| |||||||||

|  |  |  | ||||||

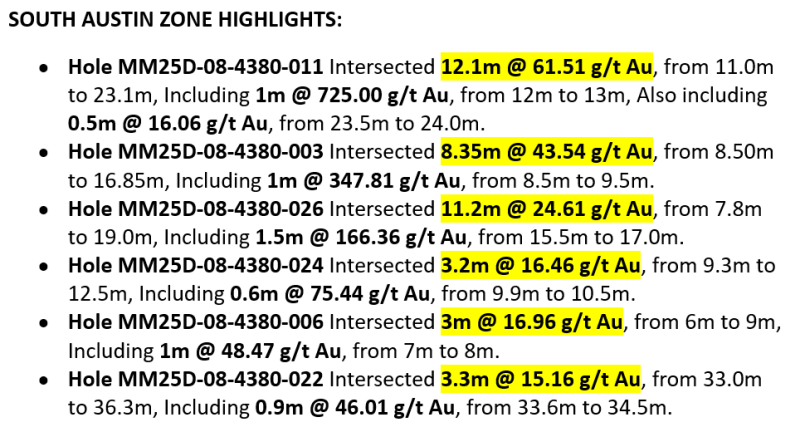

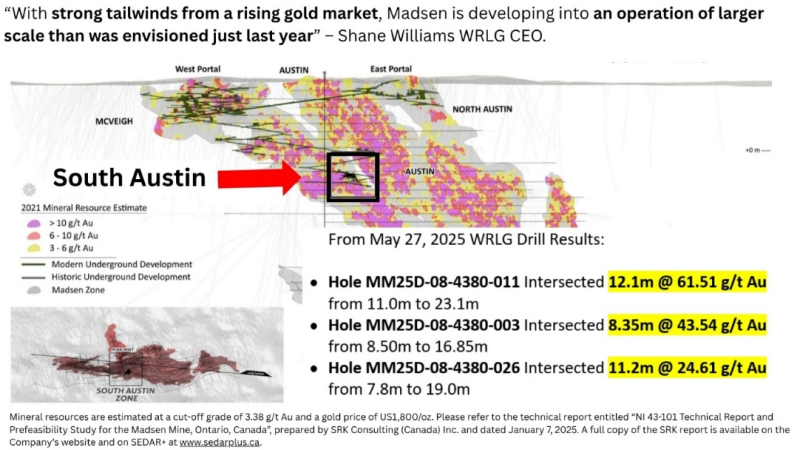

Vancouver, BC, May 28, 2025 – TheNewswire - Global Stocks News - Sponsored content disseminated on behalf of West Red Lake Gold. On May 27, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) reported drill results from the South Austin Zone.

“There’s a history with mines in Red Lake finding these fantastic pods of mineralization on the edges of deposits,” Shane Williams, WRLG President & CEO, told Guy Bennett, the CEO of Global Stocks News (GSN).

“The South Austin mineralization announced on May 27 is directly beside existing workings,” continued Williams. “It’s not long-term, back-room inventory. Our engineers are working to pull it into the mine plan within 6 to 12 months.”

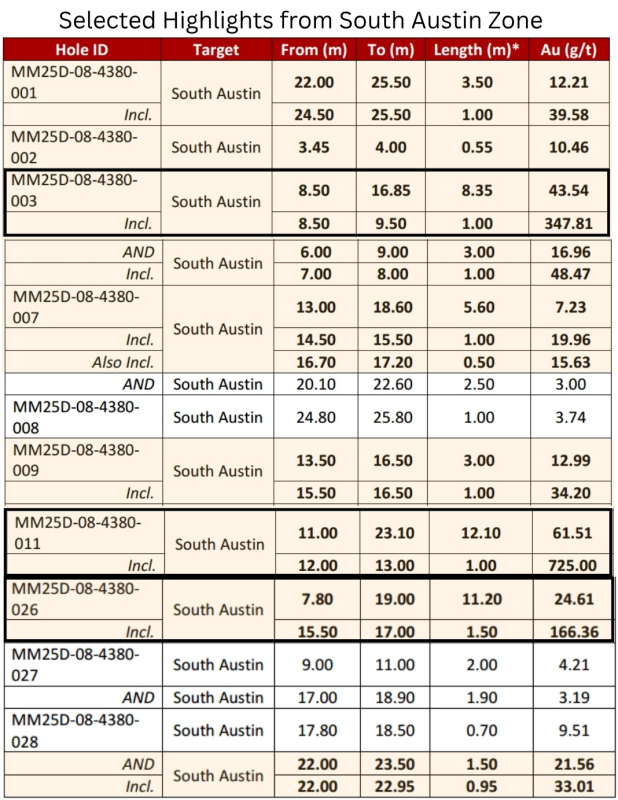

*The “From-To” intervals in Table 1 are denoting overall downhole length of the intercept. True thickness has not been calculated for these intercepts but is expected to be ≥ 70% of downhole thickness based on intercept angles observed in the drill core. Internal dilution for composite intervals does not exceed 1m for samples grading <0.1 g/t Au.

“The South Austin zone has been producing very high grades and impressive widths in the definition drilling program to begin 2025 – often associated with the presence of visible gold,” stated Williams in the May 27, 2025 press release.

“It is becoming apparent that a lot of high-grade material was left behind in this area by historic operators and we are taking full advantage of this low hanging fruit that sits immediately adjacent to our existing underground development,” continued Williams.

“As drilling progresses at depth, we expect to uncover more areas of untapped potential and look forward to providing further updates as assay results continue to be received.”

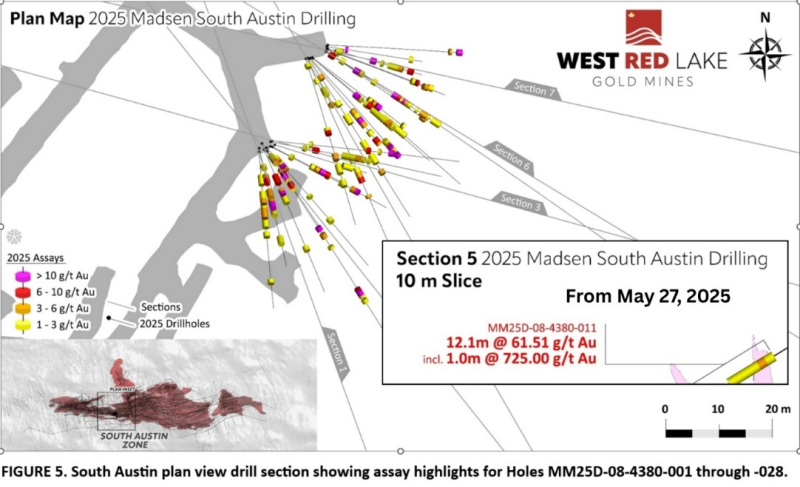

The May 27, 2025 drill results are located approximately 50 meters up-dip from the South Austin intercepts previously announced on February 26, 2025, where drilling returned 114.26 grams per tonne (g/t) gold (Au) over 10.6m, 77.90 g/t Au over 3m and 24.48 g/t Au over 8.5m.

This area is also approximately 300 m up plunge from the drill results recently announced on May 13, 2025, where drilling returned 48.97 g/t Au over 18.7m, 52.86 g/t Au over 4.5m and 25.49 g/t Au over 7.5m.

The South Austin zone continues to demonstrate significant grade and thickness potential at depth and along strike, which is being fully realized and accurately defined through definition drilling.

The purpose of this drilling was definition and expansion within priority areas of South Austin to continue adding to an already substantial inventory of high-confidence ounces to support the restart of production at the Madsen mine, which was announced on May 22, 2025.

The Company reported positive results from its recently completed bulk sampling campaign on May 7, 2025, and also filed a Technical Report for its Pre-Feasibility Study for Madsen on February 18, 2025.

The South Austin zone currently contains an Indicated mineral resource of 474,600 ounces grading 8.7 grams/tonne gold within 1.7 million tonnes (“Mt”). with an additional Inferred resource of 31,800 ounces of gold grading 8.7 grams/tonne gold within 0.1 Mt.[2]

“The Pre-Feasibility Study (PFS) used a gold price of US$1,680 per ounce,” Williams told GSN. “With gold trading around US$3,330, the gold price cited in the PFS is currently in the rear-view mirror. This has the potential to improve the economics of the Madsen Mine.”

“Madsen is developing into an operation of larger scale than was envisioned just last year,” added Williams. “It’s an exciting time to be part of this new operation as we push to see how much value we can unlock in this positive gold price environment.”

The Madsen deposits presently host an NI 43-101 Indicated resource of 1.65 million ounces of gold grading 7.4 g/t gold within 6.9 Mt and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t gold within 1.8 Mt. [1 .] [2.] [3.]

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

-

“NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada”, prepared by SRK Consulting (Canada) Inc. and dated January 7, 2025 (the “Madsen Report ”). A full copy of the Madsen Report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

-

The Madsen Mine deposit presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated resource of 1.65 million ounces (“Moz”) of gold grading 7.4 g/t Au and an Inferred resource of 0.37 Moz of gold grading 6.3 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Mineral resources as stated are inclusive of mineral reserves. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Madsen Resource Estimate has an effective date of December 31, 2021 and excludes depletion of mining activity during the period from January 1, 2022 to the mine closure on October 24, 2022 as it has been deemed immaterial and not relevant for the updated report. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc., and dated June 16, 2023, and amended April 24, 2024. A full copy of the SRK report is available on the Company’s website and on SEDAR+ at www.sedarplus.ca

-

The Madsen Mine also contains Probable reserves of 478 thousand ounces (“koz”) of gold grading 8.16 g/t Au. Mineral reserve estimates are based on a gold price of US$1,680/oz. Please refer to the technical report “NI 43-101 Technical Report and Prefeasibility Study for the Madsen Mine, Ontario, Canada” available on the Company’s website and on SEDAR+ at www.sedarplus.ca

Copyright (c) 2025 TheNewswire - All rights reserved.