Life sciences company Revvity (NYSE: RVTY) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 2.2% year on year to $698.9 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $2.86 billion at the midpoint. Its non-GAAP profit of $1.18 per share was 3.6% above analysts’ consensus estimates.

Is now the time to buy Revvity? Find out by accessing our full research report, it’s free for active Edge members.

Revvity (RVTY) Q3 CY2025 Highlights:

- Revenue: $698.9 million vs analyst estimates of $700.7 million (2.2% year-on-year growth, in line)

- Adjusted EPS: $1.18 vs analyst estimates of $1.14 (3.6% beat)

- The company reconfirmed its revenue guidance for the full year of $2.86 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $4.95 at the midpoint, a 1% increase

- Operating Margin: 11.7%, down from 14.3% in the same quarter last year

- Free Cash Flow Margin: 17.2%, down from 18.4% in the same quarter last year

- Organic Revenue rose 1% year on year vs analyst estimates of 1.1% growth (5.4 basis point miss)

- Market Capitalization: $11.48 billion

“We performed well during the third quarter as a number of key innovations and strategic partnerships have begun to come to fruition,” said Prahlad Singh, president and chief executive officer of Revvity.

Company Overview

Formerly known as PerkinElmer until its rebranding in 2023, Revvity (NYSE: RVTY) provides health science technologies and services that support the complete workflow from discovery to development and diagnosis to cure.

Revenue Growth

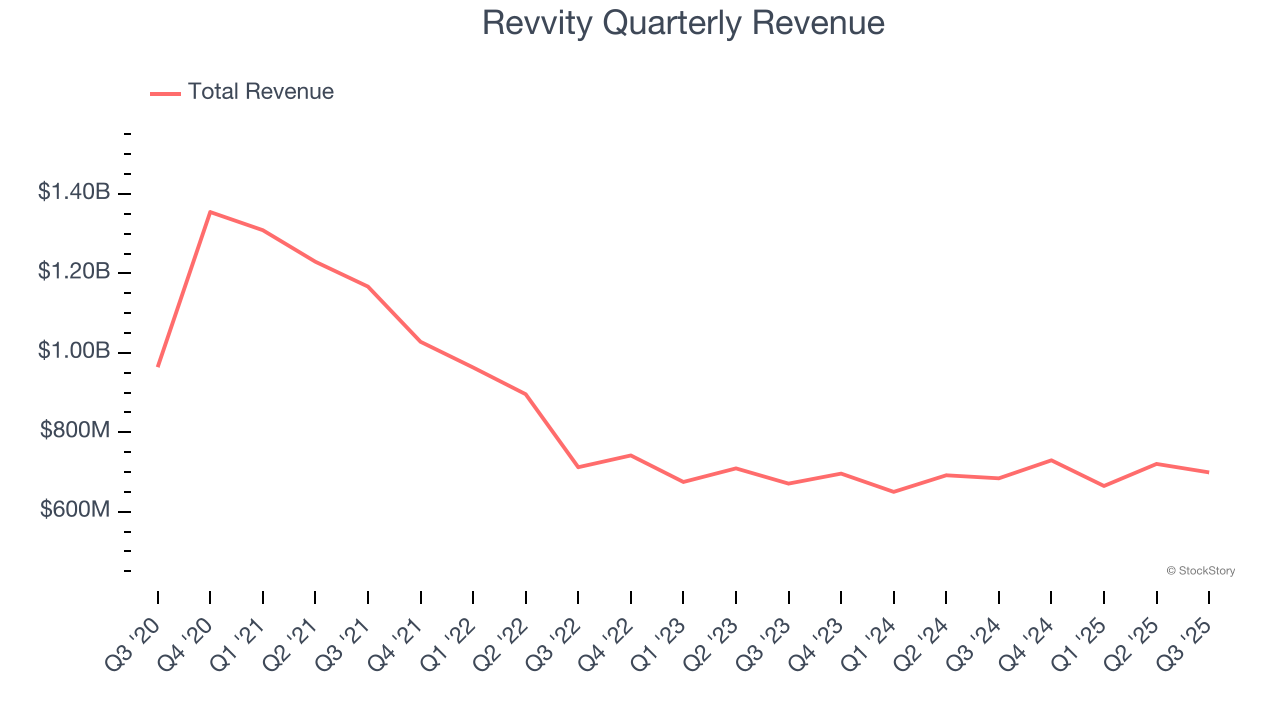

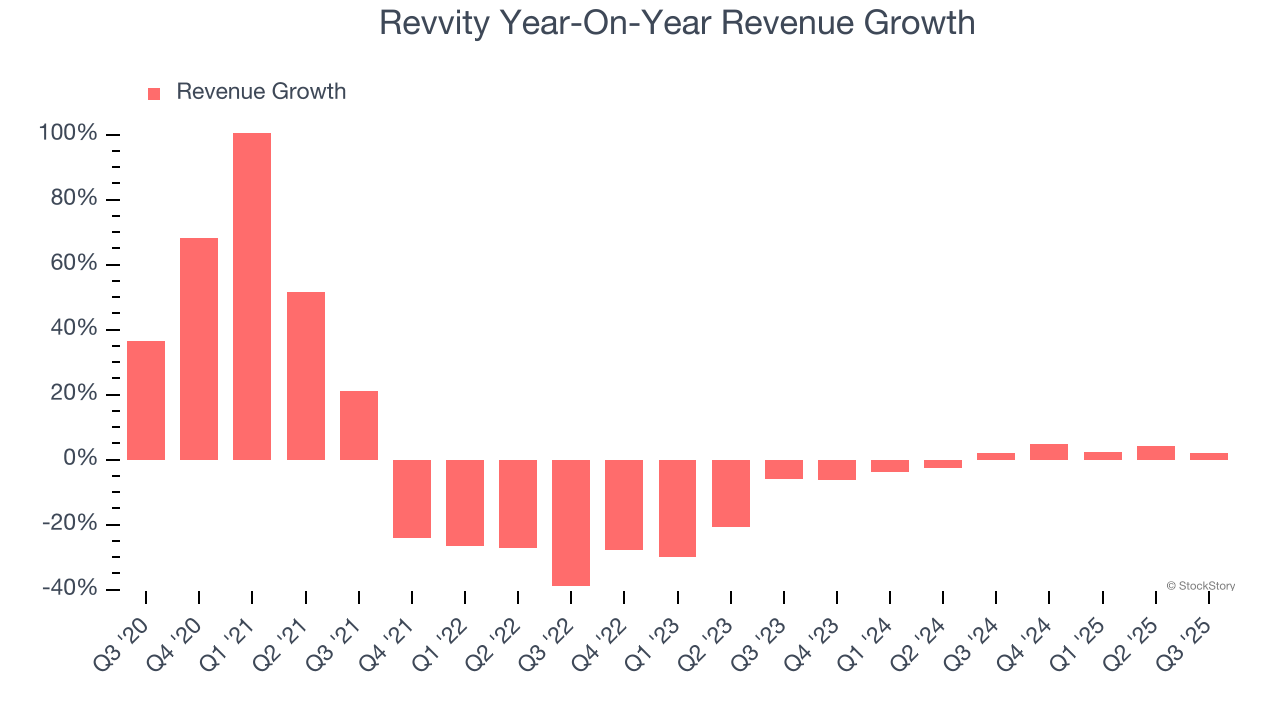

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Revvity’s demand was weak and its revenue declined by 2.7% per year. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Revvity’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop.

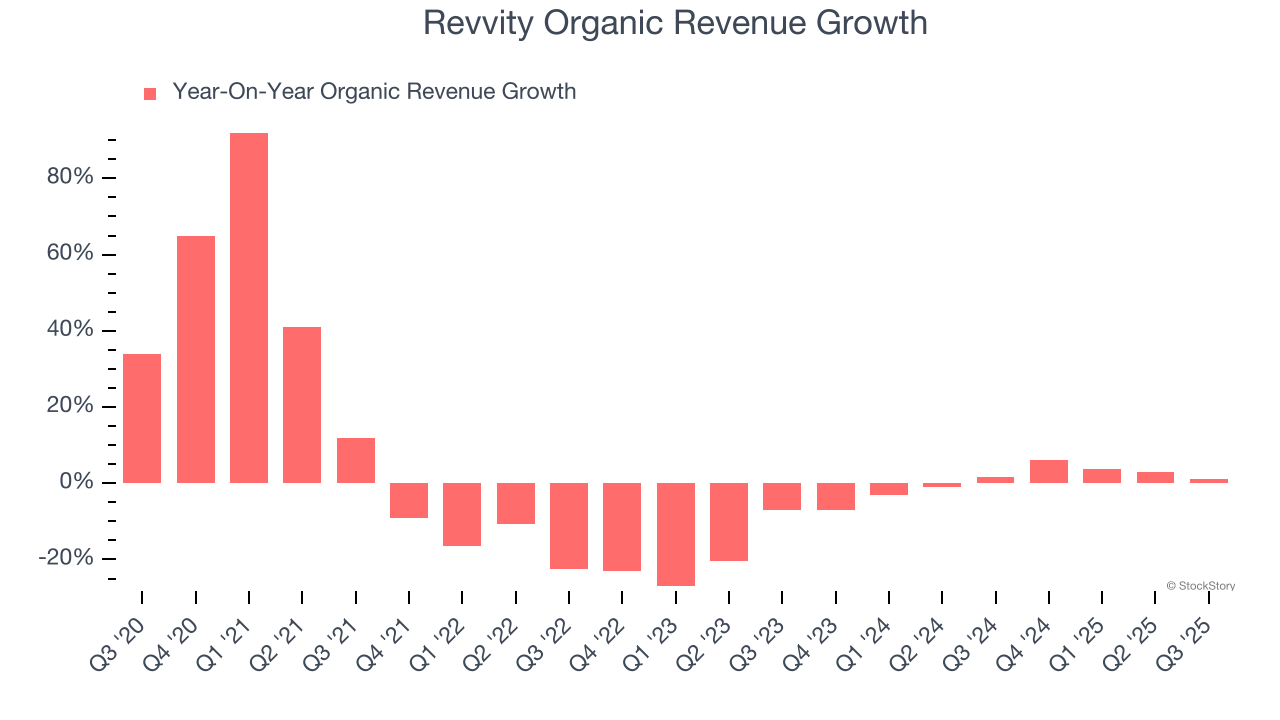

Revvity also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Revvity’s organic revenue was flat. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Revvity grew its revenue by 2.2% year on year, and its $698.9 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

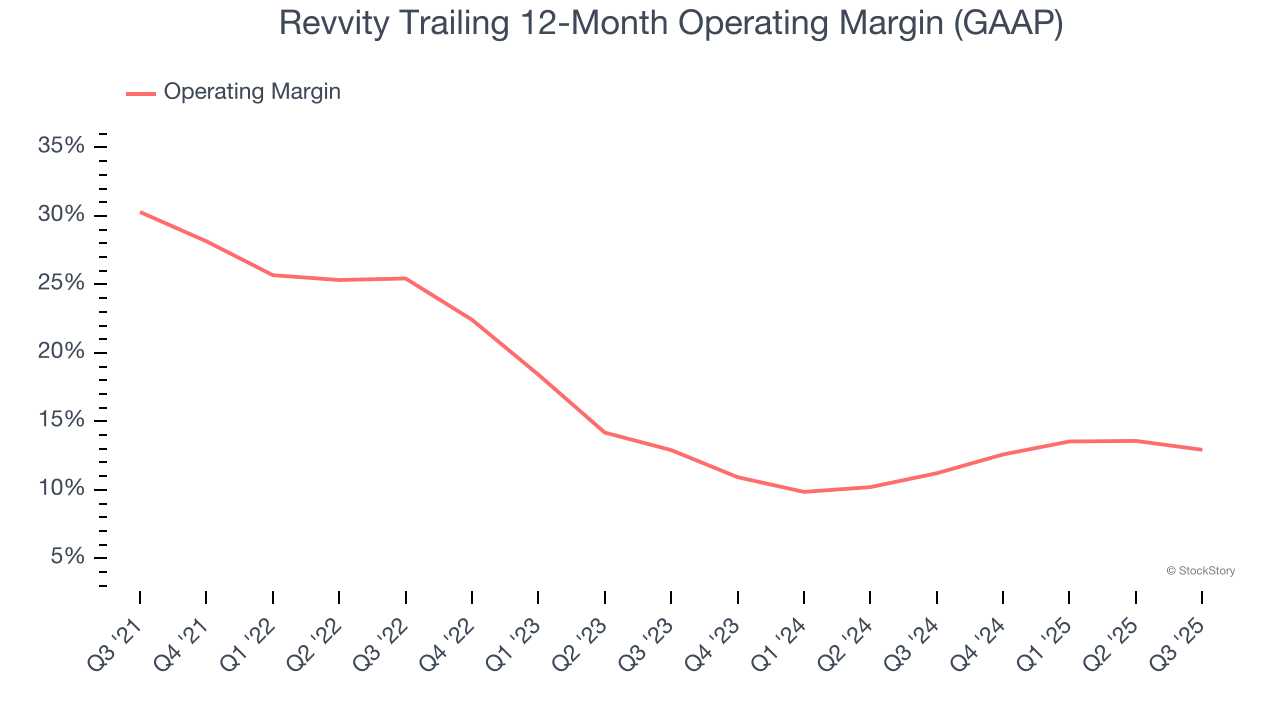

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Revvity has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 20.5%.

Analyzing the trend in its profitability, Revvity’s operating margin decreased by 17.4 percentage points over the last five years. Even though its historical margin was healthy, shareholders will want to see Revvity become more profitable in the future.

This quarter, Revvity generated an operating margin profit margin of 11.7%, down 2.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

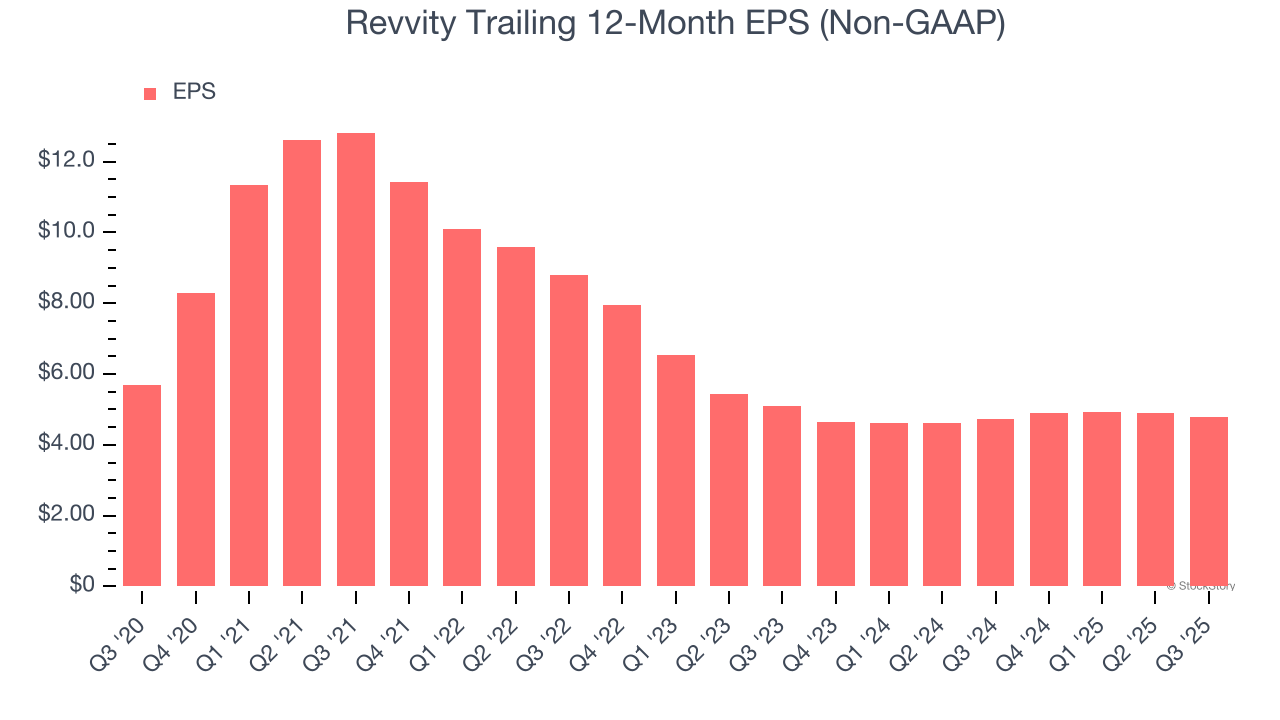

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Revvity, its EPS and revenue declined by 3.4% and 2.7% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Revvity’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Revvity reported adjusted EPS of $1.18, down from $1.28 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.6%. Over the next 12 months, Wall Street expects Revvity’s full-year EPS of $4.79 to grow 10.6%.

Key Takeaways from Revvity’s Q3 Results

It was encouraging to see Revvity beat analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue was just in line. Zooming out, we still think this was a decent quarter. The stock traded up 1.5% to $100.39 immediately following the results.

Is Revvity an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.