Famed investor Michael Burry has recently reiterated that Molina Healthcare (MOH) is one of his current bullish bets. In fact, he picked Molina as a counter to his now infamous bearish stance on artificial intelligence (AI) juggernaut Palantir (PLTR). Posting on X (formerly Twitter), Burry said, “Long MOH stock and Long PLTR puts, like peanut butter and bananas.”

But why? What makes Molina so special that Burry is willing to opt for it over a multi-bagger like Palantir? And should investors follow suit? Let’s find out.

About Molina Healthcare

Founded in 1980, Molina provides managed health care services, primarily for low-income individuals and families, seniors, and others eligible under government-funded programs like Medicaid and Medicare. Serving about 5.6 million members, Molina aims to deliver accessible, affordable healthcare to underserved populations, reflecting its founding mission of “care regardless of ability to pay.”

However, Molina stock has suffered a significant pullback of almost 50% in 2025. Its market cap currently stands at $7.9 billion.

Steep Earnings Decline, But Company Remains Stable

Molina’s Q3 results may have come as a shock to some investors, who saw the company's earnings decline 69.4% year-over-year to $1.84, missing the consensus estimate of $3.90 by a wide margin. The company blamed the Medicare and Marketplace segments. Otherwise, the financials seemed quite steady.

In Q3, the health insurance company reported revenues of $11.48 billion, an 11% increase from the prior year, as core premium revenues increased by 11.8% to $10.84 billion. Overall, over the past 10 years, Molina has grown its revenue and earnings at compound annual growth rates (CAGRs) of 12.90% and 19.69%, respectively, with analysts expecting the company to report forward revenue growth of 11.37%, higher than the sector median of 7.61%.

However, the medical care ratio (MCR) jumped to 92.6% from 89.2% in the quarter. This ratio represents the percentage of premium revenue an insurer spends on actual medical claims and health care services for members. Generally, the lower it is, the better.

Yet, the company’s cash position remains solid. Molina closed the quarter with a cash balance of $4.2 billion and no short-term debt. However, a net cash outflow of $237 million from operating activities for the first nine months of 2025, compared to an inflow of $868 million in the same period a year ago, is something the company should address.

Meanwhile, MOH stock is trading at comfortable valuations, with its forward price-to-earnings (P/E) and price-to-book (P/B) of 10.23 and 1.80, respectively — much lower than the sector medians of 19.56 and 3.22.

The Bull Case on Molina Healthcare

Molina Healthcare benefits from favorable growth forecasts, underpinned by its strong footing in the managed Medicaid arena. The company strikes an effective balance between scale and resilience. It ranks among the five largest Medicaid-focused plans in the United States, serving roughly 5 million members while preserving solid margins and the financial flexibility to absorb periods of elevated medical utilization.

Notably, state governments regard Molina as a dependable partner, particularly in coordinating care for complex, high-density populations, a role that enhances contract durability. For states, outsourcing to a sizable insurer simplifies administration. The arrangement delivers budgetary flexibility to states, shielding them from volatility tied to actual health care consumption.

Additionally, Molina’s risk profile is further tempered by concentration in fiscally sound states, California, Texas, Ohio, and Michigan, all of which maintain healthy reserves and surpluses, lowering the likelihood of abrupt rate reductions.

Further, Medicare Advantage is the fastest-expanding segment of U.S. health care, with more than 32 million enrollees nationwide. This indicates that Molina has meaningful room for expansion. Its limited exposure to pharmacy costs, combined with a heavy emphasis on Dual-Eligible Special Needs Plans (D-SNPs) that coordinate both Medicare and Medicaid benefits, creates a differentiated and integrated care model.

That said, material uncertainties persist. Molina remains highly sensitive to federal and state funding decisions. President Donald Trump’s administration proposed $880 billion in Medicaid cuts over the next decade, which is a significant long-term pressure point and has contributed to the weakness in the share price since the election.

Medical cost trends also warrant monitoring. Rising expenditures on pharmaceuticals, behavioral health services, and weight-loss therapies could compress medical cost ratios if not offset by corresponding rate adjustments.

Analyst Opinion

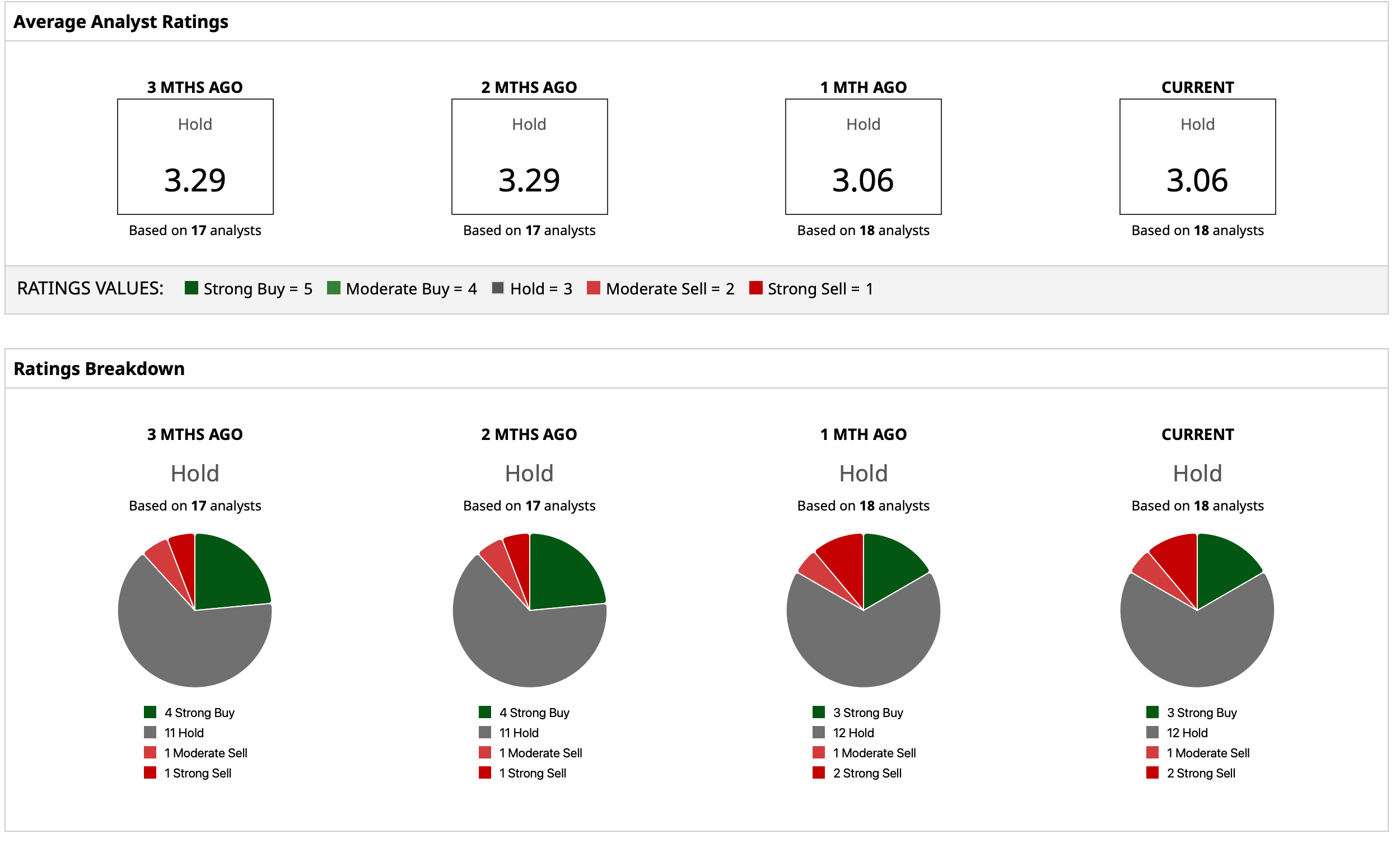

Taking all of this into account, analysts have assigned an overall rating of “Hold” for Molina stock, with a mean target price of $170. This indicates upside potential of about 16.5% from current levels. Out of 18 analysts covering the stock, three have a “Strong Buy” rating, 12 have a “Hold” rating, one has a “Moderate Sell” rating, and two have a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart