Q4 Earnings Outperformers: Amgen (NASDAQ:AMGN) And The Rest Of The Therapeutics Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how therapeutics stocks fared in Q4, starting with Amgen (NASDAQ: AMGN).

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 10 therapeutics stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.6%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.1% since the latest earnings results.

Amgen (NASDAQ: AMGN)

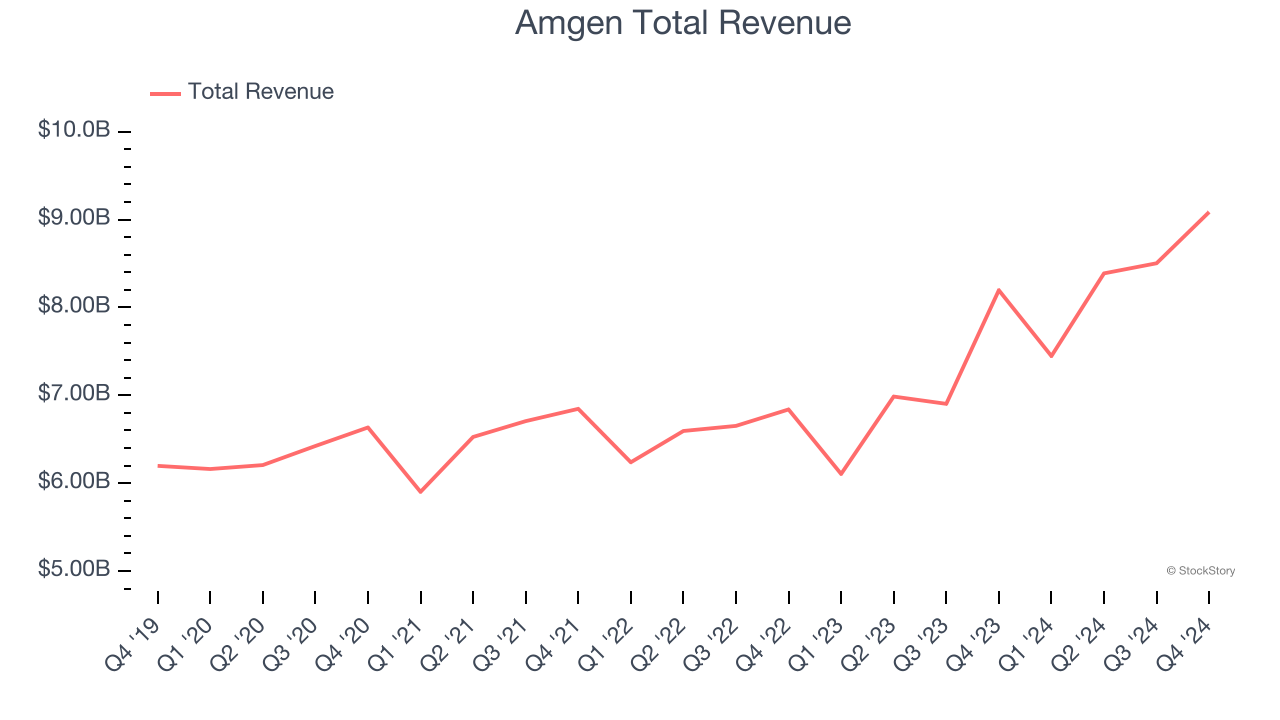

Founded in 1980 during the early days of the biotechnology revolution, Amgen (NASDAQ: AMGN) is a biotechnology company that discovers, develops, and manufactures innovative medicines to treat serious illnesses like cancer, osteoporosis, and autoimmune diseases.

Amgen reported revenues of $9.09 billion, up 10.9% year on year. This print exceeded analysts’ expectations by 2.6%. Overall, it was a satisfactory quarter for the company with full-year revenue guidance slightly topping analysts’ expectations but a slight miss of analysts’ full-year EPS guidance estimates.

"Robust growth in sales and earnings throughout 2024 reflects the momentum of our business. With strong performance globally, we are investing heavily in our rapidly advancing pipeline to deliver innovative therapies across our four therapeutic areas," said Robert A. Bradway, chairman and chief executive officer.

The stock is up 5.1% since reporting and currently trades at $303.79.

Is now the time to buy Amgen? Access our full analysis of the earnings results here, it’s free.

Best Q4: BioMarin Pharmaceutical (NASDAQ: BMRN)

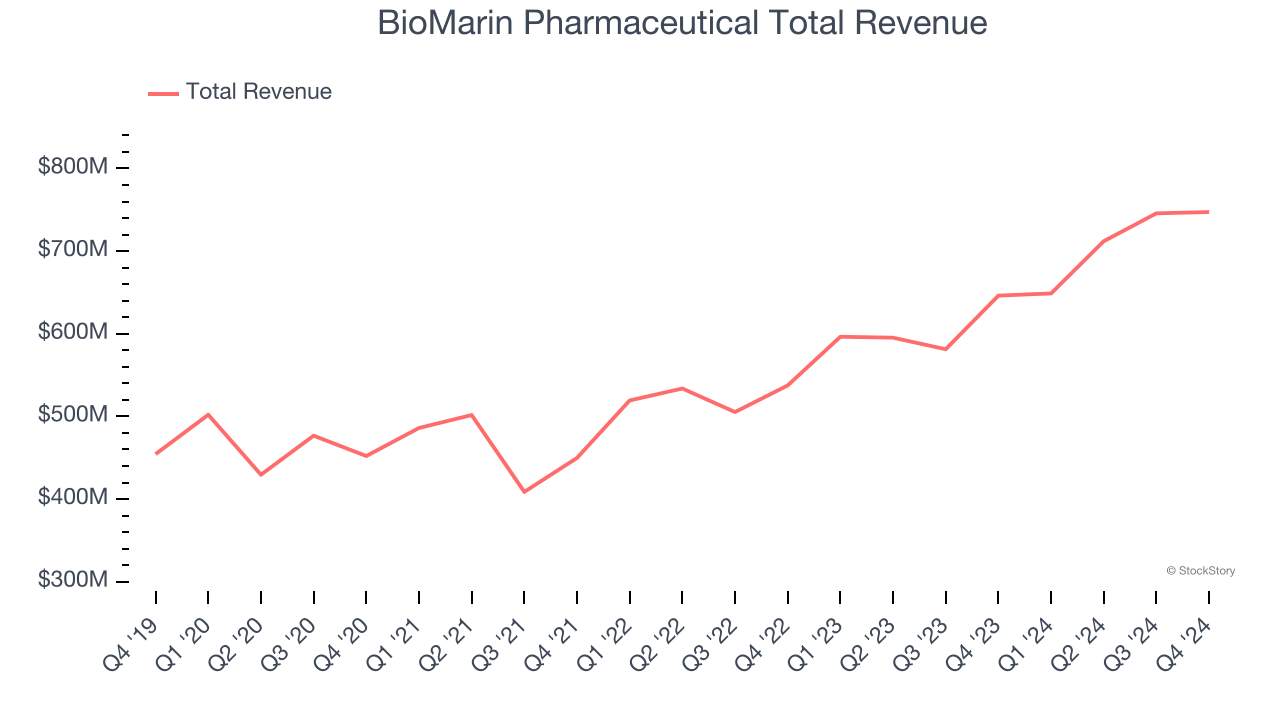

Pioneering treatments for conditions that often had no previous therapeutic options, BioMarin Pharmaceutical (NASDAQ: BMRN) develops and commercializes therapies that address the root causes of rare genetic disorders, particularly those affecting children.

BioMarin Pharmaceutical reported revenues of $747.3 million, up 15.6% year on year, outperforming analysts’ expectations by 4.8%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

BioMarin Pharmaceutical pulled off the highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 1.8% since reporting. It currently trades at $66.84.

Is now the time to buy BioMarin Pharmaceutical? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Moderna (NASDAQ: MRNA)

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ: MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Moderna reported revenues of $966 million, down 65.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations.

Moderna delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 14.4% since the results and currently trades at $27.36.

Read our full analysis of Moderna’s results here.

Sarepta Therapeutics (NASDAQ: SRPT)

Pioneering treatments for a devastating childhood muscle-wasting disease that primarily affects boys, Sarepta Therapeutics (NASDAQ: SRPT) develops and commercializes RNA-targeted therapies and gene therapies for rare genetic disorders, primarily Duchenne muscular dystrophy.

Sarepta Therapeutics reported revenues of $658.4 million, up 65.9% year on year. This print beat analysts’ expectations by 4.3%. More broadly, it was a mixed quarter as it produced a significant miss of analysts’ EPS estimates.

Sarepta Therapeutics scored the fastest revenue growth among its peers. The stock is down 43.7% since reporting and currently trades at $60.37.

Read our full, actionable report on Sarepta Therapeutics here, it’s free.

Vertex Pharmaceuticals (NASDAQ: VRTX)

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ: VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Vertex Pharmaceuticals reported revenues of $2.91 billion, up 15.7% year on year. This result topped analysts’ expectations by 4.9%. Overall, it was a strong quarter as it also put up full-year revenue guidance meeting analysts’ expectations.

The stock is up 1.4% since reporting and currently trades at $475.82.

Read our full, actionable report on Vertex Pharmaceuticals here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.