Dubai, UAE, 17th June 2025, ZEX PR WIRE, Since the launch of R2 Protocol’s first testnet season on April 17, we’ve been overwhelmed by the incredible level of participation, feedback, and momentum from our global community. In just two months, we’ve seen over 290,000 users, 13 million onchain interactions, and deep traction across key markets. With this post, we want to transparently recap what we’ve accomplished together and share what’s next as we move toward our final testnet and mainnet launch.

Key Testnet Highlights (Apr 17 – Jun 15, 2025)

-

290,000 unique wallet addresses participated in total

-

Daily active users consistently above 40,000

-

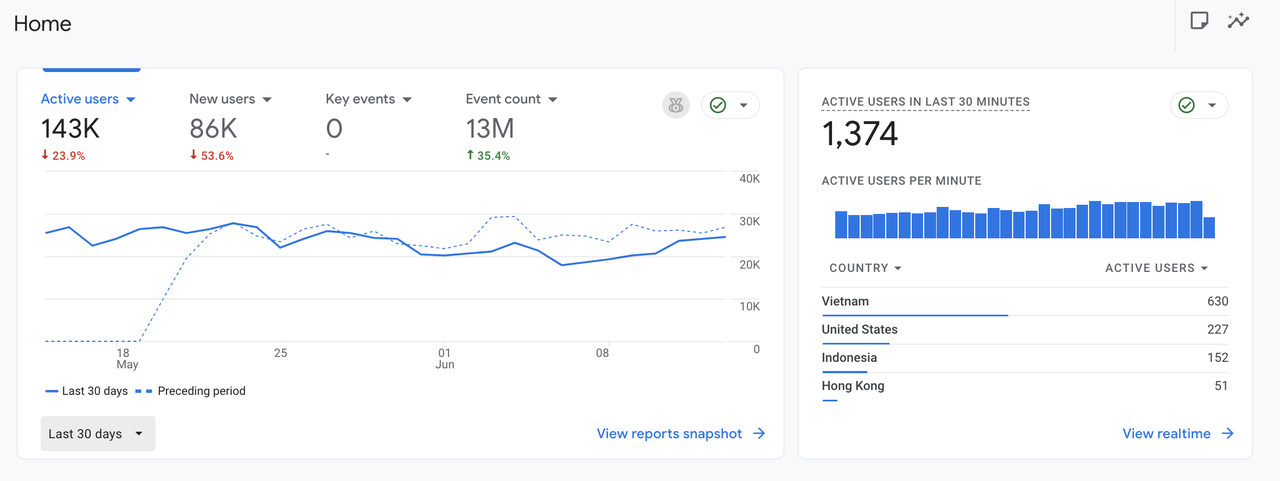

143,000 active users with over 86,000 new users onboarded

-

13 million in-dapp and onchain activities

-

848,000 engaged sessions with an average engagement time of 42 minutes per user

-

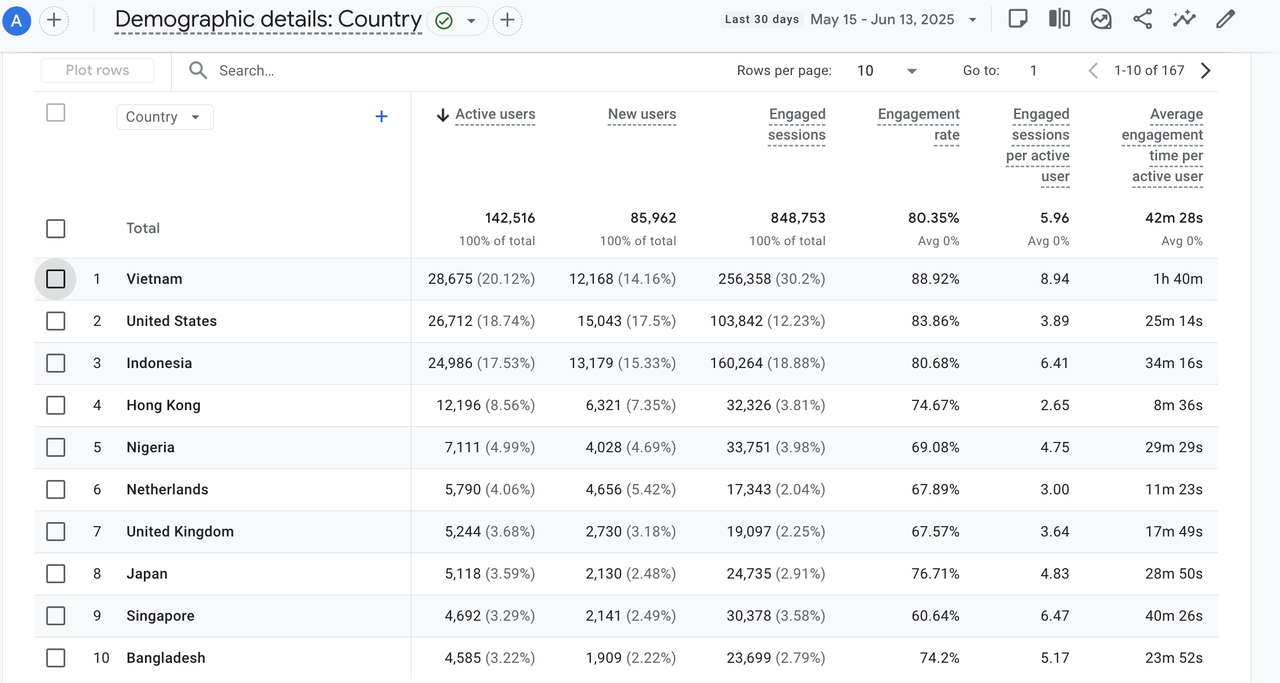

Top regions by activity include Vietnam, United States, Indonesia, Hong Kong, Nigeria, and Japan

-

Vietnam led both in total session count and average session time at 1 hour 40 minutes

These numbers reaffirm the global demand for permissionless, yield-bearing stablecoins. We are grateful to everyone who participated and helped shape our early growth.

What We Tested

Season #0 focused on validating core protocol logic and scalability across multiple functions:

-

R2USD minting and redemption and staking

-

Liquidity provision features including adding and removing liquidity

-

Point system logic

-

User dashboards, activity tracking, and event logs

-

Frontend UX feedback and iteration

-

Multichain deployment and sync stability

We also gained valuable insights into user behavior, geographic adoption patterns, and product bottlenecks that are now informing the next phase.

Ecosystem Growth

Throughout the testnet period, we successfully established collaborations with leading ecosystems and protocols including:

-

Chains and infra: Plume, BNB Chain, Monad, Arbitrum, Base, Pharos, Wormhole

-

Wallets and socials: OKX Wallet, Bitget Wallet, C98, UXLINK, Fox Wallet, Glaxe, Intract

-

LPs of Real-world asset providers: Ondo Finance, DigiFT, Superstate

-

Others: Particula and more

These partnerships reflect R2’s composability and potential to plug into broader ecosystems.

What’s Next: Final Testnet and Beyond

Estimated Final Testnet Launch: June 23, 2025

The upcoming testnet will introduce key upgrades:

-

Cross-chain bridge integration via Wormhole (at a later stage)

-

sR2USD staking with auto-compounding mechanics

-

Updated reward distribution through points

-

R2 token claim simulation & Full yield exit simulation through bonding contracts and secondary market interactions

-

More regional community penetration and localized onboarding (Japan, Korea, Latin America)

This phase will continue for approximately two months and will be critical to validating end-to-end flows and onboarding institutional and retail partners.

Our Vision

We built R2USD to combine real-world yield from traditional finance with the transparency, efficiency, and global accessibility of DeFi. Our goal is to offer users a permissionless yield medium that is simple, composable, and globally available.

R2USD is backed by tokenized real-world assets from licensed issuers across multiple regions, including Superstate and Ondo (United States), DigiFT (Singapore), Spiko and Fasanara (Europe), and Mercado Bitcoin (Latin America). We are now official LPs of Superstate, Ondo, and DigiFT, and are in the process of onboarding additional partners.

We also integrate with DeFi protocols like Morpho and Pendle to offer enhanced yield strategies fully on-chain.

We’ve received strong support and endorsements from ecosystems including Arbitrum, Plume, and Monad. These partners have provided critical help across go-to-market, product exposure, and infrastructure integration. We are actively discussing liquidity partnerships with them.

We are also supported by Wormhole, which is enabling us to expand R2USD across multiple blockchain ecosystems through cross-chain bridge integration and liquidity support.

R2USD is highly composable and can be easily integrated with centralized exchanges, wallets, and traditional funds. This makes it flexible enough to support both DeFi-native use cases and institutional adoption.

Users can exit through two paths:

-

Official redemption with T+0 liquidity (following a 3-day review window) and guaranteed base APY

-

Secondary market exit with potential upside depending on timing

Minting is permissionless and open to anyone with USDC or USDT. There is no KYC, no whitelist, and the entire process is fully on-chain.

R2USD bridges regulated yield with open access. It is a modular, yield-focused stablecoin built for the next wave of global capital.

We’re just getting started. Thank you for building with us.

— The R2 Team