Media, broadcasting, and digital services company E.W. Scripps (NASDAQ: SSP) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 18.6% year on year to $525.9 million. Its GAAP loss of $0.55 per share was 70.8% below analysts’ consensus estimates.

Is now the time to buy E.W. Scripps? Find out by accessing our full research report, it’s free for active Edge members.

E.W. Scripps (SSP) Q3 CY2025 Highlights:

- Revenue: $525.9 million vs analyst estimates of $523.9 million (18.6% year-on-year decline, in line)

- EPS (GAAP): -$0.55 vs analyst expectations of -$0.32 (70.8% miss)

- Adjusted EBITDA: $80.43 million vs analyst estimates of $68.75 million (15.3% margin, 17% beat)

- Operating Margin: 7.2%, down from 18.8% in the same quarter last year

- Free Cash Flow was -$15.07 million, down from $127.4 million in the same quarter last year

- Market Capitalization: $185.1 million

Local Media division core advertising revenue was up 2% in the third quarter, driven by the services category and overall growth in national advertising due to strong sales execution and Scripps’ sports strategy. During the fourth quarter, the company expects strong core revenue growth, buoyed by its new agreement with the National Hockey League’s Tampa Bay Lightning, continued growth across live sports markets and the comparison to last year’s political advertising displacement of core advertising. The Scripps Networks division continues to capitalize on the networks’ broad distribution on streaming platforms to grow connected TV revenue, up 41% in the quarter and helping to offset softness due to economic uncertainty. Networks revenue came in better than peers at about flat for Q3 and, combined with a 7% reduction in expenses, the division delivered a 27% margin. The WNBA season on ION wrapped successfully, with linear and connected TV revenue growing 92% over the 2024 season despite Caitlin Clark’s absence due to injury. Demand for the WNBA and other women’s sports on ION in this year’s upfront cycle was strong, with sports volume up 30% and commanding premium ad rates. Scripps recently announced the sale of two network-affiliated stations: WFTX in Fort Myers, Florida, to Sun Broadcasting, and WRTV in Indianapolis to Circle City Broadcasting, with total proceeds of $123 million. These transactions follow plans announced in July to swap stations across five markets in four states with Gray Media. This optimization of the Scripps portfolio supports the company’s strategy to improve the operating performance of its local stations and pay down debt. On Aug. 6, Scripps closed on the placement of $750 million in new senior secured second-lien notes at a rate of 9.875%. Proceeds were used to pay off the company’s 2027 senior notes; pay down $205 million of its 2028 term loan B-2; and pay off a portion of its revolving credit facilities. The company has since paid off the remaining balance on its revolving credit facilities. Net leverage at the end of the third quarter was 4.6x, down from 4.9x at the end of the first quarter and in line with the company’s projected year-end leverage. Scripps’ local television stations led an employee- and on-air campaign to raise money for the Scripps Howard Fund’s ninth annual “If You Give a Child a Book …” campaign, and proceeds will allow the Fund to invest a record-breaking $1.8 million during the 2025-2026 academic year to provide more than 300,000 books to children at low-income schools across the United States.

Company Overview

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ: SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

Revenue Growth

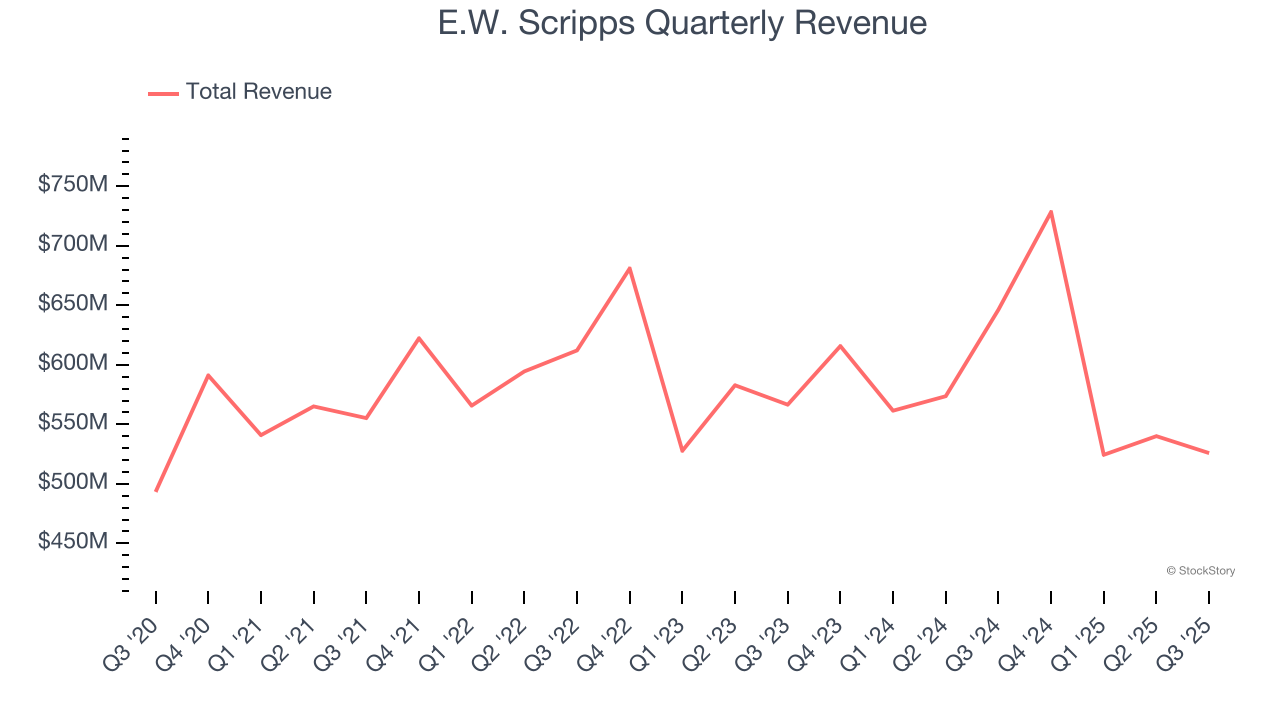

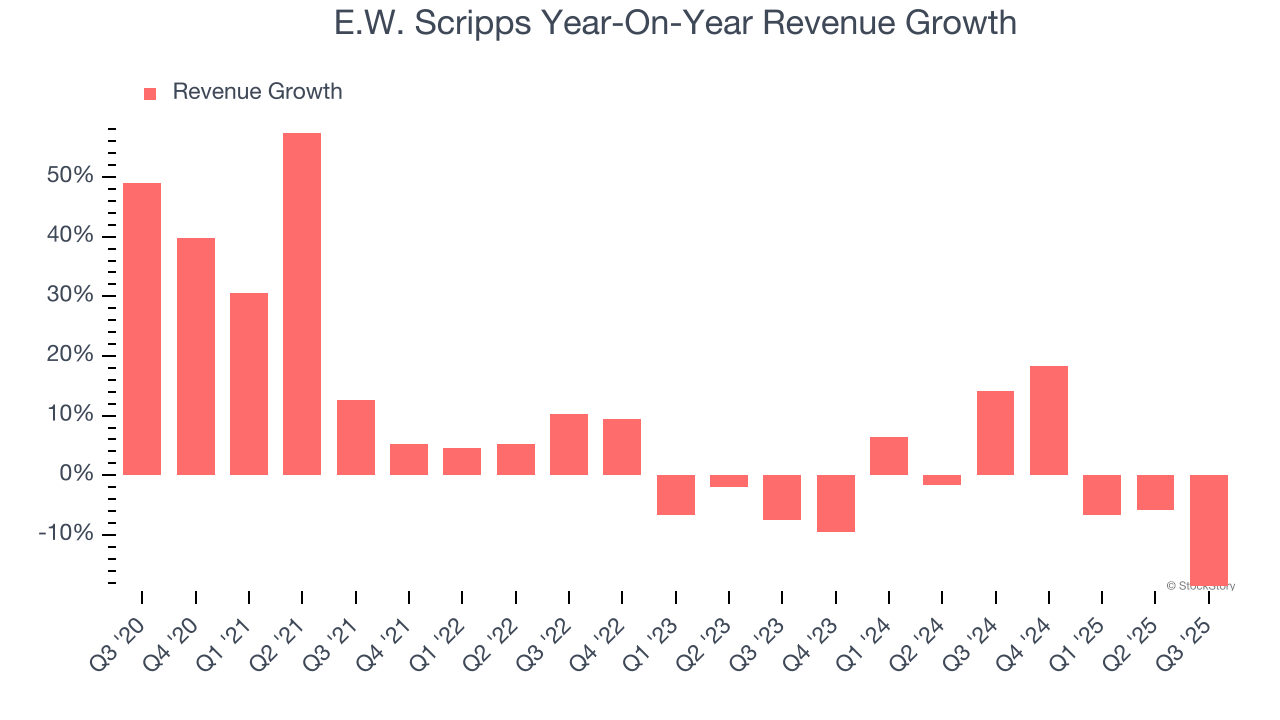

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, E.W. Scripps grew its sales at a sluggish 6.5% compounded annual growth rate. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. E.W. Scripps’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, E.W. Scripps reported a rather uninspiring 18.6% year-on-year revenue decline to $525.9 million of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to decline by 1.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

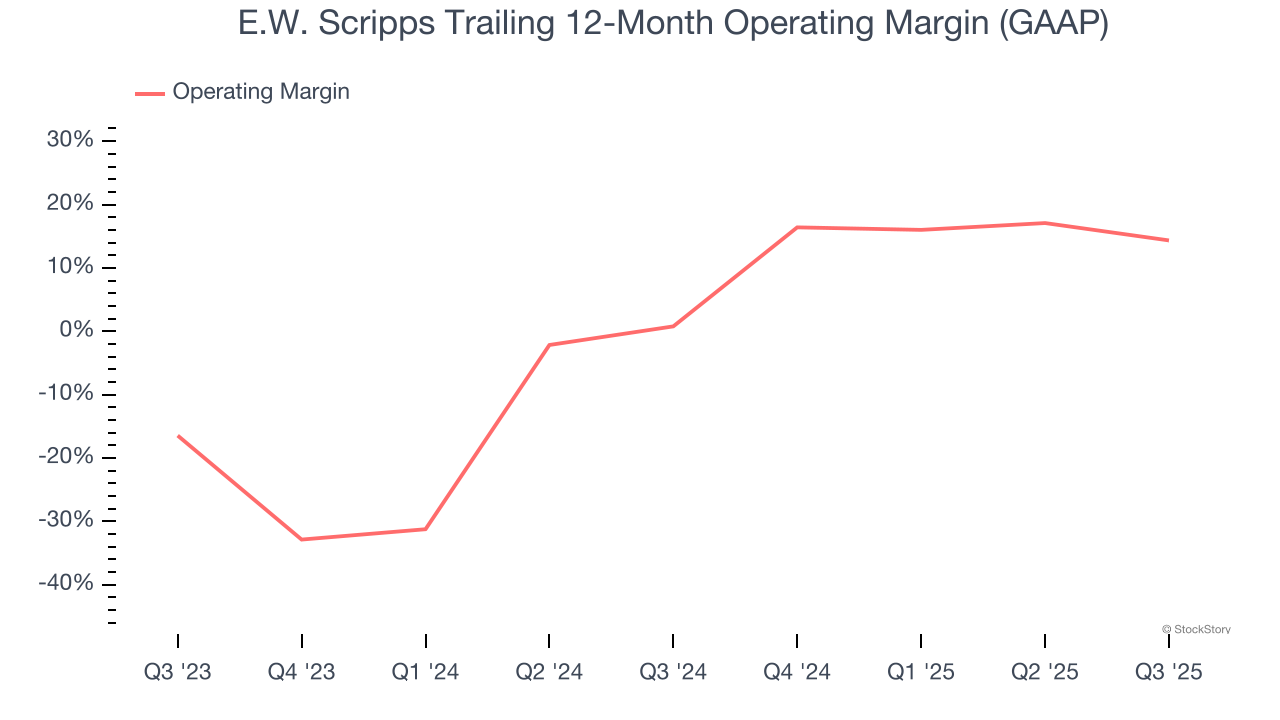

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

E.W. Scripps’s operating margin has risen over the last 12 months and averaged 7.5% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports paltry profitability for a consumer discretionary business.

In Q3, E.W. Scripps generated an operating margin profit margin of 7.2%, down 11.7 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

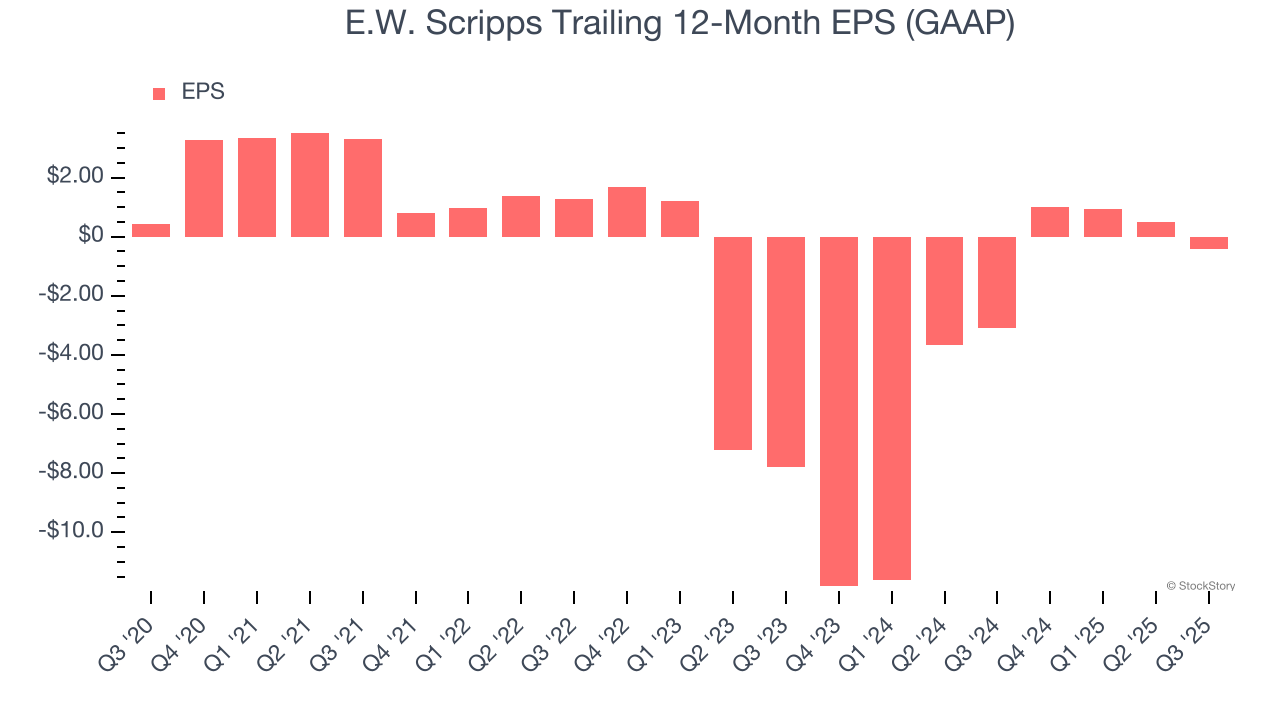

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for E.W. Scripps, its EPS declined by 24.5% annually over the last five years while its revenue grew by 6.5%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q3, E.W. Scripps reported EPS of negative $0.55, down from $0.38 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects E.W. Scripps to perform poorly. Analysts forecast its full-year EPS of negative $0.43 will tumble to negative $0.50.

Key Takeaways from E.W. Scripps’s Q3 Results

We enjoyed seeing E.W. Scripps beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS missed. Overall, this was a mixed quarter. The stock remained flat at $2.04 immediately after reporting.

Is E.W. Scripps an attractive investment opportunity right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.