What Happened?

Shares of civil infrastructure company Construction Partners (NASDAQ: ROAD) jumped 4.5% in the afternoon session after DA Davidson raised its price target on the company to $120 from $110, prompted by strong preliminary fourth-quarter results and initial fiscal 2026 guidance.

The investment firm maintained a Neutral rating on the stock. The new price target followed the company's revenue and EBITDA forecasts, which exceeded expectations. Construction Partners had already demonstrated significant momentum, with revenue growth of 39.2% over the previous twelve months. This positive view was echoed across the analyst community, as the average 12-month price target increased by 9.71% from the prior average. The company's financial health appeared solid, with earnings per share having increased by 70.6% annually over the last two years, outpacing revenue gains.

After the initial pop the shares cooled down to $120.14, up 3.6% from previous close.

Is now the time to buy Construction Partners? Access our full analysis report here.

What Is The Market Telling Us

Construction Partners’s shares are quite volatile and have had 19 moves greater than 5% over the last year. In that context, today’s move indicates the market considers this news meaningful but not something that would fundamentally change its perception of the business.

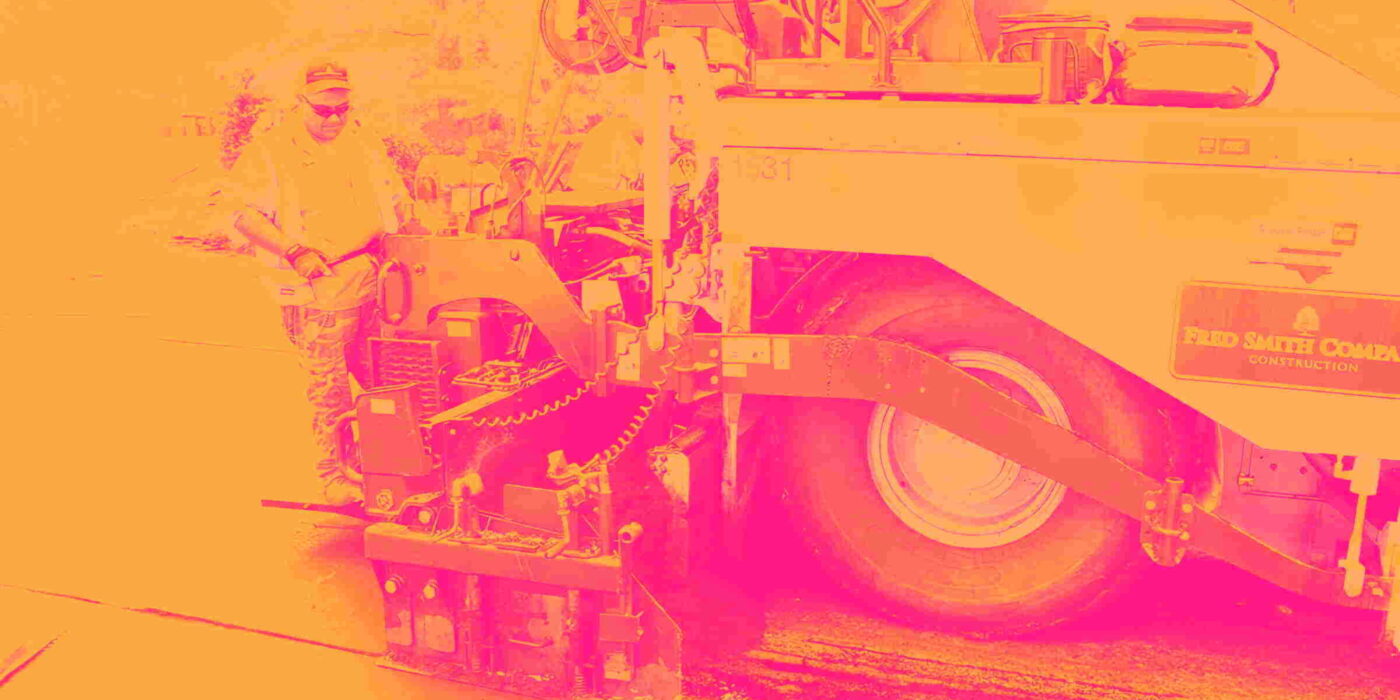

The previous big move we wrote about was 3 days ago when the stock gained 3.9% on the news that the company announced it acquired P&S Paving, Inc., a move that expanded its operations into Daytona Beach and Florida's East Coast. P&S Paving, headquartered in Daytona Beach, provided various paving, sitework, and utility services from its two hot-mix asphalt plants. This acquisition enhanced Construction Partners' ability to offer its services in the high-growth Interstate 95 corridor. The deal aligned with the company's strategy for future growth and strengthened its market position in Florida.

Construction Partners is up 36.8% since the beginning of the year, but at $120.14 per share, it is still trading 12.1% below its 52-week high of $136.74 from September 2025. Investors who bought $1,000 worth of Construction Partners’s shares 5 years ago would now be looking at an investment worth $5,688.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefiting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.