3D printing company 3D Systems (NYSE: DDD) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 19.2% year on year to $91.25 million. Next quarter’s revenue guidance of $99.46 million underwhelmed, coming in 0.8% below analysts’ estimates. Its non-GAAP loss of $0.08 per share was in line with analysts’ consensus estimates.

Is now the time to buy 3D Systems? Find out by accessing our full research report, it’s free for active Edge members.

3D Systems (DDD) Q3 CY2025 Highlights:

- Revenue: $91.25 million vs analyst estimates of $93.61 million (19.2% year-on-year decline, 2.5% miss)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.09 (in line)

- Adjusted EBITDA: -$10.8 million vs analyst estimates of -$8.17 million (-11.8% margin, 32.2% miss)

- Revenue Guidance for Q4 CY2025 is $99.46 million at the midpoint, below analyst estimates of $100.2 million

- Operating Margin: -23.4%, up from -160% in the same quarter last year

- Free Cash Flow was -$15.75 million compared to -$4.45 million in the same quarter last year

- Market Capitalization: $354 million

"I am excited to step into the role of interim CFO," said Phyllis Nordstrom.

Company Overview

Founded by the inventor of stereolithography, 3D Systems (NYSE: DDD) engineers, manufactures, and sells 3D printers and other related products to the aerospace, automotive, healthcare, and consumer goods industries.

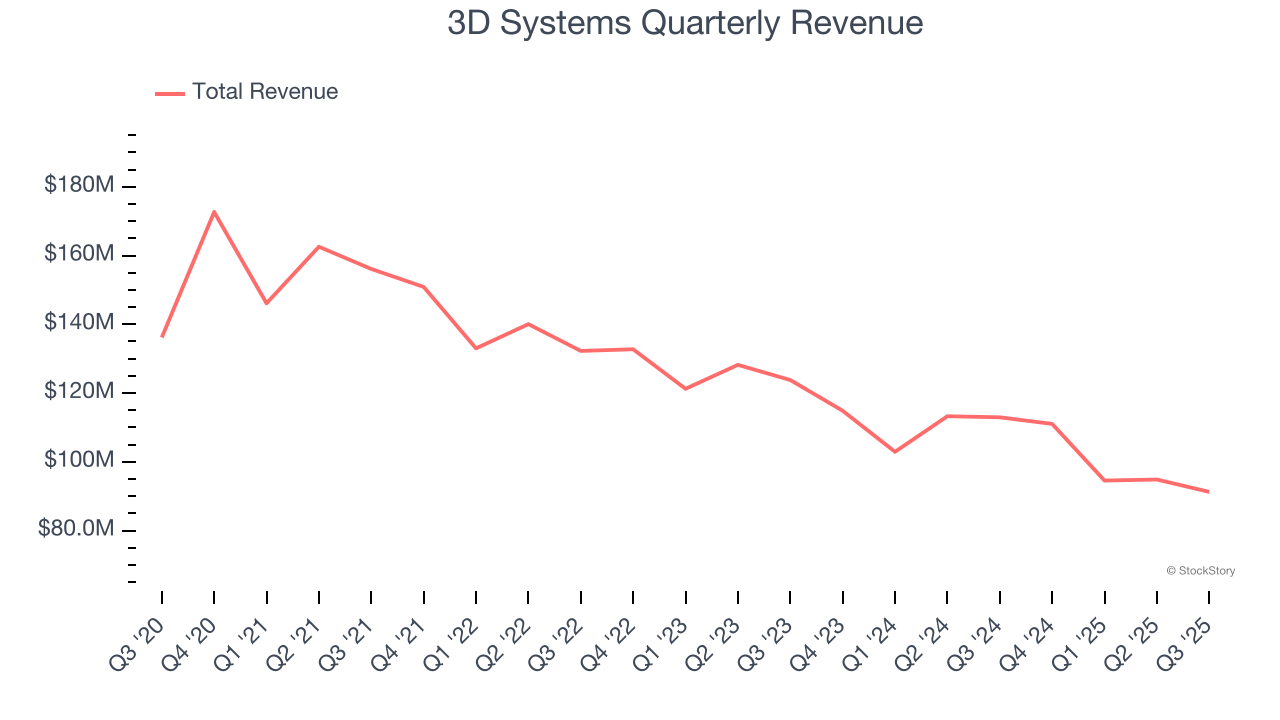

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. 3D Systems’s demand was weak over the last five years as its sales fell at a 6.7% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. 3D Systems’s recent performance shows its demand remained suppressed as its revenue has declined by 12% annually over the last two years.

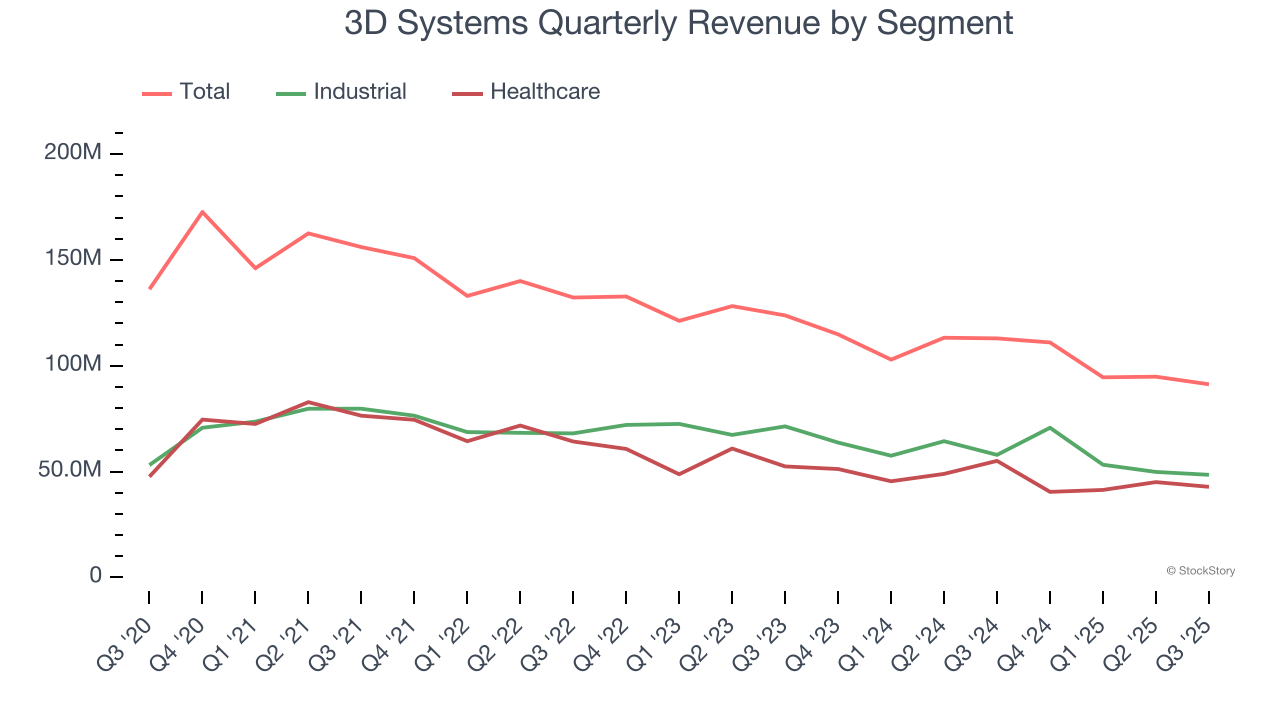

We can better understand the company’s revenue dynamics by analyzing its most important segments, Industrial and Healthcare, which are 53.1% and 46.9% of revenue. Over the last two years, 3D Systems’s Industrial revenue (aerospace, defense, and transportation manufacturing) averaged 11.4% year-on-year declines while its Healthcare revenue (dental and medical devices) averaged 12.2% declines.

This quarter, 3D Systems missed Wall Street’s estimates and reported a rather uninspiring 19.2% year-on-year revenue decline, generating $91.25 million of revenue. Company management is currently guiding for a 10.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

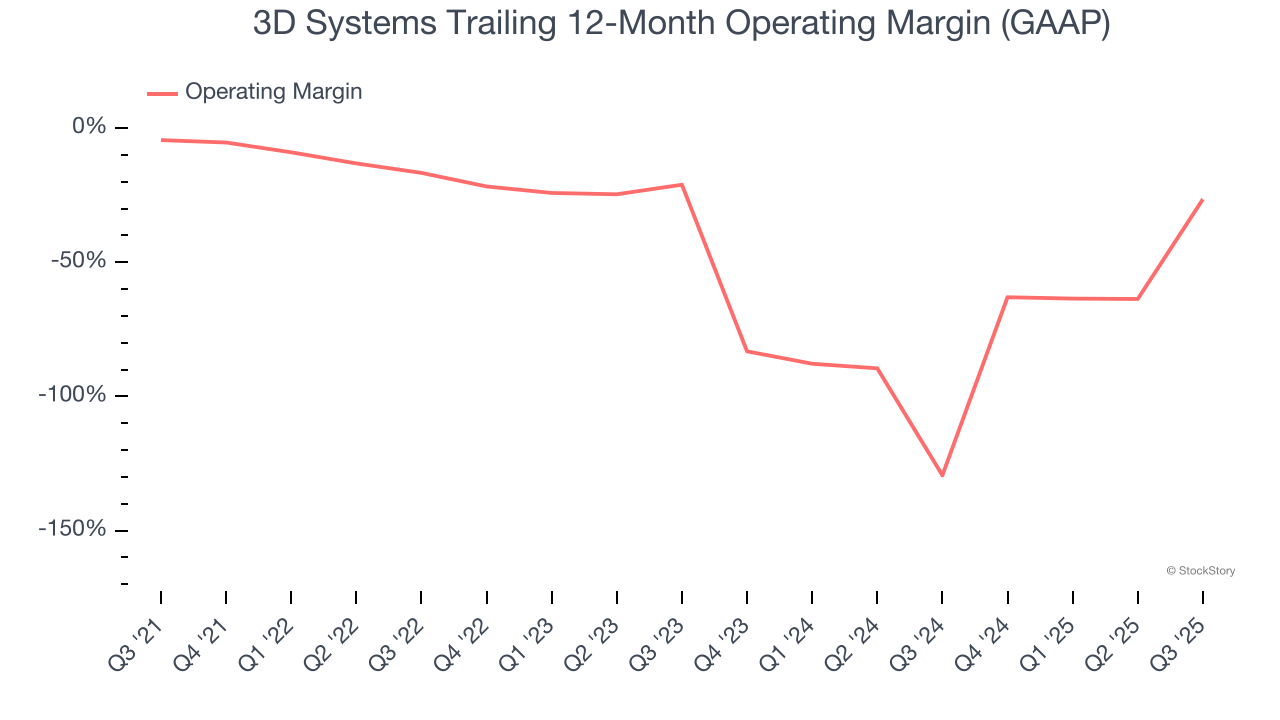

Operating Margin

3D Systems’s high expenses have contributed to an average operating margin of negative 35.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, 3D Systems’s operating margin decreased by 22 percentage points over the last five years. 3D Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, 3D Systems generated a negative 23.4% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

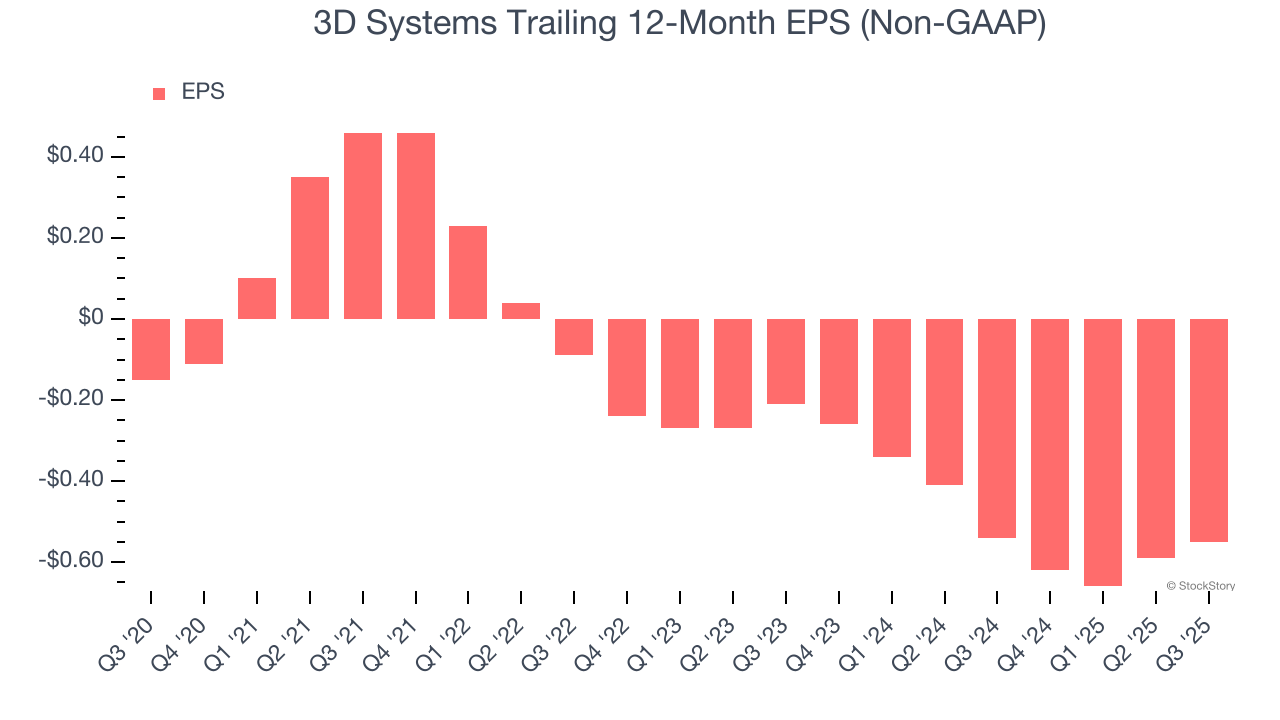

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

3D Systems’s earnings losses deepened over the last five years as its EPS dropped 29.7% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, 3D Systems’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For 3D Systems, its two-year annual EPS declines of 61.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, 3D Systems reported adjusted EPS of negative $0.08, up from negative $0.12 in the same quarter last year. This print beat analysts’ estimates by 5.9%. Over the next 12 months, Wall Street expects 3D Systems to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.55 will advance to negative $0.19.

Key Takeaways from 3D Systems’s Q3 Results

It was tough to see 3D Systems' revenue and EBITDA miss analysts’ expectations this quarter. Additionally, its revenue guidance for next quarter fell short of Wall Street’s estimates. Overall, this print could have been better. The stock traded down 10.9% to $2.34 immediately following the results.

3D Systems underperformed this quarter, but does that create an opportunity to invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.