As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at investment banking & brokerage stocks, starting with Moelis (NYSE: MC).

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 14 investment banking & brokerage stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 7.7%.

In light of this news, share prices of the companies have held steady as they are up 3.4% on average since the latest earnings results.

Moelis (NYSE: MC)

Founded in 2007 by veteran banker Ken Moelis during the lead-up to the financial crisis, Moelis & Company (NYSE: MC) is an independent investment bank that provides strategic and financial advisory services to corporations, financial sponsors, governments, and sovereign wealth funds.

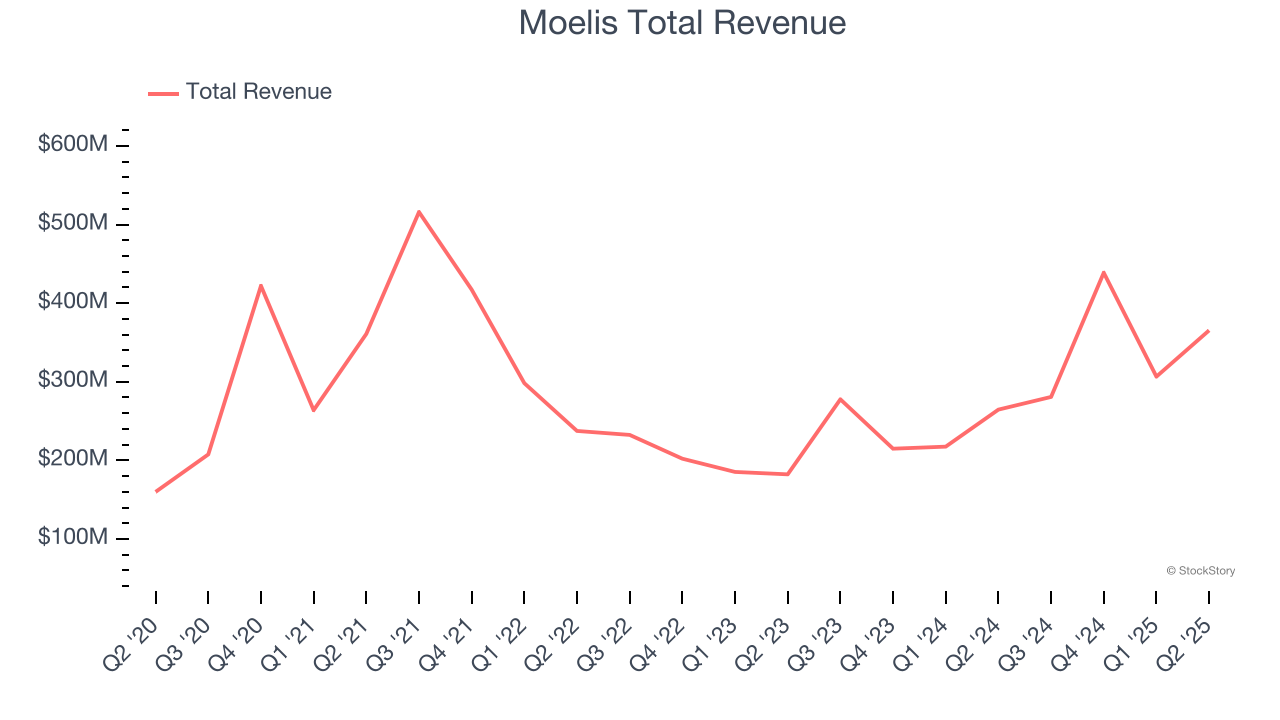

Moelis reported revenues of $365.4 million, up 38.1% year on year. This print exceeded analysts’ expectations by 17.5%. Overall, it was an incredible quarter for the company with a beat of analysts’ EPS estimates.

Moelis scored the biggest analyst estimates beat and fastest revenue growth of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $71.21.

We think Moelis is a good business, but is it a buy today? Read our full report here, it’s free.

Piper Sandler (NYSE: PIPR)

Tracing its roots back to 1895 and rebranded from Piper Jaffray in 2020, Piper Sandler (NYSE: PIPR) is an investment bank that provides advisory services, capital raising, institutional brokerage, and research for corporations, governments, and institutional investors.

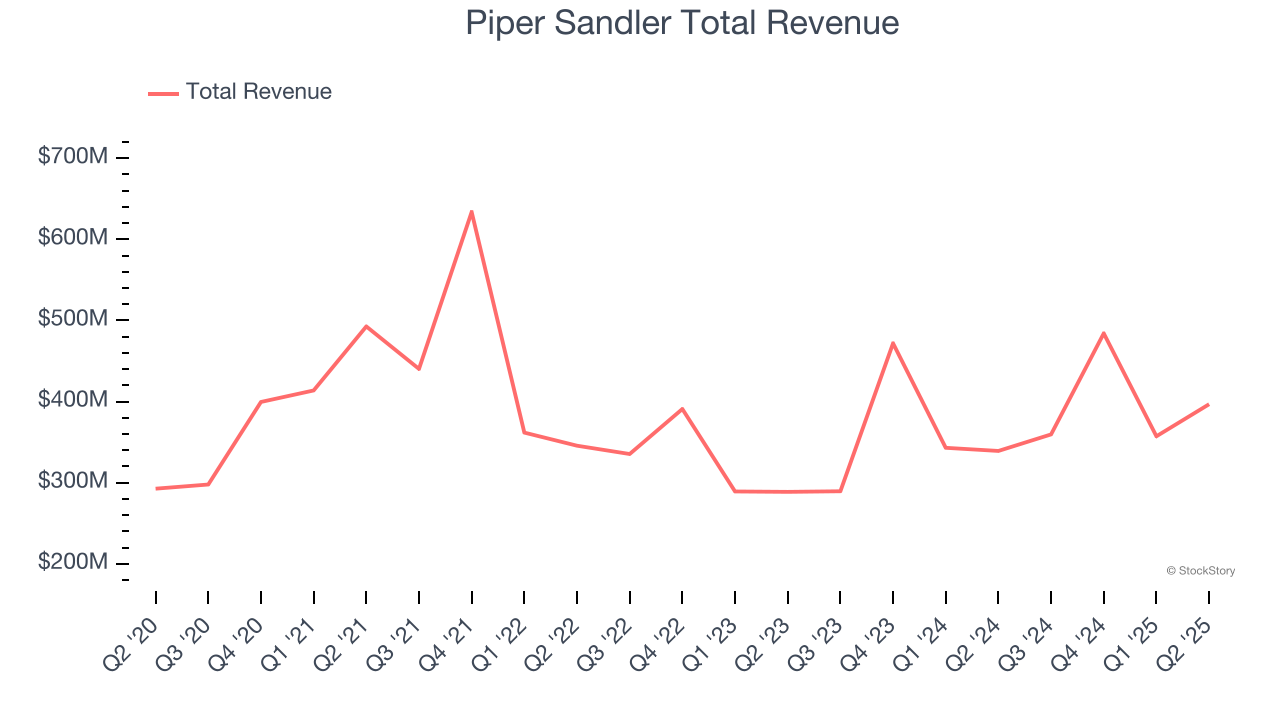

Piper Sandler reported revenues of $396.8 million, up 17% year on year, outperforming analysts’ expectations by 13.3%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

The market seems content with the results as the stock is up 4.5% since reporting. It currently trades at $328.86.

Is now the time to buy Piper Sandler? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Charles Schwab (NYSE: SCHW)

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE: SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Charles Schwab reported revenues of $5.85 billion, up 24.8% year on year, exceeding analysts’ expectations by 2%. It may have had the worst quarter among its peers, but its results were still good as it also locked in and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 3.2% since the results and currently trades at $96.12.

Read our full analysis of Charles Schwab’s results here.

Perella Weinberg (NASDAQ: PWP)

Founded in 2006 by veteran investment bankers Joseph Perella and Peter Weinberg during a wave of boutique advisory firm launches, Perella Weinberg Partners (NASDAQ: PWP) is a global independent advisory firm that provides strategic and financial advice to corporations, financial sponsors, and government institutions.

Perella Weinberg reported revenues of $155.3 million, down 42.9% year on year. This result topped analysts’ expectations by 12.9%. Overall, it was an incredible quarter as it also logged a beat of analysts’ EPS estimates.

Perella Weinberg had the slowest revenue growth among its peers. The stock is up 9.5% since reporting and currently trades at $21.82.

Read our full, actionable report on Perella Weinberg here, it’s free.

Lazard (NYSE: LAZ)

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE: LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

Lazard reported revenues of $769.9 million, up 12.4% year on year. This print surpassed analysts’ expectations by 9.5%. It was an incredible quarter as it also produced a beat of analysts’ EPS estimates and .

The stock is up 2.6% since reporting and currently trades at $56.38.

Read our full, actionable report on Lazard here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.