Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at SunOpta (NASDAQ: STKL) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.8% since the latest earnings results.

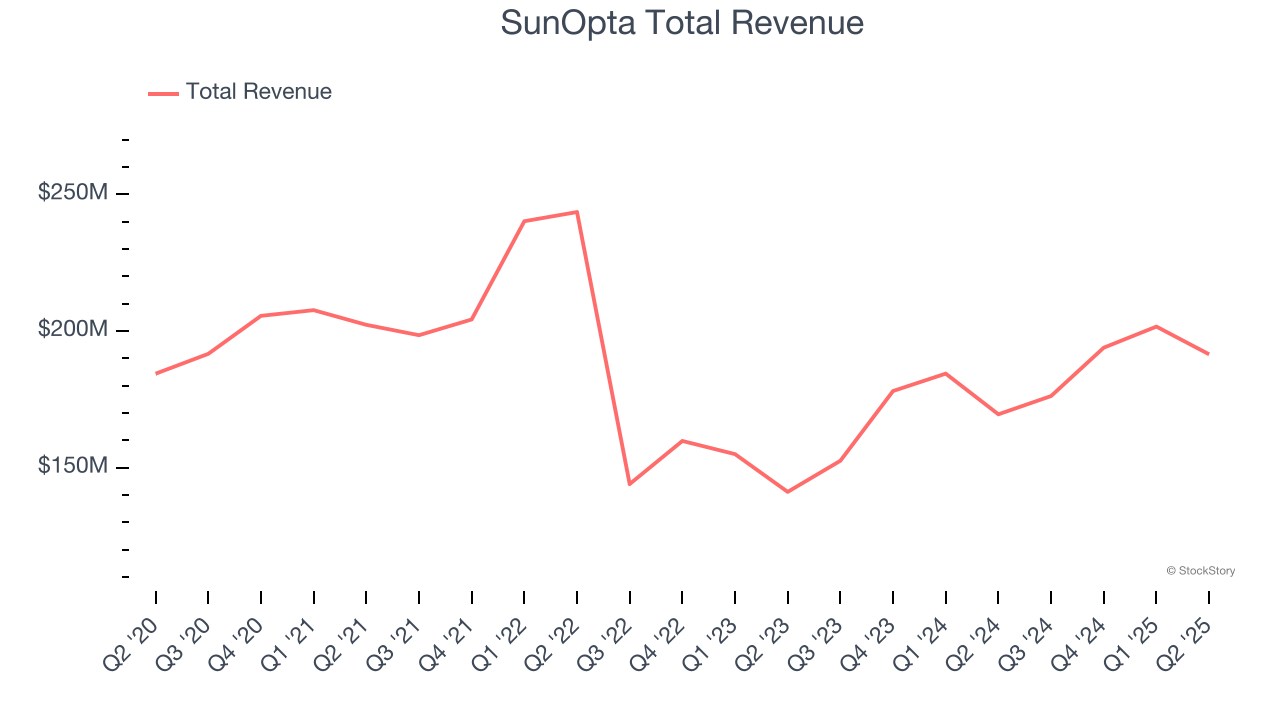

SunOpta (NASDAQ: STKL)

Committed to clean-label foods, SunOpta (NASDAQ: STKL) is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of organic products.

SunOpta reported revenues of $191.5 million, up 12.9% year on year. This print exceeded analysts’ expectations by 3.1%. Overall, it was a strong quarter for the company with a beat of analysts’ EPS estimates and full-year revenue guidance slightly topping analysts’ expectations.

SunOpta achieved the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 20.1% since reporting and currently trades at $6.22.

Is now the time to buy SunOpta? Access our full analysis of the earnings results here, it’s free.

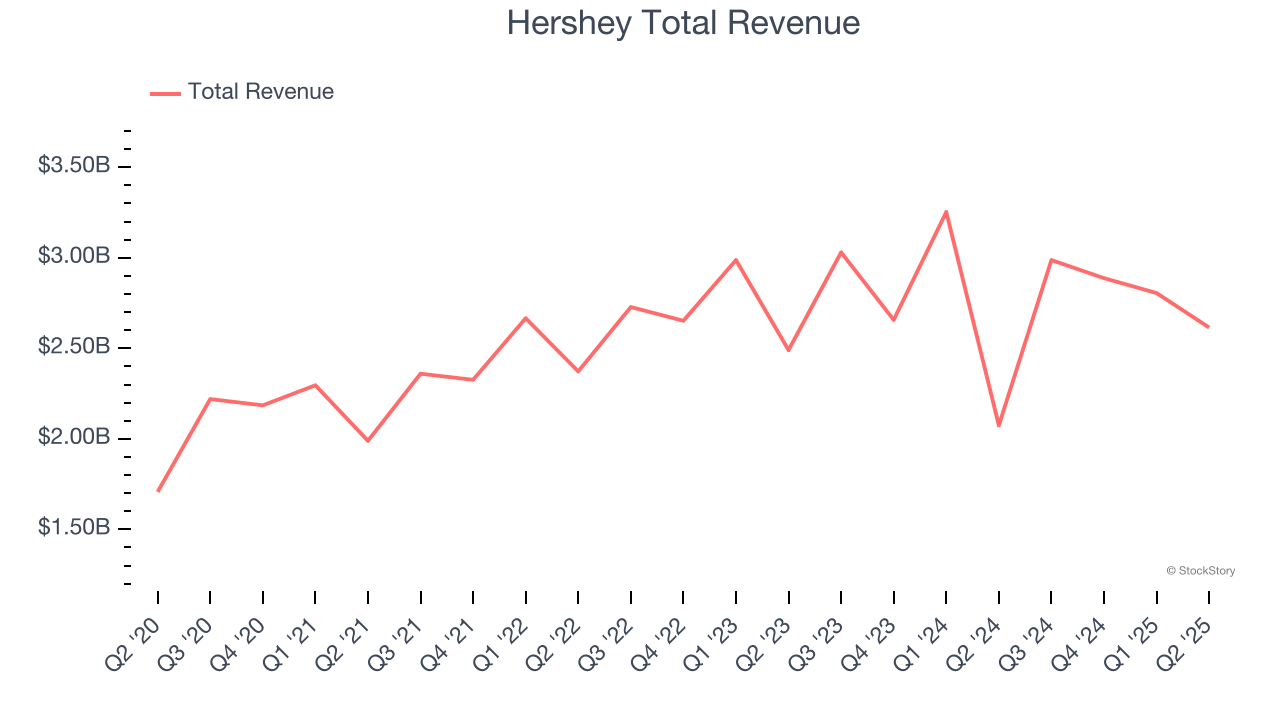

Best Q2: Hershey (NYSE: HSY)

Best known for its milk chocolate bar and Hershey's Kisses, Hershey (NYSE: HSY) is an iconic company known for its chocolate products.

Hershey reported revenues of $2.61 billion, up 26% year on year, outperforming analysts’ expectations by 3.1%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA and organic revenue estimates.

Hershey scored the fastest revenue growth among its peers. The market seems content with the results as the stock is up 3.2% since reporting. It currently trades at $192.34.

Is now the time to buy Hershey? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Hain Celestial (NASDAQ: HAIN)

Sold in over 75 countries around the world, Hain Celestial (NASDAQ: HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

Hain Celestial reported revenues of $363.3 million, down 13.2% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ organic revenue and adjusted operating income estimates.

Hain Celestial delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 22.7% since the results and currently trades at $1.67.

Read our full analysis of Hain Celestial’s results here.

Kellanova (NYSE: K)

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

Kellanova reported revenues of $3.20 billion, flat year on year. This number was in line with analysts’ expectations. More broadly, it was a slower quarter as it produced a miss of analysts’ gross margin and EBITDA estimates.

The stock is down 3.6% since reporting and currently trades at $76.95.

Read our full, actionable report on Kellanova here, it’s free.

Utz (NYSE: UTZ)

Tracing its roots back to 1921 when Bill and Salie Utz began making potato chips in their kitchen, Utz Brands (NYSE: UTZ) offers salty snacks such as potato chips, tortilla chips, pretzels, cheese snacks, and ready-to-eat popcorn, among others.

Utz reported revenues of $366.7 million, up 3% year on year. This result surpassed analysts’ expectations by 1.2%. It was a strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The stock is down 8.7% since reporting and currently trades at $12.73.

Read our full, actionable report on Utz here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.