Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at OSI Systems (NASDAQ: OSIS) and its peers.

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

The 8 specialized technology stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was 0.6% below.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

OSI Systems (NASDAQ: OSIS)

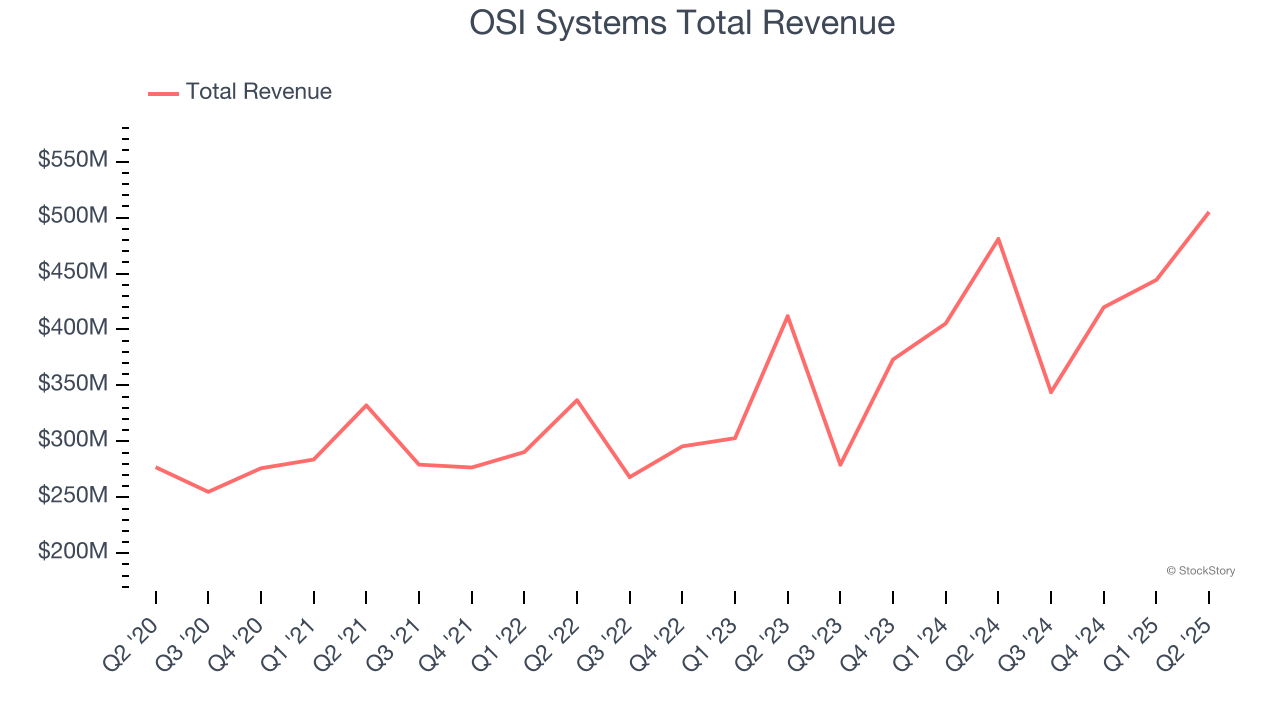

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ: OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

OSI Systems reported revenues of $505 million, up 5% year on year. This print exceeded analysts’ expectations by 2.3%. Overall, it was a strong quarter for the company with full-year EPS and revenue guidance topping analysts’ expectations.

Ajay Mehra, OSI Systems’ President and Chief Executive Officer, stated: “We are pleased to report record-breaking fourth quarter and 2025 fiscal year revenues and non-GAAP earnings per share, led by excellent execution in our Security division. Fourth quarter performance was driven by strong growth in the Security division’s service revenues resulting from an increasing installed base of our products. With robust bookings, solid backlog and high visibility into our opportunity pipeline, we are poised for success in fiscal 2026 and expect to deliver strong cash flow this fiscal year.”

Interestingly, the stock is up 3.8% since reporting and currently trades at $231.63.

Is now the time to buy OSI Systems? Access our full analysis of the earnings results here, it’s free.

Best Q2: Napco (NASDAQ: NSSC)

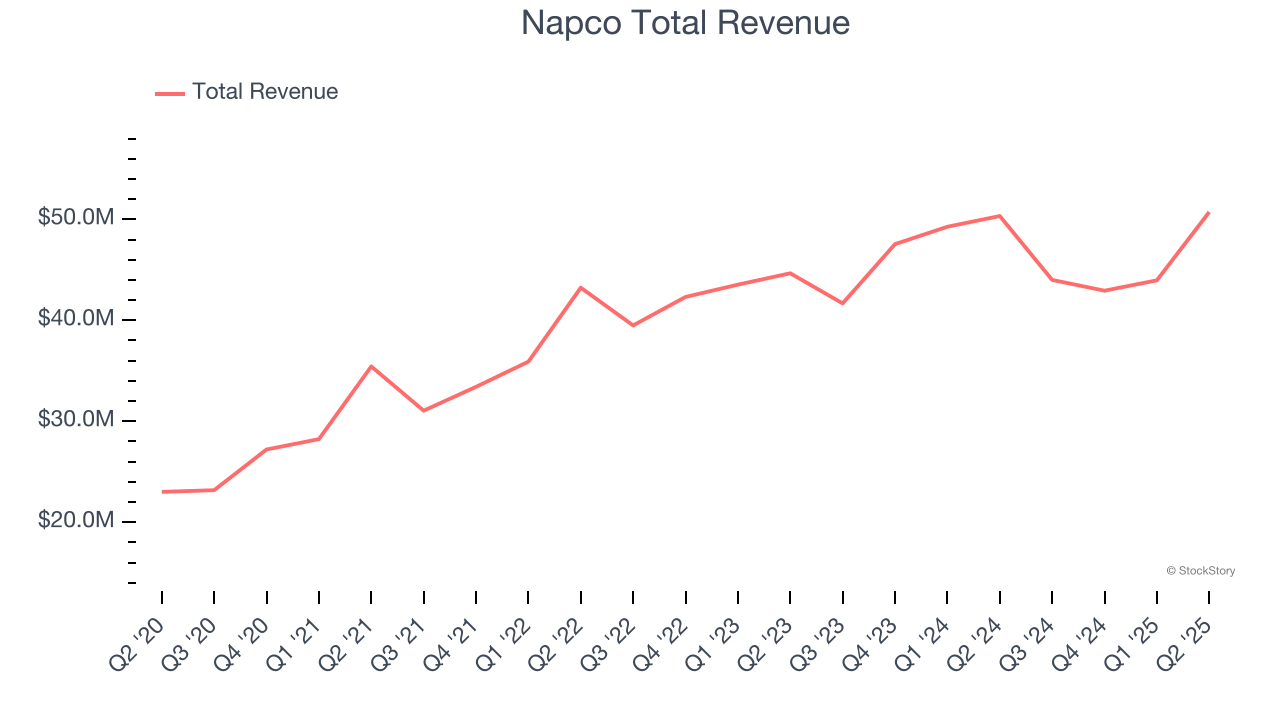

Protecting everything from schools to government facilities since 1969, Napco Security Technologies (NASDAQ: NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

Napco reported revenues of $50.72 million, flat year on year, outperforming analysts’ expectations by 14.1%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

Napco delivered the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 35.9% since reporting. It currently trades at $43.08.

Is now the time to buy Napco? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Cognex (NASDAQ: CGNX)

Founded in 1981 when computer vision was in its infancy, Cognex (NASDAQ: CGNX) develops machine vision systems and software that help manufacturers and logistics companies automate quality inspection and tracking of products.

Cognex reported revenues of $249.1 million, up 4.1% year on year, exceeding analysts’ expectations by 1.3%. Still, it was a slower quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

Interestingly, the stock is up 32.3% since the results and currently trades at $44.65.

Read our full analysis of Cognex’s results here.

PAR Technology (NYSE: PAR)

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE: PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

PAR Technology reported revenues of $112.4 million, up 43.8% year on year. This number topped analysts’ expectations by 1.3%. More broadly, it was a slower quarter as it produced a significant miss of analysts’ ARR estimates.

PAR Technology delivered the fastest revenue growth among its peers. The stock is down 31% since reporting and currently trades at $40.

Read our full, actionable report on PAR Technology here, it’s free.

Zebra (NASDAQ: ZBRA)

Taking its name from the black and white stripes of barcodes, Zebra Technologies (NASDAQ: ZBRA) provides barcode scanners, mobile computers, RFID systems, and other data capture technologies that help businesses track assets and optimize operations.

Zebra reported revenues of $1.29 billion, up 6.2% year on year. This result met analysts’ expectations. It was a strong quarter as it also put up a solid beat of analysts’ EPS estimates.

Zebra had the weakest performance against analyst estimates among its peers. The stock is down 11.5% since reporting and currently trades at $303.10.

Read our full, actionable report on Zebra here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.