The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how data analytics stocks fared in Q2, starting with Palantir Technologies (NASDAQ: PLTR).

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

The 6 data analytics stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

While some data analytics stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.5% since the latest earnings results.

Best Q2: Palantir Technologies (NASDAQ: PLTR)

Named after the all-seeing stones in "Lord of the Rings," Palantir Technologies (NASDAQ: PLTR) develops software platforms that help government agencies and enterprises integrate, analyze, and operationalize their data for decision-making.

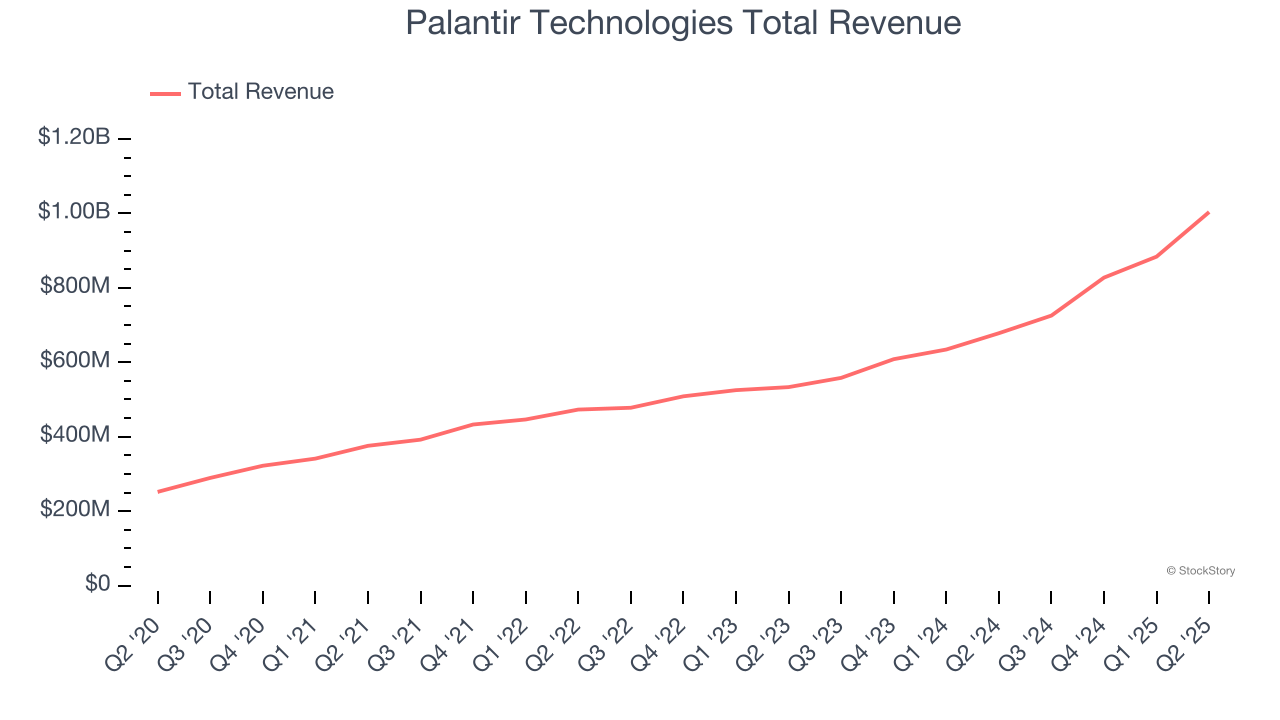

Palantir Technologies reported revenues of $1.00 billion, up 48% year on year. This print exceeded analysts’ expectations by 6.8%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

“This was a phenomenal quarter. We continue to see the astonishing impact of AI leverage. Our Rule of 40 score was 94%, once again obliterating the metric. Year-over-year growth in our U.S. business surged to 68%, and year-over-year growth in U.S. commercial climbed to 93%. We are guiding to the highest sequential quarterly revenue growth in our company’s history, representing 50% year-over-year growth,” said Alex C. Karp, Co-Founder and Chief Executive Officer of Palantir Technologies.

Palantir Technologies pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 13.2% since reporting and currently trades at $182.05.

Samsara (NYSE: IOT)

From sensors on vehicles to AI-powered cameras that help prevent accidents, Samsara (NYSE: IOT) is a cloud-based Internet of Things platform that helps businesses improve the safety, efficiency, and sustainability of their physical operations.

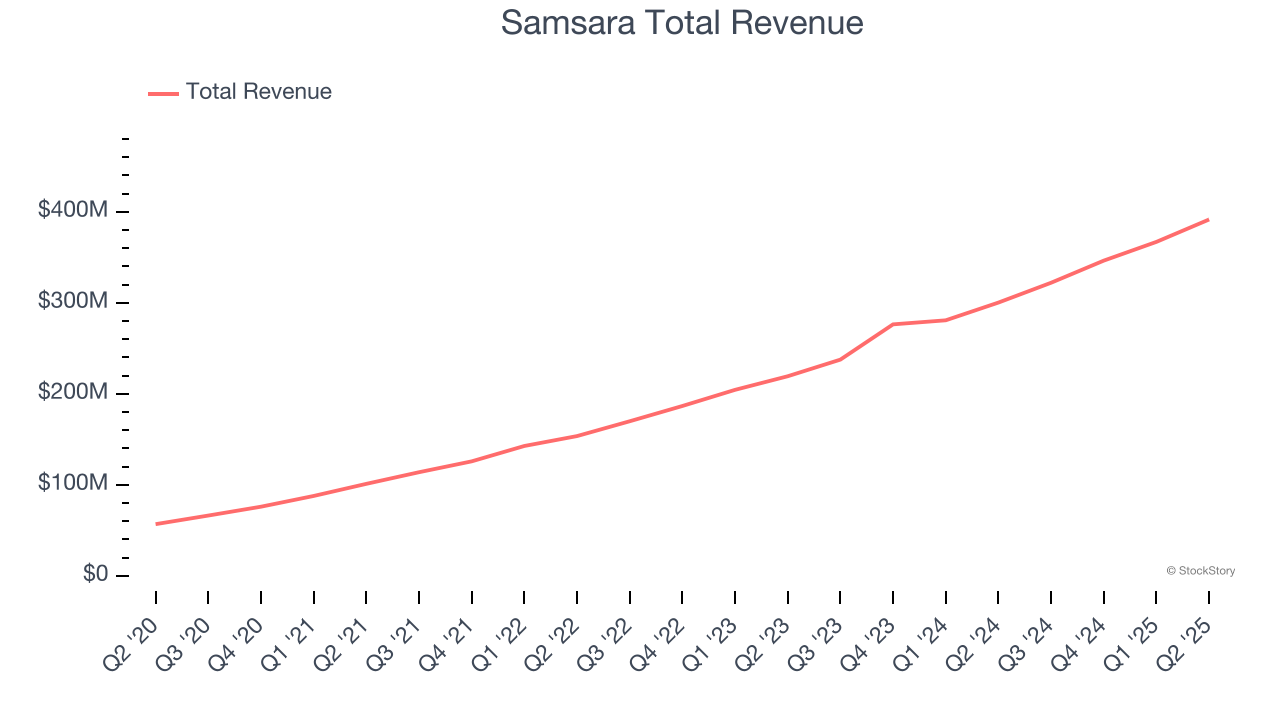

Samsara reported revenues of $391.5 million, up 30.4% year on year, outperforming analysts’ expectations by 5.2%. The business had a very strong quarter with EPS guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 7.4% since reporting. It currently trades at $38.52.

Is now the time to buy Samsara? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Health Catalyst (NASDAQ: HCAT)

Built on its "Health Catalyst Flywheel" methodology that emphasizes measurable outcomes, Health Catalyst (NASDAQ: HCAT) provides data and analytics technology and services that help healthcare organizations manage their data and drive measurable clinical, financial, and operational improvements.

Health Catalyst reported revenues of $80.72 million, up 6.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations.

Health Catalyst delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 23% since the results and currently trades at $2.85.

Read our full analysis of Health Catalyst’s results here.

Amplitude (NASDAQ: AMPL)

Born from the realization that companies were flying blind when it came to understanding user behavior in their digital products, Amplitude (NASDAQ: AMPL) provides a digital analytics platform that helps businesses understand how people use their digital products to improve user experiences and drive revenue growth.

Amplitude reported revenues of $83.27 million, up 13.6% year on year. This result surpassed analysts’ expectations by 2.4%. Overall, it was a very strong quarter as it also produced accelerating customer growth and an impressive beat of analysts’ EBITDA estimates.

The company added 17 enterprise customers paying more than $100,000 annually to reach a total of 634. The stock is down 3.9% since reporting and currently trades at $11.75.

Read our full, actionable report on Amplitude here, it’s free.

MicroStrategy (NASDAQ: MSTR)

Once a traditional business intelligence software provider, MicroStrategy (NASDAQ: MSTR) develops AI-powered enterprise analytics software while also functioning as a major corporate holder of Bitcoin cryptocurrency.

MicroStrategy reported revenues of $114.5 million, up 2.7% year on year. This number topped analysts’ expectations by 1.2%. Taking a step back, it was a mixed quarter as it also produced full-year EPS guidance exceeding analysts’ expectations but a significant miss of analysts’ EBITDA estimates.

The stock is down 18.4% since reporting and currently trades at $328.

Read our full, actionable report on MicroStrategy here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.