Customer experience solutions provider Concentrix (NASDAQ: CNXC) announced better-than-expected revenue in Q3 CY2025, with sales up 4% year on year to $2.48 billion. Guidance for next quarter’s revenue was better than expected at $2.54 billion at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $2.78 per share was 3.1% below analysts’ consensus estimates.

Is now the time to buy Concentrix? Find out by accessing our full research report, it’s free.

Concentrix (CNXC) Q3 CY2025 Highlights:

- Revenue: $2.48 billion vs analyst estimates of $2.46 billion (4% year-on-year growth, 1% beat)

- Adjusted EPS: $2.78 vs analyst expectations of $2.87 (3.1% miss)

- Revenue Guidance for Q4 CY2025 is $2.54 billion at the midpoint, roughly in line with what analysts were expecting

- Management lowered its full-year Adjusted EPS guidance to $11.17 at the midpoint, a 4.1% decrease

- Operating Margin: 5.9%, in line with the same quarter last year

- Free Cash Flow Margin: 6.4%, up from 5.4% in the same quarter last year

- Market Capitalization: $3.50 billion

“Our ongoing growth momentum demonstrates our strong position as a trusted provider of business transformation solutions that combine CX expertise, AI and IT services globally,” said Chris Caldwell, President and CEO of Concentrix.

Company Overview

With a team of approximately 450,000 employees across 75 countries, Concentrix (NASDAQ: CNXC) designs and delivers customer experience solutions that help global brands manage their customer interactions across digital channels and contact centers.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $9.72 billion in revenue over the past 12 months, Concentrix is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

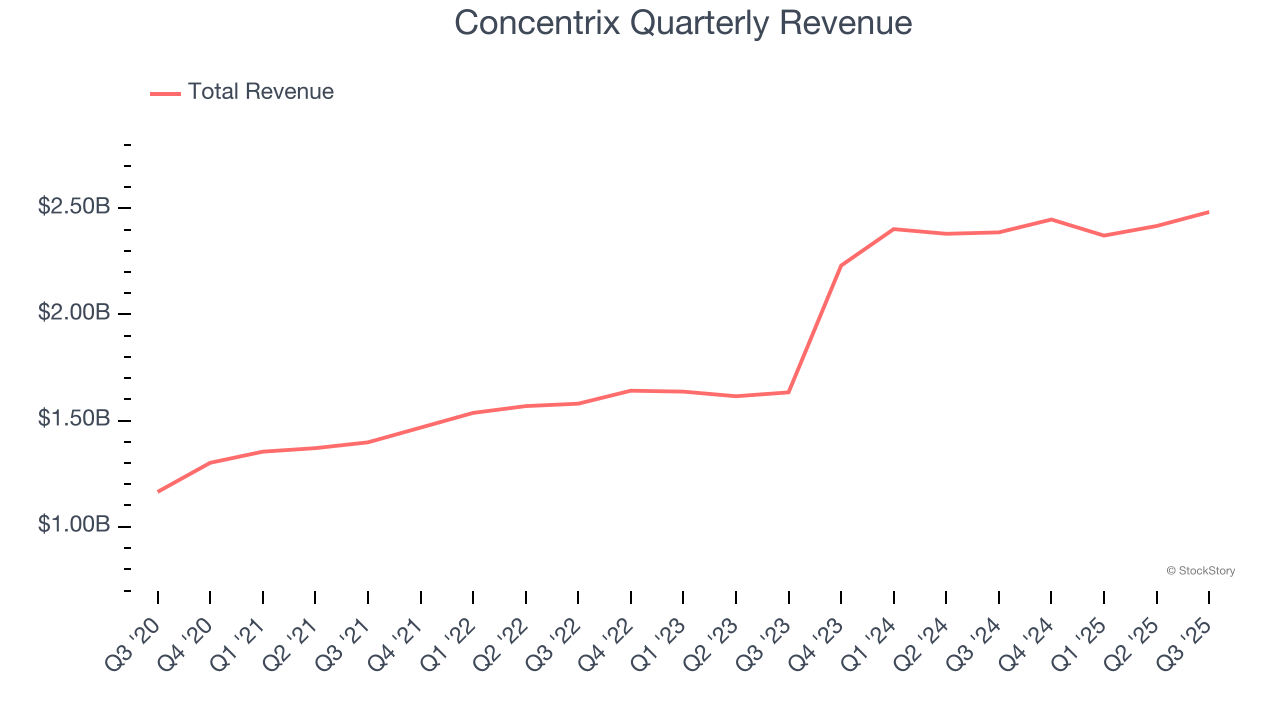

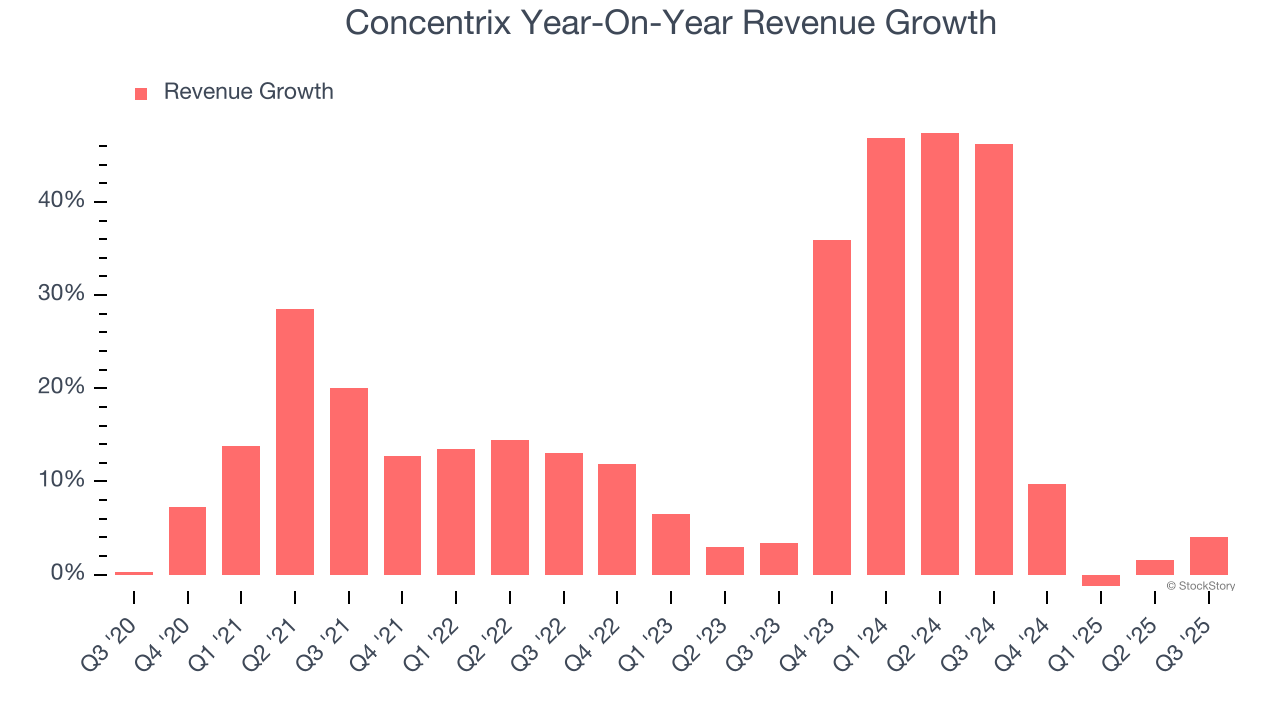

As you can see below, Concentrix grew its sales at an incredible 16% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Concentrix’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Concentrix’s annualized revenue growth of 22.1% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Concentrix reported modest year-on-year revenue growth of 4% but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 3.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.8% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

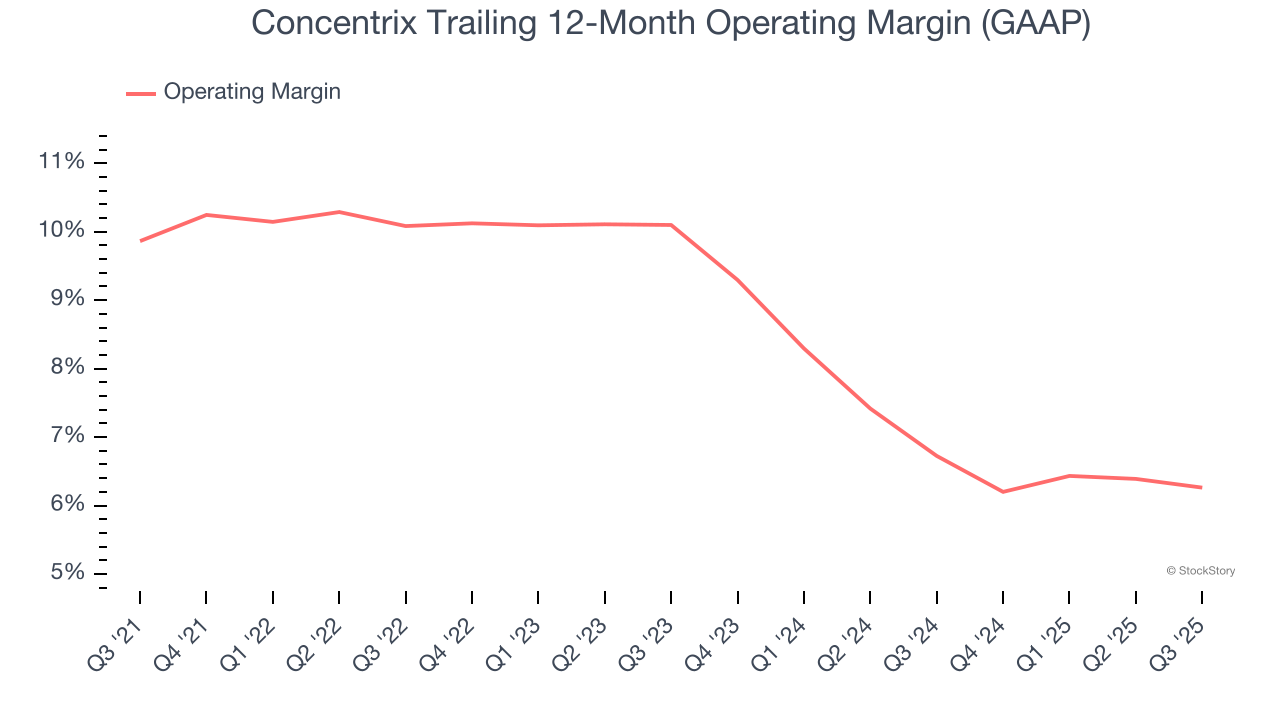

Concentrix was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.2% was weak for a business services business.

Analyzing the trend in its profitability, Concentrix’s operating margin decreased by 3.6 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Concentrix’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Concentrix generated an operating margin profit margin of 5.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

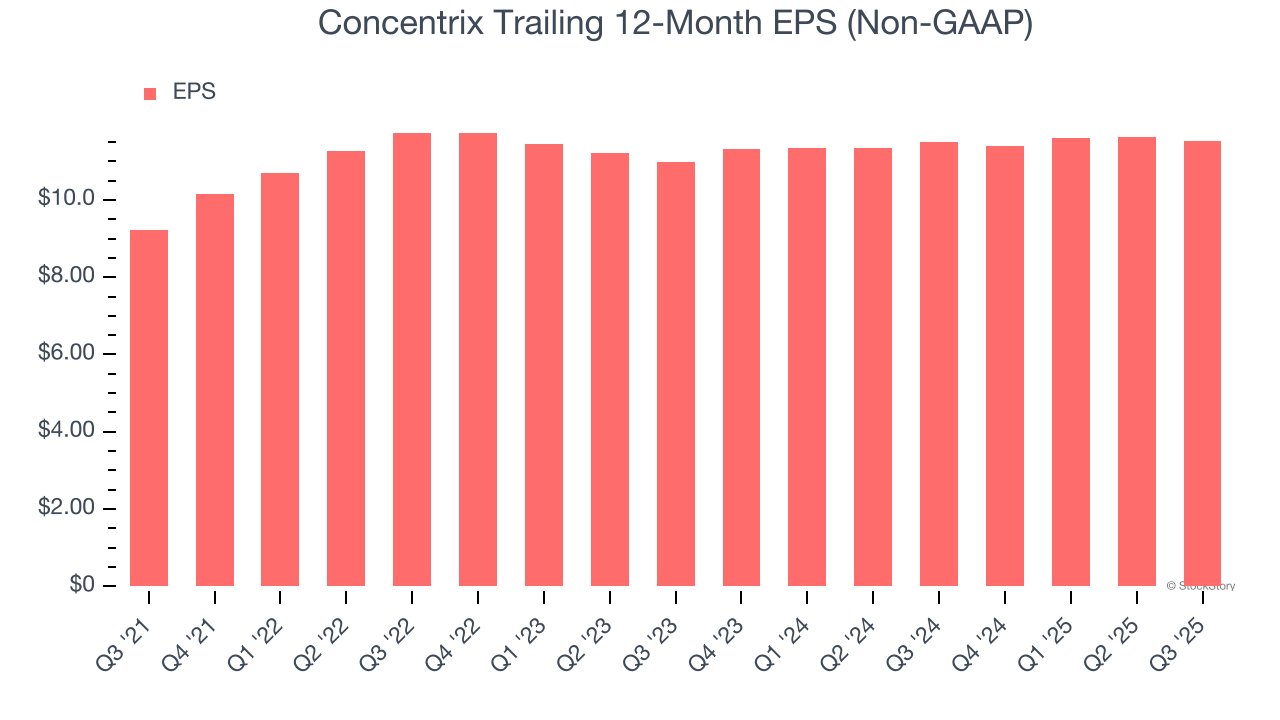

Concentrix’s full-year EPS grew at an unimpressive 5.7% compounded annual growth rate over the last four years, worse than the broader business services sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

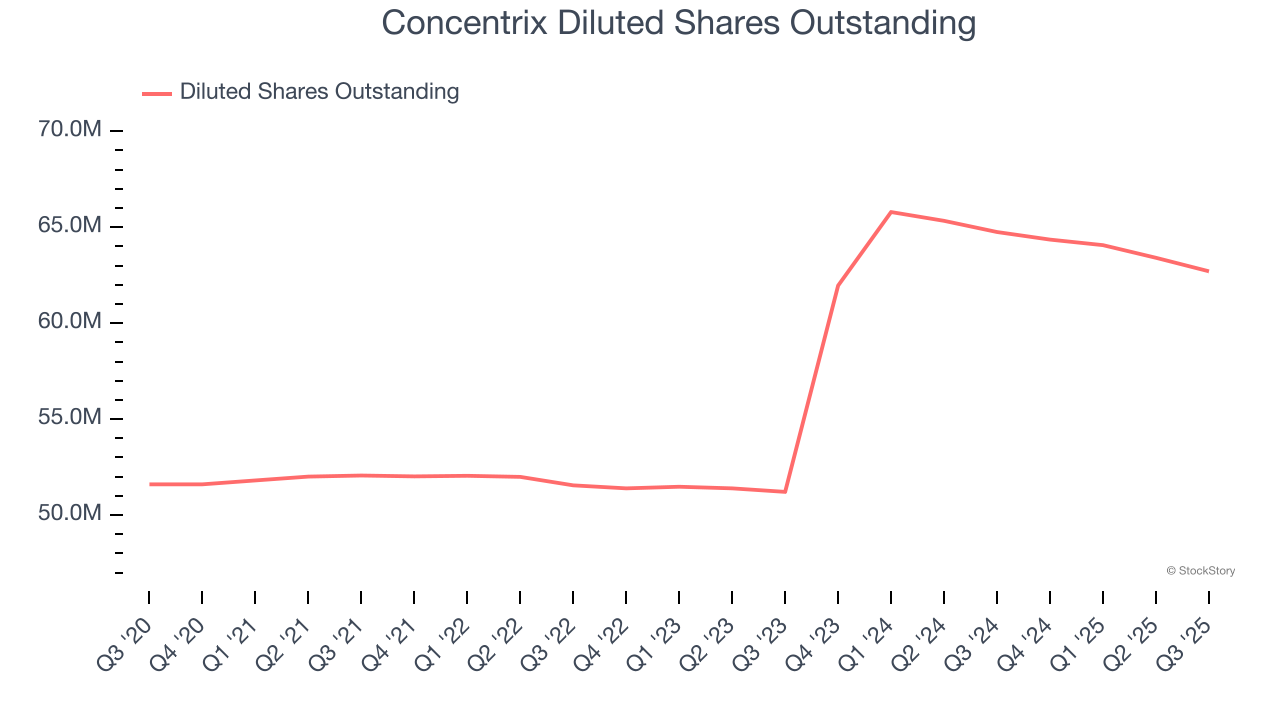

Concentrix’s EPS grew at a weak 2.5% compounded annual growth rate over the last two years, lower than its 22.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Concentrix’s earnings can give us a better understanding of its performance. We mentioned earlier that Concentrix’s operating margin was flat this quarter, but a two-year view shows its margin has declinedwhile its share count has grown 22.4%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Concentrix reported adjusted EPS of $2.78, down from $2.87 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Concentrix’s full-year EPS of $11.53 to grow 6.9%.

Key Takeaways from Concentrix’s Q3 Results

Despite a slight revenue beat in the quarter, EPS missed. To make matters worse, full-year EPS guidance was lowered to levels below Wall Street's estimates. Overall, this was a weaker quarter. The stock traded down 21.2% to $43.33 immediately after reporting.

Concentrix’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.