The Real Brokerage trades at $5.30 per share and has stayed right on track with the overall market, gaining 8.6% over the last six months. At the same time, the S&P 500 has returned 11.6%.

Is now the time to buy The Real Brokerage, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is The Real Brokerage Not Exciting?

We're cautious about The Real Brokerage. Here are three reasons we avoid REAX and a stock we'd rather own.

1. Operating Losses Sound the Alarms

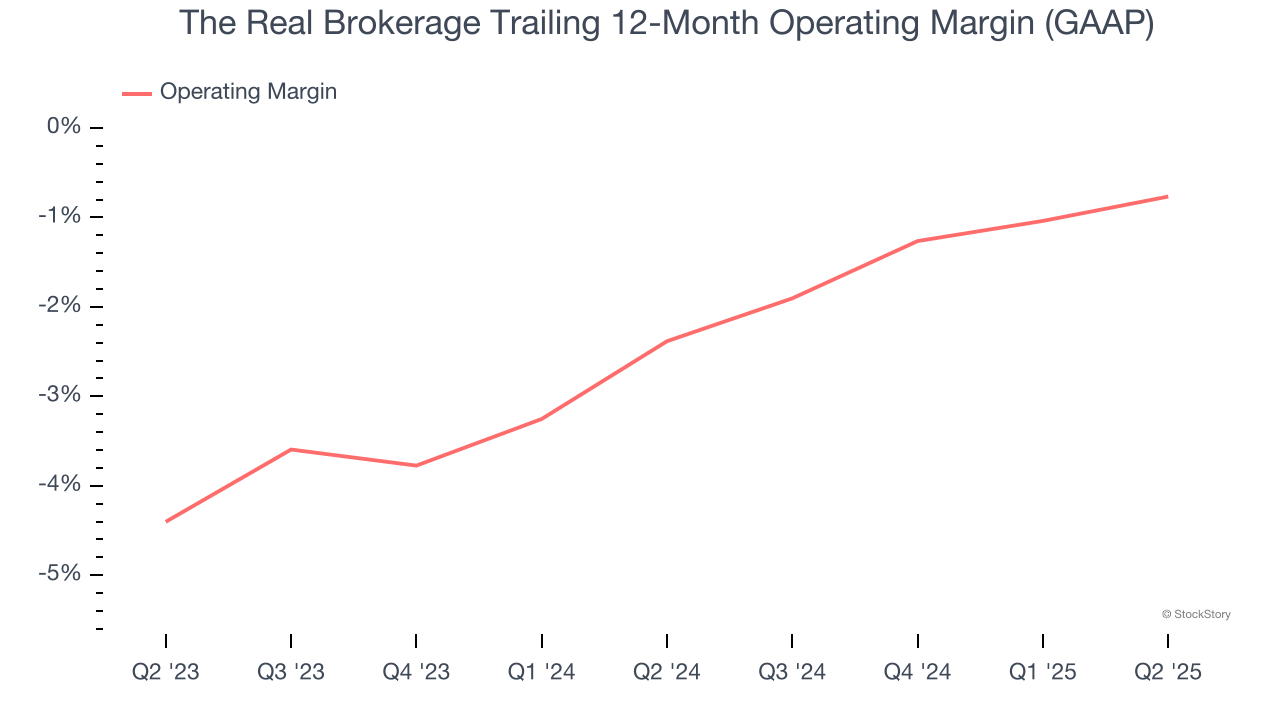

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

The Real Brokerage’s operating margin has risen over the last 12 months, but it still averaged negative 1.4% over the last two years. This is due to its large expense base and inefficient cost structure.

2. EPS Barely Budging

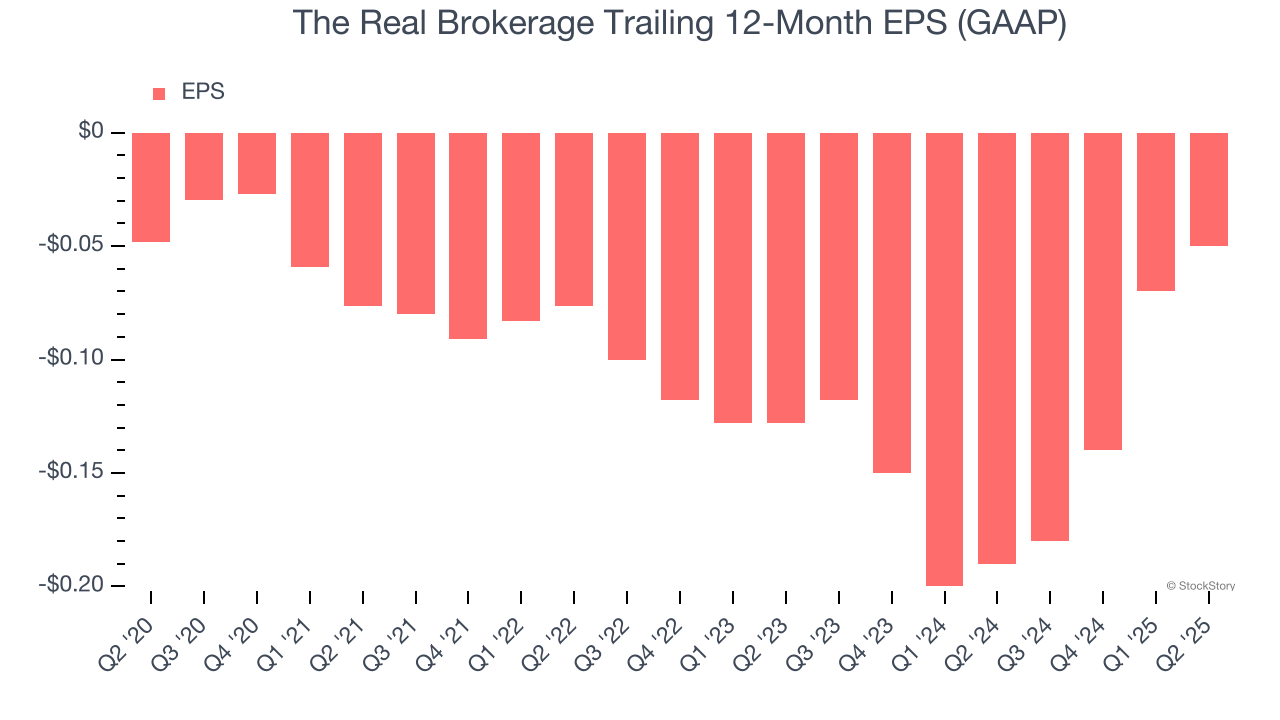

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

The Real Brokerage’s full-year EPS was flat over the last five years. This performance was underwhelming across the board.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

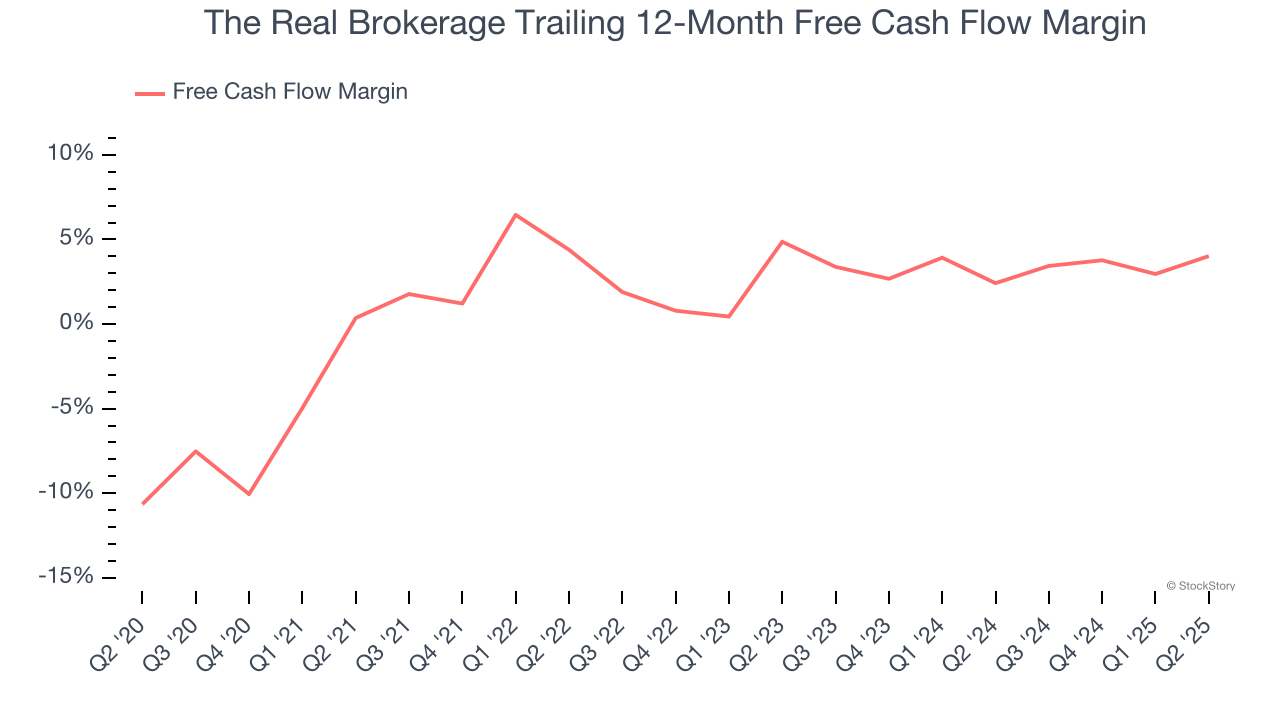

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

The Real Brokerage has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.4%, lousy for a consumer discretionary business.

Final Judgment

The Real Brokerage isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 19.7× forward EV-to-EBITDA (or $5.30 per share). At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.