What a brutal six months it’s been for Doximity. The stock has dropped 35% and now trades at $40.32, rattling many shareholders. This might have investors contemplating their next move.

Following the pullback, is now the time to buy DOCS? Find out in our full research report, it’s free.

Why Are We Positive On DOCS?

With over 80% of U.S. physicians as members of its digital community, Doximity (NYSE: DOCS) operates a digital platform that enables physicians and other healthcare professionals to collaborate, stay current with medical news, manage their careers, and conduct virtual patient visits.

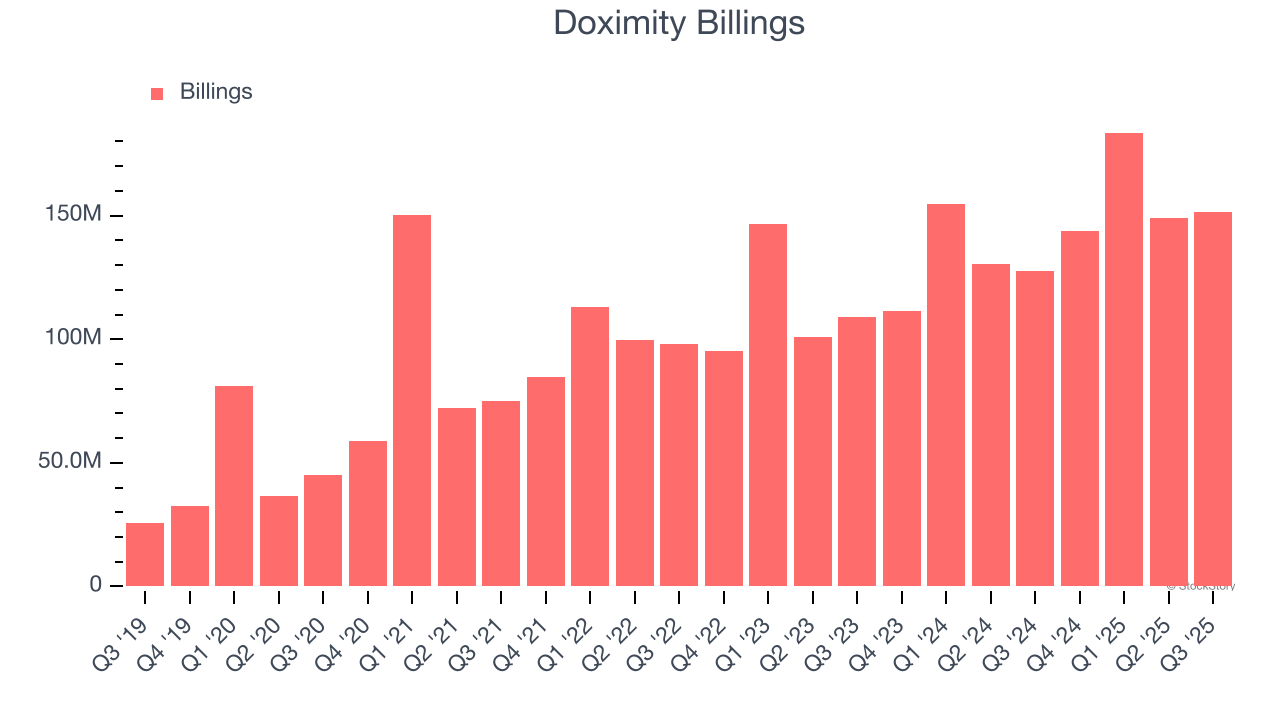

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Doximity’s billings punched in at $151.3 million in Q3, and over the last four quarters, its year-on-year growth averaged 20.1%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Doximity is extremely efficient at acquiring new customers, and its CAC payback period checked in at 5.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Doximity more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

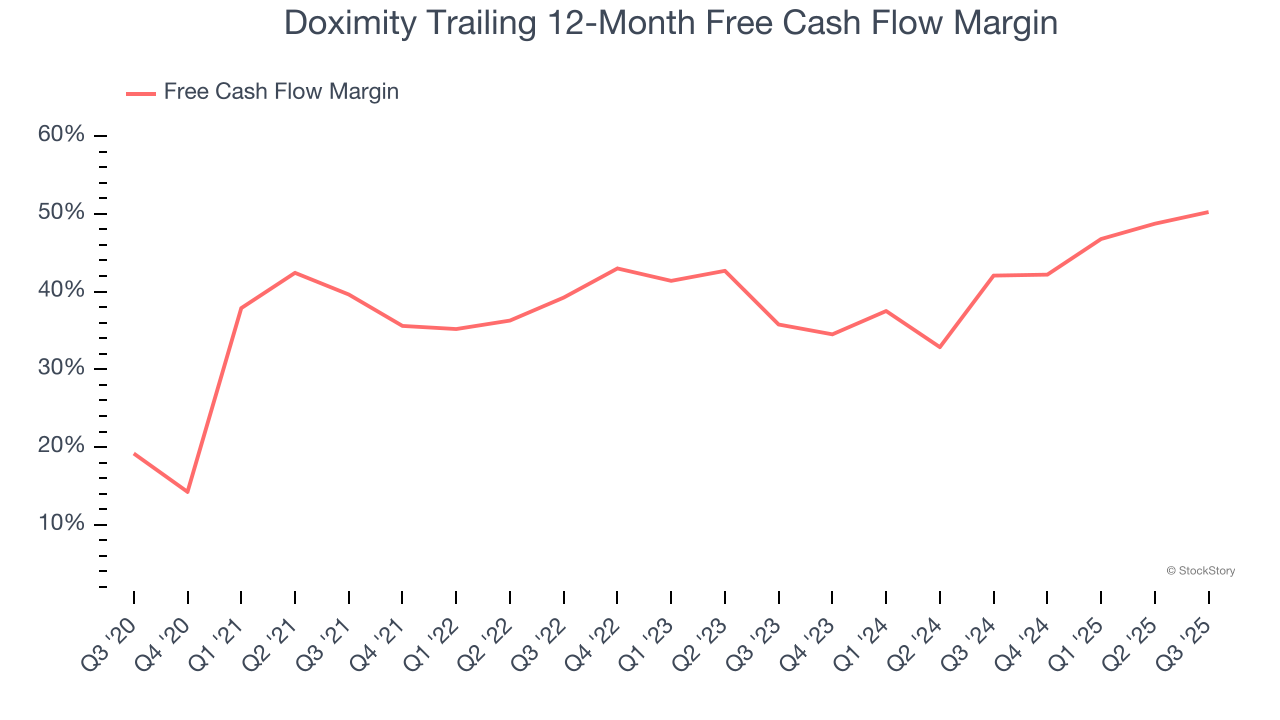

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Doximity has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 50.2% over the last year.

Final Judgment

These are just a few reasons Doximity is a rock-solid business worth owning. With the recent decline, the stock trades at 12.3× forward price-to-sales (or $40.32 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.