Planet Fitness has been treading water for the past six months, recording a small return of 2.8% while holding steady at $103.39. The stock also fell short of the S&P 500’s 15.7% gain during that period.

Is there a buying opportunity in Planet Fitness, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Planet Fitness Not Exciting?

We're swiping left on Planet Fitness for now. Here are three reasons you should be careful with PLNT and a stock we'd rather own.

1. Same-Store Sales Falling Behind Peers

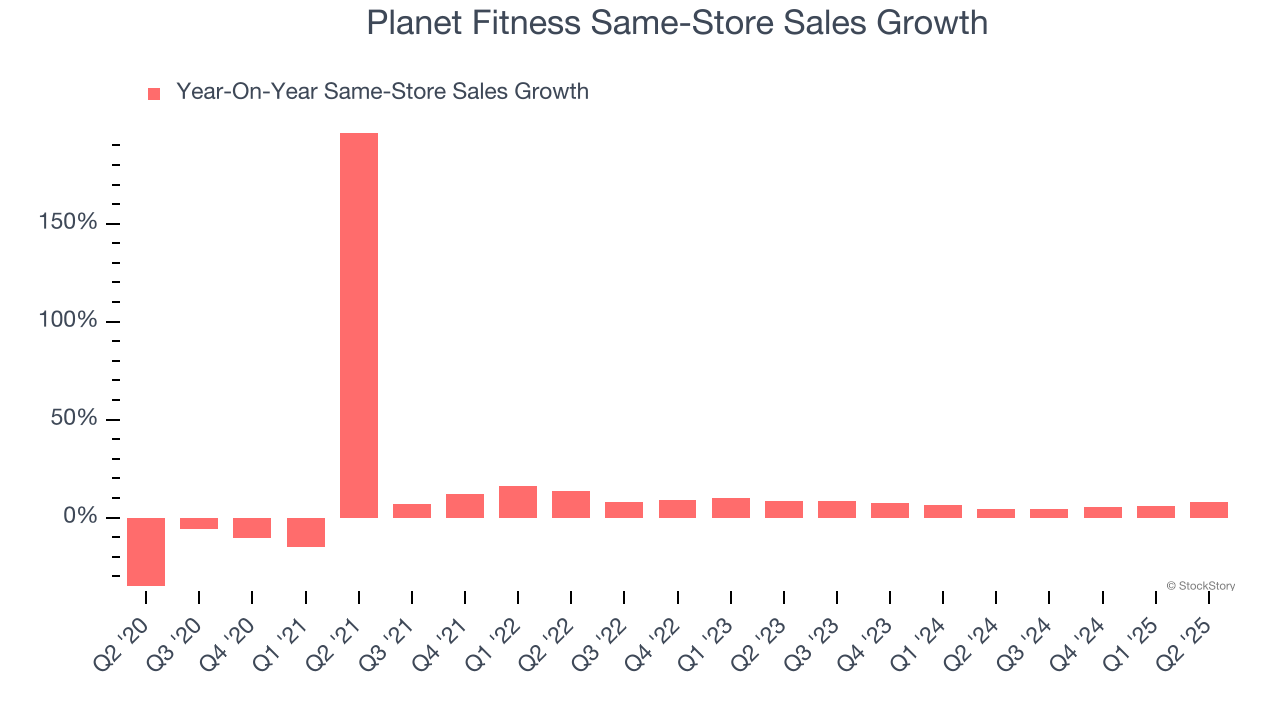

In addition to reported revenue, same-store sales are a useful data point for analyzing Leisure Facilities companies. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Planet Fitness’s underlying demand characteristics.

Over the last two years, Planet Fitness’s same-store sales averaged 6.3% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. Cash Flow Margin Set to Decline

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Over the next year, analysts predict Planet Fitness’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 16.3% for the last 12 months will decrease to 13.5%.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Planet Fitness’s ROIC averaged 3.7 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Planet Fitness isn’t a terrible business, but it doesn’t pass our bar. With its shares underperforming the market lately, the stock trades at 32.6× forward P/E (or $103.39 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.