The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Intuit (NASDAQ: INTU) and the rest of the finance and HR software stocks fared in Q2.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 13 finance and HR software stocks we track reported a mixed Q2. As a group, revenues beat analysts’ consensus estimates by 1.8% while next quarter’s revenue guidance was 1.1% below.

Thankfully, share prices of the companies have been resilient as they are up 8.6% on average since the latest earnings results.

Intuit (NASDAQ: INTU)

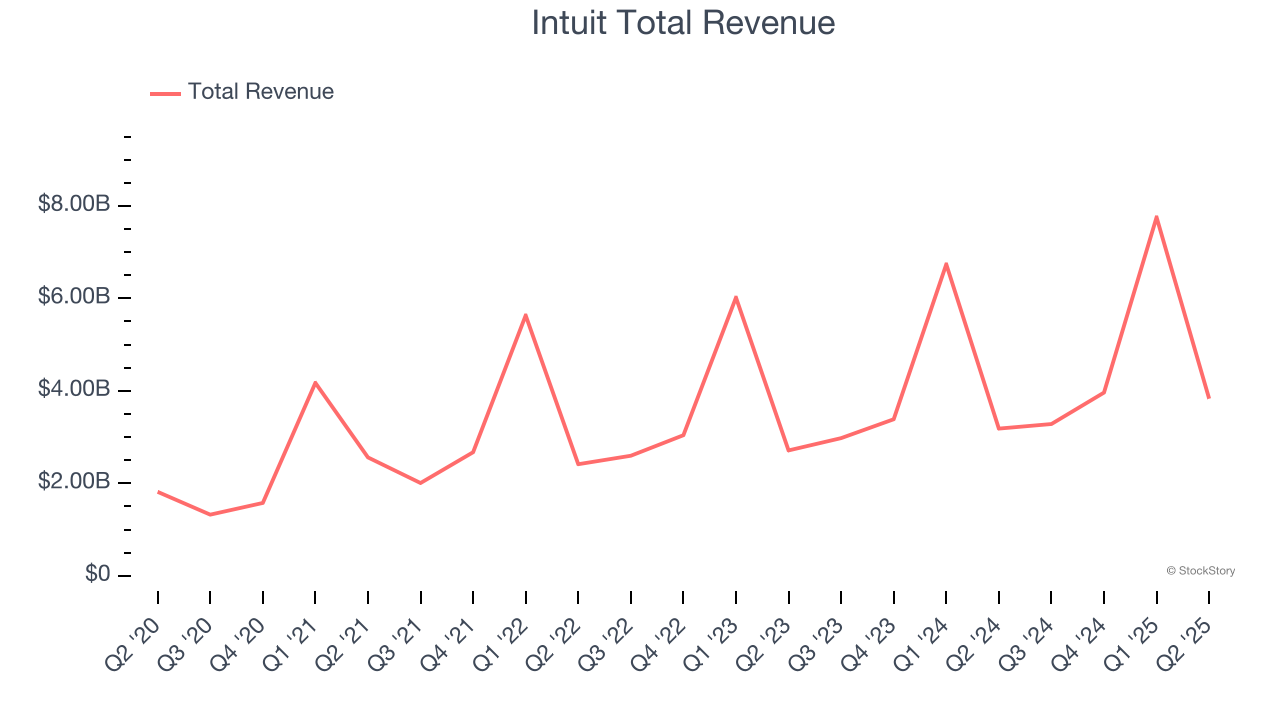

Originally named after its founding product "Intuitive for the first-time user," Intuit (NASDAQ: INTU) provides financial management software and services including TurboTax, QuickBooks, Credit Karma, and Mailchimp to help consumers and small businesses manage their finances.

Intuit reported revenues of $3.83 billion, up 20.3% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ billings estimates but full-year guidance of slowing revenue growth.

“We had an exceptional fiscal 2025 with 20 percent growth in the fourth quarter and 16 percent growth for the full year,” said Sasan Goodarzi, Intuit’s chief executive officer.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $698.

Is now the time to buy Intuit? Access our full analysis of the earnings results here, it’s free.

Best Q2: Workiva (NYSE: WK)

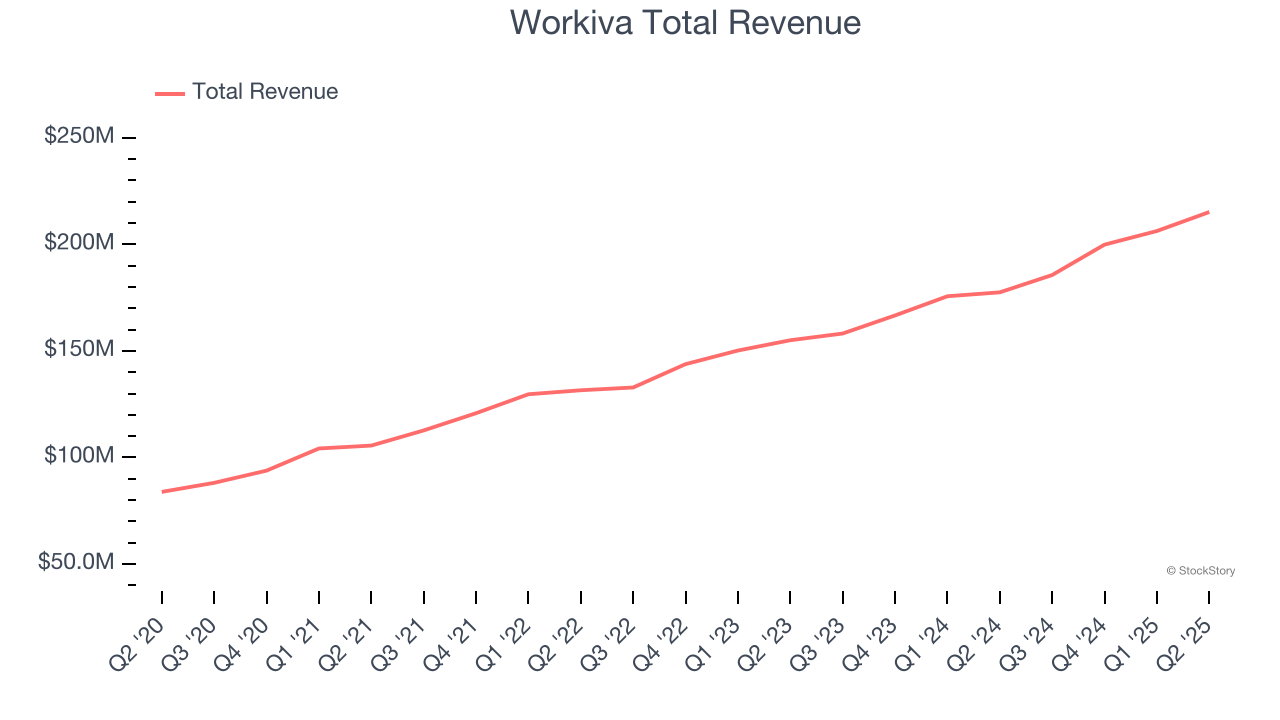

Nicknamed "the Excel killer" by some finance professionals for its ability to eliminate spreadsheet chaos, Workiva (NYSE: WK) provides a cloud-based platform that enables organizations to streamline financial reporting, ESG, and compliance processes with connected data and automation.

Workiva reported revenues of $215.2 million, up 21.2% year on year, outperforming analysts’ expectations by 3%. The business had a very strong quarter with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 30.6% since reporting. It currently trades at $83.37.

Is now the time to buy Workiva? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Paychex (NASDAQ: PAYX)

Once known as the go-to service for small business payroll needs, Paychex (NASDAQ: PAYX) provides payroll processing, HR services, employee benefits administration, and insurance solutions to small and medium-sized businesses.

Paychex reported revenues of $1.43 billion, up 10.2% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a miss of analysts’ EBITDA estimates.

As expected, the stock is down 15.3% since the results and currently trades at $128.87.

Read our full analysis of Paychex’s results here.

Paycom (NYSE: PAYC)

Pioneering the concept of employees doing their own payroll with its "Beti" technology, Paycom (NYSE: PAYC) provides cloud-based human capital management software that helps businesses manage the entire employment lifecycle from recruitment to retirement.

Paycom reported revenues of $483.6 million, up 10.5% year on year. This number beat analysts’ expectations by 2.5%. Overall, it was a very strong quarter as it also put up a solid beat of analysts’ EBITDA estimates.

The stock is down 1.4% since reporting and currently trades at $219.66.

Read our full, actionable report on Paycom here, it’s free.

American Express Global Business Travel (NYSE: GBTG)

Originally spun off from American Express in 2014 but maintaining the Amex GBT brand, Global Business Travel Group (NYSE: GBTG) provides end-to-end business travel and expense management solutions, connecting corporate clients with travel suppliers and offering specialized software services.

American Express Global Business Travel reported revenues of $631 million, flat year on year. This result was in line with analysts’ expectations. It was a strong quarter as it also logged full-year EBITDA and revenue guidance topping analysts’ expectations.

American Express Global Business Travel had the slowest revenue growth among its peers. The stock is up 32% since reporting and currently trades at $8.23.

Read our full, actionable report on American Express Global Business Travel here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.