3 Mid-Cap Dividend Stocks Having Themselves a Year

Considered a barometer of economic health, the S&P 500 is a good gauge of how stocks are doing. After all, the widely followed benchmark captures approximately 80% of U.S. market capitalization.

But it doesn't always tell the whole story.

Approximately 4,800 domestic stocks that trade on the NYSE, Nasdaq and Amex exchanges aren't part of the S&P 500. Another 2,700 trade in the OTC markets. The performances of these companies aren't generally reflected in the headlines.

In the last 12 months, the S&P 500 has been down about 3%. Taking a step down the capitalization ladder, S&P 400 mid-caps are up 4%. This means the largest 500 U.S. companies are being outperformed by the next 400 largest. Are mid-sized companies handling inflation and rate pressures better than their stoutly peers?

Within the mid-cap space, value-oriented stocks are doing even better. For example, the one-year return on the S&P 400 Value Index is around 5.5%. In other words, in this collection of low P/E ratio, dividend-paying companies are beating the S&P 500 by some 850 basis points — a stat you won't see flashing across the TV screen.

The difference isn't alarming for investors that diversify into this asset subclass. For others, it may be a wake-up call. Expanding one's investment universe beyond the well-known mega caps and blue chips can reduce portfolio risk and improve returns.

Ironically, there are roughly 500 U.S. mid-caps that pay a dividend. These three are among 2023's early winners.

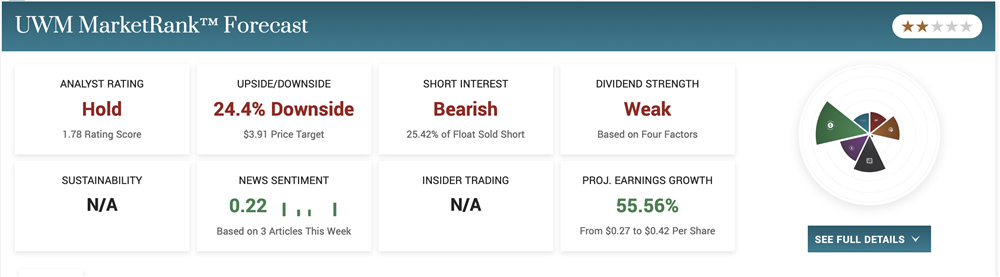

Why Is UWM Holdings Stock Up?

UWM Holdings Corporation (NYSE: UWMC) is up nearly 60% year-to-date. With rising interest rates, the nation's top wholesale mortgage lender has emerged from penny stock territory at an unlikely time. The company lost in the fourth quarter of 2022 but said it anticipates a gain margin of upwards of 1% in the first quarter stemming from its 'Game On' initiative. In addition, UWM recently cut its rates to entice new brokers to fund loans on its platform, a move that is increasing its already leading market share.

More importantly, management confirmed its commitment to a $0.10 per share quarterly dividend despite the challenging housing market. As this equates to a dividend yield near 8%, investors have consistently accumulated low-priced UWM shares.

Wall Street research firms, on the other hand, remain skeptical. Earlier this month, Piper Sandler kept its sell rating on United Wholesale Mortgage and stuck with a $3.50 target. This capped a stream of bearish and neutral sentiment towards the stock that followed the March 1st update.

UWM is proving to be a contrarian winner. But with mortgage origination activity a headwind, the run may not last.

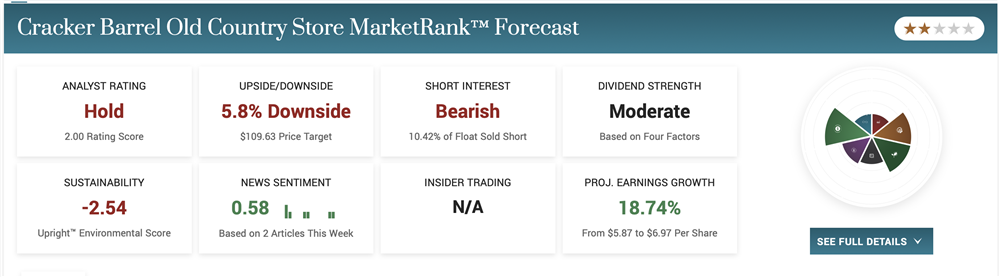

Is Cracker Barrel a Growth or Value Stock?

Cracker Barrel Old Country Store, Inc. (NASDAQ: CBRL) is up 25% in a strong year for restaurant stocks. Despite the tough discretionary spending backdrop, the company is finding new ways to grow.

Long known for attracting mostly seniors and travelers, it is appealing to younger consumers by adding affordable appetizers, alcoholic beverages and other new items to the menu. In addition, more value deals, including $5 takeout meals, are catching the eyes of young and old diners. Together with a growing catering business, these efforts will improve profit margins.

A Cracker Barrel investment also comes with a side of value. The company pays a juicy $5.20 annual dividend, giving it a forward yield of 4.3% (more than twice that of the average consumer cyclical stock). In addition, it has an active $200 million buyback program helping prop up the stock. Yet still trading 33% below its post-Covid peak, there appears to be plenty of room for dessert.

Does IGT Stock Pay a Dividend?

Gaming equipment manufacturer International Game Technology PLC (NYSE: IGT) is up almost 20% year-to-date. While casino reopenings drove more robust financial results in 2022, this year's most significant growth is expected from sports betting and online gaming.

With developing in-house solutions timely and costly, casinos are increasingly tapping IGT as a quick entry into these fast-growing markets. In addition, the company's tech-driven products are positioned to thrive from the continued legalization of online sports betting and gambling.

IGT again has a dividend to offer prospective investors as growth prospects improve. Reinstated two years ago, the $0.20 per share quarterly dividend gives the stock a 3.0% yield. And analysts are unanimously bullish on IGT, with the P/E ratio still well below its historical mean. Combining the upside implied by the consensus target (37%) and the yield gives this mid-cap value play a 40% potential return over the next 12 months.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.