE: CADE) is a bank holding company that provides commercial banking, retail banking, and wealth management services to middle-market businesses and individuals.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

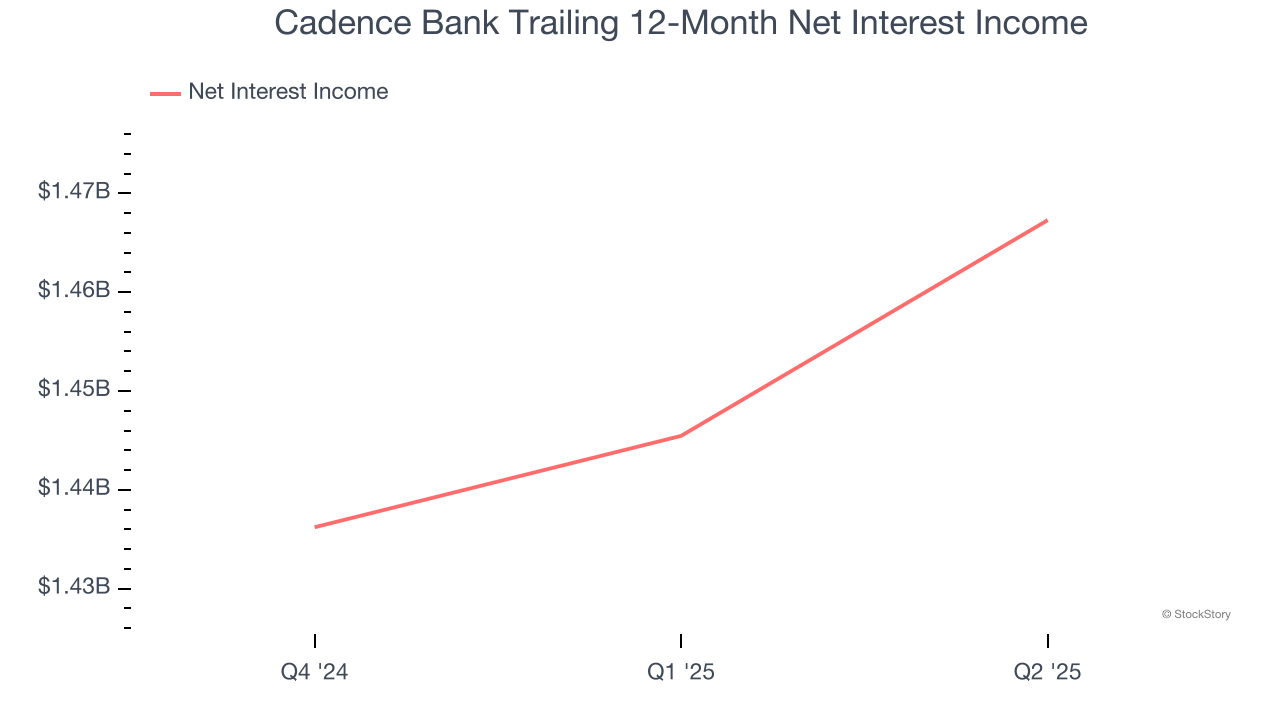

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Cadence Bank’s net interest income has grown at a 17% annualized rate over the last five years, much better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Growing TBVPS Reflects Strong Asset Base

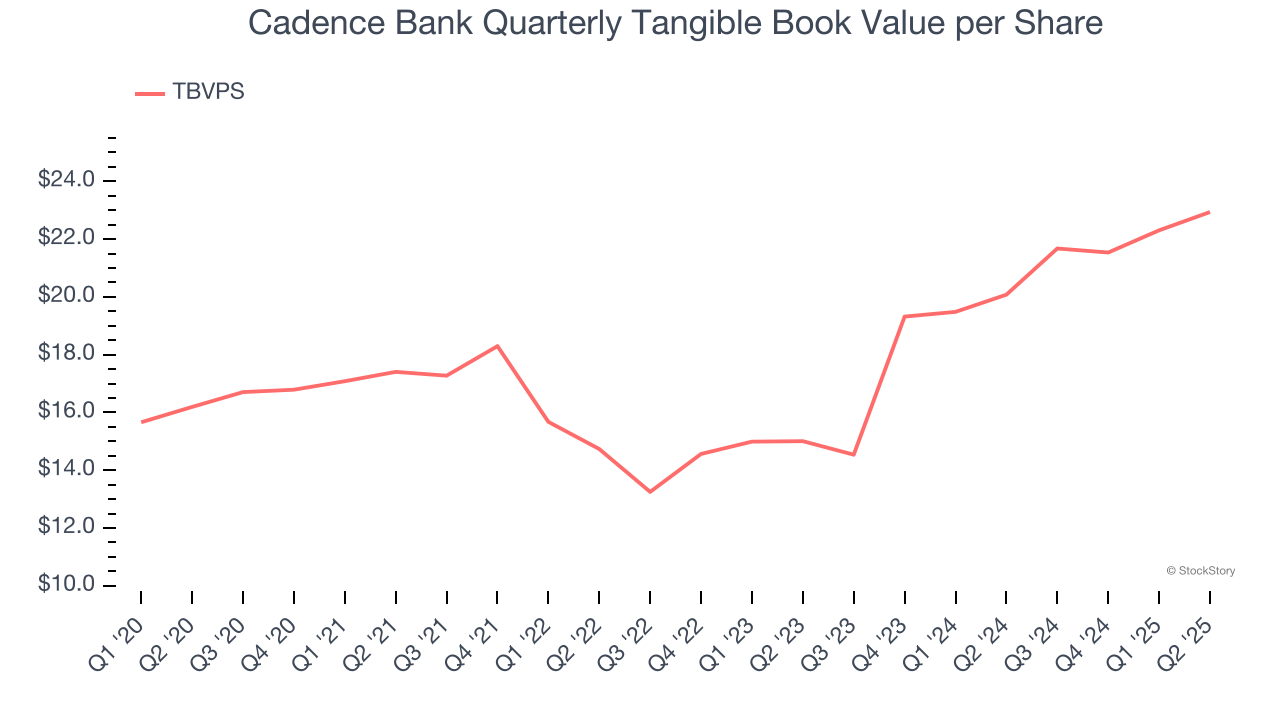

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Cadence Bank’s TBVPS increased by 7.2% annually over the last five years, and growth has recently accelerated as TBVPS grew at an incredible 23.6% annual clip over the past two years (from $15.01 to $22.94 per share).

One Reason to be Careful:

Lackluster Revenue Growth

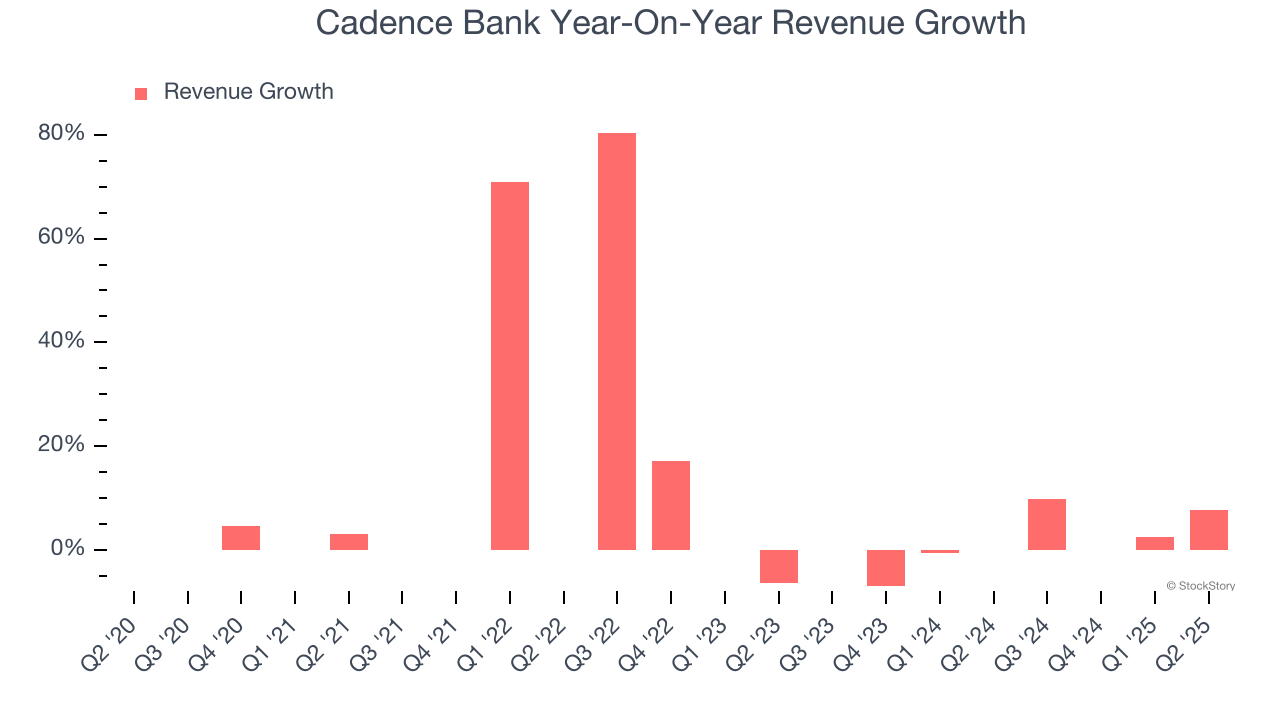

Long-term growth is the most important, but within financials, a stretched historical view may miss recent interest rate changes and market returns. Cadence Bank’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 1.3% over the last two years was well below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Final Judgment

Cadence Bank’s positive characteristics outweigh the negatives, and with its shares topping the market in recent months, the stock trades at 1.2× forward P/B (or $37.64 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.