Glacier Bancorp has been treading water for the past six months, recording a small return of 1.4% while holding steady at $48.74. The stock also fell short of the S&P 500’s 9.7% gain during that period.

Is there a buying opportunity in Glacier Bancorp, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Glacier Bancorp Not Exciting?

We're swiping left on Glacier Bancorp for now. Here are three reasons you should be careful with GBCI and a stock we'd rather own.

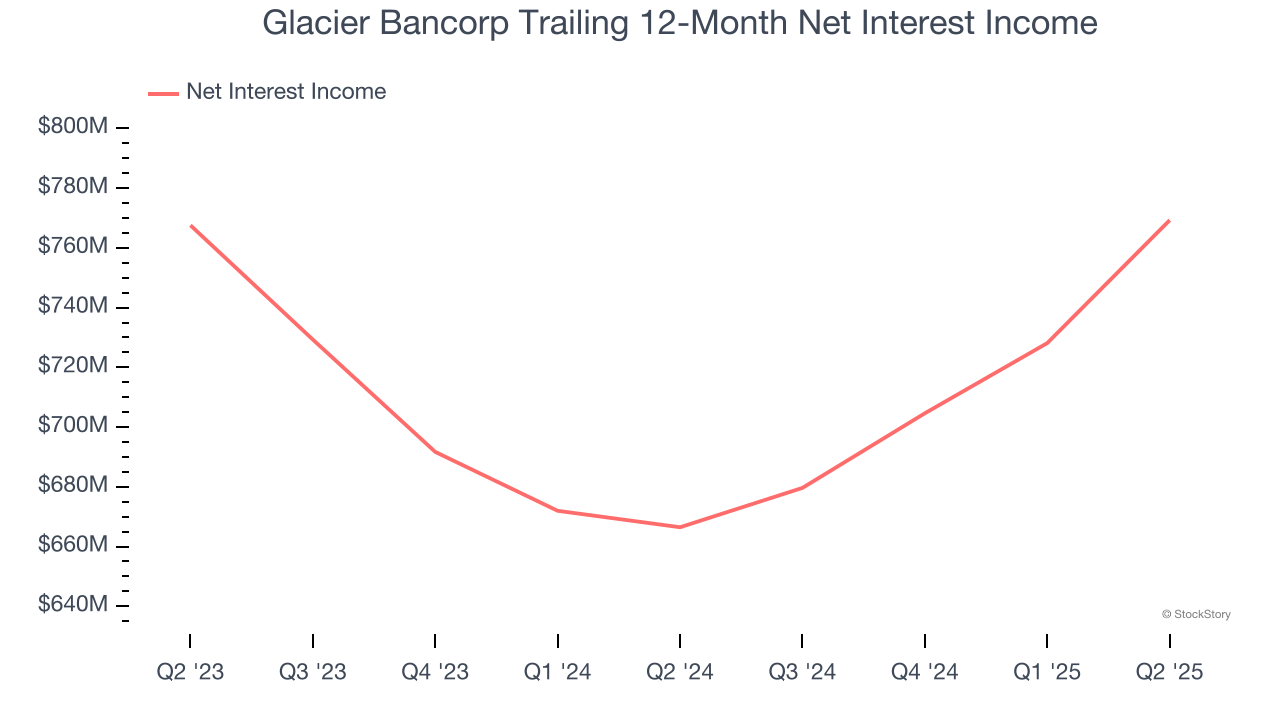

1. Net Interest Income Points to Soft Demand

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Glacier Bancorp’s net interest income has grown at a 7.1% annualized rate over the last five years, slightly worse than the broader banking industry.

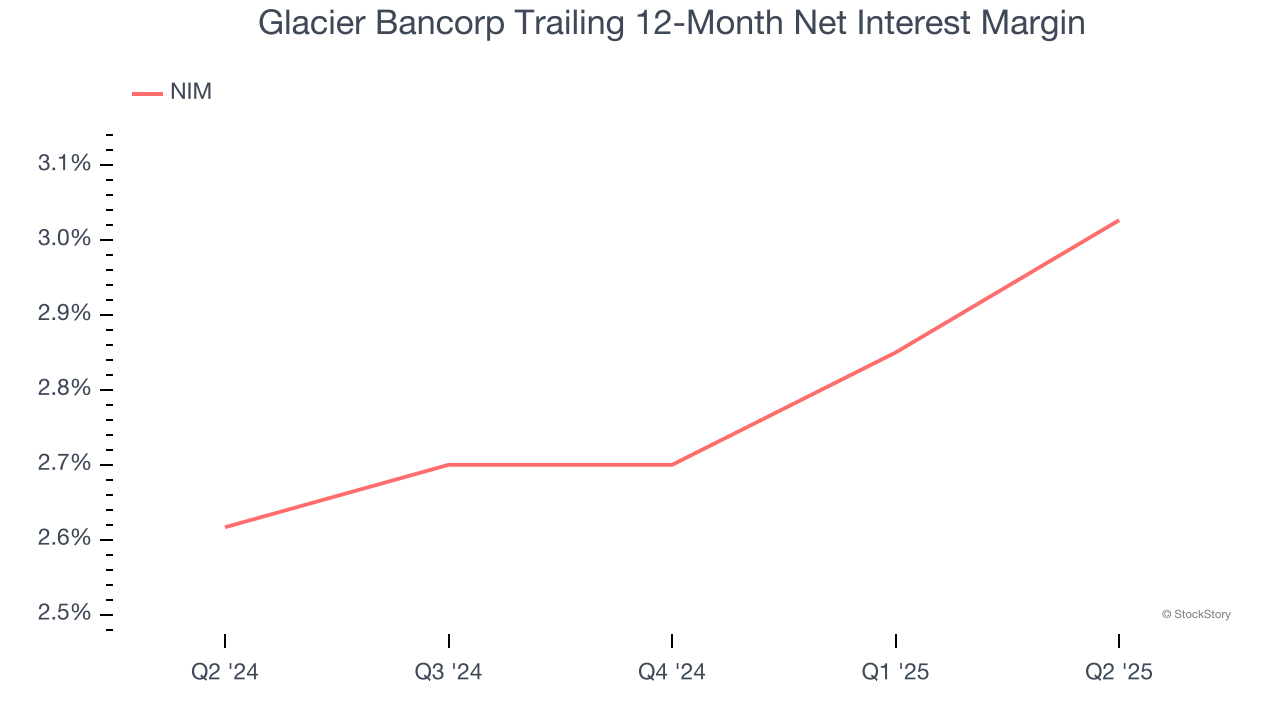

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that Glacier Bancorp’s net interest margin averaged a weak 2.8%, reflecting its high servicing and capital costs.

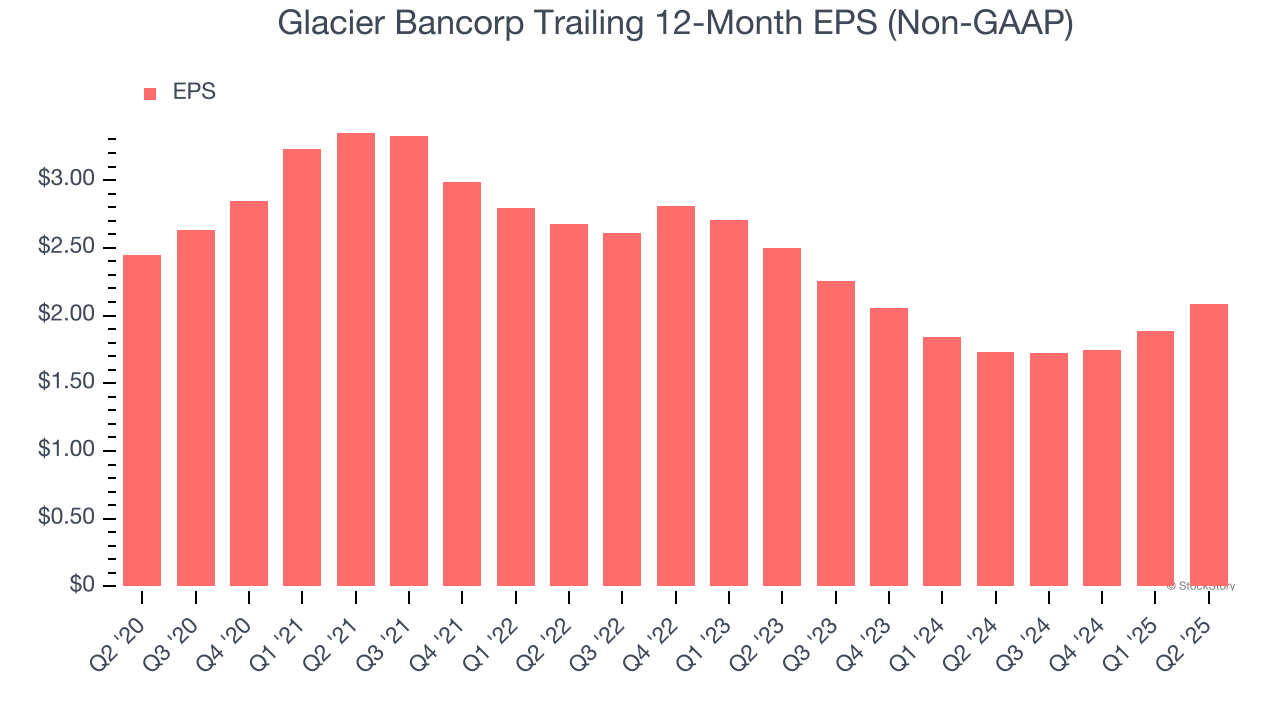

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Glacier Bancorp, its EPS declined by 3.1% annually over the last five years while its revenue grew by 5.3%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Glacier Bancorp isn’t a terrible business, but it doesn’t pass our bar. With its shares lagging the market recently, the stock trades at 1.5× forward P/B (or $48.74 per share). At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Glacier Bancorp

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.