Household products company Kimberly-Clark (NYSE: KMB) met Wall Streets revenue expectations in Q3 CY2025, but sales were flat year on year at $4.15 billion. Its non-GAAP profit of $1.82 per share was 3.9% above analysts’ consensus estimates.

Is now the time to buy Kimberly-Clark? Find out by accessing our full research report, it’s free for active Edge members.

Kimberly-Clark (KMB) Q3 CY2025 Highlights:

- Revenue: $4.15 billion vs analyst estimates of $4.15 billion (flat year on year, in line)

- Adjusted EPS: $1.82 vs analyst estimates of $1.75 (3.9% beat)

- Operating Margin: 15%, down from 24.8% in the same quarter last year

- Free Cash Flow Margin: 8.9%, down from 19.3% in the same quarter last year

- Organic Revenue rose 2.5% year on year vs analyst estimates of 1.5% growth (99.2 basis point beat)

- Market Capitalization: $38.73 billion

"The operating environment remains dynamic, but we continue to execute our strategy with discipline and excellence as we play to win," said Kimberly-Clark Chairman and CEO, Mike Hsu.

Company Overview

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE: KMB) is now a household products powerhouse known for personal care and tissue products.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $16.47 billion in revenue over the past 12 months, Kimberly-Clark is one of the larger consumer staples companies and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because there are only so many big store chains to sell into, making it harder to find incremental growth. For Kimberly-Clark to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

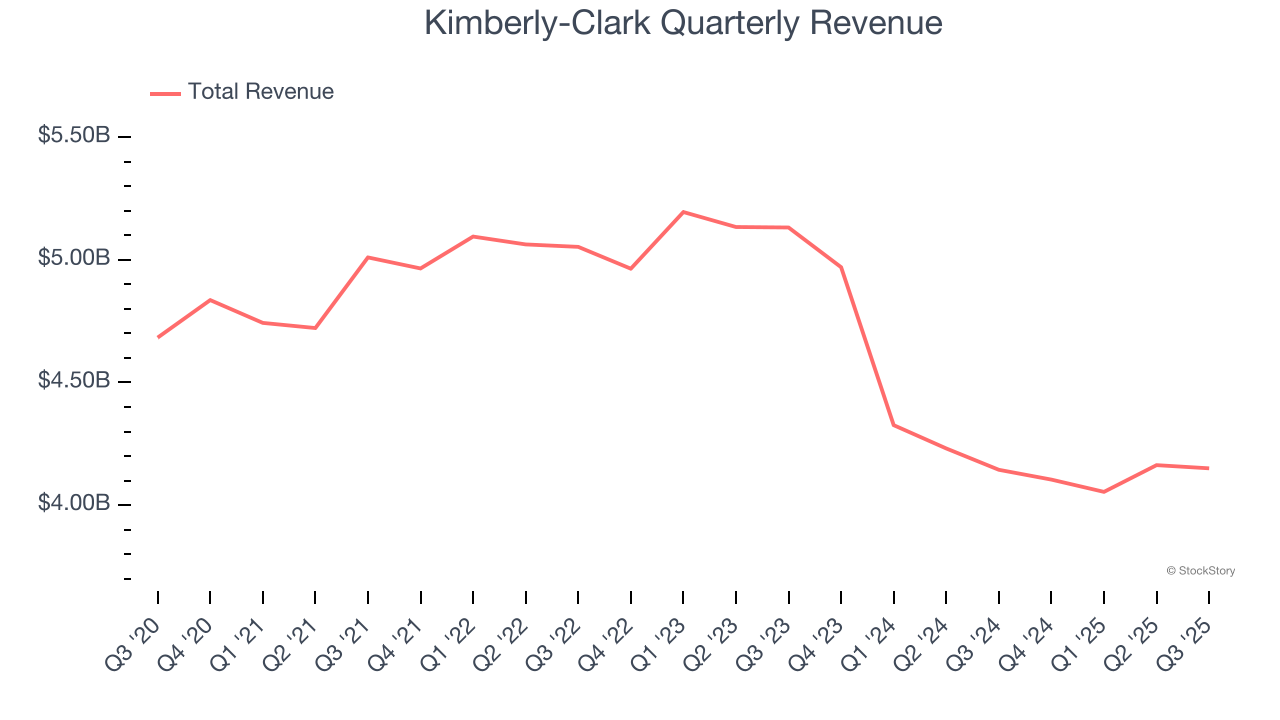

As you can see below, Kimberly-Clark’s demand was weak over the last three years. Its sales fell by 6.5% annually despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Kimberly-Clark’s $4.15 billion of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months. Although this projection implies its newer products will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

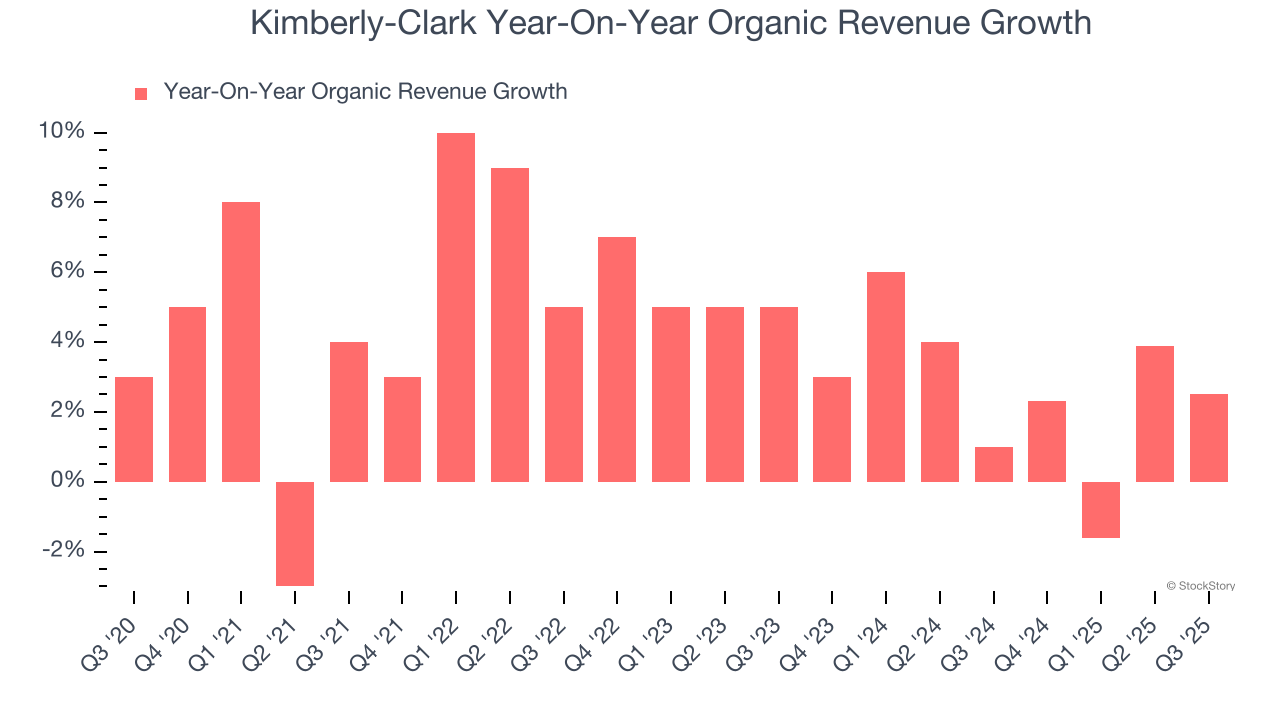

The demand for Kimberly-Clark’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 2.6% year on year.

In the latest quarter, Kimberly-Clark’s organic sales rose by 2.5% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Kimberly-Clark’s Q3 Results

It was good to see Kimberly-Clark narrowly top analysts’ organic revenue expectations this quarter. EPS also exceeded expectations. On the other hand, its gross margin fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3% to $120.30 immediately after reporting.

Big picture, is Kimberly-Clark a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.