Winners And Losers Of Q2: EVERTEC (NYSE:EVTC) Vs The Rest Of The Financial Services Stocks

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how financial services stocks fared in Q2, starting with EVERTEC (NYSE: EVTC).

Financial services firms provide various products supporting financial transactions and management. Growth drivers include increasing financial complexity requiring professional guidance, digital transformation reducing service costs, and expanding middle classes globally seeking financial products. Headwinds include fee compression from transparent pricing, regulatory compliance burdens, and competition from automated digital solutions.

The 24 financial services stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.6%.

In light of this news, share prices of the companies have held steady as they are up 1.8% on average since the latest earnings results.

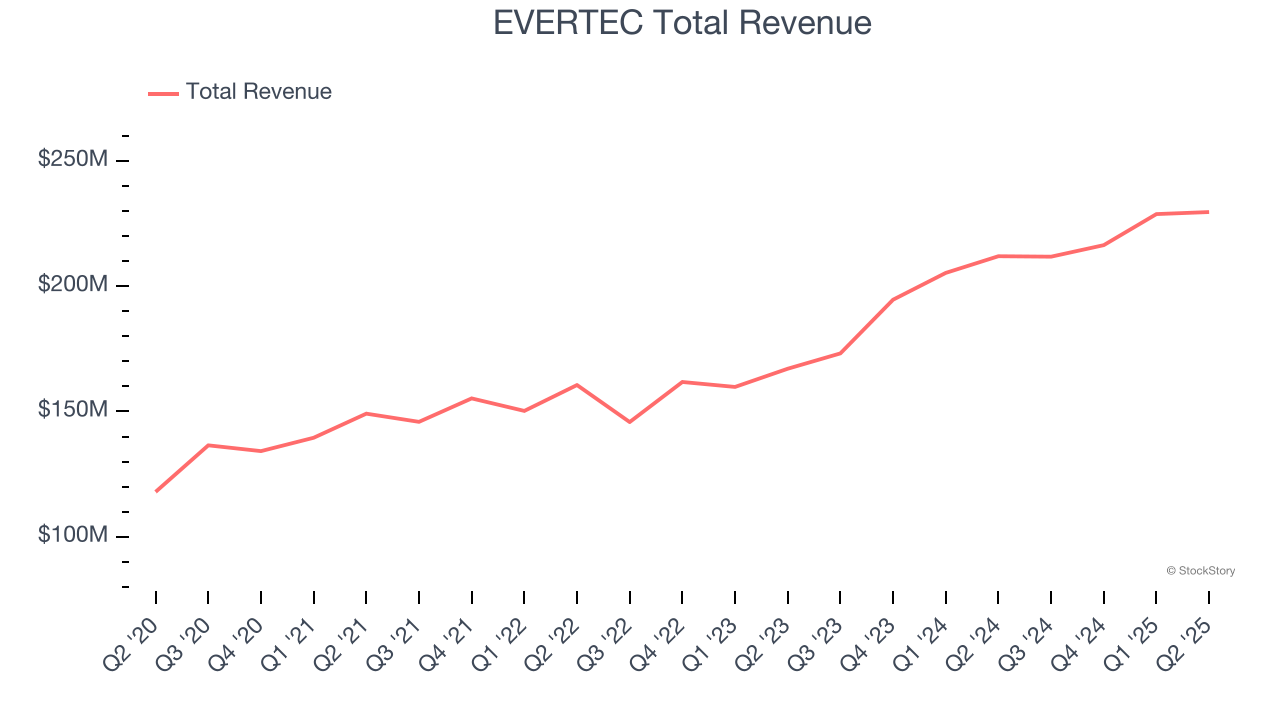

EVERTEC (NYSE: EVTC)

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE: EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

EVERTEC reported revenues of $229.6 million, up 8.3% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a strong quarter for the company with a decent beat of analysts’ EBITDA and EPS estimates.

Interestingly, the stock is up 2.1% since reporting and currently trades at $33.46.

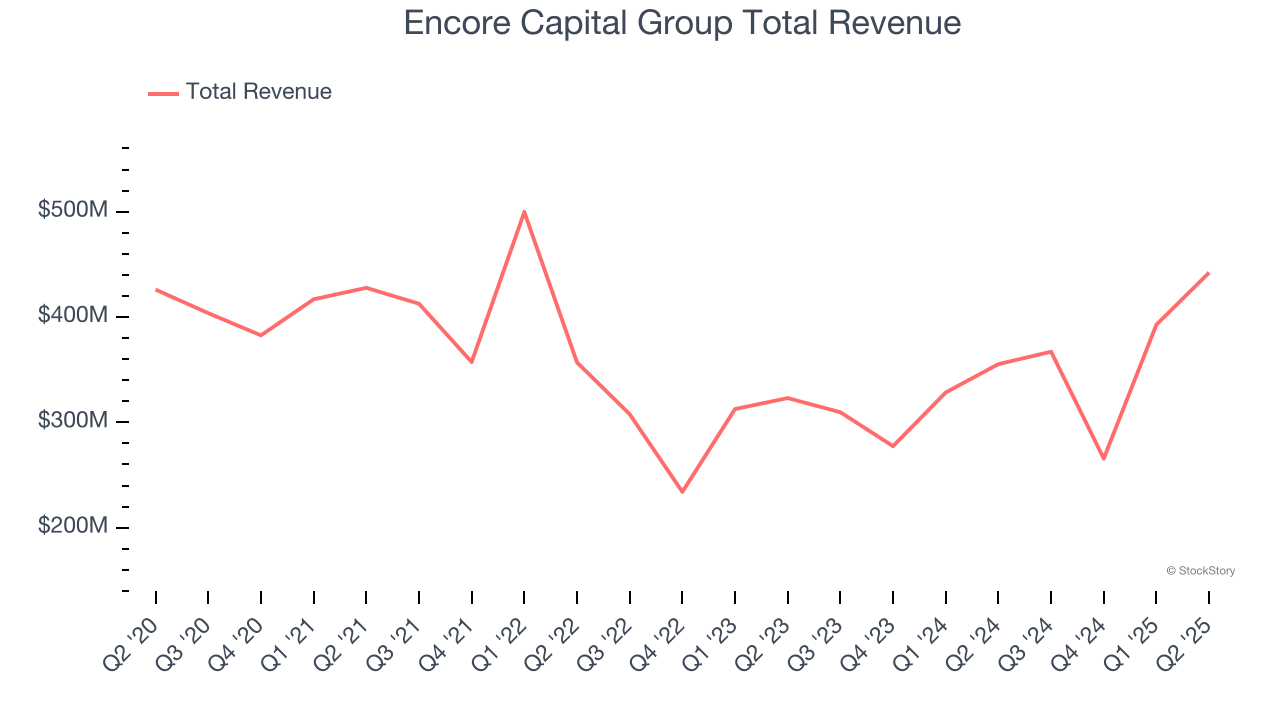

Best Q2: Encore Capital Group (NASDAQ: ECPG)

Operating in the often misunderstood world of debt collection since 1999, Encore Capital Group (NASDAQ: ECPG) purchases portfolios of defaulted consumer debt at deep discounts and works with individuals to recover these obligations while helping them toward financial recovery.

Encore Capital Group reported revenues of $442.1 million, up 24.4% year on year, outperforming analysts’ expectations by 15.3%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems happy with the results as the stock is up 19% since reporting. It currently trades at $44.56.

Is now the time to buy Encore Capital Group? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Oaktree Specialty Lending (NASDAQ: OCSL)

Managed by Oaktree Capital Management, one of the world's premier alternative investment firms, Oaktree Specialty Lending (NASDAQ: OCSL) is a business development company that provides customized financing solutions to mid-market companies across various industries.

Oaktree Specialty Lending reported revenues of $75.27 million, down 20.7% year on year, falling short of analysts’ expectations by 4.6%. It was a disappointing quarter as it posted a significant miss of analysts’ AUM and EPS estimates.

As expected, the stock is down 2% since the results and currently trades at $13.24.

Read our full analysis of Oaktree Specialty Lending’s results here.

WEX (NYSE: WEX)

Originally founded in 1983 as Wright Express to serve the fleet card market, WEX (NYSE: WEX) provides payment processing and business solutions across fleet management, employee benefits, and corporate payments sectors.

WEX reported revenues of $659.6 million, down 2.1% year on year. This result topped analysts’ expectations by 1%. It was a strong quarter as it also produced an impressive beat of analysts’ Account Servicing segment estimates and a decent beat of analysts’ EBITDA estimates.

The stock is up 4.7% since reporting and currently trades at $171.96.

Read our full, actionable report on WEX here, it’s free.

Jack Henry (NASDAQ: JKHY)

Founded in 1976 by two entrepreneurs who saw the need for specialized banking software in the early days of financial computing, Jack Henry & Associates (NASDAQ: JKHY) provides technology solutions that help banks and credit unions innovate, differentiate, and compete while serving the evolving needs of their accountholders.

Jack Henry reported revenues of $615.4 million, up 9.9% year on year. This number surpassed analysts’ expectations by 1.8%. Aside from that, it was a mixed quarter as it also recorded a solid beat of analysts’ Processing segment estimates but a slight miss of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $161.66.

Read our full, actionable report on Jack Henry here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.

More News

View More

Recent Quotes

View More

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.