Semiconductor stocks have spent most of the past year at the center of the market’s tech rally, driven largely by surging demand for artificial intelligence hardware. Even with recent volatility pulling some names off their highs, investors continue to search for the next dominant player that can challenge Nvidia’s (NVDA) long lead in AI acceleration.

That momentum has increasingly shifted toward Advanced Micro Devices (AMD), which is starting to look like the sector’s new “king of the hill.” The company’s growing traction in data-center AI chips and rising expectations around its long-term earnings power are drawing fresh attention from Wall Street. Following AMD’s Investor Day, Citi analysts said they view the company as the strongest setup in the group, highlighting upbeat revenue and margin targets alongside a path toward higher EPS over the coming years.

For investors tracking leadership shifts in the AI chip race, AMD’s current position is worth a closer look.

About AMD Stock

California AMD is a leading chip designer best known for its high-performance CPUs like the Ryzen and EPYC lines and GPUs, including Radeon and Instinct accelerators. Under CEO Dr. Lisa Su’s leadership, AMD has expanded from PCs and gaming into servers, data centers, and AI hardware. The company’s chips power countless PCs and data centers worldwide, and even game consoles. Today, AMD is emerging as a serious Nvidia competitor in AI GPUs, with a growing presence in data center CPUs and networking chips.

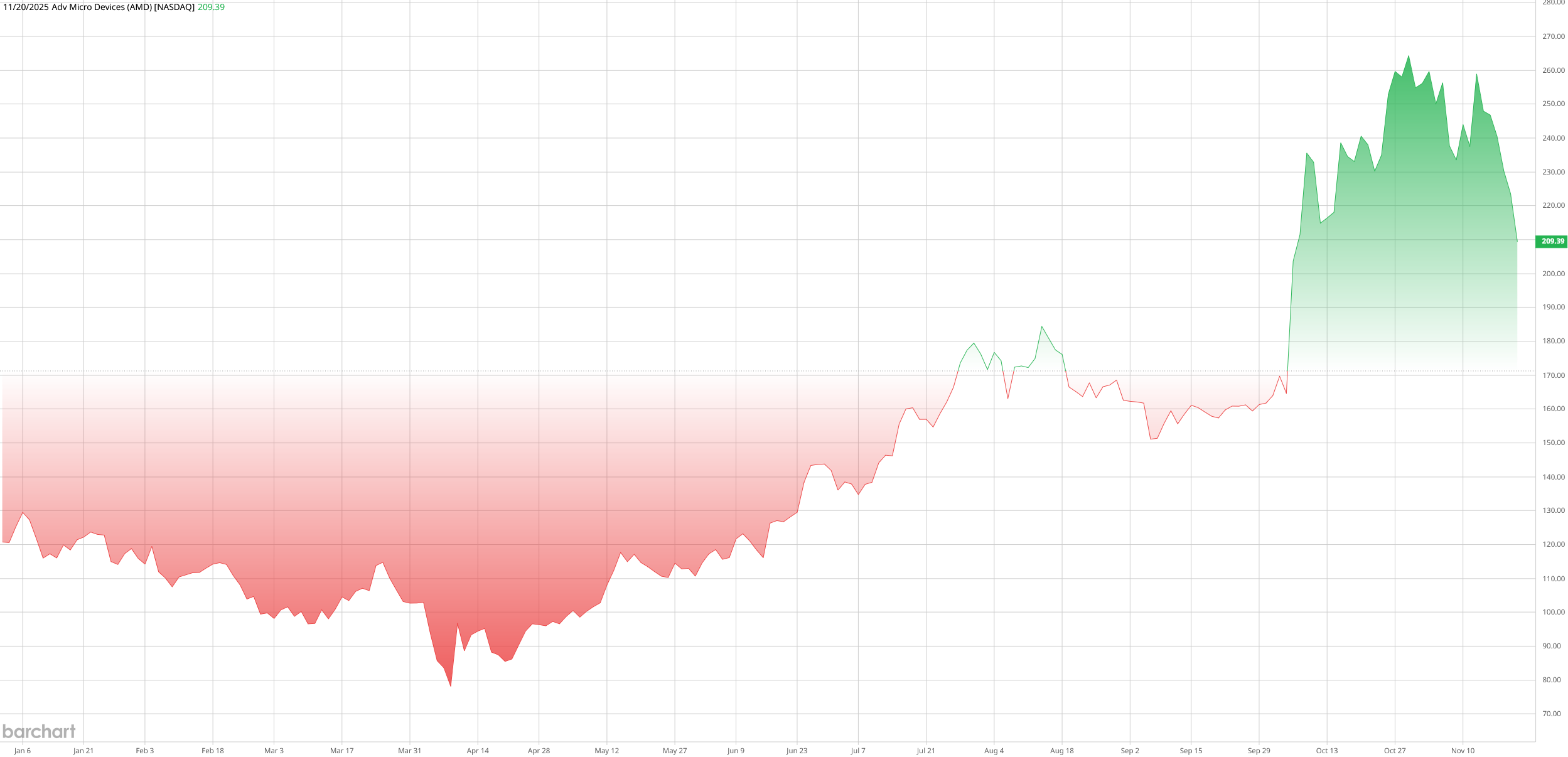

Valued at $374 billion by market cap, so far in 2025, AMD shares have soared more than 73% year-to-date (YTD), compared to just 15% for the Nasdaq Index ($NASX). This breakout followed a quiet first half and then an explosive rise in recent quarters. In early November, after the analyst day and OpenAI news, AMD hit an all-time high of around $267. However, the stock had pulled back modestly, 10%, over the past week amid broad tech profit-taking, but it remains far above early‑year levels.

From a valuation perspective, AMD now trades at extremely rich multiples. Its trailing P/E is on the order of 100x, far above the 35x median for semiconductor peers. AMD looks expensive today. Its PEG and forward multiples are likewise high relative to most chip stocks. That reflects the extreme growth investors are expecting but also means there’s very little room for disappointment if AI spending cools or execution falters.

AMD's Investor Day Rally

A couple of weeks ago, AMD held its first analyst day in three years. The crew and CEO, Lisa Su, launched an aggressive AI-focused strategy: across AMD, they want to grow by 35% annually and increase the number of data-center chips by a vast 60%. Su added that AMD is interested in capturing a double-digit share of the AI data center chip market and achieving $100 billion in that segment by 2030. They also believe the AI data center market will reach over $1 trillion in 2030, implying a greater than 40% CAGR. Management observed that AMD is poised to enter the AI roll, not only in GPUs but also in CPUs and network chips.

AMD Tops Q3 Earnings Forecast

On Nov. 4, AMD reported blockbuster Q3 earnings, which topped expectations. Revenue reached $9.24 billion, up 36% from a year earlier and a new record. That figure topped the roughly $8.75 billion Wall Street consensus. Strong CPU and GPU demand drove results, lifting operating income 75% to $1.27 billion and pushing net income up 61% to $1.243 billion.

Data center revenue climbed to $4.3 billion, up 22% from last year, supported by 5th Gen EPYC processors and Instinct MI350 AI accelerators. The combined Client and Gaming division surged 73% to $4.0 billion as Ryzen processors and semi-custom game chips delivered record shipments. Free cash flow also hit a record at about $1.53 billion for the quarter. AMD ended the period with roughly $7.24 billion in cash and short-term investments.

Management issued upbeat guidance. For the fourth quarter, the company expects revenue near $9.6 billion, plus or minus $300 million, which would represent roughly 25% year-over-year (YoY) growth at the midpoint. AMD projected a non-GAAP gross margin of about 54.5%. AMD also reiterated its longer-term ambition to grow earnings toward the mid-teens per share by 2030 if AI markets scale as anticipated.

What Do Analysts Say About AMD Stock?

It appears that Wall Street remains bustling overall, but some firms are shaking up the formula. Citi noted that AMD’s current performance has helped secure the company’s revenue and margin targets and maintained a “Buy” rating at $260. Meanwhile, a UBS analyst raised his target to $300, saying this marks the beginning of a large re-rating driven by the data center wave.

After the company's investor event, Morgan Stanley maintained its “Equal-Weight” rating but raised its target to $260.

Goldman Sachs remained “Neutral” with a less aggressive target of $210, citing that AMD's long-term game will depend on margin expansion and consistent performance. Meanwhile, UBS and Wedbush stand their ground with great confidence. UBS has just increased its target to $300, and Wedbush has risen to $270, citing less ambiguous software on AI accelerator demand.

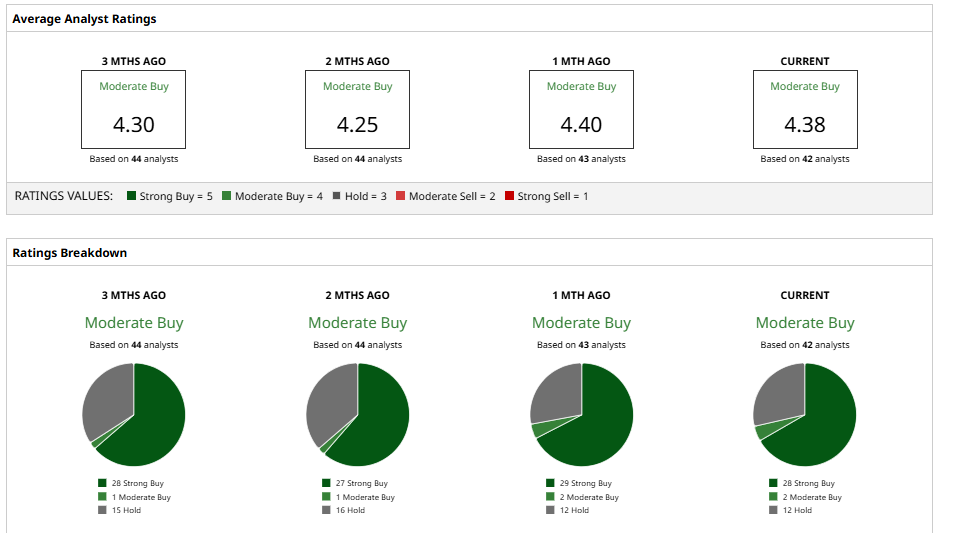

In short, among the 42 analysts tracked by Barchart, the consensus rating is “Moderate Buy.” The 12-month consensus target is approximately $288.97, implying roughly 38% upside from its current level.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Wall Street Sees a ‘Buying Opportunity’ in This Rare Earths Stock. Should You Snap Up Shares Now?

- Billionaire Gina Rinehart Is Now the Top Investor in MP Materials. Should You Follow the Money and Buy MP Stock Too?

- Can Nvidia Stock Test Wall Street’s Price Target of $350?

- A Fannie Mae IPO Is ‘Far From Ready.’ What Does That Mean for FNMA Stock Here?