What a fantastic six months it’s been for Vimeo. Shares of the company have skyrocketed 60%, hitting $7.75. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Vimeo, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is Vimeo Not Exciting?

Despite the momentum, we don't have much confidence in Vimeo. Here are three reasons there are better opportunities than VMEO and a stock we'd rather own.

1. Revenue Growth Flatlining

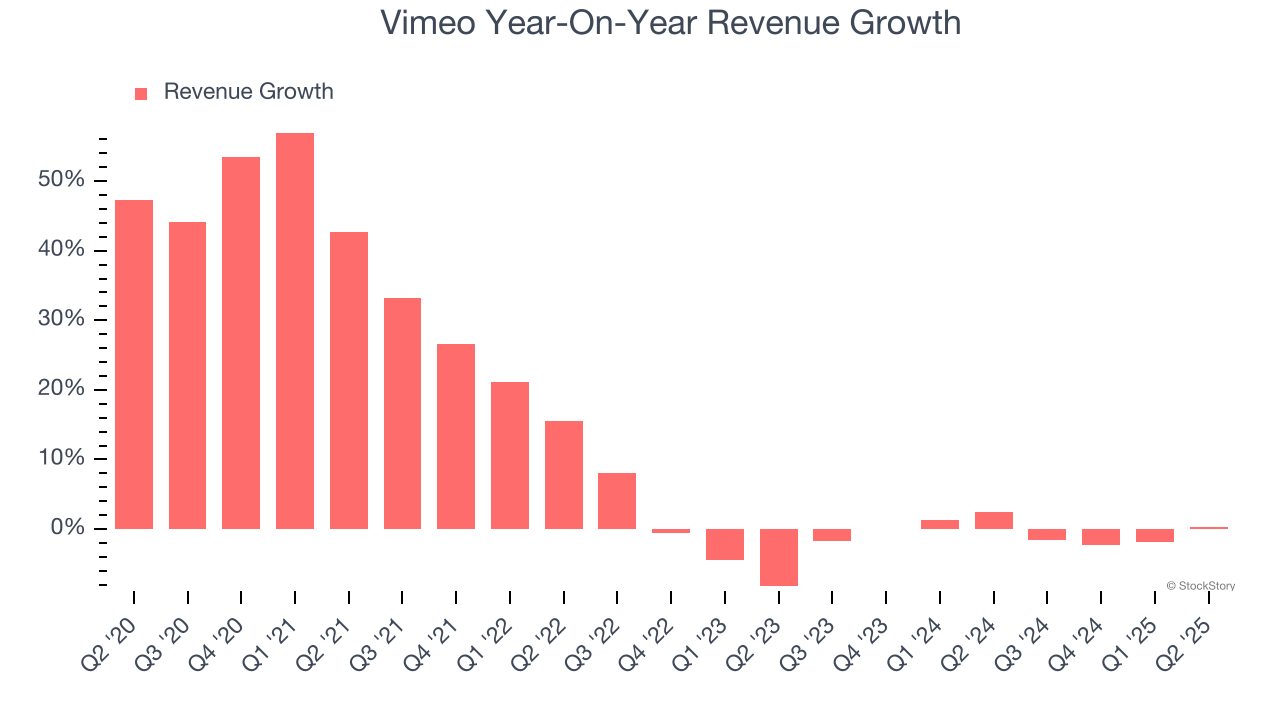

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Vimeo’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

2. Fewer Distribution Channels Limit its Ceiling

With $415.4 million in revenue over the past 12 months, Vimeo is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

3. Previous Growth Initiatives Have Lost Money

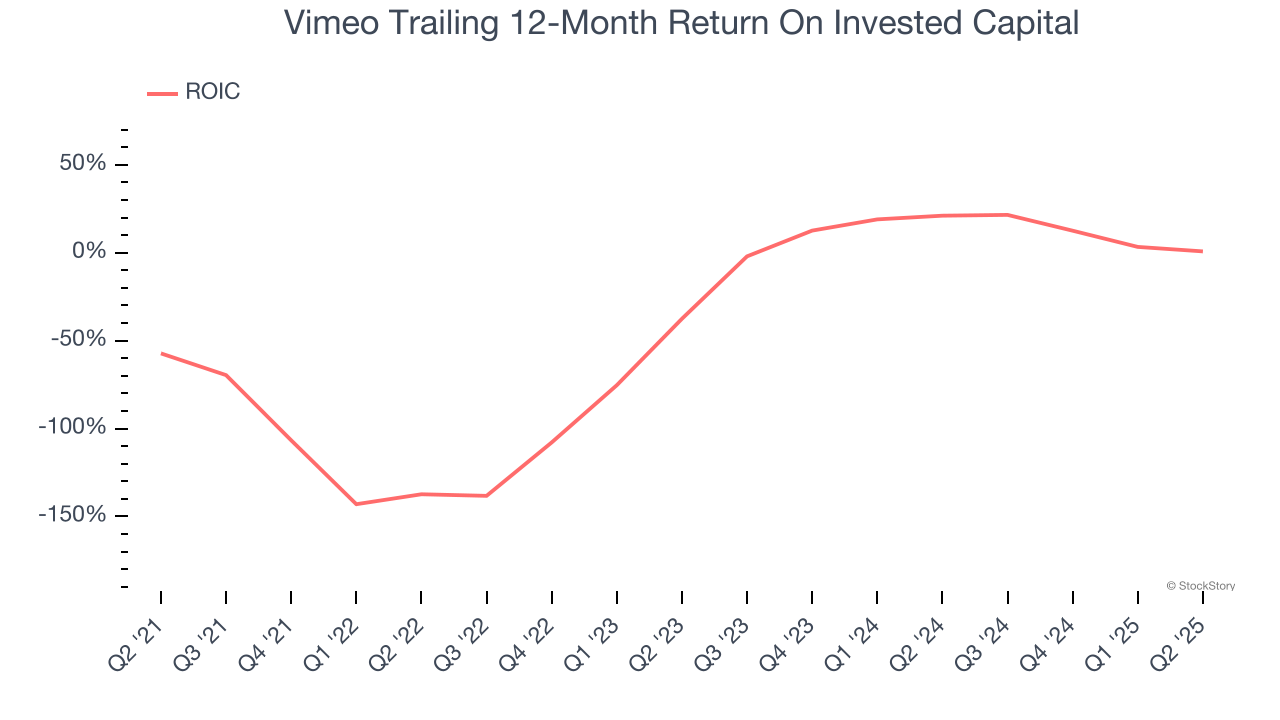

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Vimeo’s five-year average ROIC was negative 18.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

Final Judgment

Vimeo’s business quality ultimately falls short of our standards. Following the recent surge, the stock trades at 35.3× forward EV-to-EBITDA (or $7.75 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're pretty confident there are superior stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Vimeo

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.